RAS Technology Holdings (ASX: RTH) seems to be stepping out of the shadows after 24 years of operation. Since listing in 2021, the racing data supplier and technological solutions provider has more than doubled revenue from $5.3m in FY 2021 to $11.7m in FY 2023. Founders Gary Crispe and Robert Vilkaitis remain leaders in the business and their combined equity ownership is around 53%.

Prior to listing, RAS was formerly known as Racing and Sports Pty Ltd. The business name was premised on its racing and sports content website racingandsports.com.au. When this site was published, Crispe and Vilkaitis also purchased data from racing bodies and data rights holders and supplied this data to wagering operators, media organisations and retail clients.

RAS is now using software engineers and data analysts to develop data-rich features for clients. These features help clients like wagering operators and media organisations to engage and grow their bettor customer base. The clients ultimately want to find ways to encourage more gambling.

Source: RAS Prospectus (November 2021)

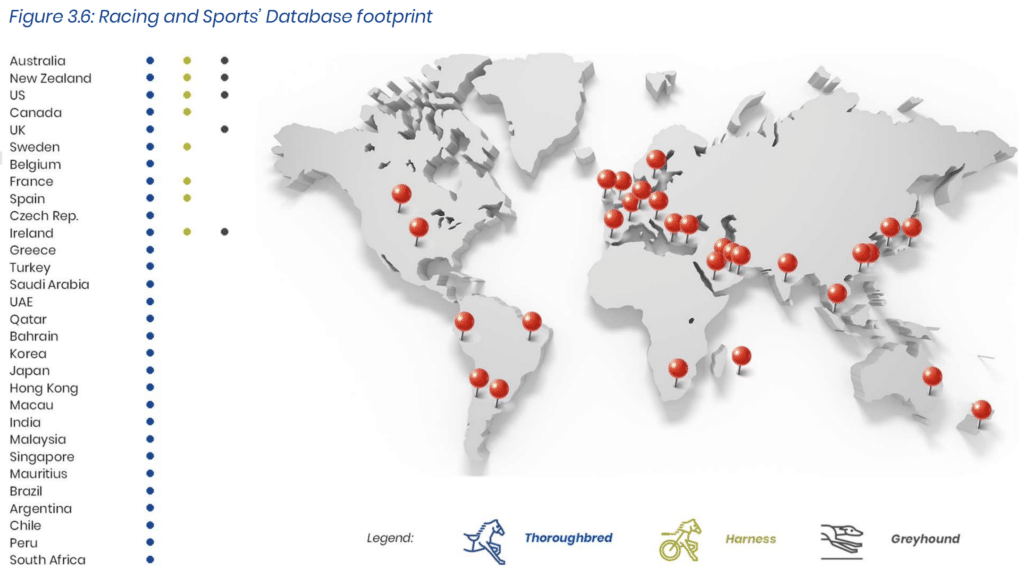

RAS has long maintained its focus on thoroughbred racing with some exposure to harness and greyhound racing as depicted below.

Source: RAS Prospectus (November 2021)

