Within the ASX small cap sector there have historically been a number of low organic growth but profitable software businesses. These kinds of investments don’t always turn out well, but they can still offer decent risk adjusted returns if you are careful about your purchase price. For example, Class Limited (ASX: CL1) was growing mostly by acquisition, but is now being acquired (at a premium) by Hub24.

Arguably, Infomedia falls into this category of resilient but unexciting software companies, and it’s not one I’d usually focus on, for that very reason.

However, I have to say it has caught my eye lately, when the share price fell from above $1.60, to below $1.40, when the CEO resigned (to become CEO of Nuix (ASX:NXL)) as it turns out. Funnily enough, the share price currently sits at about the same price it was at the nadir of the sell off in March 2020. We don’t see many software stocks that are flat since then, so it’s worth taking a closer look at the business, to figure out if the market is offering us good value.

What Does Infomedia (ASX:IFM) Do?

Infomedia has a range of software products serving automotive dealers. For example, the “Microcat EPC is the industry leading online Electronic Parts Catalogue (EPC) that grows dealer parts sales, productivity and customer satisfaction.” You can see how that works in the video below.

But these days, it’s more than just a catalogue. Rather Infomedia is trying to expand vertically with in its customer niche, with products such as “Superservice Triage”, showcased below:

The company also has business intelligence software called Info Drive.

And finally, the company recently acquired Simplepart, which provides automakers and dealers with a branded website, online store and digital marketing support to power successful e-commerce programs for parts and service. Notably, Infomedia agreed to pay USD $24.5 million, plus an earn-out of up to USD $20.5 million over

three years.

The company currently has $66m AUD in cash, so it should still be in a net cash position even after making the earn-out payment (if required).

In FY 2021, the company made profit of $16m and free cash flow of about $12.3 million (excluding acquisitions). That was down on the prior year, FY 2020, in which it produced $17.8 million in profit and $16.7 million free cash flow (also excluding acquisition payments).

The company said that “revenue and profit growth were held back in the first half of the financial year by the significant disruption of Covid-19 to dealerships globally in 2020.” The second half was weaker at a profit level due in part to the commencement of amortising the “Next Gen” software which was rolled out successfully to more than 220,000 users in 186 countries, according to the company. But it also suffered from the “derecognition of goodwill” when the company paid the earn out on the prior acquisition of the Infodrive product.

