PEXA Group (ASX: PXA) is best thought of as digital toll road. The company owns and operates the PEXA “exchange”, a software platform that provides the plumbing for property settlements in Australia. Each time a transaction is lodged (similar to a vehicle on a toll road), PEXA charges a fixed fee, usually $15-$120 depending on the type of transfer or refinance.

PEXA achieved FY 2022 revenue of $279.8 million and a net profit after tax of $21.9 million. Gross margins are 86 per cent. The company has $300 million in floating-rate debt, offset by $75.4 million cash on hand.

What problem does PEXA solve?

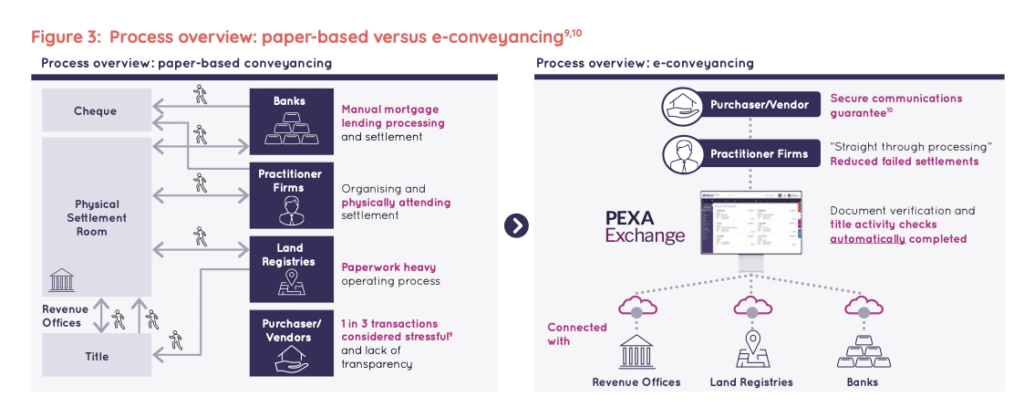

Historically, property settlement was a cumbersome and error-prone manual process. Documents would need to be couriered back and forth. There was no central place for stakeholders, such as banks and conveyancers, to share information. Paperwork would go missing. Clearly, a better solution was needed.

