Earlier in the month, the so-called “AirBnB for campervans”, Camplify, announced that it had aqcuired fellow “AirBnB for campervans”, PaulCamper. Putting aside for a moment the global profliferation of AirBnBs for campervans it is well worth examining the transaction, which Camplify CEO Justin Hales described multiple times as transformational.

How Much Did Camplify Pay For PaulCamper?

Camplify is paying an enterprise value of enterprise value of €30m PaulCamper, which amounts to about $47.6m. $1.8m will be paid in cash, and $45.8m paid in Camplify shares, at a price of $1.9624 per share or about 23.34 million shares. This would bring shares on issue to about 68.16 million, but Camplify is also raising $10.5 million in shares at $1.70 per share via a placement and share purchase plan, another 61.76 million shares. That will bring the total shares on issue to just over 74.3 million.

At the current Camplify share price of $2.07, that amounts to a market capitalisation about $154 million.

What Does Camplify Look Like After Its Transformational Acquisition?

We won’t really know what the combined company can achieve until we see some results. However, Camplify says “PaulCamper is in an EBITDA positive position for CY22” and suggests the transaction will “accelerate Camplify’s pathway to cashflow positivity and profitability– on a pro-forma FY23 basis”.

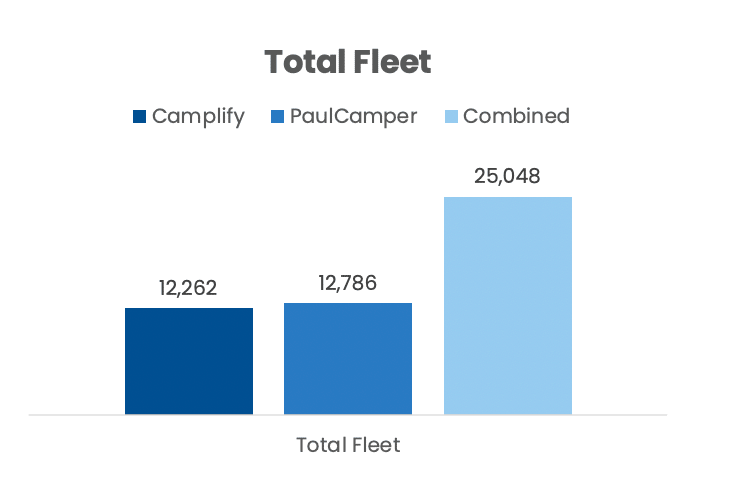

At the time of this transaction, Camplify had just over 12,000 RVs on its platform. In FY 2022, Camplify had a take rate of just over 30%. Meanwhile, PaulCamper has over 12,700 RVs on its platform and a take rate of 19%. It seems possible that Camplify can help improve PaulCamper’s take rate. In any event, improving the total fleet (especially in Europe) is strategically important as Camplify seeks to become the “go-to” destination for private campervan and trailer hiring.

PaulCamper’s bookings are forecast to be down in FY 2022, and I doubt it can return to growth without additional marketing spend.

Conclusion

At the same time as this transaction was announced, Camplify released its quarterly cash flow report showing strong receipts from customers of over $23 million and cash burn of about $2 million. Prior to this transaction Camplify had $13.3 million in cash so it was in a reasonably strong position.

While the acquisition of PaulCamper is not cheap in a traditional sense, the merger makes a lot of sense because the main way that Camplify can earn a sustainable profit margin in the long term is if it has the biggest fleet. This will make it most attractive to customers, and that in turn makes it more attractive for RV owners.

Overall, this acquisition makes Camplify more interesting to me and I’m more inclined to take a small speculative position at some point. Having said that, Camplify is still have a loss making company that is burning cash, and so I am not in a hurry to buy shares, and if I did, it would be a small speculative position.

Sign Up To Our Free Newsletter

Save time at tax time: If you’d like to try Sharesight, please click on this link for a FREE trial. It saves heaps of time doing your tax and gives you plenty of insights about your returns. If you do decide to upgrade to a premium offering, you’ll get 4 months off your subscription price (the best deal available, I’m told) and we’ll get a small contribution to help keep the lights on.

Disclosure: the author of this article does not own shares in Camplify and will not trade Camplify shares for 2 days following this article. This article is not intended to form the basis of an investment decision. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. A Rich Life does not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.