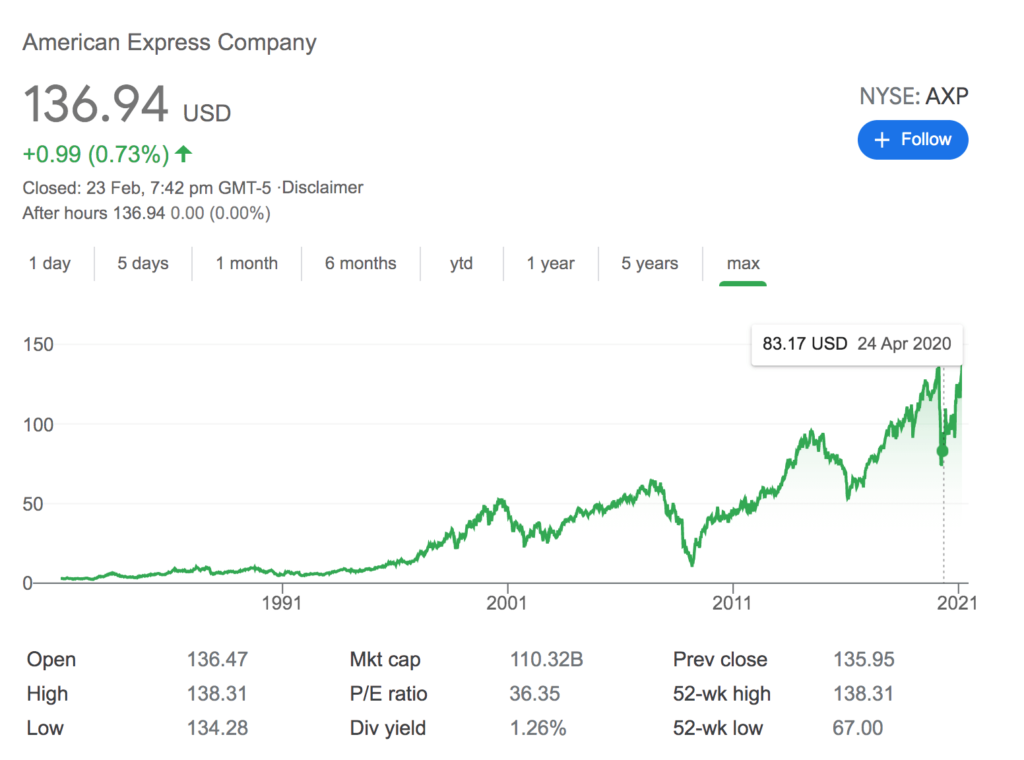

When I first wrote about American Express Company (NYSE: AXP) or Amex we were just at the beginning of the pandemic. We did not know what to expect other than a devastating impact on Amex’s business in the short-term, however, it was hypothesised in my report that the benefits of the disruption would outweigh the negatives over the long-run due to Amex’s inherent antifragility.

A Significant Pandemic Impact On American Express Company (NYSE: AXP)

It became apparent quite quickly however that the downturn of the pandemic would be felt even more heavily than the GFC downturn due to restrictions on travel, dining and entertainment (T&E) aimed at mitigating the virus’s spread.

Stimulus measures undertaken by central banks and governments would also be so expansive and material that an expected spike in bad debts and an equivalent reduction in lending would not occur. That would be to the benefit of Amex’s competitors who are all primarily lenders.

Fast forward, and the pandemic has had a brutal impact on Amex’s profitability. As of Q420, financial year total revenues are down 17%, net income is down 54% and worldwide transaction volumes are down 16%. As you would expect the impact has largely been caused by a reduction in card member spending on T&E, which is down 65% in comparison to 2019, as well as by the building of bad debt provisions.

Even in the face of these decimating results it still appears that the original hypothesis is holding true. In the face of the uniquely bad circumstances, the management team have still been able to leverage Amex’s unique assets and closed loop card network to position the company for post pandemic growth.

We have also seen management use the downturn and the uncertainty it has brought with it to make key investments. Just like they did in the GFC with the acquisition of GE’s corporate card business. This time management have taken advantage of the downturn to make another acquisition with the purchase of leading SME lender Kabbage for around $850 million.

Membership reward spend has also been redirected, with investments in non-T&E rewards, such as bonus points on groceries, streaming subscriptions, and phone bills. These are all sticky areas of spending that will see Amex likely retain this share of wallet post pandemic. The reshaping of rewards in such a short period is a strength unique to Amex given their depth of partnerships and the fact that all membership rewards services are designed and implemented in house.

Given the restrictions on T&E many cardholders would probably find their cards more or less redundant and you would expect card cancellations to be high as a result, given the steep annual fees. This would show up as a fall in card member fee revenues in Amex’s results, however no fall in this revenue can be found. The investments in membership rewards related to non-T&E have been so effective that we have seen a year-on-year increase in card member fees of 15% to $4.66 billion in 2020.

This result should not be underestimated and is by far what one should be most surprised and impressed by. It underlines the value and utility Amex could afford to invest in their card member rewards during the pandemic, and management’s expertise in doing so.

Although the credit cycle has yet to turn for other lenders, Amex still posted an impressive result with one of their best performing years. With only $1 billion of delinquent loans in December 2020 compared to $2.1 billion delinquent loans in December 2019.

We have seen the halving of bad debts on a loan book that Amex aggressively grew prior to the pandemic, primarily as a result of the company’s rapid introduction of a Customer Pandemic Relief Program (CPR) that saw $8.5 billion worth of loans enrolled in April 2020.

Can American Express Company (NYSE: AXP) Grow Faster In A Vaccinated World?

Whilst these results are impressive it appears that we may just be getting started. On the company’s recent Q42020 earnings call the excitement of CEO Steven Squeri and CFO Jeff Campbell was palpable, I highly recommend a listen of at least the Q&A.

With the company positioning itself to be more competitive in non-T&E during the pandemic, it is evident from the Q&A that they are now very much investing and gearing up for the subsequent rebound in American and global middle class spending on T&E post pandemic. Mr Squeri states that “our (Amex’s) investment levels will be higher than they have ever been … we will look to ramp up our card acquisition, we will look at value injection, we’ll look at value proposition refreshes”. It is important to not get carried away with his hype but given the rebound the company saw post GFC and dot-com bust from what were worse financial results it is hard not to.

If we continue to see a sustained and effective vaccine roll-out, which I am expecting we will, then Amex should see significant growth past pre-pandemic levels. With this growth driven by their investments during the downturn and a pent-up demand to travel, dine and be entertained.

We won’t see the results of this work any time before late 2021 or early 2022 earnings results, though of course the market is forward looking, so that is not to say the share price must languish. With the company reaching all time intraday and closing highs of $138.31 and $136.94 respectively, it seems the market is already as optimistic as ever.

Thomas Aouad, the author of this post, owns shares in Amex at the time of publication, and does not currently intend to sell them in the near future. This article is general in nature and is not financial advice, but only seeks to elucidate the state of the market. Please read our disclaimer if you have not already.

You can read Thomas Aouad’s April 2020 treatise on Amex here.