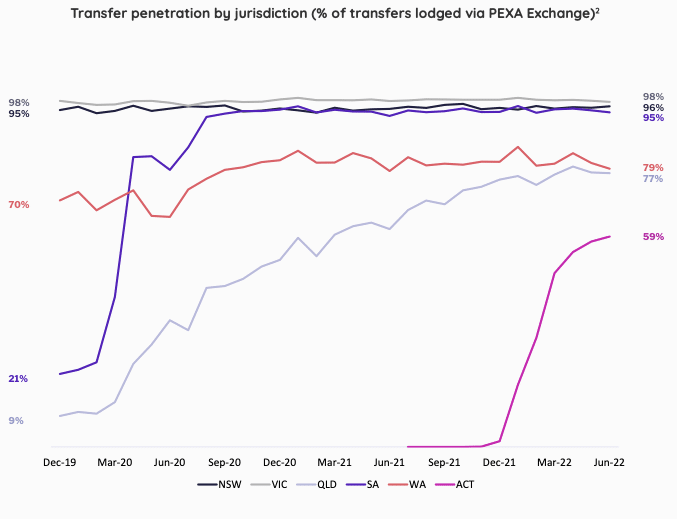

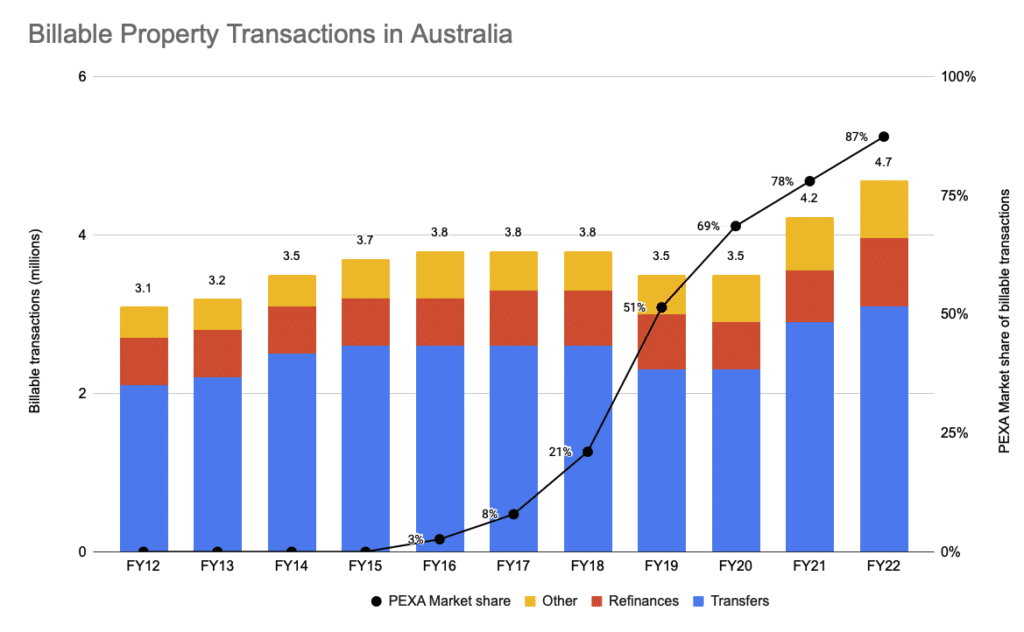

In 2008, the federal government prioritised e-conveyancing and a national system for property settlement, which would later become Property Exchange Australia, now PEXA. In 2012, all states and territories (except ACT) signed up. PEXA became the first electronic lodgement network operator (ELNO) and subsequent state-level legislation mandated its adoption. PEXA went from no market share in 2015, to 21 per cent in 2018 and today commands 87 per cent of property transactions nationally.

The government has largely achieved its goal of digitising property settlement. However, somewhat ironically, it has also, in practice, created a monopoly business. There are just two other ELNOs approved by the Australian Registrars’ National Electronic Conveyancing Council (ARNECC), both with negligible market share. The government is introducing interoperability guidelines to encourage competition, but PEXA’s network effects may prove too difficult to dislodge.

How much further can the PEXA exchange grow?

Growth in the core PEXA exchange is approaching saturation. Market share in Victoria, New South Wales and South Australia is 95 per cent or higher. Western Australia and Queensland are close to 80 per cent. These five states alone account for 95 per cent of total transactions in Australia.

Annual dwelling growth only averages 1-3 per cent per year. ARNECC regulates that PEXA can increase prices in line with or below inflation, which some wiggle for passing input costs. As a result, I expect the long-term growth of the PEXA exchange to average 5-7 per cent annually.

What is the earnings profile of the PEXA exchange?

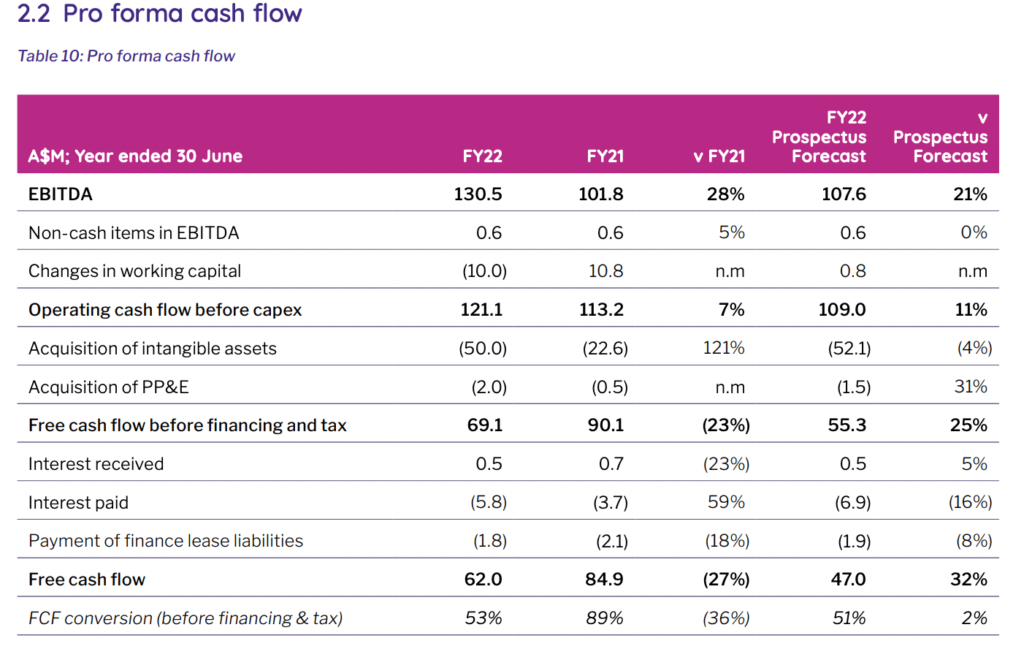

PEXA claims its FY 2022 pro forma net profit was about $38 million, with pro forma free cash flow of about $62 million, as you can see in the chart below from the FY 2022 PEXA Annual report. Even if you assume sustainable free cashflow grows considerably to around $90 million, PEXA is still trading on a free cash flow yield of below 5%, given its market capitalisation is over $2.35 billion at the current share price of $13.30.

Why did PEXA’s largest shareholder leave its register?

PEXA’s largest shareholder was ASX-listed Link Administration (ASX: LNK), which owned 44 per cent. Commonwealth Bank (ASX: CBA) owns a further 27 per cent.

On January 10, Link distributed 41 per cent of its stake to shareholders. This will lead to some selling from overseas investors, however I think in the long-term it will aid broader ownership of the company.

Currently, PEXA’s 90-day average traded volume is 350,000. At a share price of $15, just $5.2 million is traded daily. For a company with a market cap over $2 billion, this may discourage would-be institutional investors from building a position.