Bittersweet Growth

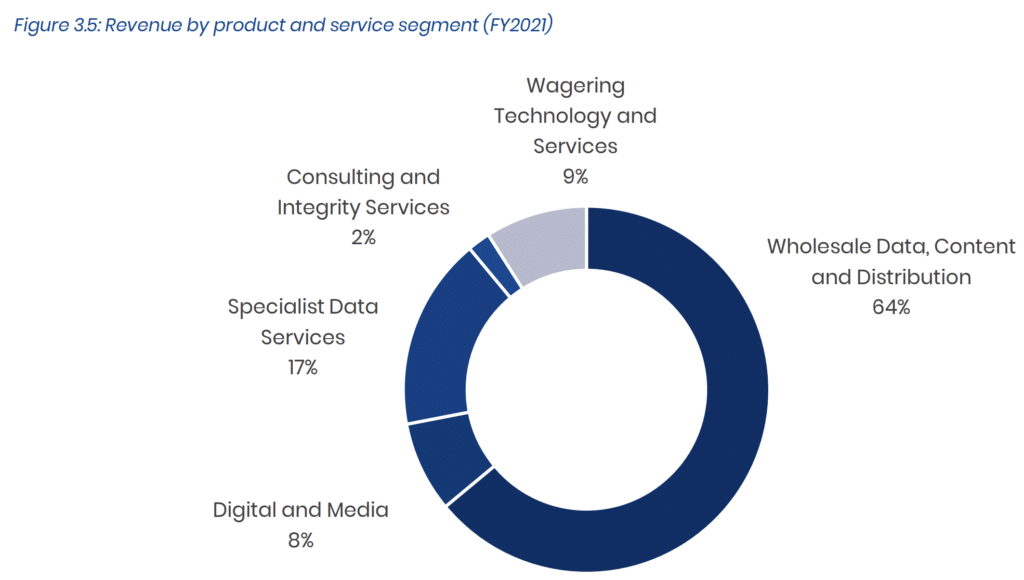

At the time of listing, RAS revenue was broken down into the segments illustrated below.

Source: RAS Prospectus (November 2021)

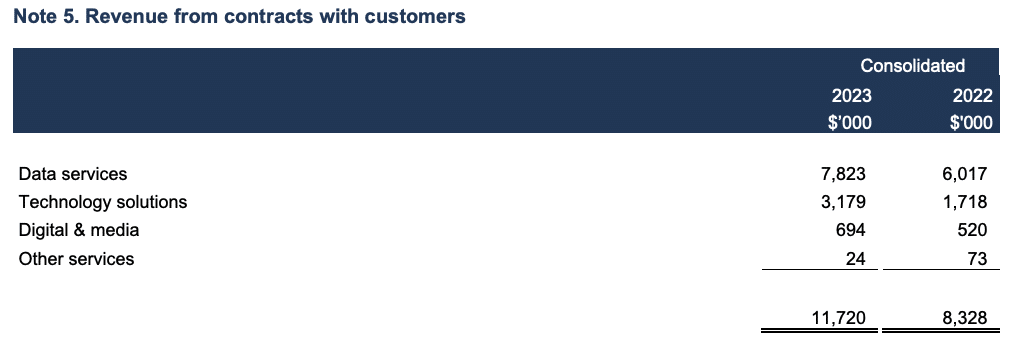

The biggest revenue contributor mainly provides wholesale data and content. Whilst wagering technology and services only contributed 9%, it’s emerging as a key growth driver and involves developing technological solutions to encourage participation and facilitate increased turnover for wagering operators. Unfortunately, management has decided to change its disclosure of the segment breakdown as seen in the FY 2023 report table below.

Source: RAS Annual Report FY 2023

It seems management has combined the specialist data services segment with wholesale data. Technology solutions has grown from 9% to 27% of total revenue in FY 2023. Such rapid growth is palpable but it comes at the expense of the need for software engineers and other tech workers. As a result, greater resources to develop technological solutions has eaten into profitability. RAS recorded a net profit after tax of $1.6m in FY 2021 followed by net losses of -$3.2m in FY 2022 and -$1.1m in FY 2023.

