The Adore Beauty share price is flat today after the release of the H1 FY 2025 results, which show that Adore Beauty (ASX: ABY) is going through a transition from purely online to hybrid retail. While the underlying business saw profitability grow, acquisition costs saw reported profits fall. The key story is margin expansion and the company’s push into physical retail, but investors will be watching closely to see if revenue growth can improve in future periods.

Adore Beauty Share Price Flat, Just Like Revenue

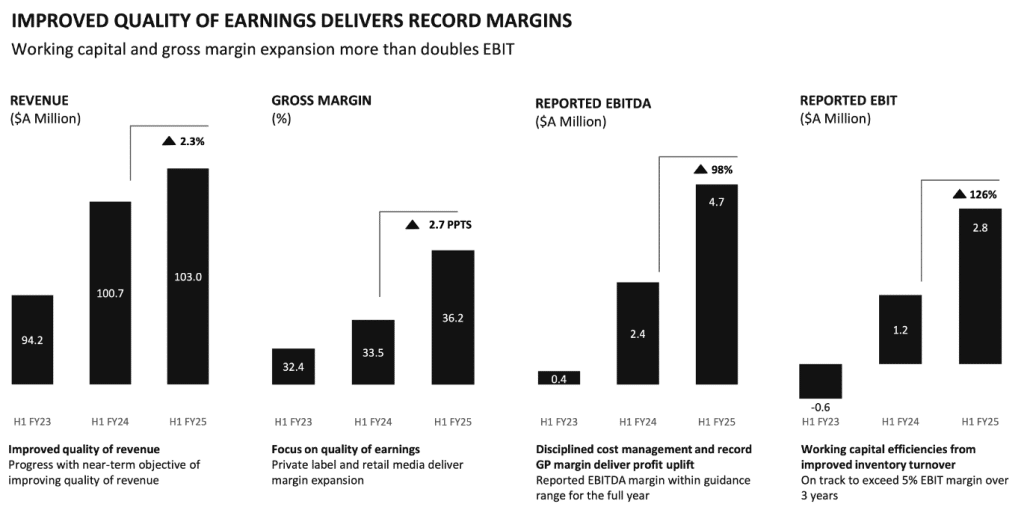

Adore Beauty’s 2.3% YoY revenue growth was rather underwhelming, especially when considering the impact of its acquisition. Management claims the slowdown was intentional, with the company focusing on “profitable revenue” by cutting unprofitable product lines and reducing promotional activity. While this has helped gross margins, top-line growth will need to improve over time for it to look attractive to investors.

“We have looked at ensuring that every piece of revenue that we take is profitable. That may mean deleting products that aren’t profitable, which could have a top-line impact, but ultimately, we’re refining our promotional cadence to build a more sustainable long-term profitability model.“

– Sacha Laing (CEO) on Results Call

While this approach makes sense for profitability, it remains to be seen whether Adore can continue expanding margins while also delivering stronger revenue growth.

Breaking Down Performance: Adore vs. iKOU

Adore completed its iKOU acquisition at the end of July 2024, integrating the premium skincare brand and its retail stores into its broader strategy. However, management has declined to break out separate financial performance figures for Adore vs. iKOU, even making it clear on the results call that they would not provide this in future. Of course, this makes it difficult for investors to assess the acquisition’s impact.

I’ve made rough estimates of the performance of the two businesses, but this is based on very limited information so should be taken with a grain of salt:

- Adore (existing business) likely contributed ~$100M in revenue and ~$3.87M in EBITDA.

- iKOU (post-acquisition, 5-month run-rate) likely added ~$3.38M in revenue and ~$0.84M in EBITDA.

While iKOU appears to be contributing positively to margins and profitability, the lack of transparency around its exact performance makes it hard to say this with confidence. My personal concern is that iKOU may actually be accounting for a larger share of EBITDA than implied above, potentially masking poor performance within the Adore brand.

Adore Beauty Gross Margins, Store Performance & Profitability Are A Bright Spot

One of the standout results from the period was the gross margin expansion to 36.2% (+2.7 percentage points YoY), reaching the company’s three-year target in just six months. Key drivers include:

- Increased sales of higher-margin private-label products.

- Growth in retail media revenue (advertising partnerships with beauty brands).

- More disciplined promotional strategies and inventory management.

On the retail front, Adore opened its first physical store at Southland (VIC) in February, with strong early results in foot traffic, sales, and margins. Higher-margin fragrance and makeup products have over-indexed in-store, helping boost profitability.

“Each of these stores is absolutely benchmarked against profitable contribution to earnings. You can expect every store to incrementally add to both top-line and bottom-line results.“

– Sacha Laing (CEO) on Results Call

The Omnichannel Expansion: A Game-Changer?

Adore is betting heavily on physical retail, with plans to open 25+ stores by FY27. The rollout schedule includes:

- 8-10 new stores per year over the next three years.

- A mix of Adore Beauty and iKOU-branded locations.

The new CEO, Sacha Laing, has form in this respect. Having been CEO at Alquemie Group – owner of General Pants Co., Lego Retail ANZ, Surfstitch, Ginger & Smart and National Geographic Wear – through a similar transition.

Crucially, management stated that the expected 30% revenue uplift over three years won’t come solely from stores – they anticipate growth in the core online business and new initiatives.

“We’re opening 8-10 stores per year over three years, but keep in mind that some stores opening in FY27 won’t reach full maturity until FY28. The 30% revenue uplift won’t come just from stores – we expect our core business and new initiatives to contribute as well.“

– Sacha Laing (CEO) on Results Call

Adore Beauty Balance Sheet & Cash Flow: Can They Fund Growth?

While Adore remains debt-free and operating cash-flow positive, its cash reserves declined significantly from $32.9M to $11.7M due to the iKOU acquisition and store expansion costs. This raises the question: Can Adore self-fund its ambitious growth strategy, or will it need to raise capital (either debt or equity)? According to the company’s update in November, they expect to fund the store rollout through operating cashflows. With $11.6M of net cash on hand, and positive operating cashflows every year since it listed (FY21), this seems reasonable to expect. But with slim margins, weak consumer confidence, and the high costs of a store rollout, the risk that capital might need to be raised in future can’t be ignored.

What’s Next for Adore Beauty?

Management reaffirmed guidance for FY25:

- EBIT margin of 2-3%.

- EBITDA margin of 4-5%.

- No revenue or NPAT guidance was provided.

Longer-term targets include:

- 30% revenue growth over three years.

- Gross margin expansion of 200+ basis points.

- EBITDA margin target of >8%.

If management were to achieve these lofty targets, that would mean revenues somewhere in the vicinity of $250-260M. Taking the lower end of the EBIT margin target, that implies around $5M of EBIT for FY27. Given the current market cap of $78M, and net cash of $11.6M, that implies an FY27 EV/EBIT ratio of around 13x. I find it hard to get too excited about such a price. Using the more optimistic ends of these targets, we end up at 8.5x, which seems more attractive. But clearly there’s a wide range of potential outcomes.

Adore Beauty Is A Business In Transition

Adore Beauty is no longer just an online retailer – the omnichannel strategy is now in motion.

While profitability is improving, low revenue growth remains a concern, and investors will want to see stronger performance in future reports. The lack of transparency on iKOU’s contribution also makes it harder to assess the full impact of the acquisition.

Ultimately, Adore’s success will depend on its ability to execute store openings profitably, expand private-label sales, and improve revenue growth, without compromising margins. The next 12-24 months will be critical in proving whether this transition can deliver long-term shareholder value.

Disclosure: The author of this article does not own shares in ABY and will not trade ABY shares for at least 2 days following the publication of this article. This article is not intended to form the basis of an investment decision and is not a recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Ethical Investment Advisers Pty Ltd (ABN 26108175819) (AFSL 343937).

Want to learn about our number one growth stock for 2025? Join the waitlist to become a supporter of A Rich Life and you’ll receive a free special report about this under-the-radar small cap that could see profits soar in the years ahead.

Join The Waitlist To Become A Supporter, And Receive Our Free Special Report Directly To Your Inbox