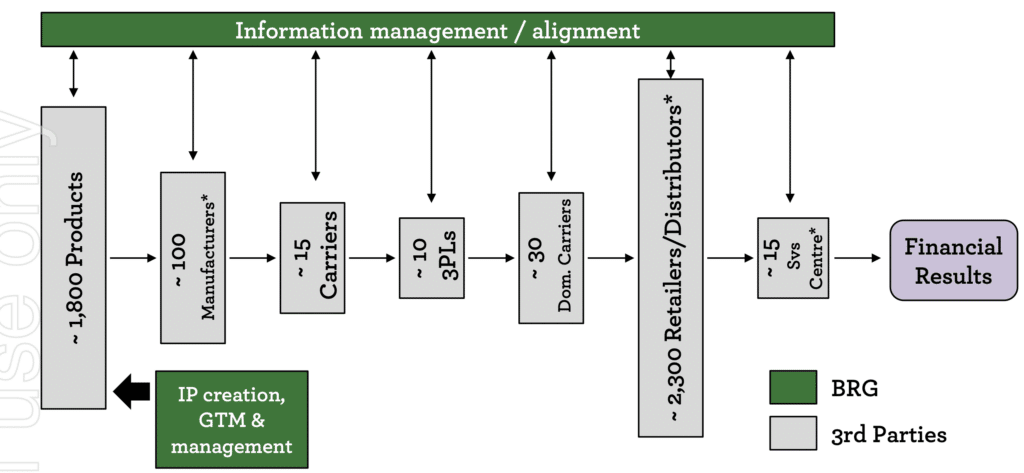

Breville Group (ASX: BRG) is a global designer of premium cooking and kitchen appliances, including coffee machines, ovens, juicers, toasters and kettles. Founded by two Australian entrepreneurs in 1932, Breville has a storied history of innovation and developing customer-centric products. Breville designs its products and then outsources manufacturing, distribution and retailing functions. Breville’s major shareholder is fellow ASX-listed retailer Premier Investments (ASX: PMV), which owns 30% of the company. Breville has a market capitalization of $2.9 billion at a share price of $20.31.

Breville reported a minor 1.3% increase in net profit after tax (NPAT) to $78.7 million in the first half of FY 2023, with mixed results across its three key regions. Return on equity fell from 19.7% to 16.1%, largely due to an increased equity base and minimal profit growth.

How Did Breville Perform in H1 FY 2023?

Breville’s total revenue increased by 1.1% to $888 million for the half. The Americas was the standout, increasing revenue by 21.8% or 11.9% in constant currency on the back of strong luxury consumer demand. Conversely, Europe, the Middle East and Africa (EMEA) sales fell 22.2%. Interestingly, management noted that sell-out, referring to consumer purchases, increased marginally, however, retailers preferred to destock rather than maintain inventory levels.

On the investor call, chief executive Jim Clayton said he suspects some retailers might be understocked. In APAC, sales were flat. Again, sell-out modestly exceeded sell-in, indicating retailers are taking a cautious approach to the new year.

Breville’s free cash flow was a negative $84.5 million for the first half, largely due to working capital. While this isn’t a great outcome, in the past five years Breville has only achieved a positive first-half free cash flow once, owing to timing differences between payments to suppliers and receipts from customers. As Breville collects receivables and unwinds inventory in the new year, free cash should improve.

Breville guided for earnings before interest and tax (EBIT) of $165-$172 million for FY 2023, which is a 5-10% improvement on FY 2022. Current analyst expectations are for EBIT of $171.0 million. Breville declared a fully franked dividend of 15 cents per share, placing it on a 1.47% dividend yield at a share price of $20.31.

