Genex (ASX: GNX) is notable because it is one of the few revenue-generating renewable energy companies on the ASX. The main focus of Genex is its Kidston Clean Energy hub, which is intended to include solar, pumped hydro storage, and wind generation. The company recently signed power purchase agreements with Stanwell Corporation and Energy Australia for its Kidston Stage 3 wind power project, signalling the ongoing development of the precinct. Meantime, the company also announced the commencement of commercial operations of its Bouldercombe battery project (build with Tesla’s megapacks).

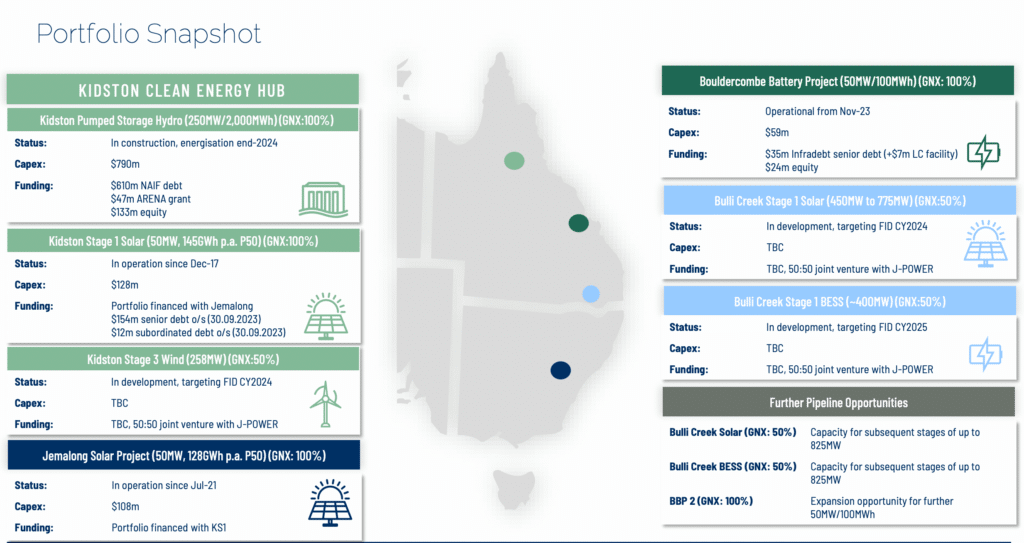

As you can imagine, I’m a strong supporter of the project, given I think it is good for both the environment, and (ultimately) our energy prices in Australia. However, that doesn’t mean the stock is attractive. The image below from the company’s recent AGM presentation gives you a good over view of Genex’s project portfolio.

The flagship pumped storage project is “on track for energisation in H2 FY 2024” and will be an important new source of revenue for Genex. Obviously, the advantage of pumped storage is that the energy can be sold when prices are highest.

It has numerous projects in the pipeline such as the Bulli Creek Solar and Battery Project, and Kidston Stage 3 Wind Farm.

Its largest shareholder is Skip Capital, which is an investment firm co-founded by Atlassian co-founder, Scott Farquhar, and its second largest shareholder is J-Power, a Japanese electricity utility. Of course, I don’t know what they think its worth, or why those shareholders are invested, but suffice it to say it is possible there are strategic or non-financial incentives in both cases.

That said, Skip Capital previously had its eye on taking the company private and explored a takeover at 25c with Stonepeak Partners in 2022. After around 4 months, the consortium walked away from Genex, and the share price has languished below that level ever since.

At the time, The Australian Financial Review reported that:

“The Australian Financial Review understands the pair balked at Genex’s operational issues, including the recent water leak at its flagship 250-megawatt Kidston pumped storage hydro project in Queensland. Genex advised the market the leak would add $10 million to $15 million to the project’s budget.”

