The FY22 Beacon Lighting results saw the lighting and fan retailer still grow revenue by 5.4% to $304.3 million and net profit after tax by 8.1% to $40.7 million. Operating cash flow fell from a record high of $61.2 million in FY21 to $52.4 million in FY 22, as Beacon ramped up inventory in the face of supply chain challenges. Capital expenditure went up slightly to over $9 million, as Beacon continues to invest in large format properties, taking its total investment in such stores to $20 million. As a result, the free cash flow was about $15m (after subtracting lease payments).

The Beacon Lighting results revealed a slightly lower cash balance of $28 million mainly due to the jump in inventory from $67.9 million in FY21 to $93.1 million in FY22 (and the dividend). It continues to be in a sound financial position with no long-term debt and short-term debt under control at about $19m. Beacon declared a final fully franked dividend of 5 cents per share, taking the total dividend to 9.3 cents per share, an improvement on 8.8 cents per share in FY21. That means the Beacon Lighting dividend yield is about 4.1% at the current price of $2.23.

Beacon has historically not received much fanfare with little to no commentary on various stock forums and broader media channels. It’s probably because as a humble lighting retailer Beacon is one of those boring businesses that just plods along.

Beacon Results Show Signs Of Resilience

Beacon’s increase in revenue was helped by a jump of 31.3% in online sales to $34.1 million along with big improvements of 22.3% in trade sales and international sales lifted from $12.3 million in FY21 to $15.7 million in FY22. The Beacon results is a positive reflection of management’s focus on optimising the three growth pillars; online, trade customers and wholesale international sales. Beacon rolled out five new stores in FY22, and all of them seem to be getting great customer feedback based on google reviews.

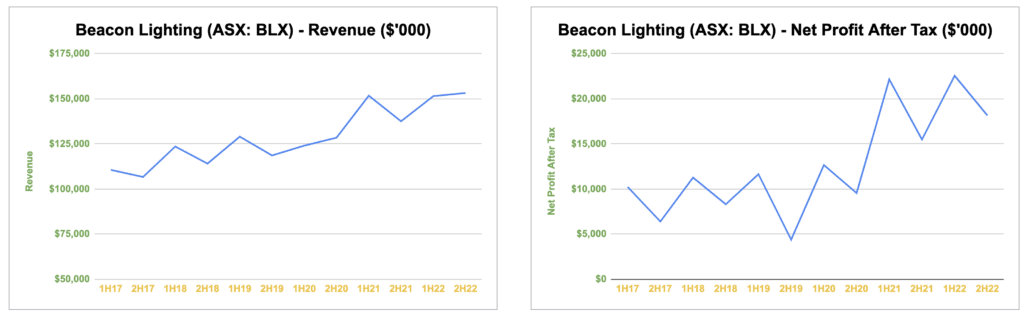

More importantly, these stores are being rolled out where there is no direct rival as Beacon continues to tag behind Bunnings. Whilst Bunnings does sell lights and fans, they’re of the industrial type compared to the more aesthetically pleasing Beacon products. Wherever there is a Bunnings, this presents an opportunity for Beacon. Beacon currently has 117 stores and is aiming to roll out between five to six stores per year to reach its long-term target of 184 stores. As you can see below, both revenue and net profit after tax continue to head in the right direction.

Despite the debilitating impact of supply chain disruptions along with record prices for raw materials, Beacon managed to achieve stronger gross margins of 69.18%, compared to 68.43% in FY21. Beacon CEO Glen Robinson noted that more premium-type product sales helped with achieving higher margins on the earnings call. Chariman Ian Robinson flagged that price increases overseas played a helping hand as well. In terms of the future outlook for gross margins, the CEO highlighted that it will likely come back a bit if they achieve much success in the trade segment, because that is slightly lower margin.

Recession Risk For Beacon Lighting

The FY21 Beacon Lighting results (last year) were very strong primarily due to a confluence of favourable tailwinds; the extension of the government home builders and renovation grant in November 2020, and the COVID-induced shift towards remote working as people created home offices. Therefore, I think the FY21 Beacon Lighting results are not a good measure of a normal year, so it was good to see further growth in FY 2022.

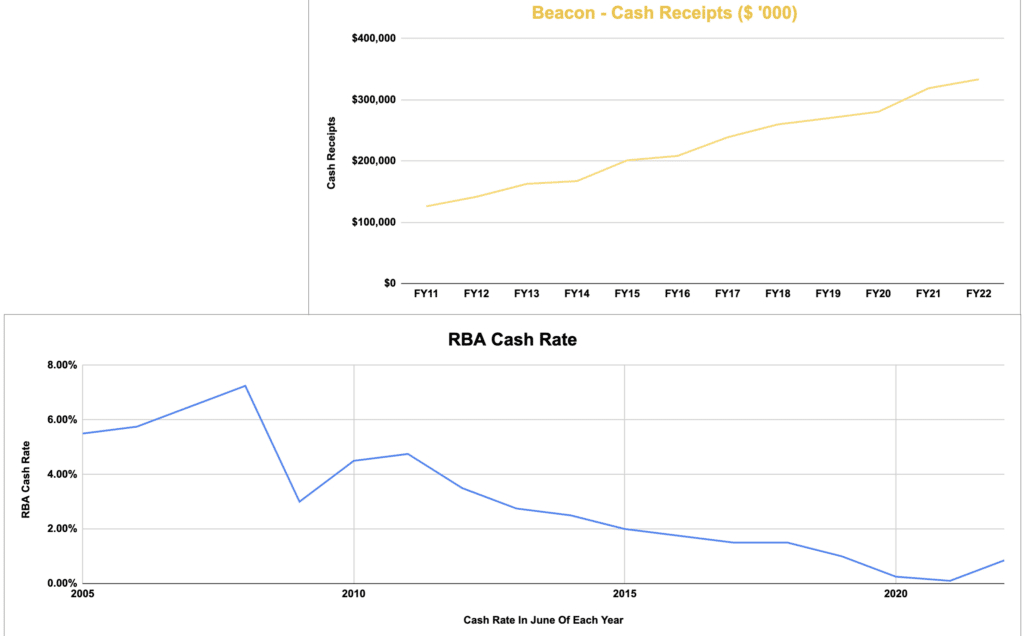

If we zoom out and reflect on how Beacon has performed on the demand side in the context of interest rate levels, it is likely that the retailer has benefitted from lower rates supporting the housing market in the last couple of years.

A decline in interest rates should theoretically have a two-pronged impact on discretionary spending and demand for residential property. Consumers should have more disposable income due to savings on mortgage repayments, and demand for property should rise. This is an ideal double-combo for Beacon as customers have more money to spend on their products and a rise in property turnover should fuel greater demand.

Would A Recession Hurt Beacon Lighting?

My biggest concern was the potential impact of rising interest rates on demand for Beacon’s products and it was annoying to not be able to access accounts prior to FY11.

I did some further digging and found a few articles published by The Sydney Morning Herald in Febraury 2011 that reported Beacon had achieved profit growth of between 15-25% between 2008 to 2010.

According to this article, Beacon generated $76.1 million in sales for FY08 and $99.7 million in FY10 when the RBA cash rate rose from 6.25% at the start of 2007 to as high as 7.25% in July 2008 and then plummeted to 3% by mid-2009 before subsequently lifted to 4.75% in 2011. From this I cannot draw any firm conclusions on how interest rates might impact Beacon’s sales, so it is possible my concern is not justified.

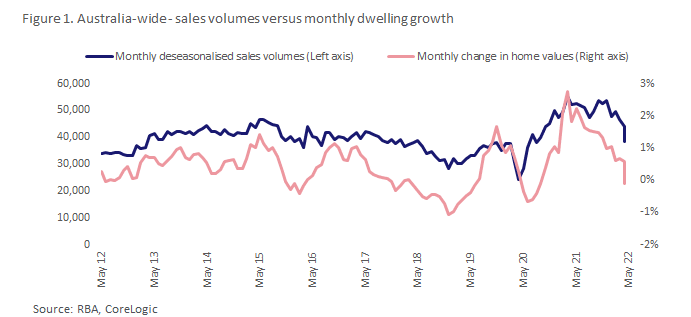

That said, it is logical that the volume of property sales would have a material influence on the demand side, because when people buy a house, they are more likely to look at changing light fittings. As you can see below, revenue growth did decelerate to 3.97% in FY19 and 2.39% in FY20 when property volumes hit the lowest point, and then Beacon benefitted from the big spike in property sales volume in FY21, recording a 14.34% lift in revenue.

