My fund, DMX Capital Partners, can broadly categorise our preferred investment types into 3 investment styles: asymmetric payoff potential, asset plays, and profitable growth. An ideal investment ticks all 3 boxes. In AVA Risk Group (ASX: AVA) we may have uncovered such a company.

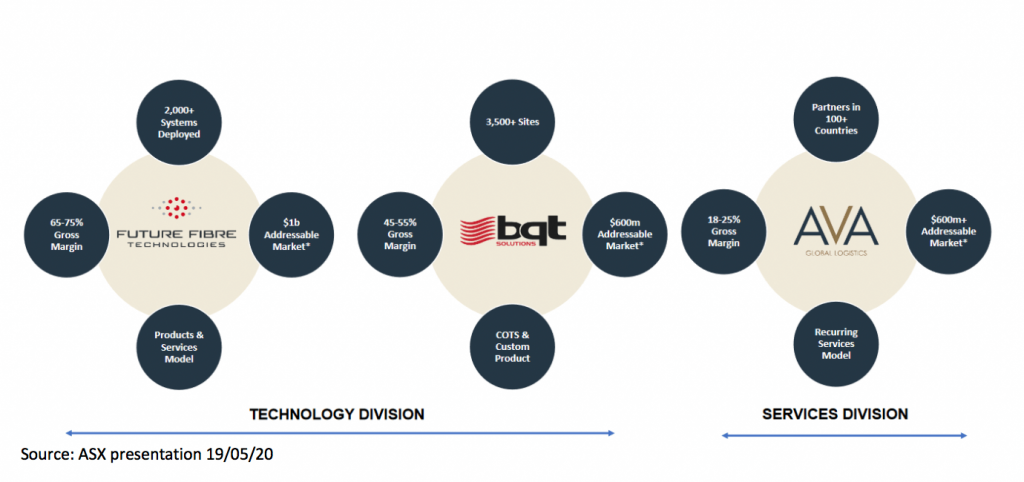

AVA Risk Group Ltd (ASX:AVA) provides global risk management services and technologies. In simple terms, its products and services help keep buildings, infrastructure and other valuable assets safe and secure all around the world. Specifically, it has three fast growing business units:

- Future Fibre Technologies (FFT) develops intrusion detection technology for perimeters, pipelines and IT / data networks (i.e. physical network security as opposed to cybersecurity);

- BQT Solutions (BQT) develops technology for biometric and card access control; and

- AVA Global provides secure international logistics and storage of high value assets.

Before we continue we’d like you to note that I am the portfolio manager at DMX Capital Partners, and DMX Capital Partners owns shares in AVA Group. The Markets Editor of A Rich Life, Claude Walker, does not own AVA Group shares at the time of publication, but his family does invest in DMX Capital Partners.

This blog post does not constitute advice or a recommendation and should not form the basis of any decision to trade shares in AVA Risk Group (ASX:AVA). We offer it as an example of our thought processes, and note there is always more to consider than can be captured in a single post, from a single author.

It is worth noting that AVA Group carries with it some significant historical baggage. Part of that baggage is due to the somewhat extensive corporate manoeuvrings and management changes that have preceded the AVA Risk Group of today. It is also in part due to a sustained history of over promising and under delivering that has impacted sentiment and confidence in the stock. While this baggage can be seen as a negative, we often find that some of the most promising opportunities are those which are misunderstood by the market. It is those companies that the market has thrown in the ‘too hard’ basket that are often the most inefficiently priced.

To understand the opportunities in front of AVA Group of today does require revisiting this complicated corporate past, which we present in the timeline below.

