Ansarada (ASX: AND) has a very uninformative name and it’s hard to research because its ticker upsets search engines. But the actual business looks pretty interesting.

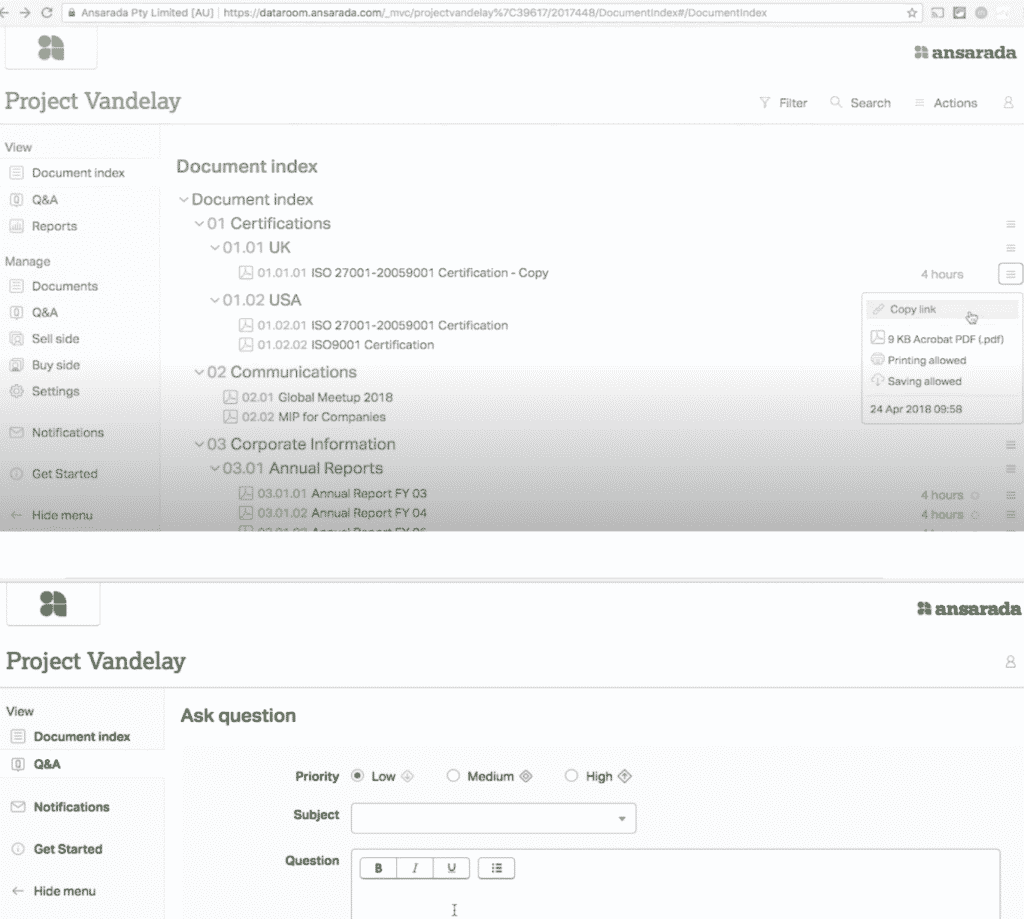

Basically, what it does is provide a virtual data room for companies and advisories that are running due diligence, divestment and acquisition processes. The data room allows would-be transactors to track questions, answers, what documents are shared and who shares them. It manages approvals and storage, and integrates with some of the offerings from Athena, the board meeting management software it owns.

There are potential horizontals that it could combine with in the future, such as cap table maintenance software (that tells a private company what its shareholders and option holders all own, and is a place to log changes).

The bells and whistles pitch is that its “big data” based on over 20k transactions allows it to make predictions about transaction outcomes based on the way parties are interacting with the data.