Why Genex is So Hard To Value

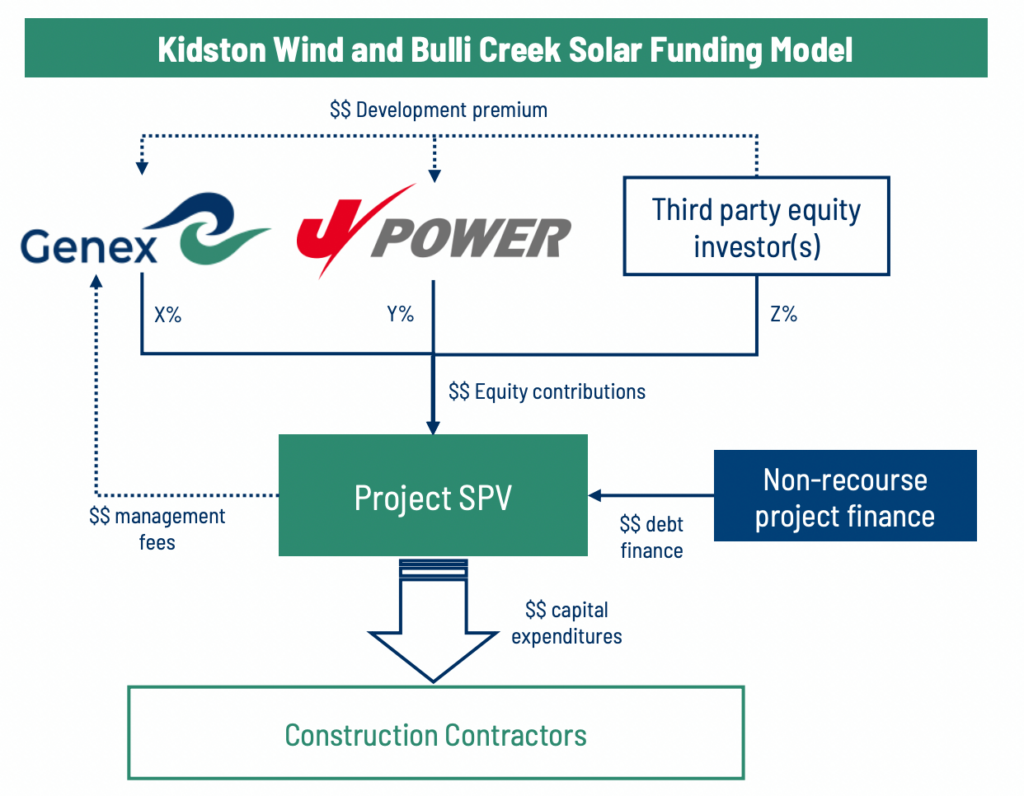

There are many reasons that it is difficult to value Genex. First of all, the majority of its assets are projects that are not in operation yet. And even when its project pipeline comes to fruition, it’s not exactly clear how much value will stay with Genex. You see, this kind of development is enormously capital intensive, so the company will have to strike deals with partners, such as is illustrated by the graphic below.

However, once the projects are built, Genex is expected to generate high margin cashflow with minimal operating and maintenance costs, compared to traditional power generation.

