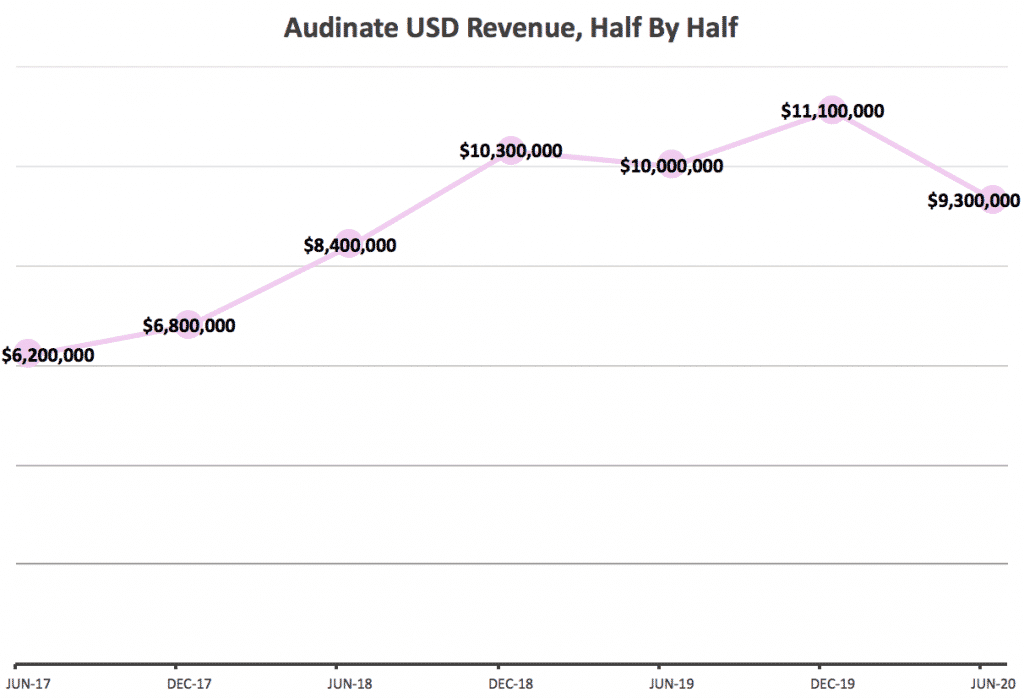

This morning Audinate Group Ltd (ASX: AD8) reported it expects to earn US$20.4 million in revenue for FY 2020. This compares to US$20.3 million in FY 2019, but in reality, it is a tale of two halves. As you can see below, the second half was worse than any in the last two years. But in contrast, the Audinate share price is actually up 7% at the time of writing, almost at the price when I started selling Audinate shares in March!

Is Audinate (ASX: AD8) Still A Growth Stock?

Although we are certainly fans of the Audinate (ASX: AD8) business here at A Rich Life, we should probably all take a moment to ask ourselves whether the business is really growing. You see, just because the growth has been stopped due to a pandemic, does not mean the growth has not stopped.

At the moment, the market is rewarding stocks that are growing faster due to the pandemic, not stocks that are suffering. It’s certainly not clear why Audinate has fared so well, given it is clearly in the firing line.

If you hold Audinate, as I do, it’s probably worth asking yourself whether you’re investing in growth or investing in a turnaround. I’d posit the latter.

Some Good News In The Audinate (ASX: AD8) Update

When Audinate last reported its results, it said that it had EBITDA of $1.9m for the first half of FY 2020. Today’s announcement says that EBITDA for the full year is about $2m, so it’s fair to say the company hasn’t blown itself up because of this half. On top of that, today the company says it has Dante in 2,804 products, which is a strong 18% increase on the 2,371 reported at the end of December 2019. This indicates that the underlying business is having some growth, but that growth in customers cannot outweigh the headwinds facing those customers.

What Now For The Audinate Share Price?

As I am writing this, the Audinate share price is up over 7%. To me, this implies that the market was expecting worst than guidance implies. This is truly bizarre, because today’s news is very negative. Given that lock-downs only really impacted about 4 months of the last 6, it would appear that the covid-induced contraction has been rather severe for Audinate.

Looking deeper, we could posit that Audinate’s customers, who sell audio equipment used in places where people gather in large groups may continue to see a contraction in demand for a very long time. Until a vaccine is developed, only a fool would spend large amounts of money unnecessarily upgrading large venues that are likely to remain relatively empty. The outlook doesn’t look great for Audinate.

In my opinion that means that the outlook for the Audinate share price is quite negative compared to companies that are either unaffected by social distancing requirements, or actually benefit from them. Therefore, while I hold a small parcel of Audinate shares as a tribute to its quality, I am not optimistic about the holding while this pandemic continues to play out.

For me, Audinate is a turnaround — albeit one that is reliant of external not internal factors to drive that turnaround. Therefore, I consider it more palatable than the typical turnaround (of a mismanaged company or one facing long term headwinds).

Save time at tax time: A Rich Life depends on Supporters to pay for its free content, so if you’d like to try Sharesight, please click on this link for a FREE trial. It saves me heaps of time doing my tax and gives me plenty of insights about my returns. If you do decide to upgrade to a premium offering, you’ll get 4 months off your subscription price (the best deal available, I’m told) and we’ll get a small contribution to help keep the lights on.

If you’d like to receive a occasional Free email with more content like this, then sign up today!

This post is not financial advice, and you should click here to read our detailed disclaimer. The author owns shares in Audinate but will not trade them within 2 days of publication.