Audinate (ASX: AD8) reported its results for the first of FY20 yesterday and the share price flopped 14% in response. I must admit to clenching my butt cheeks slightly when I first saw the title of the results release (“Audinate remains well positioned to deliver long term growth”) – which I initially interpreted as slightly defensive and standoffish in tone based on my past experience that similarly titled releases have accompanied downgrades and results below expectations. The share price reaction proved that my initial response was potentially on the money – although I don’t think the numbers were at all bad – but they were clearly below what the market had expected.

The share price had run hard from below $7.00 at the time of full-year results in August to above $9.00 late last year and into early 2020, before selling off ahead of results (not unusual for growth stocks during this or any other earnings season). The AD8 share price plumbed an intraday low of $5.82 (down 23% at that point) before recovering to $6.49 by close – a decent rebound all things considered. The wobbles of the broader stock market so far this week (as usual, experienced more viscerally for growth stocks) will certainly not have helped sentiment towards Audinate, and indeed the share price hit $6.00 today during the first hour of trade before bouncing strongly (to close at $6.65). I believe that buyers at and below $6.00 will be rewarded over the medium to longer term for their relative calmness amidst the broader backdrop of market volatility.

Strengthening operational momentum

Before parsing the financial results, let’s update our favourite operational metrics for the business – which we use to track the progression of the Dante ecosystem and the source of the company’s economic moat. Over the past couple of years, management has been accelerating product development in order to further extend Audinate’s competitive advantage over rivals. Remember – as we covered in our initiation report from August 2018 (on the old Ethical Equities site, you can google it), Audinate is attempting a Land Grab and aiming to position Dante as the de facto industry standard for the professional Audio Visual market (a scenario under which all OEMs would embed Dante in their AV product).

In the investor presentation accompanying yesterday’s results, management repeated its oft-used chart which compares the total number of protocol-enabled audio products in the market place (not reproduced here as the company stopped updated competitor numbers some time ago). Audinate believes it has ~7x as many Dante-enabled products in the market as its nearest rivals (based on the post-Integrated Systems Europe (“ISE”) trade show tally of 2,518 products from earlier this month – already 6% higher than the figure at end of December (2,371 below)).

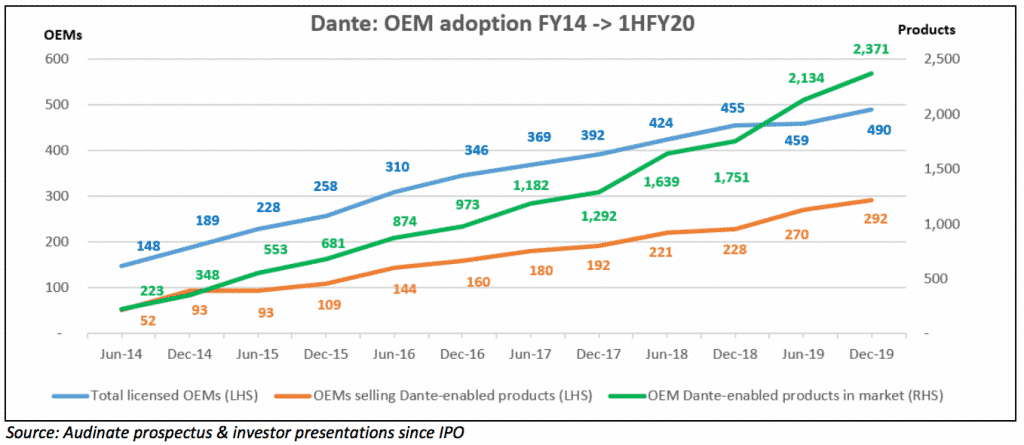

The chart below rolls forward the company’s key metrics to 31 December 2019 and as stated in our previous coverage of the company from August 2019 (on the old Ethical Equities site, you can google it) is the key set of metrics to understand the long-term growth runway for Audinate and the success or otherwise of the attempted Land Grab. The chart illustrates the potential Network Effects at play here, as the company adds new OEM customers which embed Dante into more new products launched into the consumer AV market (the green line below) – thus further strengthening Dante’s position and the need for future products to include this protocol.

As described previously, the blue line represents all OEM customers who have signed up to license Audinate’s technology, while the orange line represents those OEMs who have actually released Dante-enabled products into the market. The delta between the blue line and the orange line therefore represents licensed OEMs which are still in development phase and yet to launch their first products. As at December 2019, only 60% (292) of total licensed OEM customers (490) had released products utilising Audinate’s technology – suggesting there is a significant future pipeline of products from the 40% of licensed OEMs currently in development phase (which we understand to last 1-2 years typically).