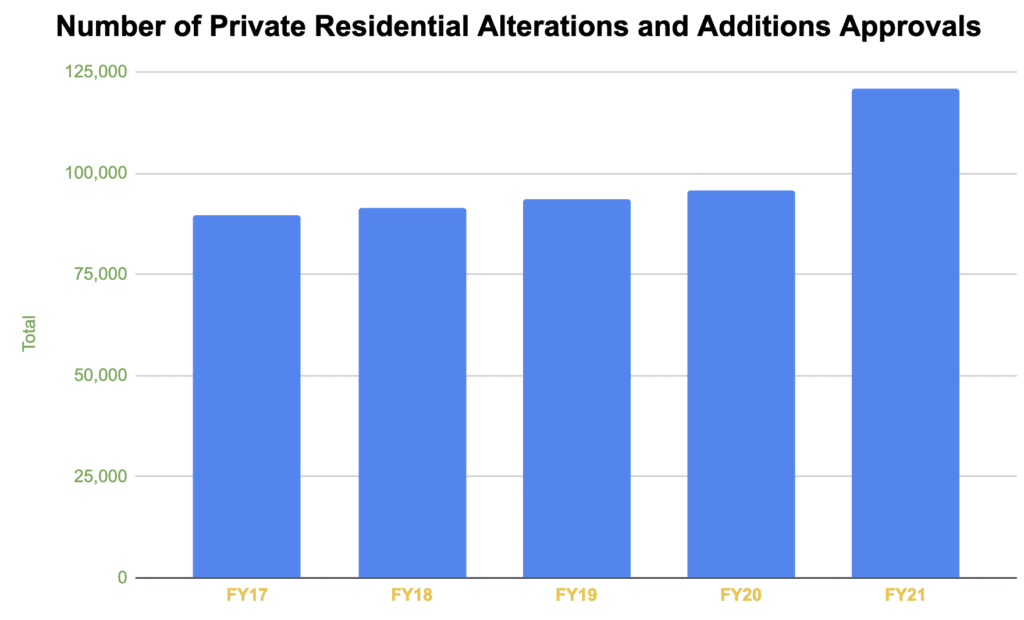

The level of renovation activity is also an important factor, as you can see, Beacon was a massive beneficiary from the record rise in FY21, primarily due to the pandemic and the preference to use savings and COVID support funding on home improvements.

When Might Beacon Lighting Stock Be A Buy?

The Beacon Lighting results for FY22 highlighted how much of an impact the spike in residential home improvements and property sales volume had on the FY21 results. Growth across the top line dropped in line with the downward trend in property sales volume. The impact of the rise in interest rates remains to be seen, making the upcoming HY results very interesting considering Beacon has bolstered its inventory.

Beacon Lighting could hypothetically grow when interest rates rise, and it has, in the past. I think this is probably because Beacon managed to capture market share away from competitors even though the total demand for lighting products may have decreased in that time after the global financial crisis. Beacon continues to consolidate its strong market position in the fan and lighting market in Australia, but its business is much larger now.

On the basis that property turnover volumes are likely to subside in a rate rising environment, it would seem more likely that Beacon Lighting’s growth will subside across the short to medium term. And I think this will likely bring about a lot of pessimism, which might create a good opportunity for long-term focussed investors to buy shares in Beacon Lighting Group.

I believe the long-term alpha-generating opportunity lies in Beacon’s ability to strengthen its dominance in a fragmented industry where the runway for growth remains strong as it targets 184 stores. A solid track record of execution, along with a family-run business mentality provides compelling pillars for success in the long-term. On the flip side, the macroeconomic factors in play at the moment should be monitored very closely as the impact of interest rates tend to have a lagged impact.

