This year, both Audinate (ASX: AD8) and Objective Corporation (ASX: OCL) have pre-announced their earnings results for FY 2022. Generally speaking, I don’t put too much emphasis on pre-announced headline results, because the devil is often in the detail. However, I thought I’d take a quick look at what we learned from Audinate and Objective Corp, and what I should look for as a shareholder, in the upcoming results.

Audinate (ASX: AD8) headline results for FY 2022

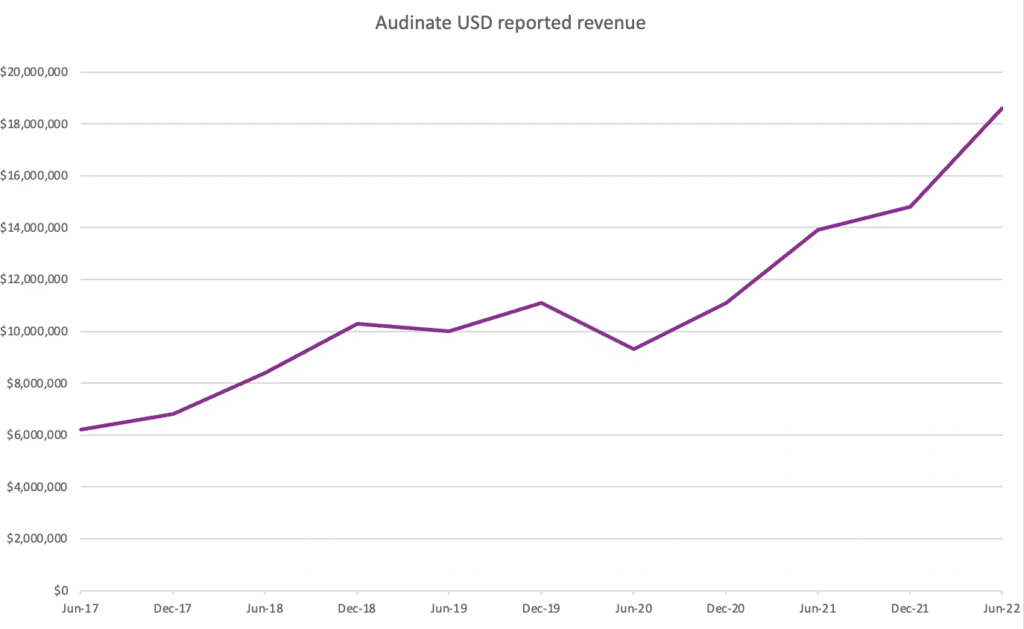

In late July, Audinate (ASX: AD8) announced its expectations for its FY 2022 Results. The good news for shareholders was that revenue is up 33% in USD terms, to US$33.4 million. This equates to about $46.3m AUD. As you can see from the chart below, that means H2 FY 2022 was the strongest ever half for Audinate, in terms of revenue.

On top of that, in its half year results, Audinate said that “US revenue growth expected for FY2022, albeit not at historical rates”. Given the context of supply shortages, this obviously suggested that growth would be weaker. As it turned out, revenue growth was actually stronger than it had been in prior years.

The Audinate share price had already risen from about $5.30 to around $9 by the time this news came out, thanks in part to a June update promising revenue over US$30m.

The company has also said that Earnings Before Interest Tax Depreciation and Amortisation would be A$3.8 – A$4.3 million (compared to A$3.0 million in FY21). This implies that the company is still operating at around breakeven, with minimal operating leverage on display, despite very strong revenue growth.

Key Questions For The FY 2022 Audinate Results

The key question for me is why Audinate revenue growth is not falling to the bottom line, and whether the company has a sensible rationale for the ongoing increase in expenditure. In the same spirit, I will be looking at the cashflow statement closely to check that the company is operating around cash flow breakeven.

That’s important, because if the company is at least free cash flow breakeven, then it has a license to continue spending on growth. If, in fact, investing cashflows are so great as to cause significant cash burn, then the company may once again need to raise capital.

On top of that, I’m sure the market will be interested in the company’s forecast for gross margins. In the first half, the gross margin was 75.6%, and in the full year the gross margin is expected to be 74.7% suggesting a gross margin of around 74% in the second half. This is notably lower than FY 2021, but still in line with past results (such as FY 2018 and FY 2019). Still, it’s not great to see falling gross margins, since that does not support the thesis that the company has ample pricing power.

Finally, the full year results will contain valuable forward looking information, such as the number of launched products using Audinate technology, information about new Dante product launches, and growth expectations in the year to come. I’ll personally be interested to see what traction, if any, the company is getting with Dante Domain Manager.