| Date | Company | Development |

| December 2011 | FCS/MSP | Smart card reader and locking technology company 4C Security Solutions (ASX:FCS) changes its name to Maxsec Group Limited (ASX:MSP). MSP’s key operating entity is BQT – a supplier of smart card readers and locking technology |

| May 2015 | FFT | Future Fibre Technologies lists on the ASX raising $21m cash and valuing the business at $84m. FFT provides fibre optic perimeter security and developed the Aura technology which underpins many of the growth opportunities in the group today. |

| June 2016 | MSP | Chris Fergus appointed Executive director to drive a logistics business in MSP |

| August 2016 | MSP | MSP Subsidiary AVA Global (AVA) established and secures its first customers in the global valuable logistics space |

| October 2016 | FFT | Chris Fergus appointed as a Director to FFT (while continuing as a MSP executive) |

| August 2017 | FFT / MSP | FFT takes a 13.7% stake in MSP, then launches takeover for MSP. The merged business is to have two divisions – a services division (AVA) and a technology division (FFT & BQF) |

| February 2018 | FFT | FFT appoints non-exec director and previous MSP executive Chris Fergus to CEO |

| May 2018 | FFT/AVA | FFT changes name to AVA Risk Group |

| September 2018 | AVA | AVA subsidiary FFT receives letter of intent to use FFT’s network security technology by Indian Ministry of Defence (IMOD). Contract valued at $15m+ |

| November 2018 | AVA | FFT(AVA) merger with MSP complete and MSP delisted |

| March 2019 | AVA | AVA appoints Scott Basham as CEO. Previous CEO Chris Fergus moved to a full time role heading up AVA Global Logistics. AVA also announced corporate interest in its logistics business. |

| December 2019 | AVA | First revenues invoiced in relation to IMOD contract. |

| February 2020 | AVA | AVA delivers its maiden first half NPAT result |

| April 2020 | AVA | First cash collected from IMOD contract. |

| May 2020 | AVA | AVA provides EBITDA guidance of $5m + |

Source: ASX announcements and DMXAM analysis

As illustrated, the AVA corporate history is complicated. Not surprisingly, given the upheaval over the years, its financial performance (until recently) has been underwhelming. The $21m cash raised by FFT at IPO in 2015 had been depleted to the point that an emergency capital raise was required in May last year.

But despite these challenges, through this period the AVA businesses continued to win new business from some of the most security conscious commercial, industrial, military and government customers in the world. These customers are very diverse and cover entities ranging from the US Army, Shell, BP, and NSW Government, to Thai Airways, the University Of Cambridge.

The technology is impressive and, as illustrated, has global relevance. AVA technology secures the perimeters of some of the most critical government buildings around the world. Similarly, its locking technology is used to secure highly sensitive international locations. In early May, the Australian Department of Defence awarded AVA a $2.4m contract for its high-security, custom encrypted, access control technology, for deployment across Defence force facilities and army bases located around Australia.

However, the quality and value of the AVA technology has unfortunately been masked by the various distractions and underperformance at the corporate level. As a result, we believe the market has (arguably justifiably) dismissed the potential of the AVA technology, notwithstanding it is market leading, has high margins (70%), and genuine global potential.

There are several recent developments that, in our view, have significantly changed the outlook of AVA, and considerably strengthens the investment case.

- Appointment of Scott Basham as CEO

- Strong performance, and potential sale, of the Services business

- Delivery of IMOD contract

- The increase in awareness of physical data network and infrastructure security to match the increase in awareness of cyber-security

Scott Basham was appointed in March 2019. Scott had worked for a number of major global security industry companies, had previously consulted to the Australian Department of Defence, is a former commissioned Australian Army officer and has a deep understanding of AVA’s markets. After a long period of distractions and underperformance, we believe Scott has bought some focus, discipline and stability to the company. The operations have been re-focussed, costs have been cut, and forecasting has been improved.

To illustrate the impact of the change of management on execution and delivery, one can look at the public forecasts made prior to and subsequent to Scott Basham taking charge.

| Date of forecast | Forecast | Actual | Beat / miss |

| 23/1/2017 | FY17 FFT revenue $18m – $23m | $12.9m | miss |

| 4/9/17 | FY18 FFT revenue $18m – $21m | $13m | miss |

| 25/6/18 | FY18 AVA revenue $20.9m – $22.8m | $19.8m | miss |

| 26/3/19 | FY19 AVA revenue $36m – $40m | $31.6m | miss |

| 4/7/19 | Q1 FY20: revenue $9m- $12m | $9.9m | In line |

| 30/10/19 | Q2 FY20: revenue $9m + | $9.2m | In line |

| 30/1/20 | Q3 FY20: revenue $11m+ | $12.3m | beat |

Source: ASX announcements and DMXAM analysis

The stability at the corporate and management level has coincided with some impressive financial achievements in recent times. AVA delivered its maiden profit after tax in the first half of FY20. After being in somewhat of a precarious financial position 12 months ago, in Q3 FY20, AVA reported a $1.1m operating cash surplus.

