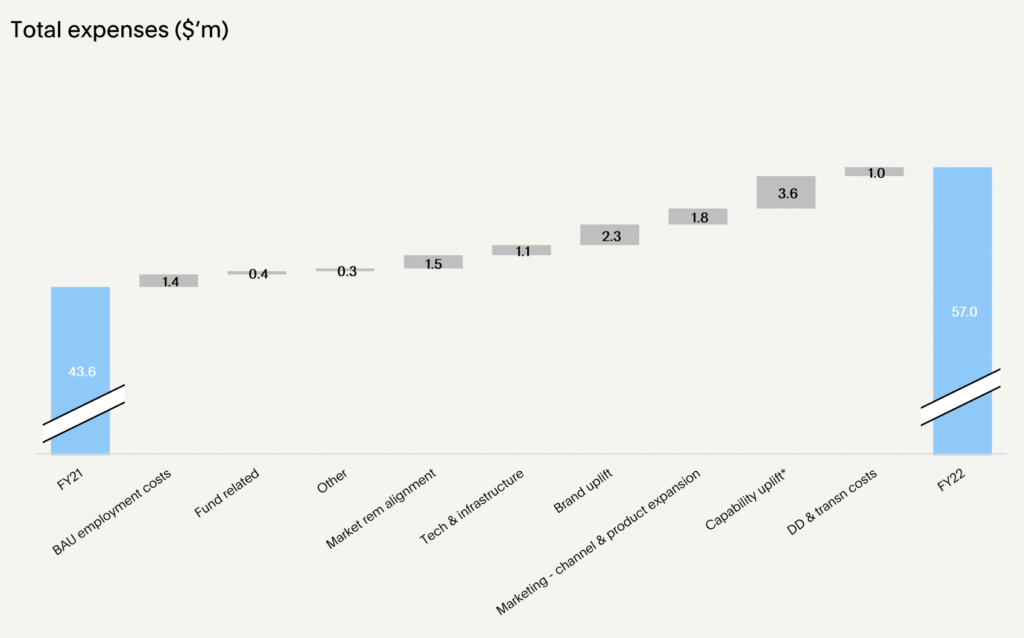

Ethical fund manager Australian Ethical Investments (ASX: AEF) today released the Australian Ethical results for FY 2022, showing net profit down 15% to $9.6 million and underlying profit down 7% to $10.3 million, in line with guidance. Australian Ethical revenue was up 21% to $70.8 million. Profit was down as revenue failed to keep up with expenses, and was hampered by a lack of performance fees and negative market movements in the second half of the year. The company also suffered from the loss of an institutional mandate worth $200m. Excluding the absent performance fees, underlying profit would have grown 10%.

Free cash flow was fairly strong at $8.5 million, even after the purchase of shares for employees, an investment in Sentient Impact Group and paying lease liabilities. The balance sheet is rock solid with over $26m in cash.

At the end of the FY 2021 Australian Ethical results, the company outlined a “high growth strategy” of “expanding our product offering, growing our brand awareness, fully digitising and upgrading the customer experience and significantly expanding our newer customer segments.” On the conference call, management described FY 2022 Australian Ethical results year one of the high growth strategy. They implied that FY 2023 would also see strong expense growth, and so the company should once again see either flat or compressed margins. Rather, they said operating leverage would start to kick in, in FY 2024.

What Is Australian Ethical’s High Growth Strategy?

Australian Ethical seems to be motivated by the idea that there is more and more competition in ethical investing services. In FY 2021 they said that “we believe it’s possible to continue on our current growth trajectory and grow our business 3 to 5 times over the next 4 to 5 years.” Practically that means investing in the following:

- increased remuneration to employees.

- investment in adviser channel.

- investment in brand awareness.

- investment in “capability across the Investment, Customer Experience, Business Intelligence & Technology and People & Culture teams.