Breville’s Inventory and Debt Rises Significantly

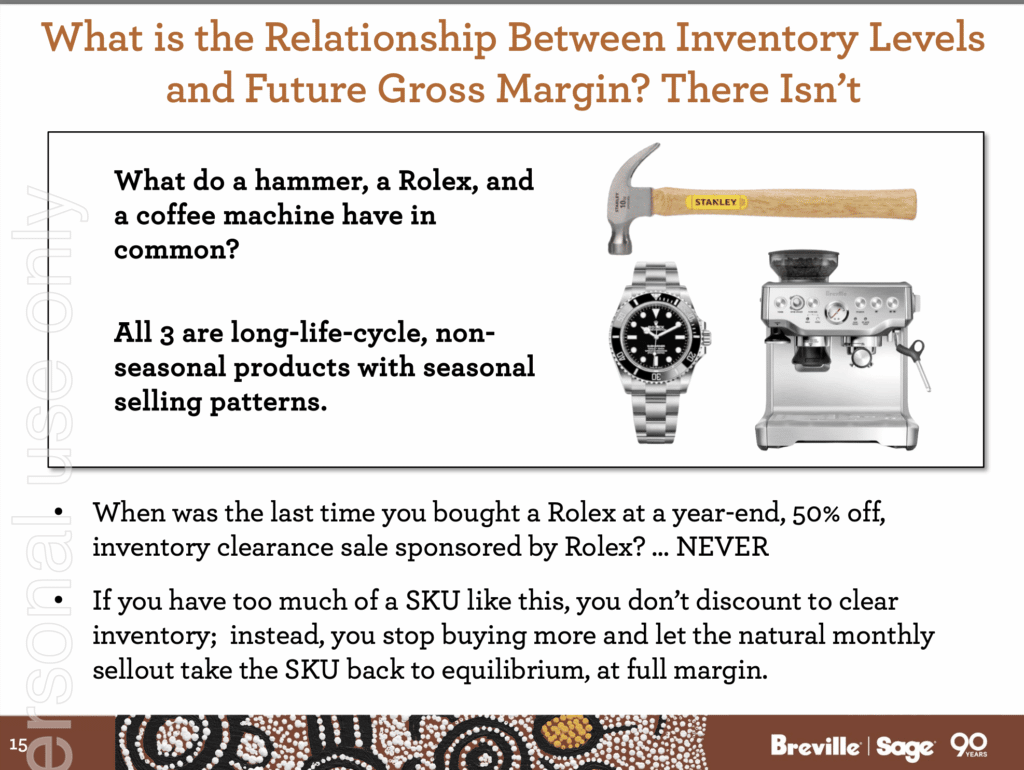

Breville is currently the 16th most shorted company on the ASX, with 6.03% of shares short. One potential reason for the short interest is that the company may have too much inventory. Breville had deliberately increased stock to counter any supply-chain issues. Clayton previously compared Breville products to Rolex watches and Stanley hammers to imply that stock doesn’t go stale.

“While inventory may be bad on a retailer’s balance sheet, it is a good thing on ours. Our products do not go stale and price does not decline over time.” – Jim Clayton, FY 2022 H1 Investor call

Total inventory increased 58% to $465.2 million over H1 FY 2022. Of that, $66 million relates to planned inventory build, with the remainder attributed to the acquisition of Lelit in addition to new product and region launches.

In FY 2019, Breville turned over its inventory 3.9x. Based on today’s numbers, that number has fallen to 2.5x. If management is correct, and Breville’s products don’t go stale, the low inventory turn isn’t a worry. However, it is questionable whether inventory holds its value over long time frames. It might not be seasonal like clothing, but every time a new model or feature is launched by competitors or Breville itself, the old stock becomes less valuable.

To support the elevated levels of inventory, Breville borrowed cash. Borrowings increased from $172.3 million in 1H FY 2022 to $327.4 million this half. Subsequently, net debt increased to $212.2 million. Note that Breville needed to pay $83.8 million to fund the LELIT acquisition. That said, Breville still has $200 million in debt facilities available and $115 million in cash on hand.

Breville Recovers Margins and Shifts Expenses

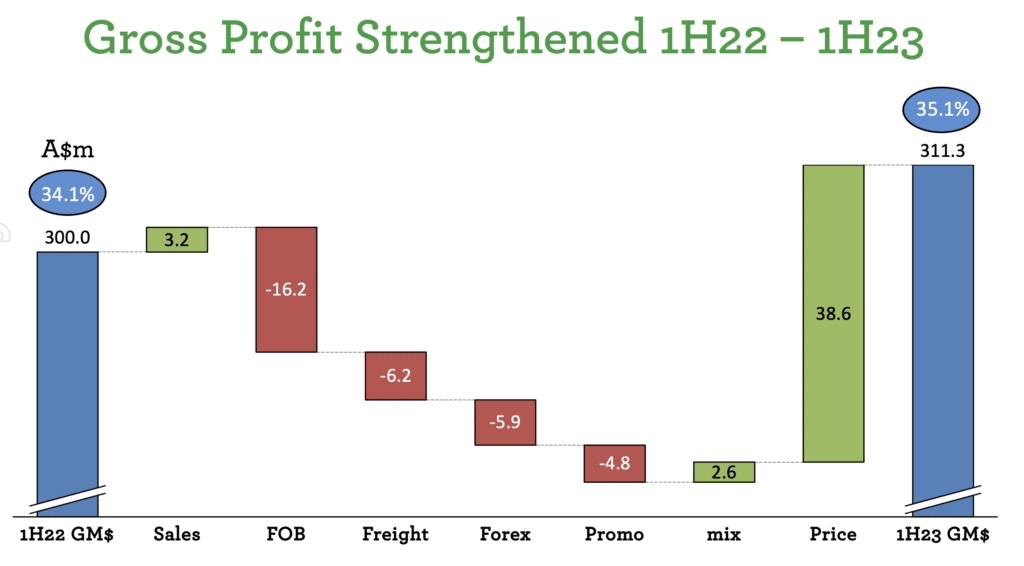

Breville’s gross margin increased from 34.1% in H1 FY 2022 to 35.1% in the H1 FY 2023 results, largely as a result of a 4% increase in prices. Increased manufacturing and shipping costs continued to be a headwind during the year, however, management noted this is alleviating.

