Yesterday, Camplify released its results for H1 FY 2022 reporting revenue growth of 108% to $6.8 million and a net loss of $2.8 million. As a reminder, Camplify is essentially trying to be the AirBnB of campervans and caravans, and currently has operations in Australia, New Zealand, UK and Spain. I expect the company to expand into Portugal soon, though this has not been confirmed.

Cash burn was about $1.8 million, and the company has $19 million in the bank, so its balance sheet is healthy.

When I first covered Camplify, I wrote that “The company remains under-followed by small cap fund managers and has a great story. Subsequently, the share price rose to above $4, and I took profits at around $3.50 and above. You can see all our coverage of Camplify stock here.

I still think Camplify is under-followed and has a great story. However, despite some impressive headline growth, I found these results quite disappointing. My main concern relates to the fact that the revenue growth has been bolstered by low margin insurance revenue. This kind of revenue isn’t interesting to me, though I understand that insurance is an important part of the offering. Insurance revenue only matters if it helps grow booking revenue. In order to understand why, let’s look at the Camplify business model.

What is Camplify’s Business Model?

Camplify’s business model is to be a network of caravan and campervan owners and people who would like to rent those. The reason booking revenue matters is that the more people list their caravans on Camplify, the more choice there is for renters, and the more renters will start using Camplify. That in turn makes it more attractive for people to list their camper vans on Camplify. The word flywheel is bandied about far too often these days, by overly promotional management. But Camplify actually has a business flywheel (I just hope they don’t start bandying it about).

Building this network for the minimum possible amount of cash burn is the only thing that matters. Either Camplify becomes the go-to for renting out and hiring Caravans, or it does not. If it does not become the leader in this niche, then it will be caught in ever increasing expensive advertising wars, just like every run of the mill e-commerce company.

If it becomes the clear leader, with the most choice, and unparalleled offerings, then it won’t need to spend so much on advertising, since it will be a genuinely better option for hirers.

Our best measure of this network is not total revenue, but rather, revenue from bookings. This metric excludes listing fees. That’s important, because a listing itself doesn’t really strengthen the network. Only bookings are an example of the network in action.

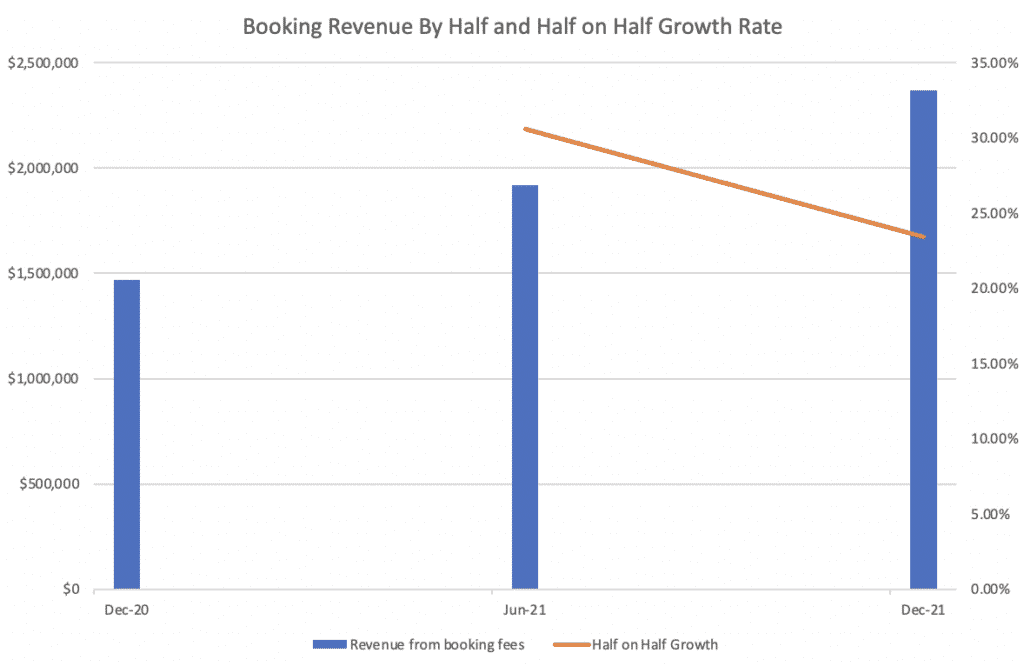

In H1 FY 2022, Camplify grew booking revenue to $2.37m, a gain of 61% on the prior corresponding period. That’s impressive at a glance. However, diving into the half-on-half comparisons, we see that the growth actually slowed from H2 FY 2021 to H1 FY 2022. That’s problematic, since the summer holidays fall in H1 FY 2022, and you would expect that to be a strong period.

