So far, BeforePay (ASX: B4P) is one of the worst ASX IPOs of 2022. BeforePay shares are currently trading at $2.30, around 29% below the IPO price of around $3.41. That will no doubt leave the BeforePay shareholders who invested in the IPO feeling like fools. Instead of paying $3.41, those BeforePay investors would have been better off simply buying on market, today.

What does BeforePay Do?

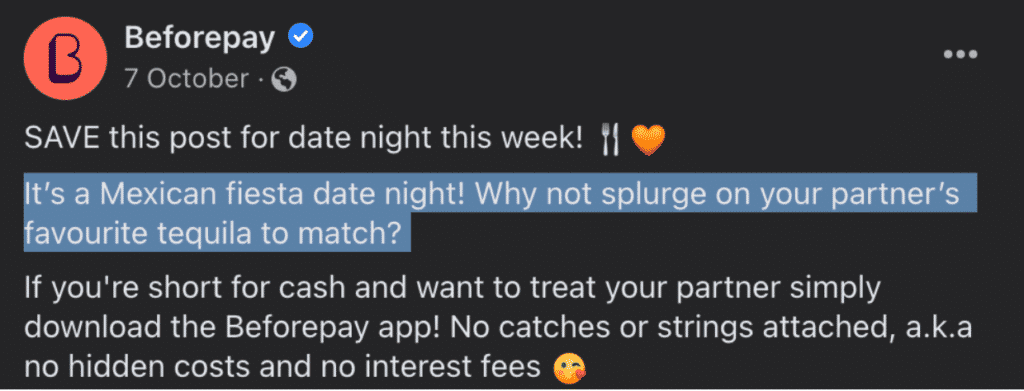

BeforePay is a company that aims to lend money to people who need short term loans. In many ways, they are similar to a payday lender. However, their service is not designed to catch consumers in a debt spiral, so arguably the company is less damaging than your average payday lending.

One key advantage of BeforePay over AfterPay is borrowers can use the money for any purpose, including alcohol, whereas with AfterPay you can only use it for approved merchants.

Is BeforePay An Interesting Stock?

Back in November, Matt Joass, Kevin Fung, Andrew Page and I discussed some of the pros and cons of BeforePay shares on the Baby Giants Investing Podcast.

We all agree that BeforePay is better than a payday lender, but I’d argue that today’s trade in Beforepay shares somewhat vindicates the more skeptical view of the business. I am not surprised to see the share price trading so far below the IPO price, given the company’s lack of ability to forecast future profits, and its very significant past losses.

If you’re interested in Beforepay stock, then check out the podcast below. The section on BeforePay starts at 12 minutes in.

Addendum:

This afternoon I was also invited to chat about BeforePay on Ausbiz. To hear the short and sharp discussion, click on the image below or head to the Ausbiz website.

From 4pm: We’ll get you across the best and worst performers on the day.

— ausbiz (@ausbiztv) January 17, 2022

Plus @claudedwalker from @ARichLifeAu talks IPOs to watch $B4P $STP $SDR #ausbiz

Catch all of the day’s interviews at https://t.co/gllBj1XvHa https://t.co/21OEIUBg44

Please remember that these are personal reflections about a stock by author. I do not own shares in BeforePay. This article should not form the basis of an investment decision. It is an investment diary valuable only for the cognitive process it demonstrates. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer.