Pure online cosmetics retailer Adore Beauty (ASX: ABY) released a succinct trading update for Q1 FY 2024. The Adore Beauty update primarily focussed on the top line as revenue rose by 4.7% to $47.5m for the quarter relative to Q1 FY 2023. In the same period, active customers who purchased a product in the last 12 months returned to growth, up 1.5%. The number of returning customers who bought another product within the last 12 months lifted by 4.7% to 497,000. Management advised it’s on track to reach an EBITDA margin of 2-4% in FY 2024.

Adore Beauty CEO Tamalin Morton seemed pleased by the positive growth in revenue and customers. Morton also highlighted Adore Beauty’s ‘Subscribe and Save’ service, which is now available across 18 brands. Other than guiding the EBITDA margin, there was little talk about costs and operating cash flow. Whilst there is no obligation to do so, it instils less confidence in Adore Beauty’s future. And there are bigger reasons why I believe Adore Beauty is likely to become a mediocre business in the long run.

Beauty & The Beasts

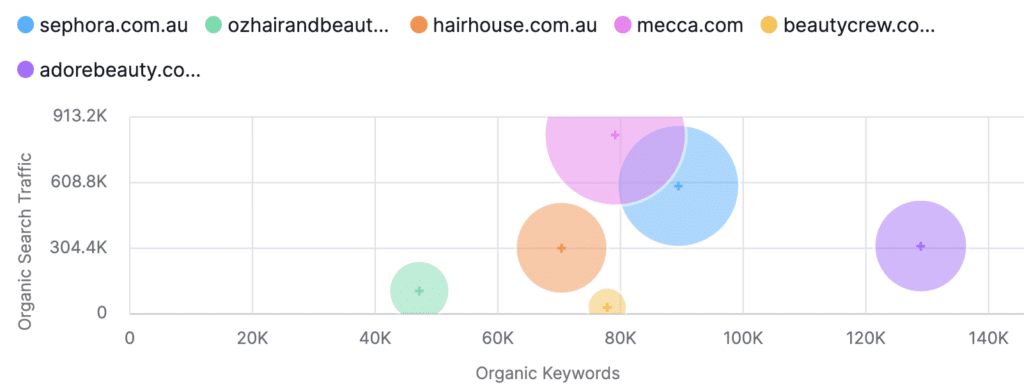

According to management and based on organic traffic in Australia, Adore Beauty is the leading pure-play online beauty retailer in Australia. There is a lot to adore. But more than one beast is looking to rule the beauty retail kingdom. Say hello to beauty retailing giants Sephora and Mecca.

Source: Semrush

Mecca and Sephora operate physical stores and I think this gives them an upper hand. Despite being the pure online player, Adore Beauty has suffered the heftiest of falls in online traffic since its peak in June 2021. Sephora has remained more resilient and Mecca has managed to lift online traffic in light of challenging macroeconomic conditions. I believe physical stores have helped the cause, empowering Sephora and Mecca to capitalise on foot traffic and shape customer experiences.

Cosmetic brands want retailers who can reach the most customers. Since Adore Beauty is unable to offer physical interactions, it’s unable to match the customer reach that Mecca and Sephora possess. It leaves Adore Beauty in a weaker position to negotiate with beauty suppliers.

On the point of suppliers, Sephora is owned by the biggest luxury company in the world, LVMH Moet Hennessy. LVMH owns luxury beauty brands like Dior and Rihanna’s Fenty Beauty, which is sold through its Sephora retail channel. LVMH’s control over the distribution of its beauty products only confers greater negotiating power over retailers like Adore Beauty.

Mecca may not have the power and support of LVMH, but it’s managed similarly. Both are led by founders. Mecca’s founders Jo Horgan and Peter Wetenhall appear to have no interest in listing and rather focus on the customer over the long term. It couldn’t be more different for Adore Beauty with founders Kate Morris and James Height stepping down from their executive roles in May 2023 after listing on the ASX in October 2020.

The quarterly update alone may provide a sense of hope. The Adore Beauty share price is hovering at record lows but don’t let this draw you into a value trap. Claude’s 3 Stocks With Good Momentum And Good FY 2023 Results may present better opportunities over the long run.

Disclosure: the author of this article does not own shares in or have a position in Adore Beauty. The editor of this article does not own shares in or have a position in Adore Beauty. This article is not intended to form the basis of an investment decision and is not an official recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. Equity Story Pty Ltd and BlueTree Equity Pty Ltd t/a A Rich Life do not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.