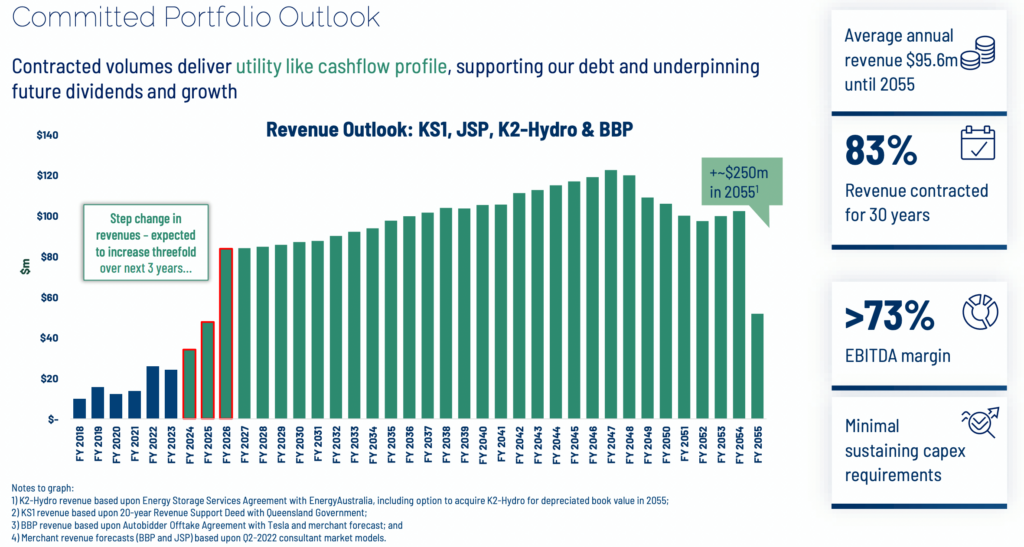

As you can see, the company is forecasting extreme growth, and is planning to more than triple the capacity of its portfolio over the next 2-3 years. However, any kind of contract delays could occur, and since these projects need to be connected to the grid, the timing is not completely within Genex’s control. Within the energy industry, connection delays are a common way for project returns to disappoint.

Until it reaches scale, Genex has pretty ugly financials. For example, in the most recent quarter, its receipts from customers were $3.4 million but its interest payments were $2.4 million. As a result its operating cashflow was negative $3.5 million. And that’s before you count the $33 million spent on developing the projects.

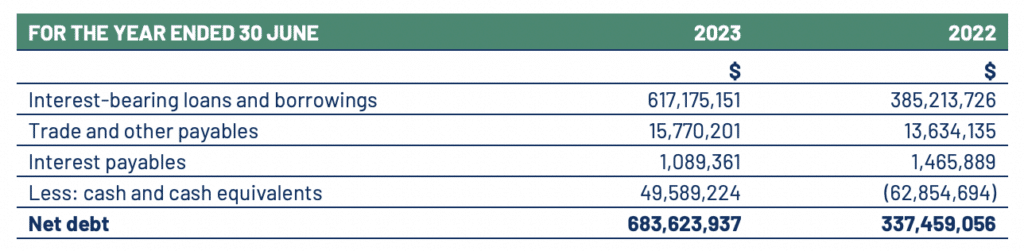

As you can imagine, Genex has net debt of over $683m, as you can see below.

This compares to a market capitalisation of about $242 million at the current share price of 17.5c.

Therefore, the enterprise value is around $925 million at the current price.

Even if everything goes well, I think it is fairly optimistic to assume Genex can generate $60m or more in EBITDA annual, though that would be approximately a 73% EBITDA margin on ~$80m of revenue. That matches with the chart above.

In that scenario, Genex would be on an EV/EBITDA multiple of about 15, which is not particularly attractive or cheap.

Therefore, even though I would love to see Genex succeed, it certainly doesn’t seem obvious to me that the stock is cheap.

Even if you could justify buying Genex on an EV/EBITDA multiple of 15, I would want to see that the company was actually achieving that level of free cashflow before investing.

In my view, the Genex share price is not sufficiently low to compensate shareholders for the risk that this novel system for storing electricity may not function as well as planned. Additionally, it is also possible the company could face delays caused by other parties as part of the connection process. Finally, I still take the view that inflation will be higher than it has been over the last decade, for at least a few more years. To me that is a real negative for an extremely capital intensive business such as Genex.

I would love to see Genex succeed but the share price is not obviously cheap to me. The current price is about 1.3x book value and seems to assume smooth progress over the next few years. However, if the shares were to trade at a discount to book value — especially if it was already breakeven at a cashflow level — then I would be a lot more interested.

Disclosure: the author of this article does not own shares in Genex. This article is not intended to form the basis of an investment decision and is not an official recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. A Rich Life does not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.