How will lower house prices impact PEXA?

PEXA revenue and therefore earnings are derived from the number of property transactions, rather than the real estate value.

Transfers account for 69 per cent of total transactions, but are higher revenue transactions and therefore account for 80 per cent of revenue – making it the primary driver of earnings.

The chart above illustrates the total billable transactions in Australia over the past ten years. The dip in FY 2019 coincided with an 11 per cent fall in national house prices resulting from changes in investment loans and potential changes to negative gearings. The above trend growth in FY 2021 and FY 2022 was largely driven by a buoyant property market as interest rates were cut to support the economy.

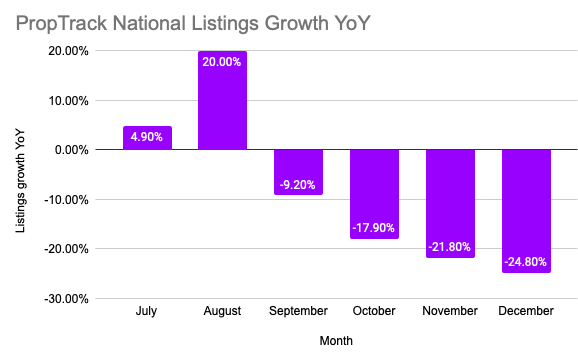

With interest moving from 0.1 per cent to 3.1 per cent in less than a year, I believe transaction numbers may fall in the near term. This hypothesis is supported by a recent drop in new real estate listings.

With respect to refinancing, the opposite is occurring. As fixed-rate loans roll-off, borrowers are moving onto variable or moving to a new lender. According to the Australian Bureau of Statistics, external refinancing values are up 20.4 per cent from a year ago.

Broker consensus is for a 3.5 per cent fall in PEXA revenue this year. However, if the fall in new listings presages a steep drop in the number of real estate transactions, PEXA could be at risk of missing estimates in the near term.

According to S&P Capital IQ, the consensus estimates for FY 2023 are for just under $270m in revenue and normalised earnings per share of $0.35. At the current share price of $13.30, that would imply a FY 2023 P/E ratio of 38. Statutory earnings per share are expected to be much lower.

What is PEXA’s growth strategy?

With the PEXA exchange in Australia largely ex-growth, management has embarked on a three-pillared growth strategy:

- International – expansion into the United Kingdom (UK)

- Insights – proprietary data & analytics products derived from the exchange

- Ventures – seed property tech upstarts

The first is taking the PEXA exchange platform to the United Kingdom. The region is 2.5x the size of PEXA’s home market and adopts the same Torrens title system. There is a clear problem for PEXA to solve; last week Her Majesty’s Land Registry publicly lamented conveyancers for basic administrative errors, which resulted in a 20 per cent stopped transaction rate.

In the UK or any other region, the biggest obstacle is adoption. Unlike Australia, PEXA does not have the government enforcing digital conveyancing adoption. It also requires significant upfront costs, with little visibility on if it will prove successful.

The second pillar is the data and analytics space. The core exchange collects information not available elsewhere, which is valuable to developers, governments and financial institutions. Management estimates this opportunity at $50 million by 2025.

Regarding insights and ventures, PEXA is embarking on merger and acquisition (M&A) activity, something it historically has no expertise in. A review of the executive management team does not reveal any recent M&A expertise across the chief executive, chief financial, chief growth or chief commercial officer roles.

Ultimately I am concerned about this strategy, as many acquisitions destroy value whether through overpaying or through “di-worsification”; reducing the quality of the overall business.

PEXA Is Resilient, But Can It Grow?

Arguably, PEXA is a high-quality software company because of its high gross margins, robust earnings profile and dominant market position. However, its growth pathway leaves plenty to be desired, because it already dominates its main niche, and may not enjoy the same competitive advantages in new markets.

While the software itself is extremely sticky in Australia due to lack of meaningful competition, the revenue model is somewhat cyclical and subject to housing market gyrations. As a result, I expect near-term earnings to come under pressure.

The biggest problem facing PEXA is the lack of growth because the current ~$13.30 arguably implies strong growth in earnings and free cash flow. I believe the UK expansion needs to be successful for PEXA shareholders to outperform the market from here, as I’m not convinced that the data monetisation or M&A growth opportunities will create sustainable growth.

Given its modest organic growth prospects in its core niche, I would argue PEXA should implement a dividend policy, allowing some cash to flow back to shareholders while still reinvesting in the UK expansion. A falling share price might create an opportunity in the future, since PEXA is a resilient business. But the short term combination of a high P/E ratio and weak short term outlook makes me cautious.

If you enjoyed this article, you might also be interested in 5 ASX Stocks With Positive 2022 AGM Updates.

Sign Up To Our Free Newsletter

Disclosure: the author of this article does not own shares in PEXA and the editor also does not. Neither will trade shares in PXA for at least 2 days following the publication of this article. This article is not intended to form the basis of an investment decision and is not a recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. Equity Story Pty Ltd and BlueTree Equity Pty Ltd t/a A Rich Life do not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.