Yesterday, Camplify (ASX: CHL) released its FY23 full-year results, boasting robust revenue growth of 133% and a 55% decrease in net loss after tax. The Camplify share price remained flat in response to this results, with a typically low volume of shares traded.

Camplify FY 2023 Results Summary

Camplify reports a wide array of metrics to the market, which is generally a good thing, as it implies strong levels of transparency. However, this approach can also be confusing or even misleading, where the company highlights or emphasises those metrics that are most positive, but buries the less positive metrics. In FY 2023 Camplify reported:

- Global revenue of $38.2 million, showing a YoY growth of 133.7%.

- Global take rate of 26.1% (including lower margin van sales).

- Global fleet size of 28,399 vehicles.

- Camplify’s future bookings valued at $28.6 million.

- Gross profit margin of 67.5%.

- Adjusted normalised EBITDA of $0.3 million, Improved from a normalised EBITDA loss of $6.7 million in FY22.

- Free Cash Flow of $1.6 million.

- Net loss after tax of $3.6 million (compared to a loss of just under $8.2 million last year).

What Is Camplify’s Organic Growth Rate?

One critical aspect with Camplify is looking beyond the presented figures and investigating organic growth. This is vital due to recent acquisitions impacting reported top-line numbers.

In the October 2022 presentation, Camplify disclosed Paul Camper generated A$11 million in 2022. Though Paul Camper’s growth rate wasn’t explicitly stated, management indicated a flat growth period. Applying this to our data and considering Paul Camper’s 7-month contribution, it likely added around $6.5 million in FY 2023.

Mighway (NZ) and SHAREaCAMPER (NZ) were acquired in May 2022. These acquisitions did not have particularly significant revenue prior to acquisition, although they did add a significant number of vehicles to the platform in New Zealand. The announcement in May 2022 said that “Pre-COVID, Mighway and SHAREaCAMPER achieved a combined GTV of $7.8 million and revenue of $2.7 million (unaudited) for FY19.” With unknown growth rates, their revenue contribution could be around $3-$5 million, though they consolidate them into the Camplify core business, so it would be difficult to know exactly.

After subtracting the hypothetical contribution from these acquisitions from the overall revenue, Camplify’s organic top line appears to be around $28 million, implying an approximate organic growth rate of about 75%. This aligns with Australia’s growth rate, 70%.

While the hypothetical organic growth rate of 75% is less impressive than the 133% reported, it still demonstrates robust performance.

Camplify’s Temporary Accommodation Program

Reading the sentiment from the questions on the announcement call, it’s evident that a many were taken aback by the outcomes achieved through Camplify’s temporary accommodation program.

This innovative initiative allows vans to be utilised in areas affected by natural disasters. An example of its effectiveness was seen during the flooding in the NSW Northern Rivers, where 479 bookings were activated under this program. The Gross Transaction Value (GTV) for the year from this program amounted to $20.6 million, contributing approximately $6 million in revenue as estimated by the CFO. This figure holds significant weight, prompting us to consider the potential scalability of this program to other countries.

Cash is King

In previous years, Camplify had experienced substantial cash burn. Despite the GAAP figures indicating a recorded loss of $3.6M, the free cash flow for the year was a positive $1.6M. This is because the receipts from customers of $136m far exceeds the revenue of $38.2 million.

As Camplify takes a booking, it immediately receives the cash from the customer. Then, it holds the cash for a time before handing it on to the owner of the campervan. This is a positive feature of the business as long as it is growing, because it reduces Camplify’s need for capital to fund growth.

You can imagine what a capital hungry business it would be if it needed to pay the campervan owners before receiving cash from the customers.

Either way, given that both free cash flow and EBITDA are mildly positive, and given that Camplify is growing revenue so quickly, it satisfies the Rule of 40, whichever definition you prefer.

Brand Recognition Development

Camplify, founded in 2015, is on the brink of its 10-year anniversary. This milestone prompted me to look at whether or not they’ve begun to establish a resonating brand within the market.

