Alexander Jannink founded Acusensus Ltd (ASX: ACE) following the tragic loss of a close friend.

The incident occurred in Los Angeles, a driver under the influence and allegedly using a mobile phone hit a cyclist in a dedicated bike lane.The tragedy led to the creation of Acusensus in 2018, with the goal of pioneering intelligent solutions that can be rapidly deployed to address road safety challenges.

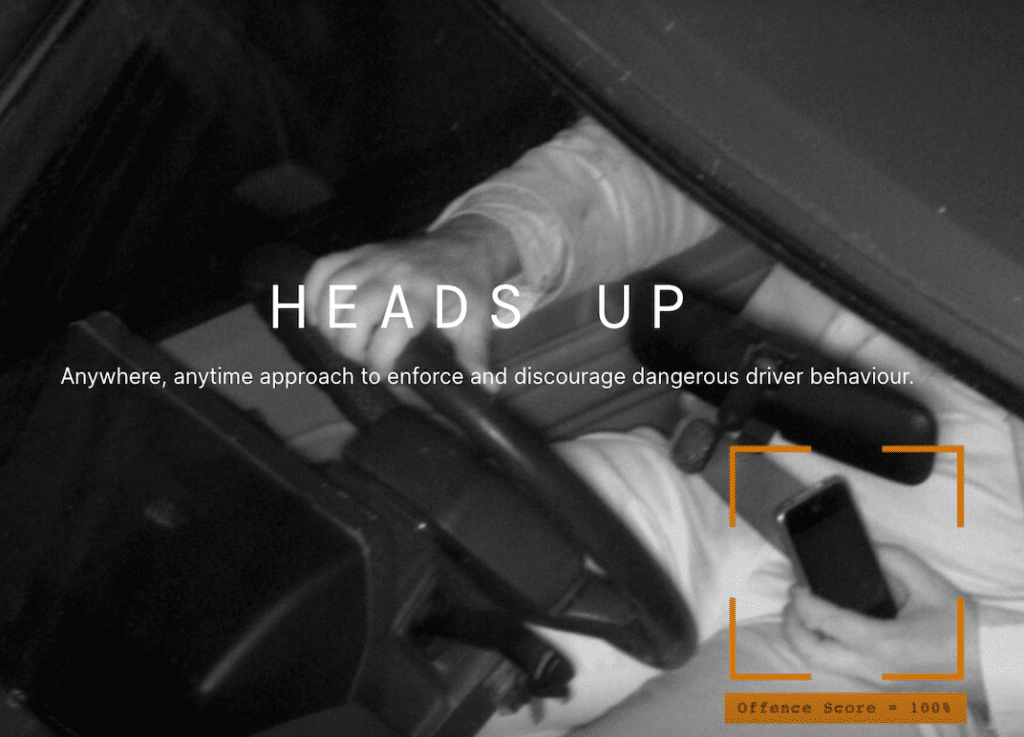

And so, the Heads Up mobile phone detection technology was developed in Australia. Think of it as a sophisticated speed camera picking up clear images of road users operating their smartphones.

According to the World Health Organisation, drivers using mobile phones are approximately 4 times more likely to be involved in a crash than drivers not using a mobile phone.

Jannink raised initial seed support from Indian power electronics company, Ador Powertron Limited. Ador Powerton remains a significant shareholder today with its Executive Chair Ravin Mirchandani also Chair & Non-Executive Director of Acusensus .

The company’s market cap is $103 million at the current share price of 82c. Acusensus listed on the ASX at the beginning of 2023 raising $20 million. Acusensus originally listed at $4 per share before undertaking a share split, where every 1 share held was split into 5, meaning the share price is still trading close to the IPO price.

Acusensus’ technology empowers authorities to tackle crucial road safety issues with solutions not only for distracted driving but also for seatbelt usage, speed and other functionalities. It does this via three solutions:

Acusensus ‘Heads-Up’

The Heads-Up solution is the company’s primary product. The system comes in two forms, either fixed or trailer-based. Heads-Up captures high resolution images of offenders providing evidence of infringements in all weather conditions and at high speeds of up to 300 km/h without motion blur or distortion. Initially built to detect drivers using mobile phones it has now been enhanced to provide law enforcement with the detection of other offences. These include seatbelt non-compliance, point to point speed detection, detection of unregistered vehicles and vehicles being driven in closed lanes of freeways.

Acusensus ‘Heads-Up’ Real Time

The trailer-based ‘Heads-Up’ Real Time solution is targeted at the North American market. The equipment is set up a few hundred metres in advance of a waiting police patrol car and monitors drivers who are using a mobile phone, speeding, not wearing a seatbelt or on an automatic number plate recognition “wanted list”. The police officer is supplied with photos and other digital evidence of the vehicle and licence plate as well as an estimate of when the vehicle will pass.

Acusensus Harmony

The harmony solution utilises the same camera system technology as the heads up solution and is targeted at speeding drivers, and is mounted to a trailer or placed within a vehicle.

How Does Acusensus Make Money?

Acusenses generates its revenue from a number of sources including:

- Licence fees – for the use of the Company’s products and intellectual property;

- Review fees – for the manual review of images taken using the Company’s products;

- Maintenance fees – for the ongoing maintenance of purchased or rented products;

- Deployment fees – for the relocation of camera vehicles or trailers from one location to another;

- Sale and/or rental of hardware; and

- Fees related to peripheral activities such as recommendations to customers for potential suitable locations for fixed and/or mobile detection units.