The improved results have been driven by strong performances in each of AVA’s three operating segments which we discuss below.

AVA Global: the Logistics Services Division of Ava Risk Group

As noted in the timeline above, Ava Global started providing international valuables logistics services in August 2016. The division provides secure fully insured (underwritten by Lloyds), door to door services for high-risk valuables, for precious metals and currency, utilising its network of security companies, freight forwarders, airlines and customs brokers.

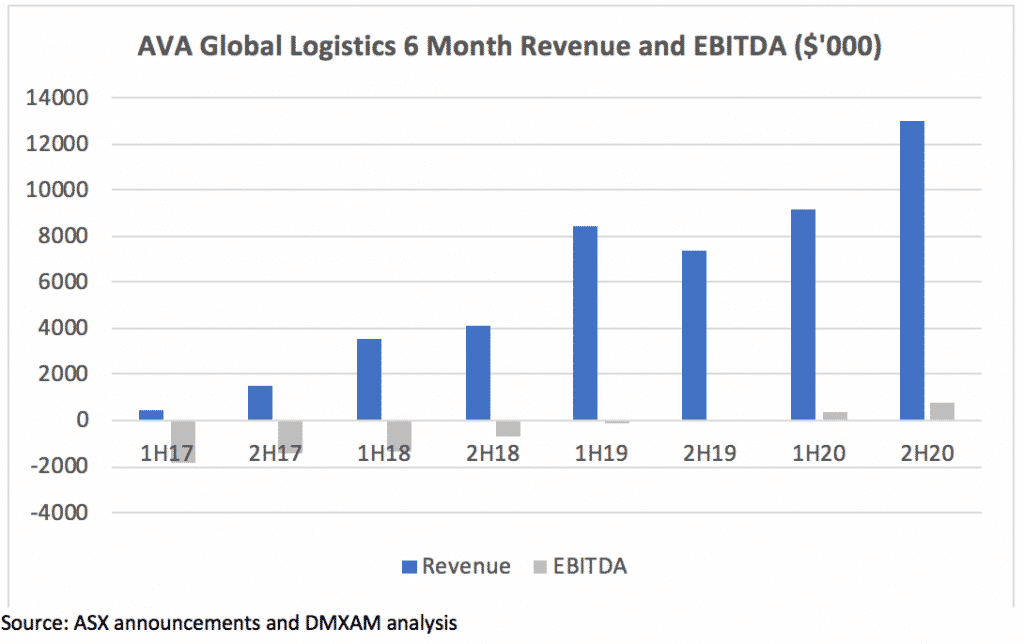

As highlighted below, the business has grown very quickly from a zero base since 2016, and we estimate FY20 revenue of ~$22m.

The division became EBITDA profitable in 2H19, and reported EBITDA of $406k in 1H20. 2H20 has started strongly, with Q3 revenue up 122% over the previous Q3. We expect the division to exit FY20 on an EBITDA run-rate of at least $1.5m. The business has strong momentum, and has recently been awarded a number of contracts with major banks to deliver currency, including one 12 month contract with a Central Bank for the secure transportation of banknotes which will generate estimated annual revenue of $2.1m. These recent contract wins (at 20% gross margin) potentially add a further $500k- $1m EBITDA to the business. On this basis, and assuming no other organic growth, EBITDA for the Services business of $2m to $2.5m is achievable for FY21.

Sale of Services Business

In March 2019, AVA advised the market it had received multiple expressions of interest from secure logistics corporations that wished to explore a potential equity investment with respect to the services division. We understand the Board held back dealing with the services business at this time as they wanted to drive further growth in the business before looking to transact. It makes sense for AVA Group to exit the services business to focus on its extensive higher margin technology opportunities (discussed below).

It is worth noting that Ava Global Management are heavily incentivised to complete a sale of the Services business by February 2021. A performance plan allows for senior employees of Ava Global to share in a pooled allocation of up to 32.7% of the exit value of Ava Global in excess of $5m (or the debt and equity funding provided to Ava Global to run the business, which-ever is greater). This performance plan terminates on 1 February 2021.