Business model

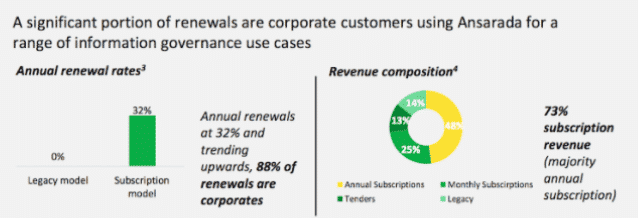

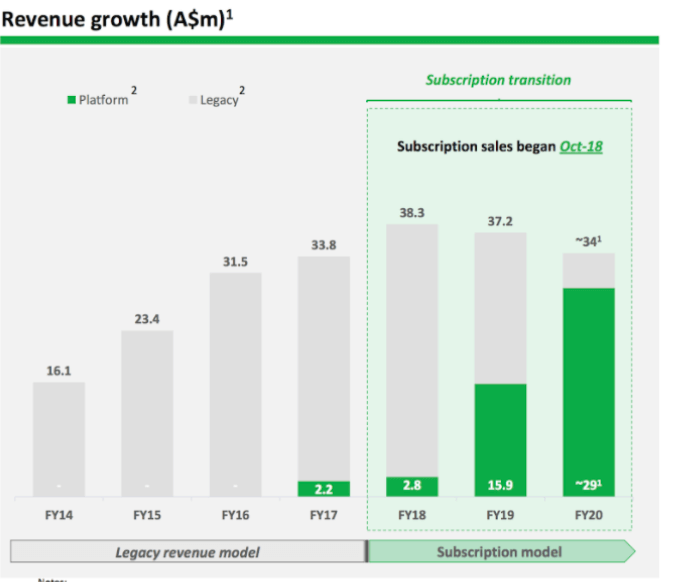

While Ansarada has a diverse bunch of clients, as you can imagine, this software is generally used sporadically, rather than constantly. Nonetheless, prior to listing Ansarada embarked on the process of turning their offering into a clunky SaaS model. I say it is clunky because Ansarada is for transactions, and so it must be hard to retain clients on a subscription basis. Alarmingly, the one year renewal rate is 33%. I need to clarify what this means, but it seems like that means most clients just use it for around a year, conclude their transaction, then discontinue use.

On the face of it that sounds bad, but it’s consistent with what you would expect due to the use case. Arguably, savvy business combinations can help the company have a more cogent subscription offering. In any event, I’m not too concerned because it’s quite possible that managers who discontinue use in year 2 will be back in the future, and I don’t see the departures as indicative of bad software. As you can see below, the company implies that this transition to a subscription is the reason that revenue has been down the last two years. These revenue falls must therefore reverse in the near term or management will begin to lose credibility.

Valuation

Ansarada has FY 2020 revenue of about $33.2 million and about 101 million shares (if all options are exercised). That would give it a fully diluted market cap of $141 million at the last traded price of $1.40. It has pro forma cash of about $20 million (against an operating loss of $9m last year), so I think it’s conservative to use $120m as an enterprise value proxy. If we credit it only for SaaS platform fees, not transaction based revenue, as a revenue proxy, we have $24.5 million. That would give an EV to Sales ratio of about 4.9.

Why might it be undervalued?

I believe undervaluation may have arisen due to a slightly bizarre business model, that doesn’t fit neatly into existing valuation paradigms and the decision to reverse list, which is generally how the worst companies list (though plenty of good companies have come to market in this way).

Some thoughts on management

Certain heuristics suggest that the CEO and founding team are honest individuals.

For example, Ansarada raised capital to a firm that donates its fees to charity, and counts likeable fund managers including Australian Ethical Investments as early backers. The CEO is clearly charismatic and the capital structure looks consistent with people genuinely trying to grow and improve a business they care about.

Offsetting that somewhat, the listing at $1.48 per share took place as a reverse merger with the already-listed company TheDocYard (ASX: TDY) retaining 17% of the overall equity, if my maths are correct. TheDocYard had receipts from customers of around $200,000 in its most recent quarter. This compares to about $38.5 million in receipts from customers at Ansarada, in FY 2020 (or $9.6m per quarter). I’ll make enquiries about the thinking behind this method of listing, and update here accordingly.

In one scenario TDY has sufficiently good tech that Ansarada is saving something on development costs. Another scenario might see the (very small) TDY team as being valuable recruits. A third might value mainly the customer acquisition aspect, and cross-selling opportunity. It would be great to see management better articulate the rationale here, but these kinds of processes are inherently political so it can be hard to get a read.