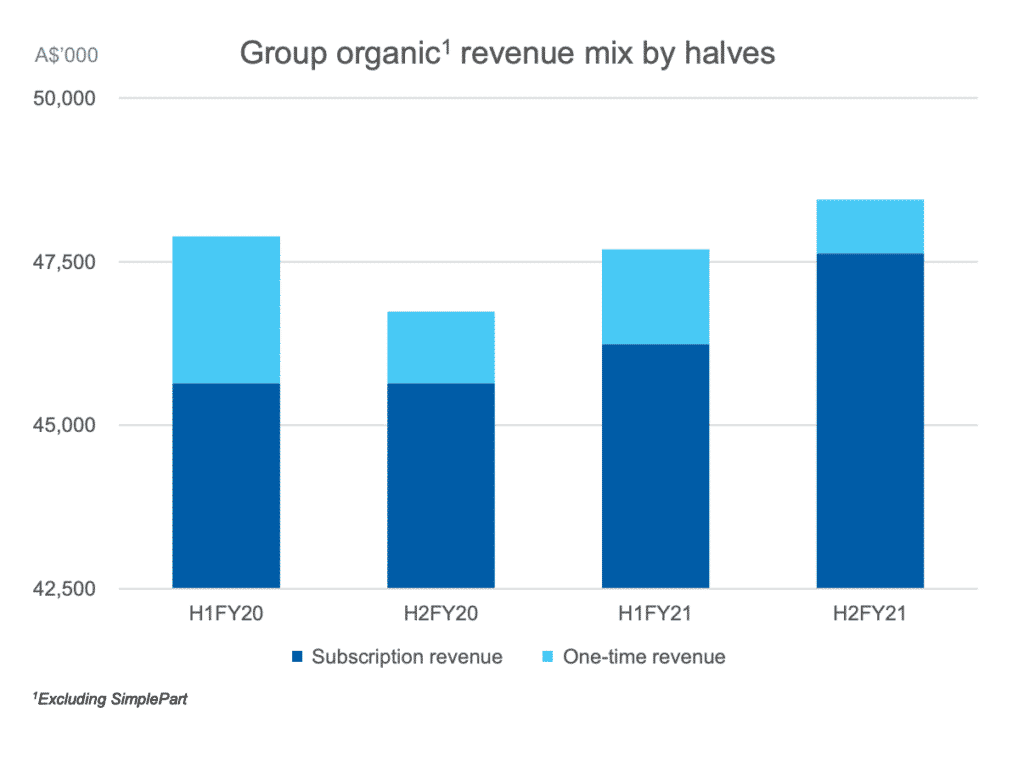

While it’s good to see that recurring revenue increased in the second half, the drop off in one-time revenue may bode poorly, since most of that revenue is for integration, installation and training new clients.

With just a little bit of growth, you could easily see Infomedia reaching recurring revenues of $100m per year, putting the stock on about 5.4 times annual recurring revenue.

Now, SimplePart is expected to increase profit in FY2022, but we can get a very conservative estimate of profit by simply assuming that all the various moving parts even out, and profit stays flat at $16m. A more balanced estimate might assume a little organic growth and credit for the SimplePart acquisition, and land at closer to $21 million.

At the current share price of $1.43 Infomedia has a market cap of about $540 million, putting it on about 27 times this conservative profit estimate. My conservative and balanced estimate are way below analyst consensus estimates (per S&P CapIQ) of over $23 million. I think $23 million would be possible, but it also feels at the bullish end of the scale given the best half year profit the company has made is $9.5 million, and if we more than double that, we still need to assume $3 million profit from SimplePart to get to $23 million.

Zooming Out

Here we have a decent quality recurring revenue software stock trading on a somewhat reasonable multiple of a middling estimate of profits, which is probably slowly improving its business quality and has just started accelerating its recurring revenue growth.

The CEO and CFO have both just resigned, and the replacement CFO worked for GBST and Amaysim, both of which were companies that missed guidance in their time. One would hope that Infomedia is not going to come in below analyst estimates, but that would seem to be a genuine possibility.

To my mind, there are a few ways to play this. For starters, I could back the “consensus analyst estimates”, which would arguably mean the stock is pretty attractively priced, given it can probably keep growing with “add on acquisitions” and winning the occasional new contract. If it grows profit at just 10%, then within 5 years it would be on a P/E of 15, which would probably be way too low (depending on the macro environment, I guess).

Alternatively, I could wait and see if they give any hints about how the business is faring, at the AGM. Ultimately, it is very understandable that the market might doubt analyst forecasts, given how both the CFO and CEO have made an acquisition and then left the company before it has been fully paid off.

That said, if the company actually hits analyst estimates, then the shares look fairly cheap to me. So I think Infomedia is worth watching closely, even if it is still a bit too risky for me right now.

Edit Wednesday November 10: There’s plenty more beyond the above to consider when thinking about Infomedia. In particular, there is a reasonable argument to be made that in the long term electric cars will be bad for the company as they require less servicing. On the other hand, perhaps complexity of servicing will go up, in the short term, as long as there is a mix of electric and combustion.

Personally, I think there’s a heightened risk of missing analyst expectations, but the stock could be interesting as a takeover target, at a lower price.

For further discussion of Infomedia, check out episode 2 of the new BabyGiants podcast, featuring myself, Matt Joass, Andrew Page and Kevin Fung:

Please remember that these are incomplete personal reflections about stocks by author. I do not own shares in Infomedia, though I retain the right to buy some if I decide to. This article should not form the basis of an investment decision. It is an investment diary valuable only for the cognitive process it demonstrates. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer.

For early access to content like this, join our Free newsletter!

Note: If you haven’t already tried Sharesight, we thoroughly recommend testing it out. The service allows you to see your proper investing returns over multiple time periods, including sold positions, and to do a thorough review of your wins and losses. It saves heaps of time doing taxes. If you’d like to try Sharesight, please click on this link to for a FREE trial. If you do decide to upgrade to a paid subscription, you’ll get 2 months free, and we’ll get a small contribution to help keep the lights on.