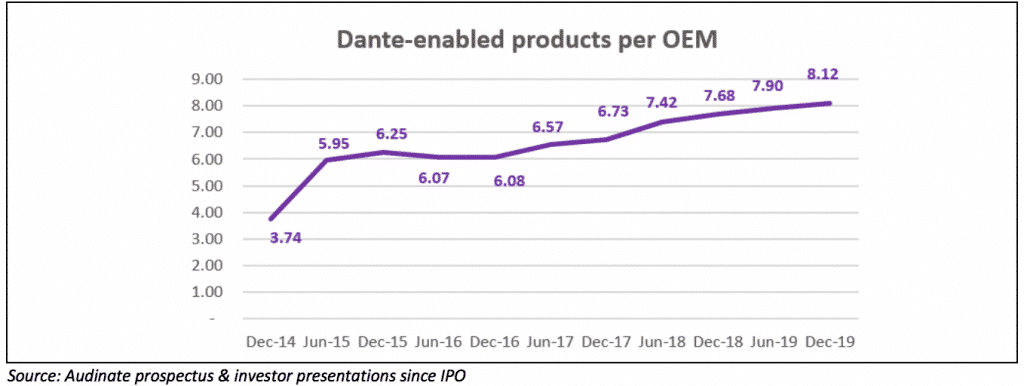

In summary, the total number of licensed OEMs increased by ~7% in the 6 months between June and December 2019; the number of OEMs selling Dante-enabled products increased by ~8%; and the total number of products in the market increased by 11%. So far, so good. The new chart below illustrates that the average number of Dante-enabled products per OEM is still increasing despite the dilutionary impact of more OEMs signing up to license the technology. I believe that Dante is still currently embedded within only a small fraction of the OEMs’ product range, and that Audinate will continue to increase penetration within its OEM customer product portfolios.

To my mind, this provides a degree of comfort over potential future revenue and earnings from the OEMs still in development phase. In my mind’s eye I can see the slope of the key green line in the chart above steepening over FY21 to FY23 from the twin effects of (1) OEMs moving from the 1-2 year development phase to launch phase; and (2) OEMs which have already moved into commercialisation phase over the past couple of years expanding their product range. Time will tell, but key operational metrics still seem to be tracking positively in relation to OEMs already licensing Audinate’s technology…

…but this of course ignores the fact there are still a significant ofOEMs yet to license the Dante protocol. Assuming that management’s long-used estimate of >2,000 professional AV OEMs in the company’s core target ‘Sound Reinforcement’ segment is still accurate, this suggests customer penetration of less than 25% based on 490 licensed OEMs at December 2019 and that there is still substantial potential upside from contracting new OEM customers and increasing the blue line above.

Dante Video represents significant potential future upside

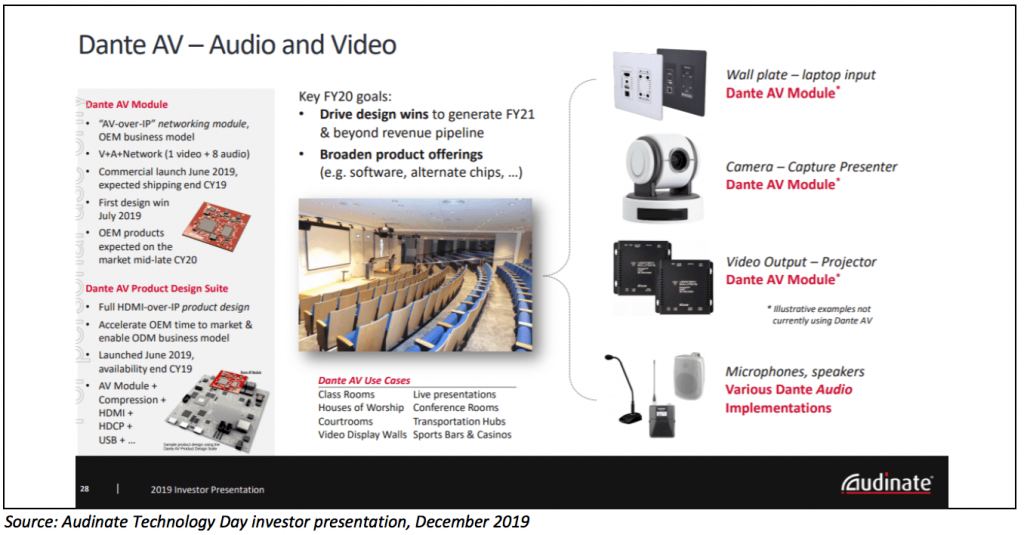

The key operational metrics detailed above do not of course include any contribution from the new Dante AV (combined audio & video) product – which was first launched at the ISE trade show in February last year. The slide below is reproduced from the company’s Technology Day presentation in December and illustrates use cases for the AV product.

Per the results investor

presentation released yesterday, the first Dante

AV Product Design Suite chips are likely to ship next month (delayed a

quarter from the estimated date above due to product modifications requested by

key customers) – which will precede the commercial availability of the first

OEM products in the December 2020 half-year. As such, the first meaningful

revenues from Dante AV will not be generated

until FY21 – and even then it may not be until FY22/FY23 before this new

product range is generating $1M of annualised revenue. Yamaha (a key AD8

shareholder) and Bolin Technologies are two of the first four OEM customer wins

for this product, and Bolin showcased its new range of pan/tilt/zoom cameras

with Dante AV integration at the ISE

2020 trade show a couple of weeks ago. Signs so far are positive and we believe

that Audinate can leverage its growing dominance in networked audio to gain

traction in the networked video market.