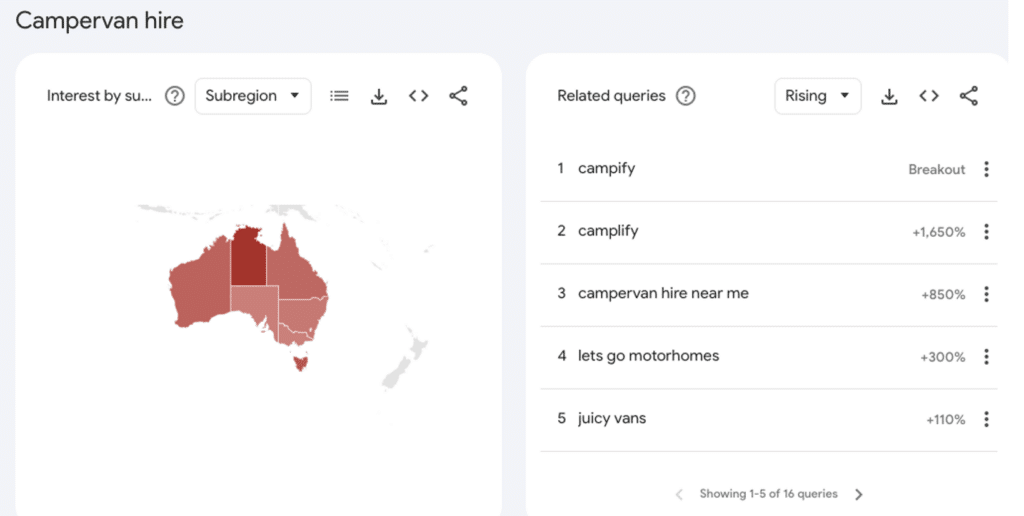

To explore this, I’ve chosen to look at Google Trends which mirrors consumer search behaviours for campervan rentals. My focus was to determine whether individuals are searching on Google for campervans in general, specifically for Camplify, or perhaps for a more established entity like Apollo.

Here is the outcome:

Source: Google Trends Data – Australia

The findings offer the following insights:

- There has been a noticeable increase in consumer interest in campervan rentals, with search results rising by 850% over five years. While Covid may have contributed to this shift, it likely isn’t the sole factor.

- Camplify is steadily gaining traction in search interest, showing an impressive 1,650% growth over five years and a 300% surge in the past year.

- While Camplify still trails behind Apollo in search volume, the trend is gradually shifting in favour of Camplify.

What are Hirers Saying?

The majority of reviews for Camplify can be found on Trustpilot (nearly 7,000 reviews) and Product Review (approximately 400 reviews).

In general, users tend to rate the platform highly. After analysing numerous reviews, several recurring themes emerge, including:

- A diverse range of vans available.

- User-friendly interface: swift owner connection and a seamless digital experience.

- Owners maintain clean and well-kept vans.

- Efficient refund process for booking changes with ample notice.

The service isn’t flawless, with comments made on:

- Certain users encounter frustration when confirmed bookings are abruptly cancelled 20 minutes after confirmation due to van availability discrepancies.

- Additional costs (booking and service fees) can substantially inflate the overall booking price.

- Occasionally, the website fails to accurately capture licence details, necessitating manual reentry and headaches.

What are Camplify Van Owners Saying?

There is a challenge that Camplify faces, and it revolves around its most valuable asset – the extensive pool of van owners that form the supply side of its platform. As Andrew Chen profoundly explains in “The Cold Start Problem,” the success of marketplaces hinges on the quality of their supply.