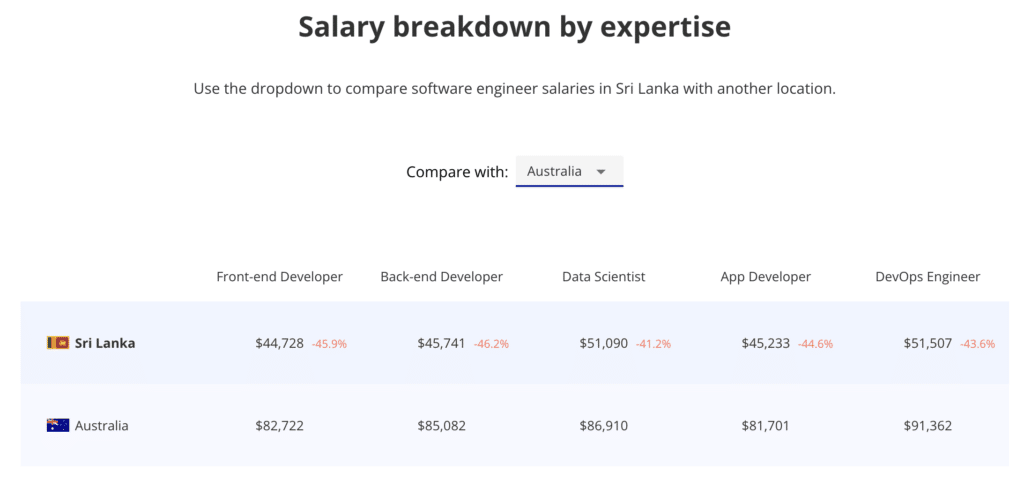

RAS seems to be winning customers by employing lower-cost software engineers and data analysts located in Sri Lanka. The salary range for these roles in Sri Lanka appears to be much lower than in Australia based on a range of sources including Glassdoor and Payscale. Most notably, according to Arc, a remote career platform that helps developers find jobs highlights the discrepancy below.

Source: Arc (US dollars)

Competitor Betmakers Technology Group Ltd (ASX: BET) suffered significant net losses in the last three financial years, primarily due to employee expenditure. Most of the tech employees at Betmakers are located in Australia. RAS could carve out a low-cost competitive advantage if peers continue to use more expensive engineers and wages in Sri Lanka remain low. Whilst a potential competitive advantage is emerging, it’s not difficult for new players to replicate. Also, I couldn’t find any businesses that have managed to achieve sustained success within the industry.

Potential Power Struggle

The most important input for RAS is data otherwise there is no business model. However, RAS does not own the data and acknowledged this as a key risk in its prospectus. RAS disclosed its key suppliers are limited to a small group of source data suppliers, both in Australia and overseas. Given it appears to be a small group of suppliers, this probably weakens RAS’s existing fragile bargaining position.

Global competitor Genius Sports Limited (NYSE: GENI) knows this power struggle all too well. It serves more than 600 wagering operators with a focus on sports data. Despite generating $US341m in revenue for the year ended 31 December 2022, it posted a net loss of -$US181m.

In its 2023 annual report, cost of revenue when excluding the impact of the reduction in stock-based compensation lifted by $US64.9m, which was driven by higher data rights and media direct costs and increased amortisation of capitalised software development costs and acquired intangibles. Data and streaming rights costs increased from $US97.9m in the year ended 31 December 2021 to $US128.7m.

In Genius Sports’ 2023 annual report, server and bandwidth costs were disclosed as material variable revenue-generating costs. This is a key expense that RAS will need to contend with as it signs up more clients and offers more features, requiring more data. Data and processing expenditure for RAS has doubled every year since listing in 2021 and currently sits at $1.6m for FY 2023.

On top of that, sports betting has questionable if any value to society and arguably does more harm than good. It is therefore fair to say that RAS faces increased regulatory risk compared to most tech companies, should regulatory changes put their customers under stress. Many investors may wish to avoid investing in RAS for ethical reasons. For example, a 2015 study found that around 25% of gamblers in Australia bet more than they can afford to lose. But while the gambling industry is heavily steeped in addiction and money laundering, that does not mean it is unprofitable.

Management also flagged intentions of expanding across sports data. Genius Sports’ recent performance serves as a timely reminder of the dangers in extrapolating RAS’s performance in thoroughbreds and greyhounds to other sports.

At a current market capitalisation of $45m and revenue growing at breakneck speed, the current valuation could underwrite RAS’s weak competitive advantage and brittle bargaining position across the value chain. However, I’d rather invest in a more pure technology business that possesses a stronger competitive advantage and is higher up in the food chain. Xero (ASX: XRO) potentially falls in this category. Claude recently provided A Rich Life members with his thoughts on Xero’s H1 FY 2024 results.

Disclosure: the author of this article does not own shares in ASX:RTH. The editor of this article does not own shares in or have a position in ASX:RTH. This article is not intended to form the basis of an investment decision and is not an official recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. A Rich Life does not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.