Virtual data room SaaS provider Ansarada (ASX: AND) revealed positive results in Q1 FY 2024. Total customers may have lifted by 122% relative to Q1 FY 2023, but most were non-paying. Paying subscriber numbers fell slightly from 2,702 to 2,681. Revenue grew from $12.9m to $13.3m across the same period. Cost cutting enabled Ansarada to reverse negative operating cash flow of -$2.5m and achieve positive operating cashflow of $1.9m. Ansarada currently holds $21.6m in cash.

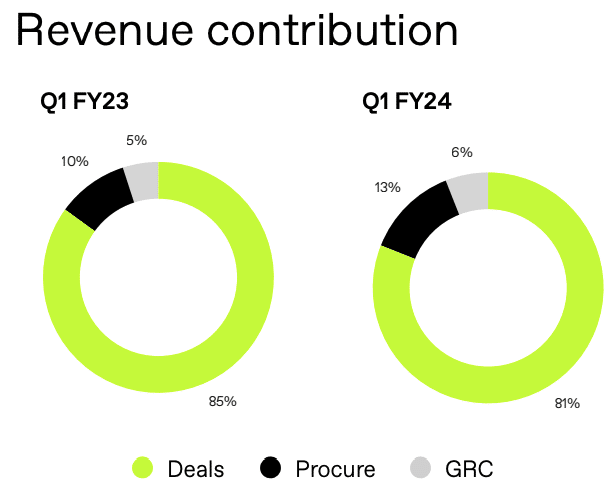

Despite positive results, management’s outlook is not particularly optimistic. Management noted lower merger and acquisition (M&A) activity is negatively impacting volumes. Ansarada is trying to find more recurring revenue opportunities that are less sensitive to economic activities. This presents a significant challenge because its revenue from deals remains the core driver as seen below.

Source: Ansarada Q1 FY2024 Investor Presentation

Ansarada benefits when companies are optimistic about future growth and eager to merge and acquire businesses to fuel growth ambitions. Lawyers and bankers use Ansarada’s data room solutions to execute these deals. More deals lead to greater usage of Ansarada’s services. However, once deals are completed, there is no need to continue the subscription.

Dreary Deals Outlook

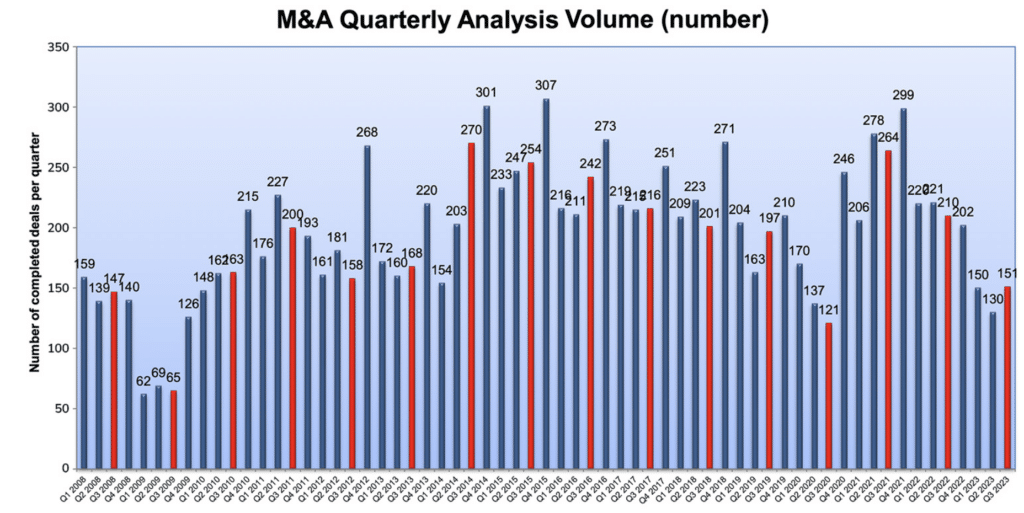

Ansarada’s surge in revenue growth across FY 2021 and FY 2022 stemmed from a strong cycle in deals activity. However, deals have dried up as companies’ wallets have shrunk due to higher interest rates, inflation and supply chain challenges. The level of M&A activity shown below highlights the cyclical nature of revenue from deals.

Source: Consultancy.uk

Another way to gauge corporate appetite for deals and growth is the activity levels of major consultancies. The idea of a merger or acquisition is often planted by consultants. Such work is declining as the Big 4 accounting firms cut staff and consultancy giants McKinsey and Bain have delayed the start dates of graduates as reported by the Wall Street Journal.

Ansarada is in a tough position where its core revenue is subject to the whims of a slowing economy. The deals business is needed in order to support the growth of other segments like procurement and governance, risk and compliance. However, these segments come with different types of clients that require different solutions. Greater complexity results in more challenges in scaling the business. As a result, Ansarada will require a more diverse set of software engineers and employee expenditure remains the biggest cost driver.

Given the grim outlook of consultancy work and the difficulty in scaling the business, Ansarada doesn’t present a clear asymmetric opportunity in my eyes. I would prefer spending time monitoring higher-quality ASX stocks like the 3 highlighted by Claude earlier this month.

Disclosure: the author of this article does not own shares in or have a position in Ansarada. The editor of this article does not own shares in or have a position in Ansarada. This article is not intended to form the basis of an investment decision and is not an official recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. A Rich Life does not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.