Importantly the revenue collected by Acusenses isn’t linked to the number of offenders caught. Should the solutions succeed in curbing offending drivers the company’s revenue isn’t impacted. The company’s preference is to collect a fixed monthly fee for its services.

Acusensus primary focus is government contracts and are typically awarded via tender.

At the time of writing the company has six multi year contracts in place with Queensland, NSW & the ACT providing a number of services. It also has a mobile phone usage and seatbelt non-compliance in commercial vehicles contract with the state government of North Carolina in the US. Acusensus continues to target international markets which isn’t always a happy hunting ground for ASX listed companies. On that subject, in its most recent quarterly update Acusensus noted that contract discussions had commenced with new potential US customers and three enforcement trailers had been delivered to the UK.

Despite these green shoots, it is clear that Acusensus faces customer concentration risk, given the vast majority of its revenue comes from just three Australian state governments. For example, the company’s contract with the NSW government was recently renewed with increased revenue expected; but will have to be renewed again in just one year.

Does Acusensus Have A Regulatory Tailwind?

Obviously the societal benefit of reducing road accidents is enormous.

Not only that, governments around the world are continually putting measures in place to reduce and eliminate road fatalities. In the US, the government launched the Road to Zero coalition with the goal of ending fatalities on the nation’s roads within the next 30 years.

Editor’s note: However, the real reason governments love road rule enforcement is to raise revenue.

Per Grand View Research the global road safety market size was evaluated at US $3.07 billion in 2022. It is estimated to grow at a compound annual growth rate of 17.5% from 2023 to 2030. The US itself is expected to grow at 18.2%.

Management and a Unique Ownership Structure

As discussed at the top, Acusensus was founded by Alexander Jannink.

He remains as managing director and holds just over 13% of the company through a related entity. Previously, Jannink was the Head of Future Product Group for Redflex Traffic Systems Limited (previously ASX: RDF)

The quirk in current ownership is the major shareholder Ador Powertron who owns just over 16% of the company. Ador Powertron provides a number of solutions including hydrogen power, clean air, road safety, defence, battery formation & testing and EV charging. Ador Powertron was an early stage investor, providing the seed funding required to get Acusensus off the ground. Acusensus entered into a distribution agreement with Ador back in October 2020, giving Ador Powertron certain rights in relation to distribution, marketing and supply of Acusensus International’s traffic enforcement solutions in India.

Ravin Mirchandani is the Chairman, a director and a shareholder in Ador Powertron and is co-founder and Chairman of Acusensus.

While Mirchandani clearly would have some influence over how Ador Powertron operates there is a risk that the major shareholder could exit despite his wishes.

As with any IPO it’s important to be across the escrow periods. Below sets out the release dates with the most recently full year accounts marking the first release date:

Since the first release there has been no movement in director holdings and only a ownership shift with a substantial holder moving shares from a super fund to a private company.

Competition

Acusensus is arguably first out of the gate with mobile phone detection, but there are a number of other companies that compete for tenders and pilots in the distracted driver sector. Sensen Networkds (ASX:SNS) is one company listed on the ASX that utilises technology to scan number plates and report data. One Task has put its own claim on having a world first phone detection system. Hazen.ai is another in the same industry. So while Acusensus has the first move advantage in Australia, notoriously slow-moving governments give the competition time to catch up.

An additional threat to Acusensus is other methods of enforcement.

Apple has introduced Driving Focus which silences text messages and other notifications. It will also allow Siri to read replies to you and incoming calls are only allowed when the phone is connected to the in-car bluetooth system. However, I do not think these kind of features will end mobile phone use while driving, so I don’t see it being the end of monitoring or surveillance.

Financial Performance

It’s always important to consider how the company has performed post IPO but also how it got there.

To Acusensus’ credit, inventory has remained stable over time and intangibles aren’t out of control and remain at what I feel are a reasonable level of total assets. Trade receivables spiked in 2023 which will have contributed to the boost in 2023 revenue and unearned contract liabilities also grew which will be something to watch from a cash flow perspective.

I would expect to see research and development expenditure grow as the company moves into new areas including road worker safety and impaired driving detection.

In 2023 Acusensus grew revenue by an impressive 46% to $42 million. Profit before tax dropped to $575k down from $1.1 million in 2022 on the back of an increasing employee costs, IPO transaction costs and an impairment. The result was well ahead of the prospectus expectations which had revenue of $37 million and a loss before tax of $1.2 million.

If you were to ‘normalise’ the 2023 P&L and strip out IPO transaction costs of $684k and squint your eyes to remove the impairment expense of $220k (which you optimistically hope won’t continue to occur) you could argue a ‘normalised’ profit before tax of $1.5 million. This would imply on a normalised basis growth of around 20%.

Clearly with a market capitalisation around $100m, and normalised profits before tax of ~$1.5m, Acusensus is priced for considerable profit growth.

This could well occur.

Being the first mover in aspects of the industry bodes well for the company. I also believe it will appeal to governments around the world who want to make roads a safer place. In saying this, government contracts can be competitive through tender and the company is at the mercy of a change in government or policy.

Beyond a certain point, growth is going to be reliant on the international market. International expansion has been notoriously difficult for ASX companies although there has been some encouraging signs for Acusensus in the US, UK and Europe. So that strategy comes with a very real risk of failure.

Given the optimism in the share price, I’m happy to sit from the sideline and watch for a little longer. I think the company has a lot of promise, but I would like to see some further contract success internationally before I consider a position.