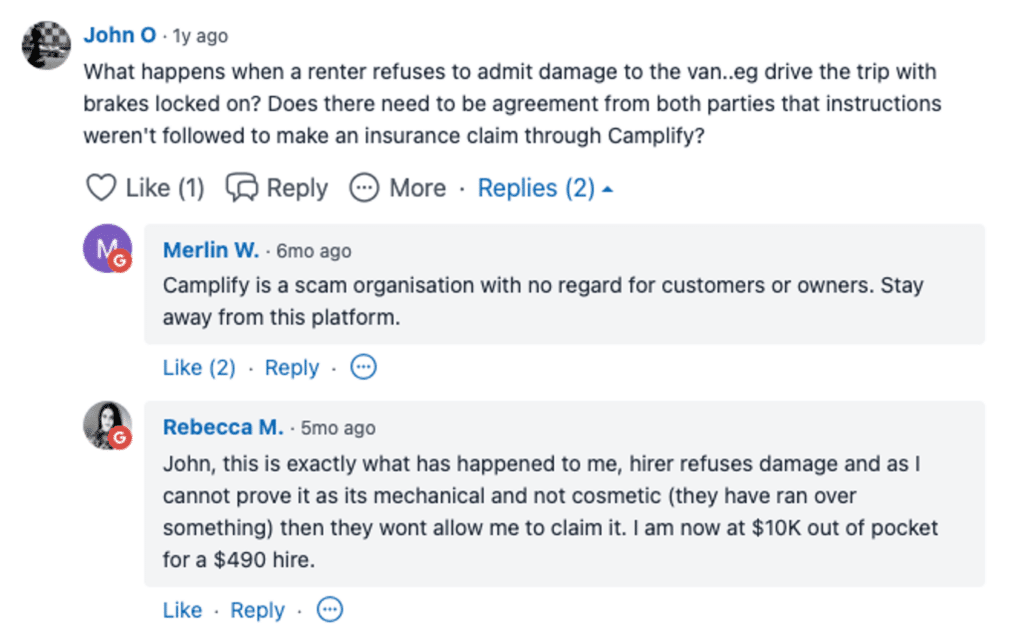

The issue Camplify confronts arises from situations where a van is rented and subsequently damaged during the rental period. Online data highlights that several van owners aren’t adequately compensated for the damages they’ve incurred.

For instance, consider this exchange. For the sake of clarity, we are not suggesting that the comments below are accurate, merely referencing it as evidence of what some people are saying.

Source: Product Review

If such situations persist, it will have an adverse impact on their brand. Hence, I view this as a challenge that they need to address directly, given there are also other reviews expressing concern about how Camplify manages damage to vans.

How big is Camplify’s market?

Reflecting on the question, “Can Camplify continue its track record of strong growth?”, a valuable measure to consider is the extent of the untapped market potential they have. According to the company, only 1.3% of the registered RVs in Australia are listed on Camplify. This suggests that there is a significant growth opportunity still ahead for them.

The challenge lies in answering the question: “How much of this market share can they effectively capture?” As an avid camper myself, I often inquire about where fellow campers acquire their RVs when I visit campsites. Over the years, I’ve noticed Camplify’s presence increasing.

However, certain RV owners will not want the hassle of renting our their vehicle, and certain RV renters will prefer the more standardised experienced available when from a company. For example, the roadworthiness of vehicles on the platform may vary more than the vehicles owned by a rental company.

What I’ll Be Watching

In the upcoming 12 months, I will be keenly observing the growth trajectory in European regions, particularly focusing on Germany, as Camplify works on integrating Paul Camper into its broader operations. The performance in the UK will be of interest as well, along with the take rates emerging from the integration of the German platform onto Camplify’s technology.

Camplify has demonstrated a penchant for acquisitions since its listing. Given its strong cash reserves and historical behaviour, it is reasonable to anticipate further acquisitions in the coming years. Such situations tend to mildly stress investors. Should another acquisition materialise this year, our assessment will, as always, hinge on the presented case and financial figures.

Considering the robustness of forward bookings (standing at $28M), it’s conceivable that elevated growth expectations are already factored into the current valuation. The true test lies in Camplify’s ability to sustain its newfound marketing efficiency and execute effectively in the face of these high expectations.

To access all our subscriber only content, join the waitlist to become a supporter, via this link.

Disclosure: The author of this article Jean-Philippe Picard owns shares in CHL. The editor Claude Walker does not own shares in CHL. Neither will trade CHL shares for at least 2 days following the publication of this article. This article is not intended to form the basis of an investment decision and is not a recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

Sign Up To Our Free Newsletter

Save time at tax time: If you’d like to try Sharesight, please click on this link for a FREE trial. It saves heaps of time doing your tax and gives you plenty of insights about your returns. If you do decide to upgrade to a premium offering, you’ll get 4 months off your subscription price (the best deal available, I’m told) and we’ll get a small contribution to help keep the lights on.