The various Breville expenses changed notably, but the cost base didn’t change much overall. Advertising and marketing fell $12.2 million. Other expenses declined by $16.0 million. Those savings were eroded by higher employee and premise costs, which increased by $23.2 million. Management also capitalised an extra $5 million of research and development spending.

Will Demand Fall for Breville’s Products?

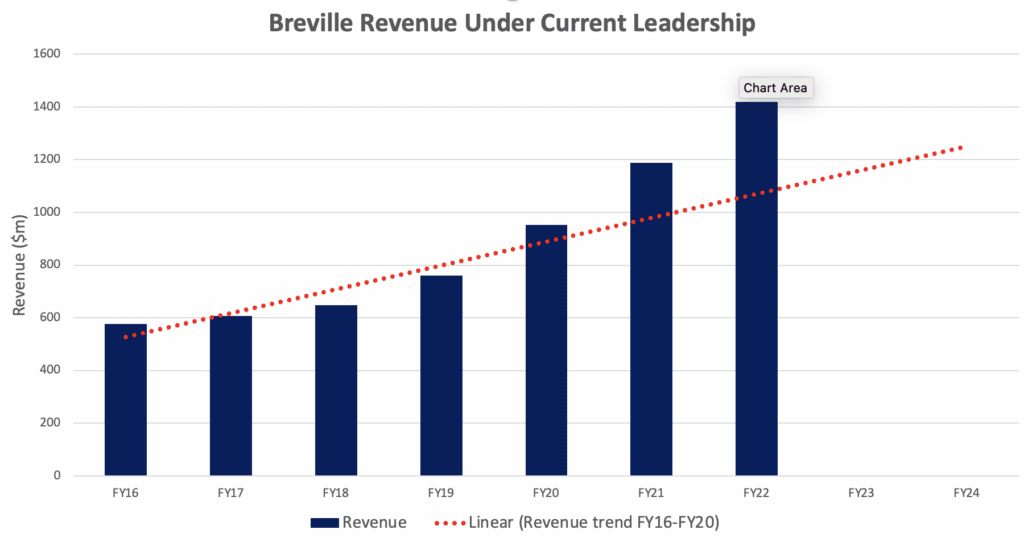

Besides inventory, my major concern for Breville is demand over the medium term. The pandemic boosted sales significantly; well exceeding the pre-pandemic growth rate (see red dotted line). Like Rolex and Stanley, I don’t believe most buyers will go back each year to purchase a new model.

I expect some level of demand unwinding to play out over the near term, which could be exacerbated by a weakening economic outlook for Europe and the United States. This is also illustrated by retailers, particularly in APAC and EMEA, opting to let inventory run down rather than renew orders with Breville. Moreover, the latest consumer sentiment survey by Westpac shows households are 20.3% less likely to buy a new major household item than a year ago.

It should be said that Breville plans to roll out three new products this year. It will also benefit from growth in new regions like Mexico and South Korea.

Are Breville Shares Good Value?

Given how Breville performed in the first half, I suspect it will end up achieving an NPAT similar to the FY 2022 number of $105 million, with some downside risk to that expectation, should the global economy deteriorate. Capital expenditure is higher than depreciation, therefore free cash flow should be lower than NPAT. However, with the timing of inventory and receivables, the free cash flow this year could end up being higher. Using $105 million as a yardstick, Breville trades on earnings multiple close to 30.

If I could be sure the business will continue to grow at the same rate it has historically enjoyed, I would consider purchasing shares. But I’m cautious about the outlook for the consumer. Breville has benefitted from a potential pull forward in demand that may result in some lean years going forward. Retailers reducing sell-in is a clear forward indicator that demand is waning, and that’s before considering the $465 million in inventory Breville needs to offload. In summary, I’d prefer to observe Breville from the sidelines for now and see how the next 6-12 months unfold.

To keep up to date with all our reporting covering, be sure to bookmark our ASX Small Cap Earnings Season Calendar For February 2023.

Correction: The original article said management failed to reach its own expectations for peak inventory in June. However, the original inventory forecast was made before the LELIT acquisition, therefore holding management to this prediction is not appropriate.

Disclosure: the author of this article does not own shares in Breville and the editor also does not. Neither will trade shares in Breville for at least 2 days following the publication of this article. This article is not intended to form the basis of an investment decision and is not a recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. Equity Story Pty Ltd and BlueTree Equity Pty Ltd t/a A Rich Life do not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.