Industry feedback and comparative sales suggests an EBITDA multiple of 7.5x to 10x might be achieved for the sale of this business. If this was to occur, (and based on our FY21 estimates discussed above) the potential proceeds to AVA are calculated below:

| EBITDA (FY21 est, $m) | 2.00 | 2.50 |

| Multiple (x) | 7.5 | 10 |

| EXIT value ($m) | 15.00 | 25.00 |

| less mgmnt share ($m) | 3.27 | 6.54 |

| AVA share ($m) | 11.73 | 18.46 |

As illustrated, AVA could potentially benefit by between $12m to $18m from selling Ava Global by February 2021.

Future Fibre Technologies: Another Division of AVA Risk Group

As noted in the timeline above, Future Fibre Technologies (FFT) was the original ASX listed business. Operating since 1994, the company has evolved its product suite with its Aura AI security detection product now driving sales.

The key use cases for the product are intrusion detection technology for:

- Perimeters such as prisons, airports, military, and utilities

- Pipeline monitoring (Oil and Gas)

- Critical data network monitoring to prevent data theft (tampering of the fibre)

- Conveyor belt monitoring (Aura IQ)

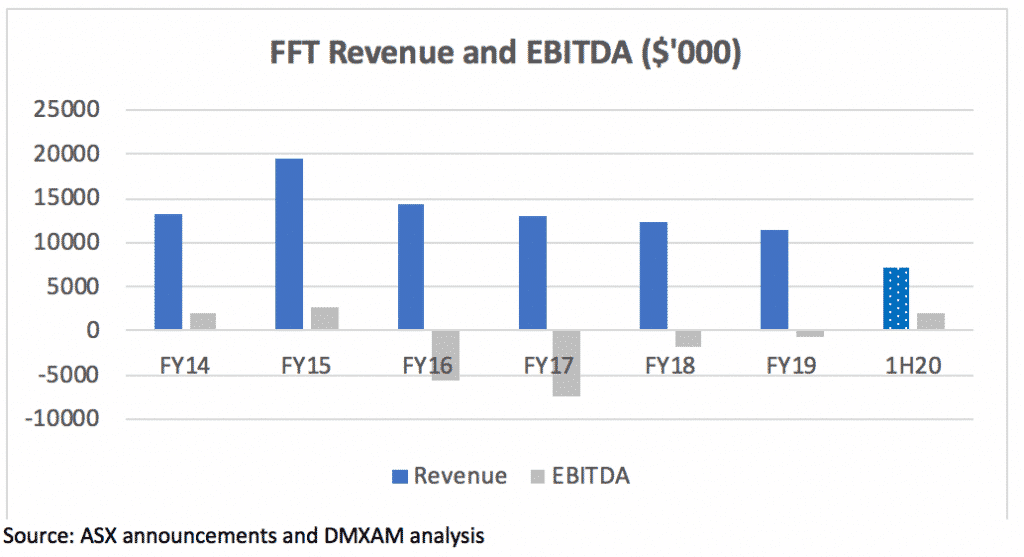

The FFT products have significant global relevance and validation with more than 2,000 FFT detection systems having been deployed across 70 countries. However, since listing FFT has had a volatile financial history. But, as can be seen in the chart below, 1H20 revenues and EBITDA should move the segment to a record EBITDA position in FY20.

While the company does receive upgrade orders for their products, the revenue model is mostly project-based, which has previously resulted in variable revenues. Gross Margins are around 70%. As illustrated, the EBITDA trend over the last 4 years has been positive, with meaningful profits now being generated.

Indian Ministry of Defence (IMOD) data network security

In late 2018, the company received a Letter of Intent for its Fibre Network Security product from the Indian Ministry of Defence (IMOD) (via an in-country partner, SFO) for $18.3m. After extensive competitive benchmark testing, FFT’s Secure Link product was selected to protect and provide real-time monitoring of over 40,000km of military fibre optic data network infrastructure deployed across India. FFT is paid a license fee by SFO, so the revenue is essentially 100% gross margin. We initially took the news with some scepticism as it seemed too good to be true. However, FFT has now booked its first revenues from the project in 1H20 and more importantly received cash payment of $1.5m in April with the remainder of the project order expected to be received over FY20/21. The most recent ASX announcement as at 19 May indicated that ~25% of the project has now been delivered, with ~$4m having been invoiced to date. Other divisions of IMOD or countries could follow if the initial project is successful. It does highlight the potential of AVA Risk Group to secure globally significant large scale profitable security projects.

With current cash of around $4m as of 31 March, the cash coming from the current IMOD project alone, could push that balance over $22m by the end of FY21.

Interplay with Cyber Security

The IMOD deal is significant in that it highlights governments increasing willingness to pay large amounts to protect critically important physical infrastructure (in this case data networks). This is a powerful thematic. While cyber-security (data protection/encryption) is important, equally if not more important, is the physical security of the fibre optic cables upon which the data travels, as well as other pieces of critical public infrastructure.

Indeed, in a recent submission in relation to cyber security by AVA to the Department of Home Affairs, AVA point out security weaknesses in relation to key Australian data networks and other assets:

“Fibre optic communications are widely deployed in government, military and commercial telecommunications networks. It is possible for relatively unskilled individuals to gain access to these cables without the knowledge of the infrastructure owner. Often done with relatively simple and easily procured equipment, these individuals are able to disrupt or into networks at the fibre optic level to monitor traffic without raising the alarm or leaving meaningful evidence trail.”

“While encryption is obviously a significant deterrent to this activity, not every piece of dat on a network is necessarily encrypted. Even if particular data is encrypted, with evolving technologies and computing power, current encryption standards may not be sufficient in the future, especially if it is possible for large dataset samples to be extracted without the data infrastructure time and place.”

“Government departments, intelligence agencies, military services, financial institutions, power and water utilities and commercial businesses with sensitive and valuable intellectual property should all have stringent measures in place to mitigate both physical and cyber threats to their networks. Yet often many appear oblivious to the danger of leaving even a closed fibre network unprotected. As such, critical infrastructure owners can potentially be exposed to the threat of state-on-state action, terrorism or industrial espionage.”

The AVA submission was in response to the Australian Government’s 2020 Cyber Security Strategy Paper. The Australian Government is currently developing its next Cyber Security Strategy as part of its commitment to protect Australians from cyber threats.

AVA Group is a long standing supplier of services to the Australian Government. As recently as early May, AVA Risk Group’s BQT won a $2.4m contract to use its high-security, custom encrypted, access control technology to secure Department of Defence army bases. It would not be out of the question to see AVA involved in a large scale critical infrastructure security deal, similar to that multi-million dollar arrangement negotiated with India in relation to the IMOD project discussed above. The potential for AVA to participate in this emerging physical security opportunity could be significant.

Conveyer belt monitoring: Aura IQ

But FFT’s technology is not just relevant to security and perimeter protection. FFT recently released its “Aura IQ” product for conveyor belt health monitoring. This is another fibre solution that detects sounds coming from the conveyor belt that may indicate part failure. The technology can be used in mining, bulk handling, port operations, the cement industry & agribusiness; with the research underpinning the product funded by Rio Tinto, Vale SA, Anglo American & Australian Coal Association.

The CSIRO has a great profile of the technology here.

“A new Australian-designed and distributed acoustic sensing system – AURA IQ – is changing the way mines manage conveyor belt maintenance. It is much safer, more accurate and more efficient than conventional monitoring methods, and could save mining companies millions of dollars”

AVA suggests there is a $300m market for this product. While no revenue has been booked yet, nine Proof of Value trials have either been completed or are underway, involving some of the largest mining companies in the world. We understand feedback has been extremely positive. When the first deal is struck, we can quantify future earnings with a little more certainty. The revenue model is SAAS. This may help even out the revenues from period to period.

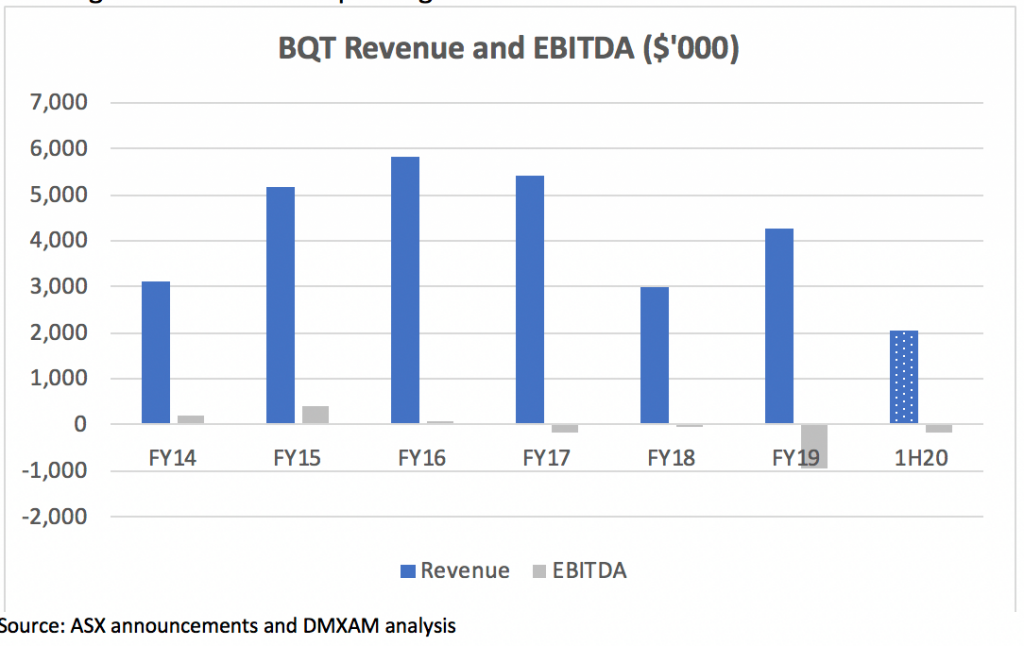

BQT Solutions Division of AVA Risk Group

The company has won notable contracts with the Australian Government and the Department of Defence in the last year.

However, the real potential here is a large deal flagged in September 2019 for 100,000 units of the YG80 “Orca” lock. According to management, this deal is still in play. This lock retails for around $1,000. There are COGS and distribution margins, but we will leave it to readers to work out the maths of the potential profit here.

We consider there to be significant optionality here in BQT in relation to benefitting from this potential large scale multi-million dollar, multi-year deal.

AVA Risk Group (ASX: AVA) Half Year Results

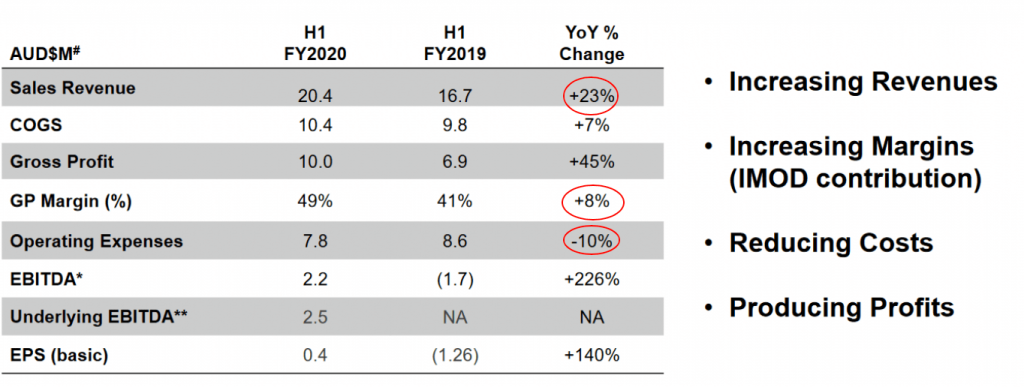

Bringing this altogether, with the recent improvements across all three divisions (FFT, BQT and AVA Global), in 1H20 AVA delivered its maiden NPAT result.

We can see the year-on-year improvements in revenue and gross margin, as well as Management’s focus on improving the cost structure, highlighted by a fall in OPEX. Continuing this strong profit trend, in May 2020, AVA has confirmed FY20 EBITDA in excess of $5m. (Its EV is currently $33m).

Investment Thesis

In the introduction we felt that AVA ticked our ideal investment types being Asset Play, Profitable Growth, and Asymmetric Payoff. We now lay out how we come to that conclusion.

- Asset Play

We consider an asset play a company where its market capitalisation is exceeded by cash and/or excess assets. AVA’s current market cap can be covered from the potential sale of the Services business, current cash, and IMOD future receipts alone as shown in the table below.

| Ava Global (Services) Sale Value – mid-point ($m) | 15.0 | |||

| Current Cash ($m) | 4.0 | |||

| Future IMOD Receipts ($m) | 18.3 | |||

| Total | $37.3m | |||

| AVA Market Capitalisation @16c | $37.4m | |||

After the (hypothetical) sale of the services business, we are still left with the FFT and BQT businesses (which would have zero value attributed to them). (Reflecting its troubled history, AVA Group also conveniently has $35m of unutilised tax losses).

We consider that both FFT and BQT should at least have some value attributed to them – given they both have developed globally relevant, market leading technologies, with a Tier 1 customer base and demand underpinned by strong security tailwinds, and have the potential to secure large scale, multi-million dollar projects. As noted above, when FFT initially listed on the ASX, it had a market capitalisation of $84m.

- Profitable Growth

We prefer investments where a company is profitable and growing and has a global addressable market. On the ASX, these types of companies can achieve high PE multiples. Identifying a turnaround at an early stage can provide strong returns for shareholders.

With new management in place with a stronger focus on profitability, FY20 has proven to be a watershed year where consistent profits look to have resumed. 1H20 Underlying EBITDA of $2.5m will likely mean the company will find itself in a screen of profitable companies after FY20 results are released. House broker, Canaccord, has AVA achieving EBITDA of $5.7m and eps = 1.6c. This would place AVA on a PE < 10x.

- Asymmetric upside

Howard Marks once said, “If I were asked to name just one way to figure out whether something’s a bargain or not, it would be through assessing how much optimism is incorporated in its price.”

Given the company is trading below its potential asset value and is on a PE < 10x, we would argue that no optimism is in its share price and downside is limited. Yet, there are short-term catalysts that should drive a rerate in price that is reflective of the earnings and growth profile and provide asymmetric returns from PE expansion:

- FY20 earnings being released highlighting the value in AVA

- A growing cash balance as receipts from IMOD are realised

There is also some real home-run potential if they can strike deals in the following areas:

- Aura IQ conveyer belt monitoring rollouts

- Further high value data network security/critical infrastructure protection sales

- Major BQT 100,000 unit locking deal

While these deals are not guaranteed, we would not discount them either. Wins like the IMOD contract show that the business has the technology to pull off lucrative contracts with multi-million dollar pay-offs.

Based on the achievements of the past 12 months, and with the new focused Management, strong tailwinds and all the corporate distractions now well in the past, we feel the odds of securing these types of large scale deals have significantly improved. As discussed above, we feel that we are not paying a lot for this potential (or possibly nothing – if things go right for AVA with IMOD and the sale of the services business).

Risks

The main risks to the thesis are:

- IMOD receipts are not received. Given the delays to date, there is concern that these receipts are not forthcoming. This is partially mitigated by a $3m bank guarantee and the initial cash received in April.

- COVID-19. Potential customers may defer deployment of systems in FY21, thus reducing FTT/BQT revenues. There are also risks with their supply chain, inventory, and the ability to visit customer sites.

- Services forecast Risk. We have extrapolated recent performance into FY21. There is a risk that these prove to be optimistic.

DMX Capital Partners Limited owns shares in AVA Risk Group.

If you haven’t already tried Sharesight, it saves heaps of time doing taxes. A Rich Life depends on Supporters to pay for its free content, so if you’d like to try Sharesight, please click on this link to for a FREE trial. If you do decide to upgrade, you’ll get at 4 months free and we’ll get a small contribution to help keep the lights on.

This post is not financial advice, and you should click here to read our detailed disclaimer. The author owns shares but will not trade them for at least 2 business days (inclusive of today) following this article.

If you’d like to receive a occasional Free email with more content like this, then sign up today!