These investments benefit employees, by expanding the team and paying them more, but at the expense of profits. However, I do think it makes a lot of sense to build out the company’s capability to take over other superannuation funds, as we are seeing with the takeover of Christian Super. On the conference call management said that “M & A opportunities are coming… a lot”.

Is Australian Ethical Investments (ASX: AEF) Growing Funds Under Management?

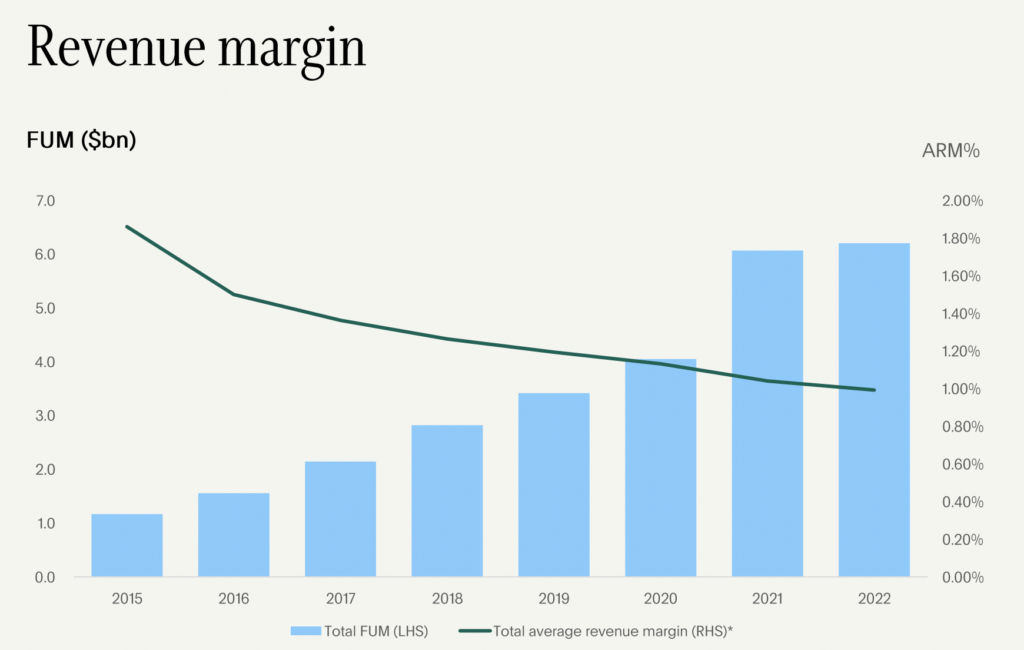

These Australian Ethical results showed funds under management were up just 2% during the year to $6.2b, since market losses cancelled out increasing investments by clients.

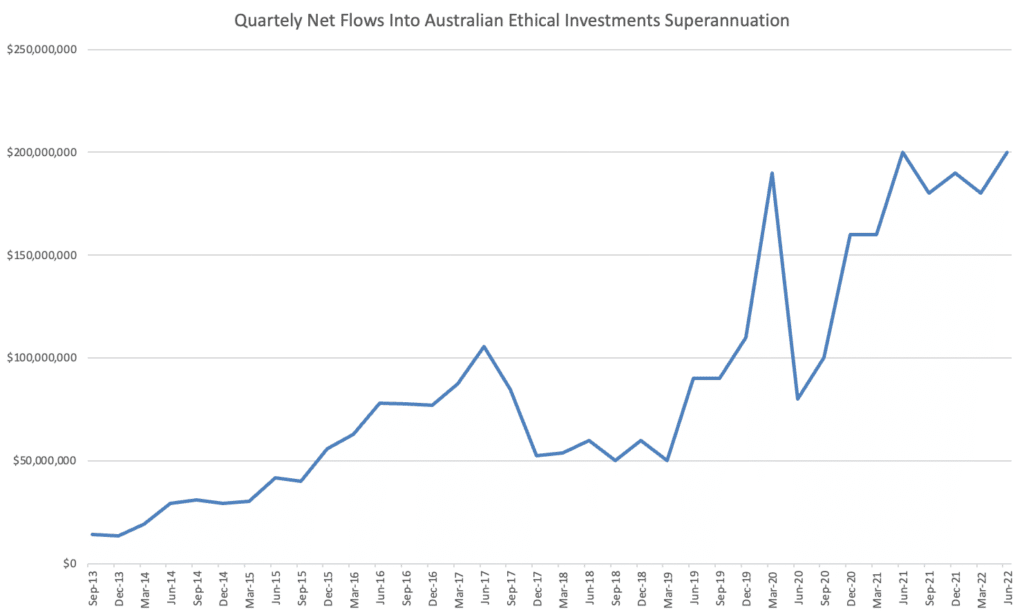

The main reason I think Australian Ethical Investment is an interesting business to hold is that there is lots of automatic growth arising from the fact that so many people use them as a superannuation provider. I have been tracking the company for many years, and as you can see, it has gradually increased the amount of superannuation money it takes in, every quarter.

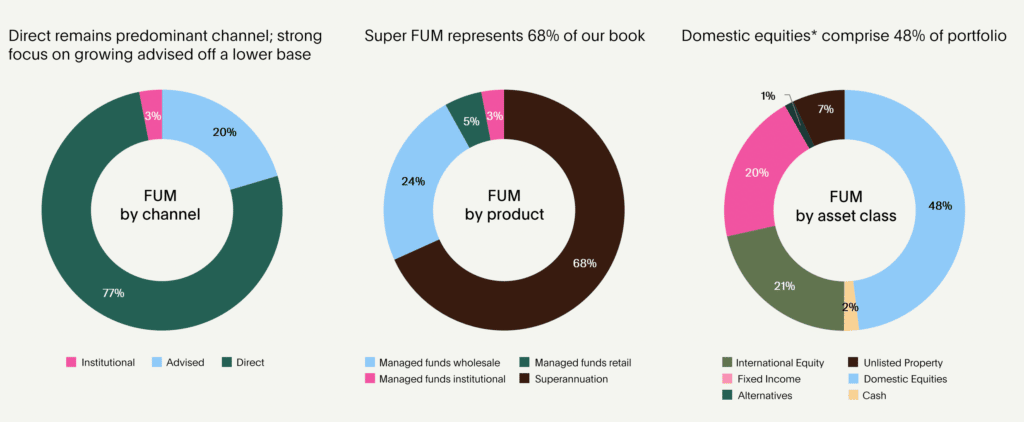

Although Australian Ethical also makes money from managed funds, superannuation is more than two thirds of its total funds under management. Most of the funds Australian Ethical manage are invested directly by the consumer, not through a gatekeeper like an adviser or an institution. I think that’s a good thing, since individual investors are less likely to have bargaining power, more likely to set & forget, and do not face an extra layer of adviser fees. I think it is a complete waste of money to pursue growth in the adviser channel, but Australian Ethical definitely pursues “growth for growth’s sake” and as far as I can tell it always has (to its ultimate benefit, I might add).

What Are The Risks For Australian Ethical Shareholders?

One of the big problems for Australian Ethical is more competition, which the company acknowledges when they say “During the period we saw record super flows of $0.8 billion, an increase of 22% year on year – again a very pleasing result given the increasingly competitive superannuation market especially as competitors launch their own ‘ESG-style’ products.” I personally tend to agree this was a good result in the circumstances and it is great to see quarterly net flows to super products increasing over the year.

However, one down side of increasing competition is that Australian Ethical always has to decrease its fees. That’s ok, and it’s not something you can change about the business. As the company puts it, there were “fee reductions during the year as we pass on benefits of scale and remain competitive.” These fee reductions will continue, albeit balanced with “profitable growth”.

What Does The Australian Ethical Investments Share Price Tell Us?

The main difference between underlying profit and statutory profit is that the former excludes due diligence costs in relation to mergers & acquisition activity. However, the company has invested heavily in M&A capability and wants to continue with more mergers and acquisitions. This makes sense, but it also means that M&A is not really a one-off expense. Therefore I would use statutory profit.

Statutory earnings per share fully diluted was about 8.5 cents per share. This compares to a current share price of $6.46, putting the company on a trailing P/E ratio of about 76. Now, Australian Ethical is likely to grow revenue in FY 2023 and FY 2024 because the merger with Christian Super is expected to complete in FY 2023 and will add “30,000 members representing around $1.96 billion in FUM transferring to Australian Ethical.” FY 2024 is more likely to see profit growth, as expense growth is more likely to moderate in that year.

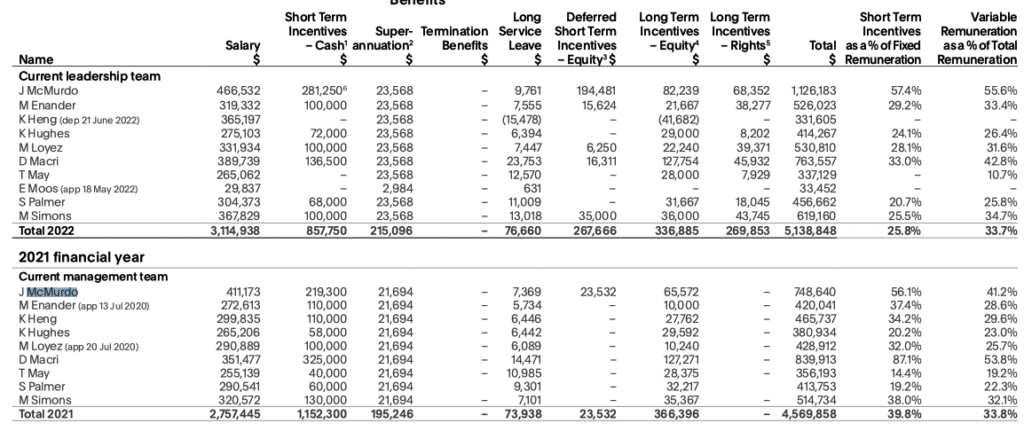

Australian Ethical is likely to grow profits in the long term the short term looks less rosy. On top of that, the company increased the CEO’s salary (excluding bonuses) by over 10% in a year when profit was down. As you can see below, key management personel remuneration equates to more than half of company profit!

On top of that, the balanced super option actually underperformed its benchmark by 2.7% over the last 1 year, though it is still outperforming over 3 years, 5 years and 10 years. Its benchmark is CPI + 3.5% so higher CPI will make outperformance less likely, in turn making marketing more difficult.

Finally, the short term outlook is very weak, with the company saying that, “our profit outlook will reflect higher growth in operating expenses than in revenue.” To me, this contrasts with the fairly high price to earnings ratio based on trailing statutory earnings (which on my reading is not likely to grow in the short term).

I am an Australian Ethical Investments shareholder and I intend to remain one, simply because of I find that systemic growth in ethical super to be an extraordinary tailwind. However, I think the current price is out of whack with the short term reality (though it may be cheap in the long term). While I did make a tiny purchase if AEF shares in June at substantially below current prices, I’m much more likely to sell than to buy at the current price of $6.46. I will quite possibly trim my holding a little bit, after these muted Australian Ethical results. My desired buy price is probably now a little lower than the price I said in my most recent coverage.

Did you find this article useful? Sign up to receive access to hidden, Free content like this!

Please remember that these are personal reflections about stocks by an author, and this article is not intended as a recommendation. The author owns shares in Australian Ethical. This article should not form the basis of an investment decision. It is an investment diary valuable only for the cognitive process it demonstrates. To the extent that this article is advice under the law, it is general advice only. It has not considered your investment objectives. To the extent that this article is financial advice, it is authorised by Claude Walker (AR 1297632), Authorised Representatives of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. Equity Story Pty Ltd and BlueTree Equity Pty Ltd t/a A Rich Life do not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.