For the last few months, I’ve been covering a company called Australian Clinical Labs (ASX:ACL).

It is the largest pureplay provider of PCR covid testing. I think it is cheap.

However, one key element of my investment thesis, which I outlined here, was that testing volumes would continue to grow with case numbers. You can see all our Australian Clinical Labs coverage here.

At the time of writing I am still holding some ACL shares, though I have already sold some shares at higher prices, as per this update.

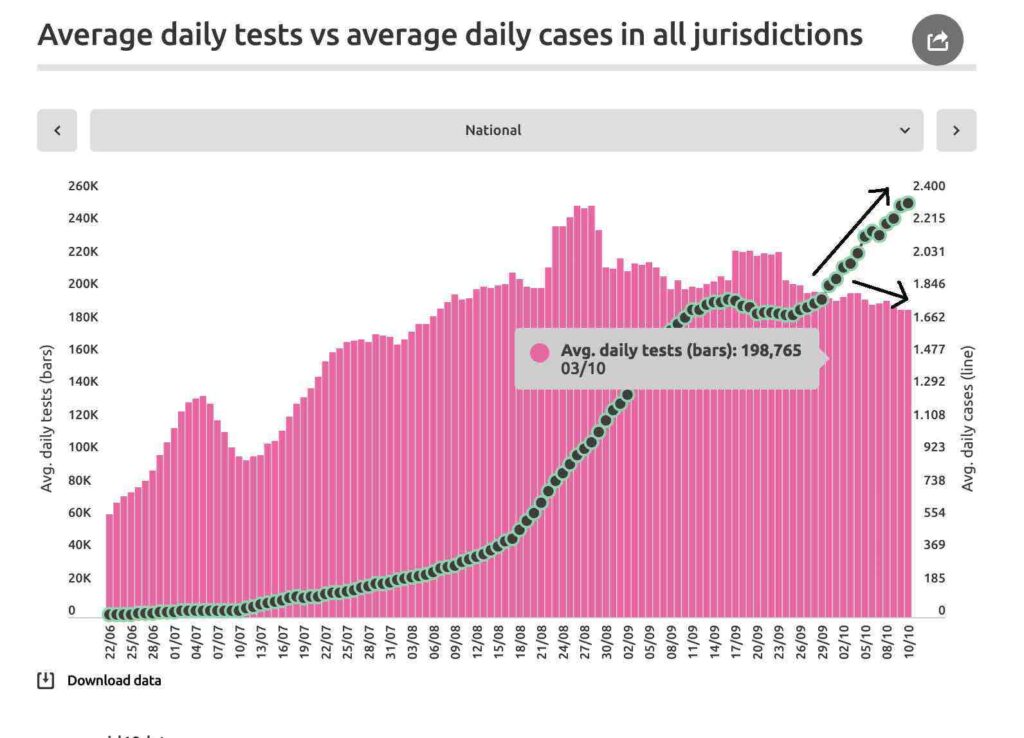

However, even though I personally believe that the company is too cheap, I have to admit that my thesis is broken since I had previously contended that testing volumes would follow case numbers. As you can see below, that’s no longer true, since cases are increasing strongly but testing is decreasing. In the graph below, the pink is the test numbers and the dots are the case numbers.

As a result, in the coming days I’ll probably start selling my Australian Clinical Labs shares. I’m not quite sure the timing, and I’m not in a particular hurry, but suffice it to say I’m planning to sell out. We may have already seen peak PCR testing in Australia, especially with the recent TGA approval of rapid antigen testing.

Please remember that these are only incomplete reflections on a stock by the author, who currently owns ACL shares but is planning to sell them in the near future. This article should not form the basis of an investment decision. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer.