It’s high time I wrote this article. I could have written it a week ago.

The reality is that the global economy is going to be severeley impacted by this coronavirus pandemic. I have saved an important part of my little family’s capital by drastically increasing my cash reserves in February. But I didn’t to as much as I should have.

Therefore, I wrote yesterday, that “I will be moving aggressively towards a “market neutral” position, which I aim to maintain until I have more visibility to when the pandemic will end.” My problem is that I don’t have enough cash on the sidelines. That cash will be particularly useful when the market reaches a truly desperate state. We are not there yet.

Why do I think we have further to go?

Every day I see investors and asset managers flouting their long positioning.

Looking at the small cap funds I invest in, very few of them have more than about 10% – 15% cash, with only Brazier Equity moving aggressively in response to the pandemic, during the month of February.

All in all, I invest in some of the best fund managers. They have good results, and they are delivering on their strategies. But not all small-cap fund managers are so good. I anticipate a large amount of withdrawals from many actively managed funds in the coming weeks. This will put a second wave of selling pressure on the small-cap companies that populate my portfolio.

The USA Is Going To Suffer Very Badly

During the last few weeks, I have attuned my thinking to the people who have actually managed to position their funds appropriately for the bear market. The most obvious ones to me are: Ben McGarry, John Hempton, Rob Shears and Matt Brazier. Most people do not know Matt, but his investors know that he sold out of 70% of his fund’s portfolio in February. I know of no other long-only fund that did that.

All of these people are behaving in a way that indicates that we have further to fall. Ultimately, this coronavirus pandemic brings solvency risk to many companies, and that is exacerbated by poor management of the disease.

By all accounts, the USA is extremely committed to privatised healthcare. It is political to suggest state subsidy. Over there, it costs significant sums to the individual to get a test for coronavirus, according to reports on twitter like the one below (Edit: Trump has now announced subsidised testing, but testing rates are still very low in the USA):

Just went to Seattle’s UW Medical Center to ask how much patients are being charged for a coronavirus test.

— Michael Hobbes (@RottenInDenmark) March 11, 2020

$100-$500 if they have insurance.

$1,600 if they don’t.

