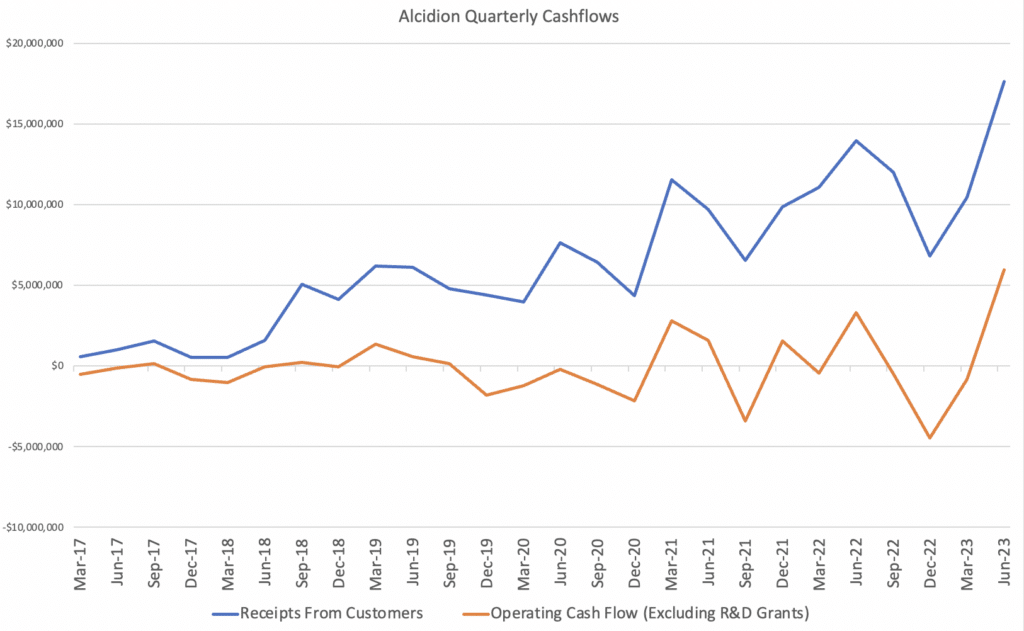

Patient administration and hospital ward workflow company Alcidion (ASX: ALC) this morning reported record receipts from customers of $17.6 million. On top of that, Alcidion also achieved record quarterly operating cashflow of just under $6m, as you can see below. FY23 revenue (unaudited) is expected to be around $40.0M, up ~16.0% on pcp.

However, the quarterly new sales of just $7.3 million was far from a record result, and does point to some potential growth challenges. The silver lining here is that the company was still able to make new sales, even without some of the bigger contracts it had hoped for.

Alcidion makes no secret of the fact it has fallen short of its own expectations with regard to larger contract wins. In particular, the CEO flagged delays to the UK electronic patient record program of work, which is now expected to be completed in 2026 rather than 2025.

While the causes of the delays are multifactorial, the CEO Kate Quirke mentioned that the allocation of funds to trusts was delayed. Her understanding is now that some of those trusts now have the funds, and procurement is moving forward. She noted that those trusts that have received funds will have to spend those funds by the end of March. Therefore, there are valid reasons to hope for EPR contract wins in the UK during FY 2024, albeit no guarantees.

Alcidion’s Miya Precision modules such as Miya Noting can help hospitals achieve “substantial time savings and safer ways of working, just hours after the go-live”. Therefore, implementing these software solutions would appear to be in the best interest of patients and hospitals alike.

Importantly, “Alcidion enters FY24 with $33.7M of contracted and scheduled renewal revenue expected to be recognised as revenue over the course of the year.” At the end of FY 2022, Alcidion said it had contracted revenue to be recognised in FY23 of $28.3M plus $2.9M of scheduled renewal revenue expected to be recognised in FY23. So on any view of it they added at least $8.8m in revenue during FY 2023. If the company adds $8.8m revenue during FY 2024, then it will have $42.5m in revenue for FY 2024, growth of just 6.25%

However, the CEO is clearly expecting the absolute amount of contracted revenue to grow. She said that “The costs are leveling out and we are expecting revenue growth to continue on the current trajectory… I will give more information and colour to that at the full year. Operational costs have bottomed out and we are continuing with this sort of revenue growth.”

If we consider the current trajectory to be 16%, then even a slight reduction (say, to around 12%) would give revenue of around $45 million. In the first half of FY 2023, Alcidion lost about $2.8m on $19m revenue. Assuming some degree of operating leverage, it might finish FY 2023 with a loss of around $4m on $40m of revenue. This operating cost base might allow Alcidion a slim profit in FY 2024, especially if revenue growth maintains the 15% range. But for now Alcidion shareholders must remain cautious, as profitability may well be pushed out to FY 2025.

On the bright side, the free cash burn for the year was only around $3m, largely as a result of acquisition payment worth ~$2.7m. This gives plenty of credence to the CEOs claim that Alcidion will not need to raise capital, given its $14.6m cash balance.

Overall, this was a very solid quarter within a fairly tough year for Alcidion.

Sign Up To Our Free Newsletter

Disclosure: the author of this article owns shares in Alcidion (ASX: ALC), and will not trade them for 2 days following this article. This article is not intended to form the basis of an investment decision. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).