This morning nursing and hospital software company Alcidion (ASX: ALC) announced its quarterly cash flow result. Even though the operating cash flow was negative, the CEO made it very clear on the call that operating cash flow would have been positive but for a significant “one off” expenditure associated with the prior acquisition of Silverlink.

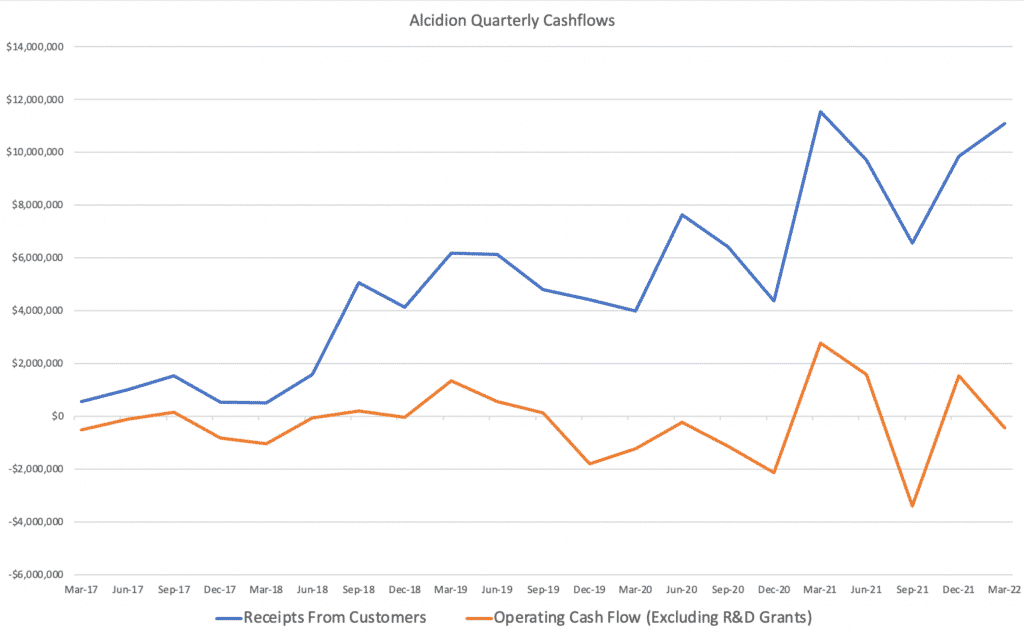

In the chart below you can see that receipts from customers were slightly lower than the prior corresponding period. However, this was not particularly concerning since the immediate preceding quarter (to December 2021) demonstrated strong growth on the prior corresponding period. On top of that, the March quarter in 2021 was a very strong quarter so in a sense the reduction on the prior corresponding period is probably more about timing than a signal of organic shrinkage.

The CEO Kate Quirke said on the conference call that Alcidion expects to finish FY in an operating cash flow positive situation. I asked the CEO specifically what she meant by that on the call. She said she meant cash flow positive excluding M&A costs for the full year. Given that operating cash flow would have been ~$1.6m this year (instead of negative ~$450k) we can surmise at least $2m in M&A costs. There might be more next quarter (I’m not sure). Assuming there are not, then full year operating cashflow should be more than a $2m deficit meaning next quarter should be positive.

One piece of positive news during the quarter was that Worcestershire Health and Care NHS Trust bought Miya Flow. This trust is one of NHS England’s mental health global digital exemplars, so if the trust is happy with the product, that may lead to new sales down the track.

Alcidion is looking set to generate almost $33m in revenue this year, as a bare minimum, assuming no more contract wins this quarter. It should come close-ish to cashflow breakeven, though I have to say I wish the business would hurry up and burst into profitability. It is extremely important that Alcidion proves it has the guts to make a profit. Otherwise the market will just assume that it will eventually run out of money. Alcidion has over $17m in cash though, so it doesn’t suffer from too much time pressure on its path to profitability.

The current share price of 19.5c implies a market cap of about $250m, or 7.5x a very conservative FY 2022 revenue estimate. I might consider this is a reasonably attractive price but I’m a little concerned that a substantial portion of the company’s revenue is lower margin non-recurring revenue. Therefore, I’m simply holding my shares (a small holding right now, around 1% of my portfolio) and waiting to see if the company can either improve its revenue quality or (more importantly) get closer to making an actual profit.

The author owns shares in Alcidion and will not buy or sell for at least 2 days after publication of this article. This article should not form the basis of an investment decision. It is an investment diary valuable only for the cognitive process it demonstrates. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer.

Sign Up To Our Free Newsletter

Save time at tax time: A Rich Life depends on Supporters to pay for its free content, so if you’d like to try Sharesight, please click on this link for a FREE trial. It saves me heaps of time doing my tax and gives me plenty of insights about my returns. If you do decide to upgrade to a premium offering, you’ll get 4 months off your subscription price (the best deal available, I’m told) and we’ll get a small contribution to help keep the lights on.