Investors Around The World Keep Talking About The Flu

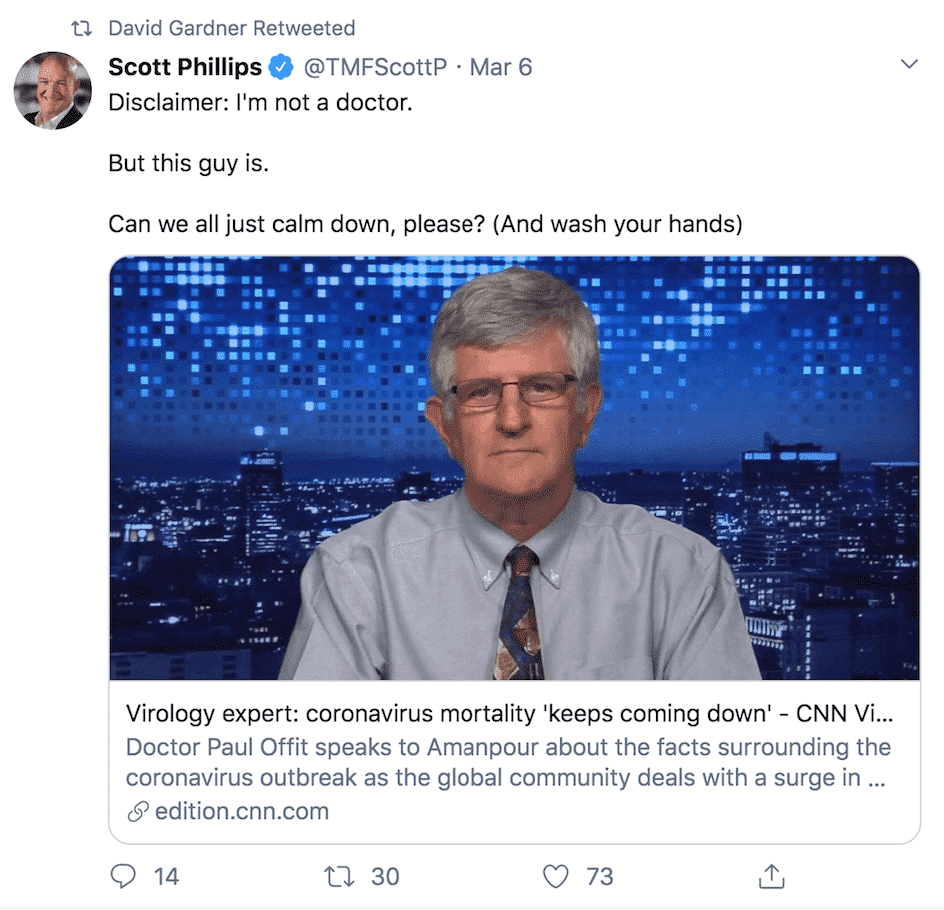

Meanwhile, just a few days ago, David Gardner, the founder of The Motley Fool with 20k followers on Twitter, retweeted Scott Phillips the Research Director of Motley Fool Australia, when he shared a video that said:

“The virus will be very similar to influenza virus” and “the good news is that it’s very unlikely to be any more damaging than influenza virus is; I cannot imagine frankly that it will cause one tenth of the damage that the influenza virus causes every year in the United States.”

You can find the original video here, and you can see the tweet below:

Putting aside the ethical implications of spreading this message to the community, it shows a level of complacency by those who influence retail investors so very much.

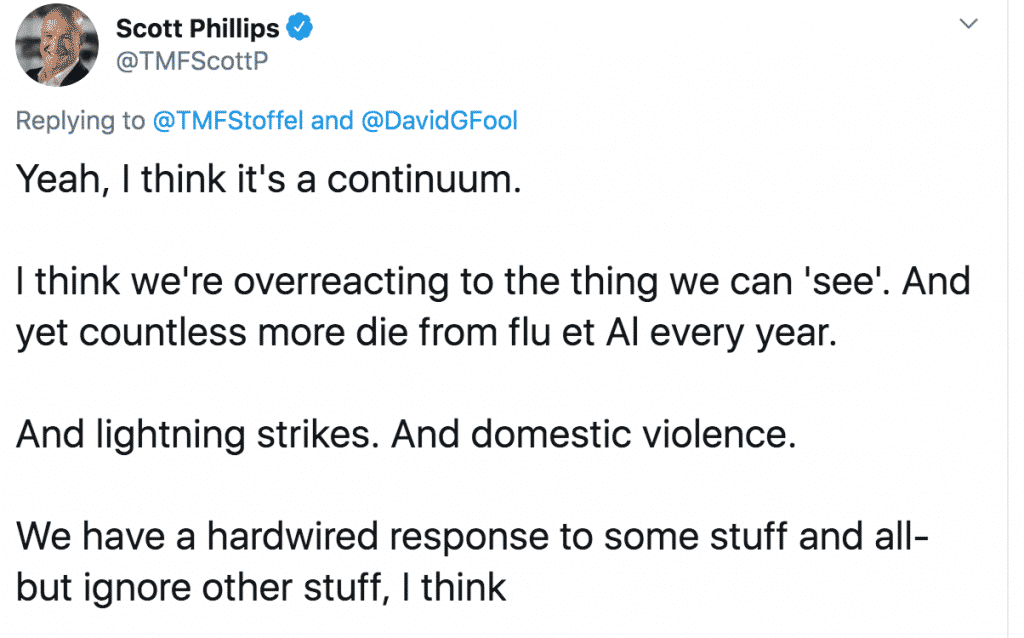

At the moment, it’s still socially acceptable for large research organisations to spread the message that “more Australians will likely die from flu this year. That we treat those two things so differently suggests more than rational logic at play…”

Until either it becomes manifestly unacceptable to say such things, or else we invent and distribute a vaccine, I do not think things will get much better. While the velocity of the share price falls may reduce from here, as a fundamental evidence based investor I will be looking for signs the real-world situation is improving before expecting the markets to improve.

Not The Flu

You do not have to spend very long to find a doctor in Italy (on the frontline of the outbreak) warning that the coronavirus is not just a flu. But on top of that, you need to also think that China’s lockdown, preceded by chaotic overcrowding of some hospitals, was as a result of their inability to manage a disease “similar to the flu”. China is far too capable for that to be coherent, in my view. Of course plenty in the markets think society is already overreacting.

This post is not financial advice, and you should click here to read our detailed disclaimer.

If you’d like to receive a occasional Free email with more content like this, then sign up today!