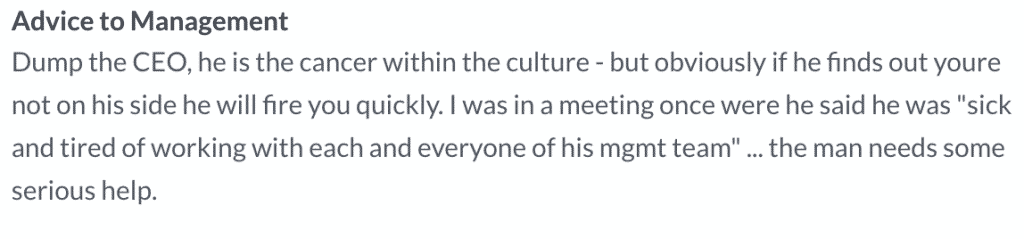

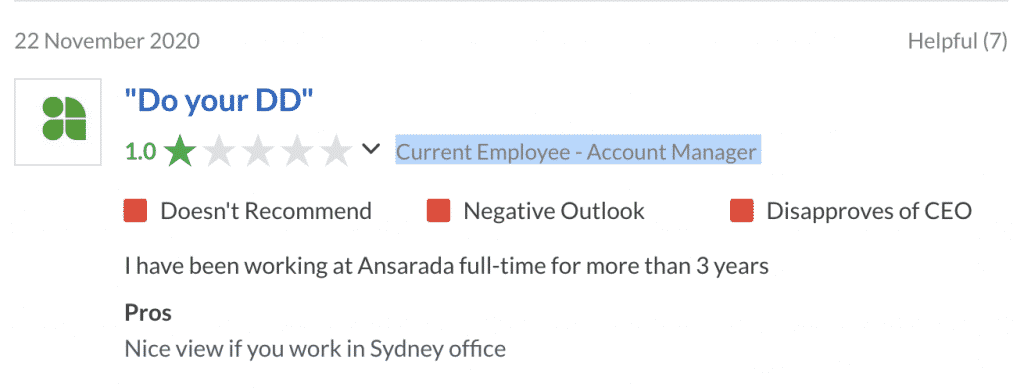

Offsetting all this, the Glassdoor reviews of the CEO are very unfavourable, such as this recent one from a current employee below:

I’ll ask him some questions about this, and that should give me a better idea of what I think the situation is, but there is no doubt that one message on Glassdoor was designed to warn investors away from the stock.

Another employee wrote on Glassdoor that:

“Despite the above Ansarada is in dire straits. The CEO is unable to take accountability for previous mistakes and blame is passed down the hierarchy to either employees at the bottom or previous colleagues who made a smart decision to leave. At Ansarada there is a leadership team and then then is a ‘leadership’ leadership team that consists of those who have figured out that staying close, agreeing unapologetically to whatever the new ‘grand plan’ is ensures them job security, promotions and a place in the Ivory Tower to avoid any of the ‘stuff’ handed down. The CEO believes that once he has read a book on something he is suddenly an expert. Anyone who is hired for their expertise and holds an opposing view is soon in the bad books and on the chopping block.”

Now, I have no idea about the truth of the situation but this is what I found.

Risk versus Reward

To my mind it seems more likely that Ansarada would trade on 7 or 8 times revenue rather than 2 – 3 times revenue. So as long as it grows revenue from here, I think the stock is likely to be a winner.

The company has made a big hullabaloo about a path to breakeven. I am skeptical of these things. For example, the Chairman of Ansarada is the Chairman of Nearmap. Nearmap has at least twice played down its likelihood or needing new capital to grow, and then raised capital yet again. It is certainly a serial capital raiser.

The best upside would be if they are actually true to their breakeven plan. I would really love to see that as it would imply high levels of management integrity. But we will have to wait and see.

Sociological framework

This company hasn’t had a great deal of attention. It has been featured in the AFR a handful of times, but I can’t find it on Livewire or Motley Fool.

Biggest negative

The biggest negative is the Glassdoor reviews; but Nearmap had terrible Glassdoor reviews at 50c per share, and it’s still done well since then (though not as well as it could have). In the best case scenario the CEO can get all employees feeling more supportive, in the worst case, the anonymous Glassdoor reviews are worth heeding.

Biggest positive

The biggest positive is that the company has achieved high Australian market share (according to this article on its website). This may be indicative of a superior product, which is what one needs to scale globally.

This is not advice. These are investment notes of mine; not a recommendation. I could have made mistakes in the notes; and I still have many loose ends to explore. I own shares in Ansarada at the time of writing. Please read our detailed disclaimer.