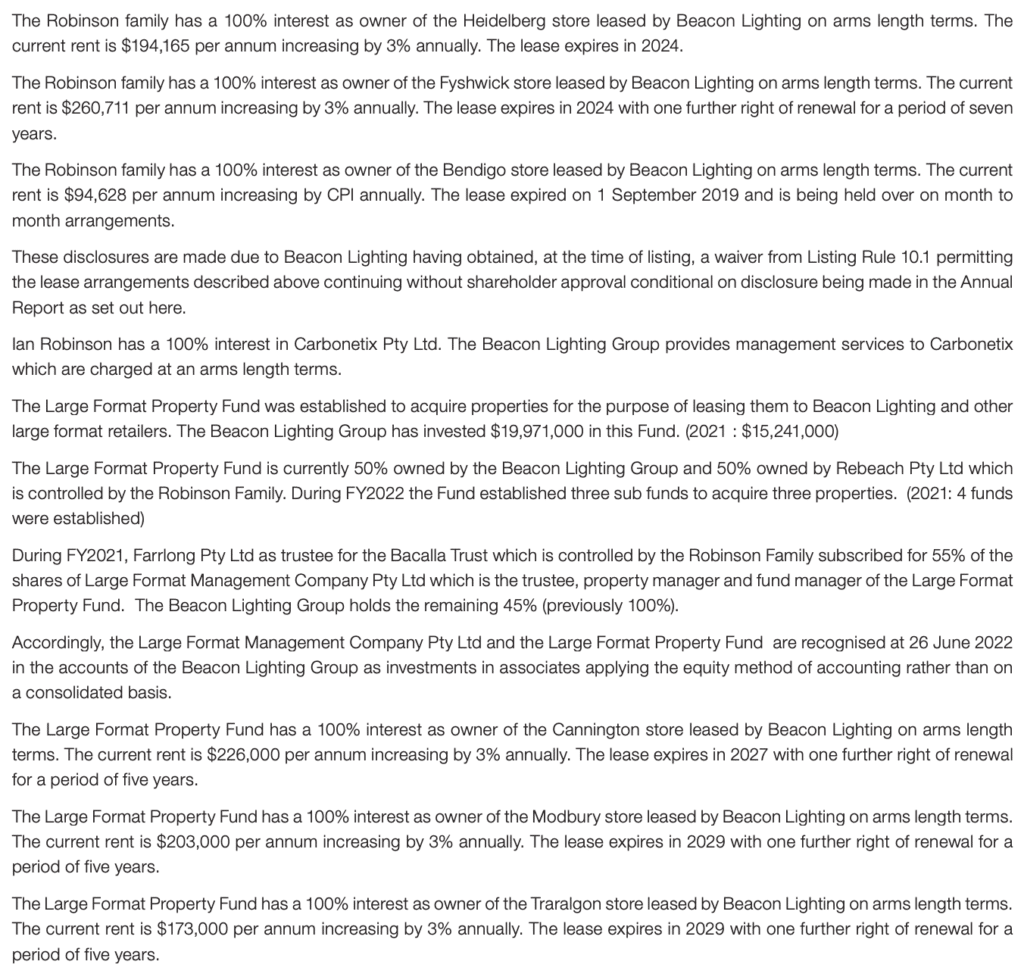

Notably, the related party transactions at Beacon Lighting are extensive, so shareholders would need to be satisfied that Beacon is paying a good price for rental properties owned by related parties. You can see the related parties, below:

The current PE multiple is around 12x with a dividend yield of 4.15%. Historically, the PE multiple for Beacon has hovered around 17x, so it seems the market is already pricing in for the potential macroeconomic challenges ahead. That said, it seems likely that Beacon is a sufficiently high quality business to survive a temporary downturn; and it deserves a spot on your watch-list in case the market becomes too pessimistic about these short to medium term challenges.

Save time at tax time: If you’d like to try Sharesight, please click on this link for a FREE trial. It saves heaps of time doing your tax and gives you plenty of insights about your returns. If you do decide to upgrade to a premium offering, you’ll get 4 months off your subscription price (the best deal available, I’m told) and we’ll get a small contribution to help keep the lights on.

Did you find this article useful? Sign up to receive access to hidden, Free content like this!

Disclosure: the author of this article does not own shares in Beacon Lighting (ASX: BLX) and will not trade Beacon Lighting shares for 2 days following this article. This article is not intended to form the basis of an investment decision. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. Equity Story Pty Ltd and BlueTree Equity Pty Ltd t/a A Rich Life do not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.