Objective Corporation (ASX: OCL) headline results for FY 2022

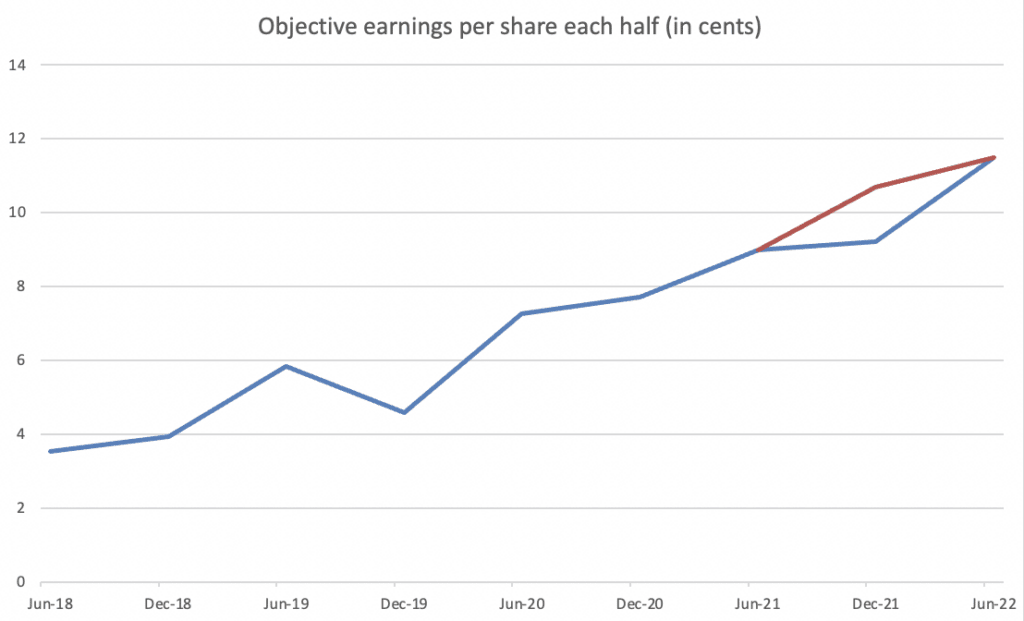

In the middle of July, government and regtech software provider Objective Corporation announced its headline results for FY 2022, disclosing that it expects revenue up 12% to $106.5m and net profit after tax (excluding the $1.4m NZCC settlement) up 30% to $21m. This is a very strong result, because it shows the company is benefitting significantly from operating leverage, unlike Audinate. As you can see below, this underlying Earnings Per Share result is the best half year result ever for the company. The red line shows earnings per share excluding the NZ Competition Commission settlement paid by Objective.

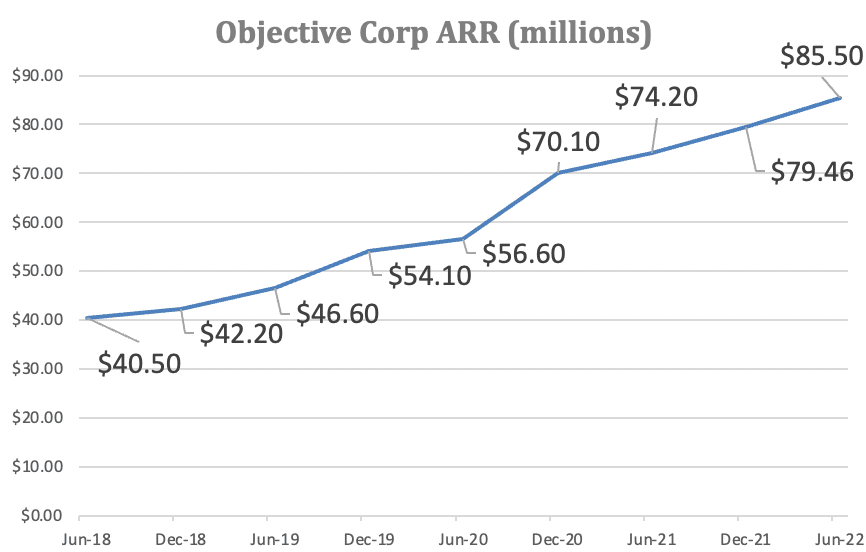

Objective Corp annualised recurring revenue (ARR) grew about 7% half on half, which is in line with recent periods.

We already know cash flow will be strong, since operating cash flow came in above $30m.

Key Questions For The FY 2022 Objective Corporation Results

I look forward to seeing the segment breakdown and in the last half I had noted I expected stronger growth from RegTech and Planning divisions compared to the content and processes software. One potentially positive sign would be that the new Nexus software is gaining traction.

It seems unlikely from these headline results that I would make any major changes to the thesis. However, my guess is strong free cashflow will boost my confidence a bit. It will also be interesting to see if the company increases the dividend at all, though given the company’s long term growth and careful use of acquisitions, I base my valuation more on earnings and free cash flow than dividends.

Based on the underlying EPS figures we’ve been given, the main bear point is likely to be a fairly optimistic price tag of around 70 times earnings, based on annualising the record 2nd half. However, I will not update my valuation until the results are out. The main questions other than valuation would be whether Objective’s competitive positioning is changing and how quickly it can grow without acquisitions.

Please remember that these are personal reflections about stocks by an author, and this article is not intended as a recommendation. The author owns shares in both Audinate and Objective Corporation. This article is not intended to form the basis of an investment decision. It is an investment diary intended to be valuable only for the cognitive process it demonstrates. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

Save time at tax time: If you’d like to try Sharesight, please click on this link for a FREE trial. It saves heaps of time doing your tax and gives you plenty of insights about your returns. If you do decide to upgrade to a premium offering, you’ll get 4 months off your subscription price (the best deal available, I’m told) and we’ll get a small contribution to help keep the lights on.

Sign Up To Our Free Newsletter