1H20 results and likely downgrade for full-year FY20

Audinate’s 1H20 results are included in the main table below (which contains half-on-half results for the company dating back to FY17). The thin table below right also compares actual 1H20 results versus our projections from our last update on the company back in August 2019 (in which we attempted to project both halves of FY20E based on management’s guidance on revenue (taking the mid-point of the range) and seasonality for the current fiscal period).

Prima facie the company only narrowed missed our projected revenue (by ~1%), and actually outperformed our projected EBITDA by $0.2M (~11%) largely due to higher gross margins (the highest GM% achieved since FY15). However, we must note that:

- EBITDA benefited from the adoption of AASB 16 Leases (and the reclassification of rent costs as finance costs and resulting transfer below the line) and would have otherwise been flat vs 1H19; and

- Revenue and COGS benefited from the currency tailwind of the A$ depreciating against the US$ during the period – and in its transactional currency (US$) sales increased by only 8%. Higher margin software unit sales increased 11% vs the December 2018 half (driving the increase in gross margin above) and Chips, Cards & Modules (“CCM”) unit sales were down 2% vs pcp.

Pleasingly, however, software unit sales increased by 32% from the preceding June 2019 half, and CCM sales were up 3% – so the company did in fact return to growth in 1H20 after a lacklustre second half of FY19.

Management noted the continued impact of tariffs imposed on certain Audinate products and also on OEM products manufactured in China – which it had already flagged as a potential headwind at the time of full year results in August (and which caused the pull-forward of 2HFY19 sales into 1HFY19). While the company flagged that some of its OEM customers are trying to alleviate tariff impacts by relocating manufacturing to other countries (Audinate indeed did this with its own Malaysian manufacturing operations), it’s clear that this is likely to weigh on 2HFY20 results – as will the current coronavirus-caused manufacturing shutdown in China.

As previously flagged, the company further invested in its engineering and R&D teams in order to accelerate product development (increase from 34 to 53 people in the last 12 months, the majority of whom are software developers).

We also know that Audinate is investing in its Sales & Marketing team and has created the Dante certification program in order to train system integrators, audio engineers and consultants. This creation of expertise amongst the end users in the Dante ecosystem (with 80,000 certified professionals globally at December 2019) is likely to lower barriers to adoption and accelerate the use of Audinate’s technology over the medium to longer term and is a smart strategy in my opinion.

Management did not provide hard guidance for full-year FY20 but did iterate that it expects further half on half revenue growth – albeit below historical growth rates due to the continuation of broader macroeconomic impacts outlined above.

This essentially represents a downgrade to previous full-year guidance. In our FY20E projections from several months ago we had estimated 2H20E revenue of ~$20M (based on the original 45%/55% 1H/2H split) – that would represent a 24% increase in the top line from the half year results just delivered, and intuitively feels too high at this point. It seems more likely that 2H20 revenue is closer to $17-18M – which would represent a 5-8% revenue downgrade (versus the midpoint of the previous range). This is not at all a large downgrade in the scheme of things.

Closing thoughts

I continue to believe that Audinate remains an attractive longer-term investment opportunity – particularly with the share price down nearly 30% from its recent all time high (of $9.30) at today’s closing price (of $6.65). While the effective downgrade to FY20 revenue is clearly not ideal, the company has continued to make meaningful operational progress in the interim, and the recent 30% share price discount handed out by Mr Market in the last several weeks more than adequately compensates for the higher near term uncertainty – in my view.

Key metrics have strengthened further over the first half of FY20 and I anticipate a significant acceleration in revenue over the next few years as OEM customers currently in development launch their initial suite of Dante-enabled products, and as earlier adopting OEMs continue to expand their product range. The new Dante AV technology is also a potential game changer – however shareholders will need to be patient with the first meaningful AV revenue not expected until later this year.

It is still early days in the migration of the audio networking industry from audio to digital, and currently more than 75% of global OEM players have not yet licensed the Dante technology. There is a long multi-year growth runway open to the company, and for the next few years at least management will be largely focused on investing in R&D and S&M ahead of longer term revenue and profitability (although the company is also very mildly profitable).

Audinate remains a long-term core portfolio holding for me personally. I recognise however that the company is relatively expensive on traditional metrics (in the same sense that Xero is expensive as that company executes its own Land Grab). While none of this is intended as advice, I note that Audinate has a current market cap of around $450M, and very low (current day) profits, so many would consider it relatively risky.

_______

Disclosure: I (the author) own shares in Audinate. I may trade shares in the future – but, not for at least 2 days after the publication of this article.