The other disappointing aspect of these results was that the company reported $800,000 of van sales revenue with a $700,000 cost of goods sold, implying that they made a gross profit of just $100,000 from van sales during the half. Now, on one level, the van sales business makes sense as a way of encouraging more vans onto the platform. Previously, I thought it was a good idea.

However, on reading these results I was struck by the fact that the company’s catch phrase is to “build a beautiful efficient business” but the van sales gross margin is just 12.5%. What an absolute joke! It seems far too early in the Camplify business to be diversifying into waste of time distractions like selling vans. Realistically, I think that the decision for Camplify to sell vans is a bad one. How many full time employees have their time wasted building this low margin feature of the business that makes it worse?

Ultimately, the combination of the slowing half-on-half revenue growth and the bad decision to di-worsify into van sales has caused me to sell my remaining stock. The reason for this is that only the booking revenue is the high quality revenue (with margins. just below 80%). The rest of the revenue is “low quality revenue” that should be ignored, in my view, since it exists only to help the high margin revenue grow.

The decision to focus on growing “low quality revenue” also has me question the wisdom of the board.

Camplify Is Priced As A High Quality Business

High quality booking revenue was $2.37 million in this half, growing 23% half on half. Let’s assume that growth rate doubles (unlikely). In that case, second half revenue would come in at 46% higher, being $3.46m for total FY 2022 revenue $5.83m.

Now on top of that, the company has made an acquisition in NZ, which previously made about $1.35m in revenue. Let’s assume that grows to $2m (again, generous) and add it to our hypothetical FY 2022 bullish estimate. Then we have $7.83m [Edit: for clarity, this is an estimate of booking revenue].

The current market cap, including escrowed shares, is around $120m, at the share price of $3.14.

This puts the business on around 15x an extremely bullish estimate of high quality revenue for FY 2022. That is too high for a business that has slowing half on half growth and is distracting management with low margin retail operations that at best suck up capital and attention for very little gain.

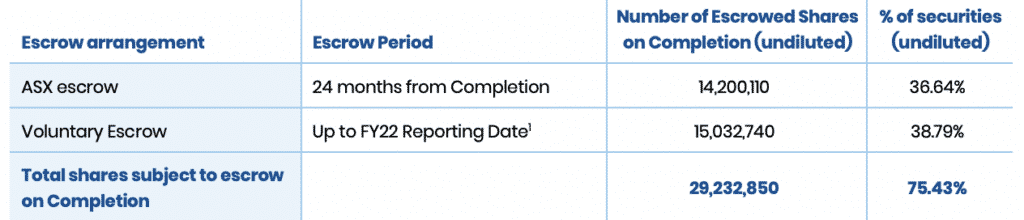

It is also important to remember that 38% of the company’s shares at the end of the FY 2022 results. This also creates a short term risk to the share price.

As a result, I have sold my remaining Camplify shares.

Camplify Is Still A Very Interesting Business

The one risk with this approach is that I may end up buying back Camplify shares at a higher price, down the track. You see, if Camplify really does become the global Air BnB of Campervans, then could be worth billions. Arguably, the reason it trades at such a high multiple is that there is a potential that it becomes an extremely high quality business. In that scenario, I may have shot myself in the foot by selling.

If the shares always remain expensive, then I could miss out on a massive winner.

On the other hand, if escrowed shares hit the market after the FY 20222 results, then the share price may end up quite a bit lower. To my mind, I would be happy to buy Camplify on around 10x its high quality revenue, assuming it keeps up a decent pace of growth and doesn’t burn too much cash.

All in all, I am taking a somewhat risky approach by selling out because I really do like this business. However, at the end of the day, I cannot ignore the multiple bearish signals outlined in this article. One of the guiding lights of my investment style is that I want to find businesses that are improving the quality of the business. I certainly hope that Camplify will hone in on high quality booking revenue growth rather than other revenue.

Finally, it must be noted that on the conference call, I asked about the marketing spend (which was about 50% of gross profit). The CEO said that 70% of the marketing spend is focussed on acquiring Van owners to the platform. This is an important difference from marketing spend that is focussed on buyers (or hirers). While 80% of hirers will only use Camplify once, getting a new van onto the platform is much more enduring. Therefore, I think that the focus should be getting more (existing) vans on to the platform, rather than trying to sell vans to people who don’t have them.

I make this point because I would be extremely worries if 70% of the marketing spend was to find hirers. As it stands, one thing I like about Camplify is that demand is fairly strong, and one of the main impediments to growth is getting vans onto the platform. The company should redeploy all staff engaged in selling vans to recruiting existing van owners.

The author recently sold shares in Camplify but does not own any at the time of publication. This article should not form the basis of an investment decision. It is an investment diary valuable only for the cognitive process it demonstrates. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer.

Sign Up To Our Free Newsletter