During February, insurance broking company AUB Group (ASX: AUB) reported statutory net profit after tax (NPAT) down 52% to $26.4m but underlying NPAT up almost 13% to $79.3m. Revenue increased 12.1% on the prior corresponding period to $712.6 million. While it is always worth scrutinising what is excluded from underlying profit, in this case the biggest swing factor was the movement in contingent consideration (a future payment obligation, contingent on meeting performance targets), as you can see below. That means the underlying profit gives a better guide to the trajectory of earnings.

While I believe these exclusions make sense when considering the trajectory of earnings growth, I don’t generally use underlying profits as a major tool for valuation. Instead, I tend to track statutory earnings and dividend payments.

You can see below that while the AUB statutory earnings per share does jump around a fair bit, the dividend payments take a more regular growth trajectory. In both cases, the second half is always stronger, and over the long term the statutory earnings per share easily covers the dividend.

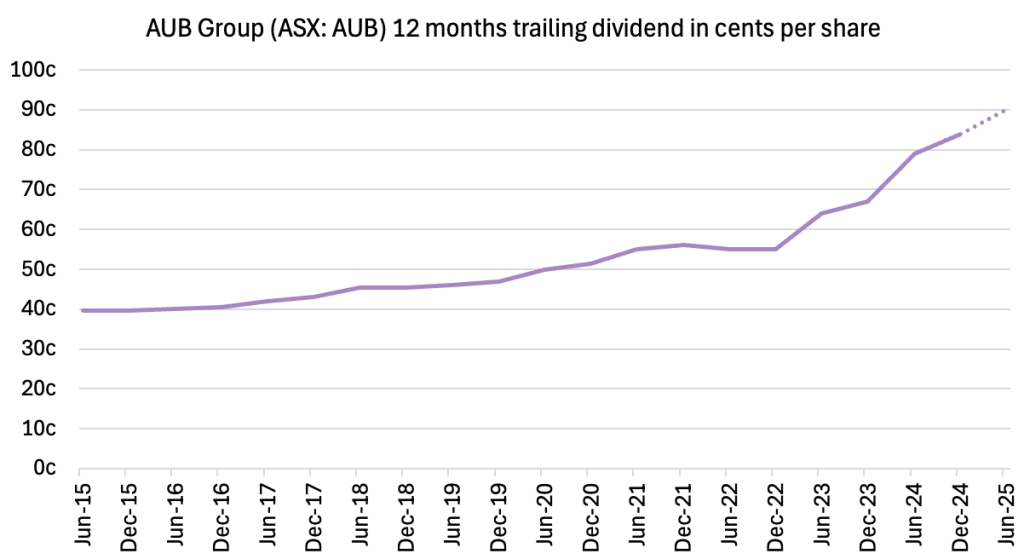

I like to also look at the trailing twelve months dividend payment to smooth out the half-on-half volatility and make the growth trend of the last decade much more obvious. I’ve included my estimate for the final dividend in the chart below. If these estimates are correct, then at the current share price of $28.81 AUB Group trades on a forward dividend yield of over 3.1%, fully franked.

Operating cashflow was strong in H1 FY 2025, at over $100m (that’s before the impact of cash held in customer accounts). Free cashflow was strongly negative due to significant acquisition payments, particularly the Tysers acquisition. In fact, the company has agreed to a $95m final payment for Tysers in February (post December 30 reporting date) and has increased its borrowing capacity by an additional $250m to fund it. The balance sheet is definitely the weakest element of the business, since it carries significant debt as you can see below from their investor presentation.

That said, because of the more than $1b held in trust accounts, AUB still benefits from higher interest rates, even though that does increase the interest it pays on its corporate debt. Equally, while its income from interest received of around $27m in the last half, should drop with lower interest rates, at least a large portion of that impact will be offset by lower interest payments on its debt (around $26m in the last half).

Does AUB Group Benefit From Chaos?

My impression from the AUB Group earnings conference call suggested the CEO Mike Emmett remains fairly bullish on the long term outlook, despite any volatility that might occur in markets. He said that, “I believe premium rates will go up for the rest of my lifetime,” and “the more volatile and uncertain the world is, whether that’s because of geopolitical risk, whether it’s economic risk, whether it is economic activity, inflation, weather events, et cetera, all of that conflates to be positive, and I hate to say this, but I will, [all of this is a] positive for insurance brokers.”

Finally, the AUB CEO also offered some hope that all the recent acquisitions are performing reasonably well, when he mentioned that “we are building out a portfolio of businesses that are not only performing better than forecast, but they actually have more potential than we anticipated.” Therefore, even though the changing macroeconomic zeitgeist has made me sell a lot of different stocks, I still consider AUB Group shares to be in the ‘buy’ territory and I am strongly considering adding to my existing shareholding (but not for at least 2 days after publishing this article).

Please note the author owns shares in AUB at the time of publication and will not trade AUB shares for at least 48 hours after the publication of this article. The author has not considered your investment objectives and this is not personal advice. This article is not intended to form the basis of an investment decision. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Ethical Investment Advisers Pty Ltd (ABN 26108175819) (AFSL 343937).

Want to learn about A Rich Life’s number one small-cap growth stock with a market capitalisation under $300m? Join the waitlist to become a supporter of A Rich Life and you’ll receive a free special report about this under-the-radar small cap that could see profits soar in the years ahead.

Join The Waitlist To Become A Supporter, And Receive Our Free Special Report Directly To Your Inbox