Yesterday, Australia’s third largest pathology network Australian Clinical Labs (ASX:ACL) reported profit of $60.4m from revenue of $646.7 million in FY 2021. This is its first report as a listed company and it is a merger of several smaller pathology networks, not all of which were operating together for the full year, so its pro forma profit of $88.7 million is arguably more relevant. Either way, the market liked the result, pushing the shares up to all time highs above $4.50, before they dropped slightly to $4.44 yesterday.

The current P/E ratio is low, at around 10, given pro forma earnings of almost 44 cents per share. However, this is probably because partly the market thinks the level of covid testing from FY 2021 will not be sustained going forward. As a reminder, I bought shares in Australian Clinical Labs in July 2020, because I thought it would benefit from increased covid testing volumes as the epidemic spreads in Australia.

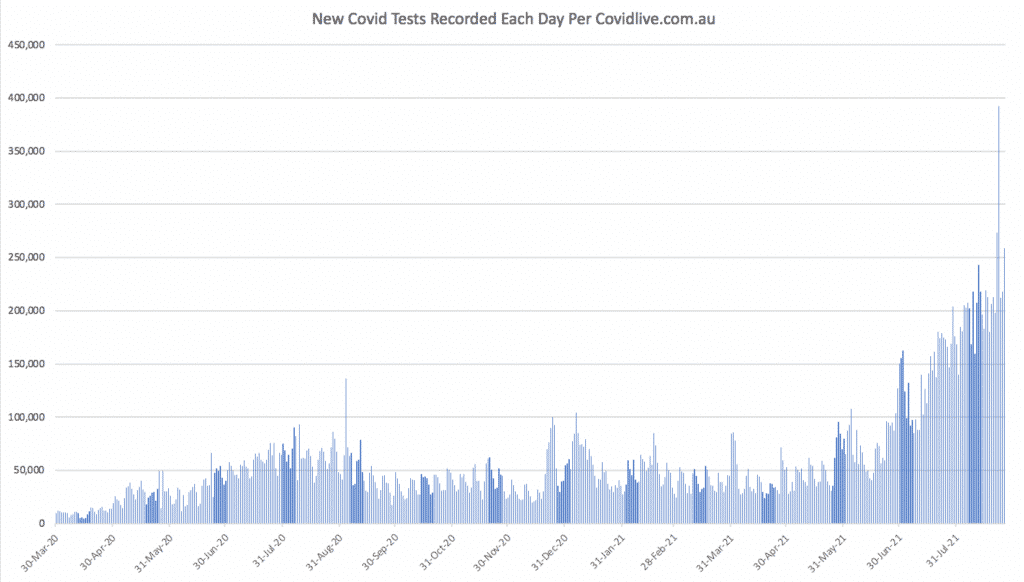

The governmental decision not to eliminate covid in NSW with a hard lockdown, means Covid is now endemic in Australia. This is problematic given low vaccination rates and so governments have used extensive test, trace and isolate protocols to try to slow the spread. You can see below how the number of new covid tests each day have increased since July. To quote the Australian Clinical Labs CEO, Melinda McGrath on the conference call: “We think we’ll continue to be central to making sure the disease doesn’t get out of control.”

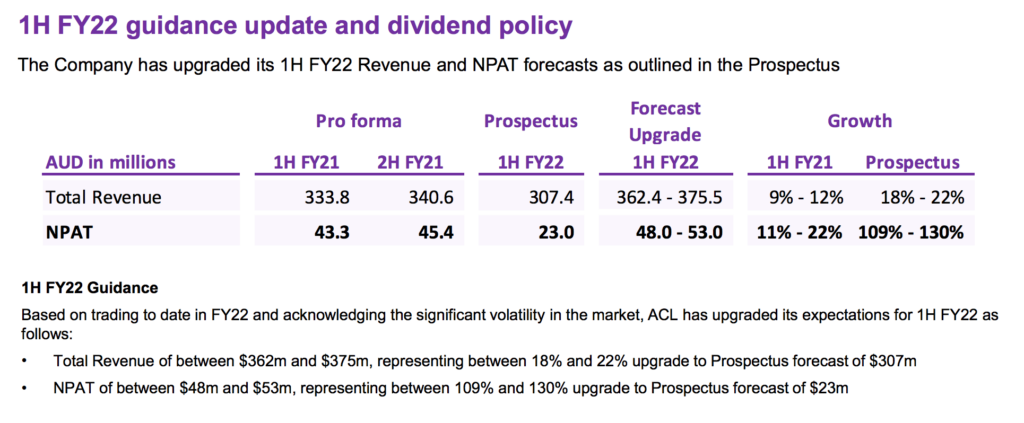

The trading conditions have been better than the company initially expected. Partly that’s because of a large increase in covid testing, but also it seems that non-covid testing is holding up better than it did in the initial lockdown last year. The result has been that profit was slightly above the top end of upgraded guidance for FY 2021, and a hefty 109% upgrade to the prospectus forecast for 1H FY2022.

Are Australian Clinical Labs (ASX:ACL) shares cheap?

At the current price of $4.44, ACL has a market cap of $896 million and net debt of about $260m. Based on annualising the forecast for the next half, the company is trading on about 10x earnings. Of course, it’s impossible to say how long current testing demand will persist.

One concern I previously had was that rapid antigen testing could take market share from the higher margin PCR tests. I asked the CEO about this, and she said, “I think rapid antigen will increase demand… they have a high percentage of false positive and false negative… in addition to that we’ve been approached by companies to do rapid antigen testing with them… that’s a non medicare commercial activity… I think it [rapid antigen testing] will just expand the pool of non medicare testing.” Only time will tell if this is accurate but it’s somewhat reassuring that rapid antigen testing may have some positives for ACL, even if it does reduce covid PCR testing volumes too.

Furthermore, it was previously my view that non-covid volumes would drop significantly during outbreaks, but the CEO said on the call that “the non covid volumes are certainly not going down as much as we had seen initially… overall we’re really happy with where the non covid volumes are and we’re seeing good growth in all of our channels.”

One risk is that the company increases expenses as a result of its current good fortune. Currently, it is benefitting from extra covid testing revenue. This puts a rocket under profit, due to operating leverage. That’s a positive for now, but as testing volumes reduce, the operating leverage works the other way, and profit can drop quite a lot. Overall, I doubt that the shares are cheap on a normalised basis. Rather, they simply look cheap as a result of very benign operating conditions. Sometimes, that’s more than enough to see the share price rise, potentially because of quantitate investing systems, but also if people want to protect their portfolios against the outbreak in Australia. In any event, I don’t think the shares are particularly expensive, at current prices.

Importantly, almost 100 million shares are currently under escrow, most of them belonging to Crescent Capital partners, the private equity firm that put together the IPO. After the December 2021 results (that is, H1 FY 2022), about 33 million of those shares will come out from escrow. It is likely Crescent Capital will sell these shares. On the downside, that will place some downward pressure on the share price. On the upside, that will increase liquidity and make it more likely for Australian Clinical Labs to be included in the ASX200, which should stimulate passive buying. Either way, I will likely look to sell some or all of my shares before this time.

For now, with Covid testing volumes continuing to march higher, the short term outlook for Australian Clinical Labs looks positive.

Please remember that these are personal reflections about a stock by author. I own shares in Australian Clinical Labs and will not sell for at least two days after publishing this article. This article should not form the basis of an investment decision. It is an investment diary valuable only for the cognitive process it demonstrates. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer.

An aside from me: If you watch Ausbiz, and want to be alerted of interviews I do as they happen, you can follow me on Ausbiz. I do appreciate any follows on that platform, so if you do follow me; Thanks!

For early access to content like this, join our Free newsletter!

Note: If you haven’t already tried Sharesight, we thoroughly recommend testing it out. The service allows you to see your proper investing returns over multiple time periods, including sold positions, and to do a thorough review of your wins and losses. It saves heaps of time doing taxes.If you’d like to try Sharesight, please click on this link to for a FREE trial. If you do decide to upgrade to a paid subscription, you’ll get 2 months free, and we’ll get a small contribution to help keep the lights on.