When it reported its half year results for H1 2020, Advance Nanotek (ASX:ANO) was able to boast of a whopping 93% gain in profit after tax. While the reality of the situation probably isn’t as good as this figure makes it look, this profit result did play a key role in strengthening the long term thesis by proving that increased revenue would flow down and boost the profit line.

If you looked at the NPAT line, you might miss the impressive operating leverage in the business which is obscured by differing levels of tax expense and income which will normalise over time. Looking at profit before tax (PBT), we can see that Advance Nanotek grew revenue by 123% and PBT by 176%, demonstrating strong operating leverage.

Taking a longer term view it actually suggests that Advance Nanotek is at an inflection point, and it’s quite likely to achieve continued impressive profit growth. I’d posit that we have at least another year or so of strong profit growth, as revenue growth slows but remains impressive. Looking on the the bright side, this suggests more upside to come.

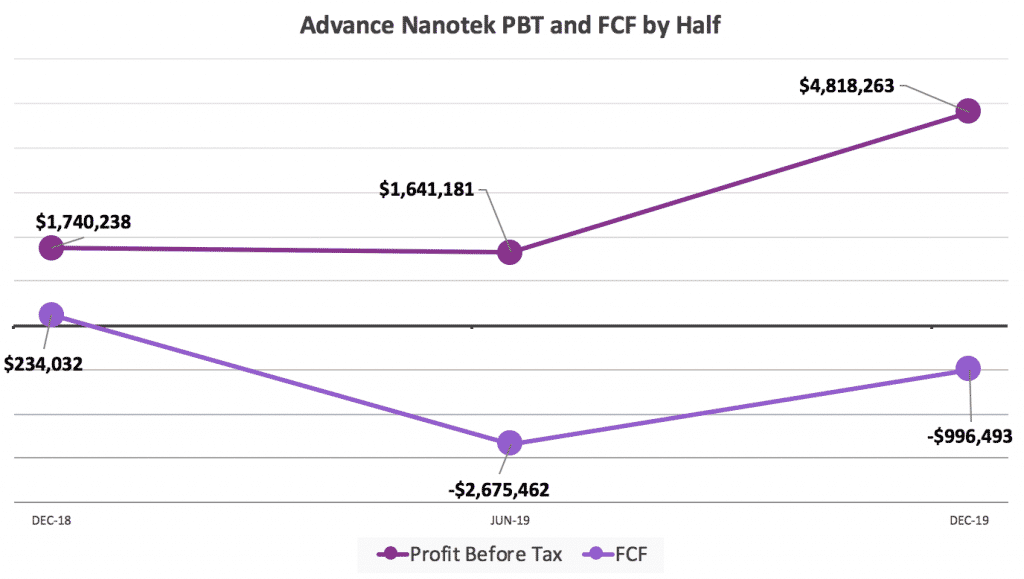

Turning to the darker part of the story, the company’s cashflow continues to be problematic as it ramps inventory to satisfy soaring demand. As a result, major shareholder Lev Mizikovsky lent the company $1.1m during the half (which was paid back), no doubt with the assistance of the recent capital raising. You can see how free cash flow and profit before tax have diverged, in the graph below.

We have previously covered at great length the opportunity for increasing demand for Advance Nanotek’s products in an initially hidden report sent first to you, our supporters. You can find it by googling “ethical equities ANO”, but I won’t link to it until I understand the SEO implications for A Rich Life.

If that thesis holds true, then we should see sales continue to increase and cashflow continue to stagnate for a little while longer. While we might not see operating leverage kick in quite yet, I would expect to see profits

In what I like to refer to as a super bizarrre rando flourish, the company has also announced that “ANO is in the early stages of a feasibility study to leverage the capture of its CO² emissions from its zinc oxide production equipment and convert the CO² into oxygen through the growth in hydroponics, on site at Shettleston Street Rocklea.” I’m obviously impressed by their move, even though I doubt it will help the business much. As in The Castle, “it’s the vibe your honour.” Yolo!

However that does provide a segue into a more serious matter which is that the company is run in a way that seems more appropriate to a tiny company that a $400m market cap growth darling. On the one hand, the sometimes half-hearted communications from the company, and occasional mishap (such as when they miscounted inventory) will not help it achieve high sentiment in the market. On the other hand, these guys don’t seem to be wasting any money on investor relations!

If we very conservatively doubled this half year’s profit we would get an annualised profit run rate of $6.7m, against a market capitalisation of about $364 million. That’s a P/E ratio of 54.

There’s no doubt this price captures some real optimism and I’m certainly not rushing to buy shares right now. Having said that, at these prices if the profit run rate can grow by 150% over the next 18 months, the stock would arguably look quite cheap. Given the cracking pace of profit growth going on at the moment, that seems rather achievable. This is certainly not advice, nor is it a recommendation, but it does explain why I’m a happy holder for now.

If you’d like to receive a occasional Free email with more content like this, then sign up today!