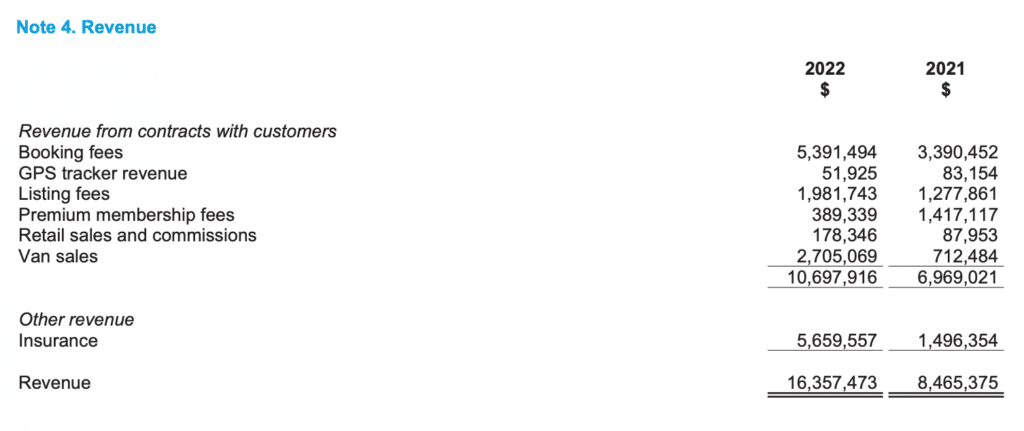

Campervan lending platform Camplify (ASX: CHL) today reported full year results. The FY 2022 Camplify results showed revenue growth of 92.6% to just under $16.35 million and the loss deteriorating from $2.06 million last year to a whopping $8.16 million this year. We have previously written plenty about Camplify, so I won’t rehash the operations and all reasons it is interesting in this article.

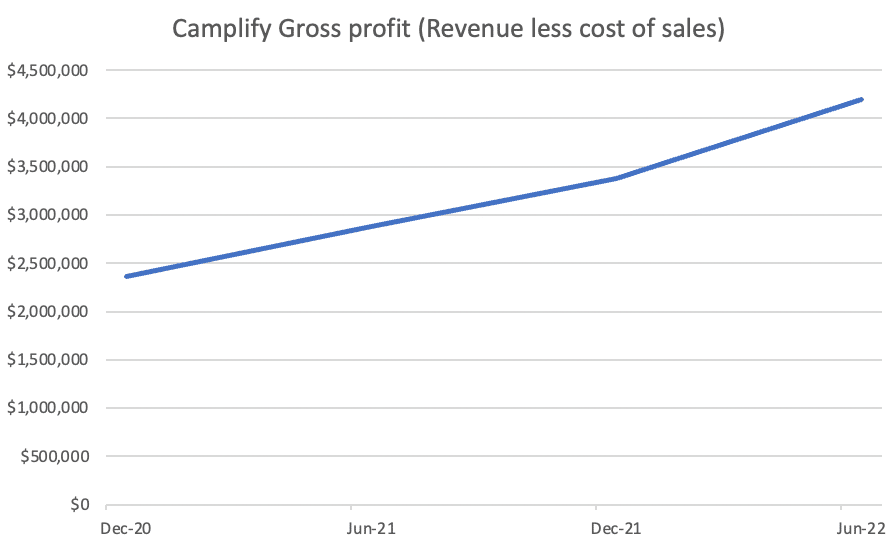

I find it more useful to look at gross profit than revenue, because the gross profit margin is declining rapidly. Camplify’s gross profit was just under $7.1 million in FY 2022, up 35% on FY 2021. You can see how this is much lower than the revenue growth, because Camplify’s gross profit margin is dropping, fast. Gross profit margin was over 70% in the half to December 2020, but under 44% in the half to June 2022.

The problem with looking at Camplify’s revenue growth rate, is that the revenue is increasingly dominated by low margin insurance revenue, and polluted by low margin campervan retail revenue. On the Camplify results conference call, management said insurance costs have dramatically gone up and that is one of the key things that has impacted both the gross profit and the bottom line.

Is Camplify’s Network Effect Getting Stronger In These Camplify Results?

As you can imagine, Camplify is focussed on trying to build an unassailable network effect in its markets. If Camplify has (for example) 50% of the campervans in an area, it would be very hard for anyone to ever set up a competitor. Even if the competitor could magically get the other half of the existing fleet, it still wouldn’t have more options than Camplify, making it permanently less attractive for potential hirers.

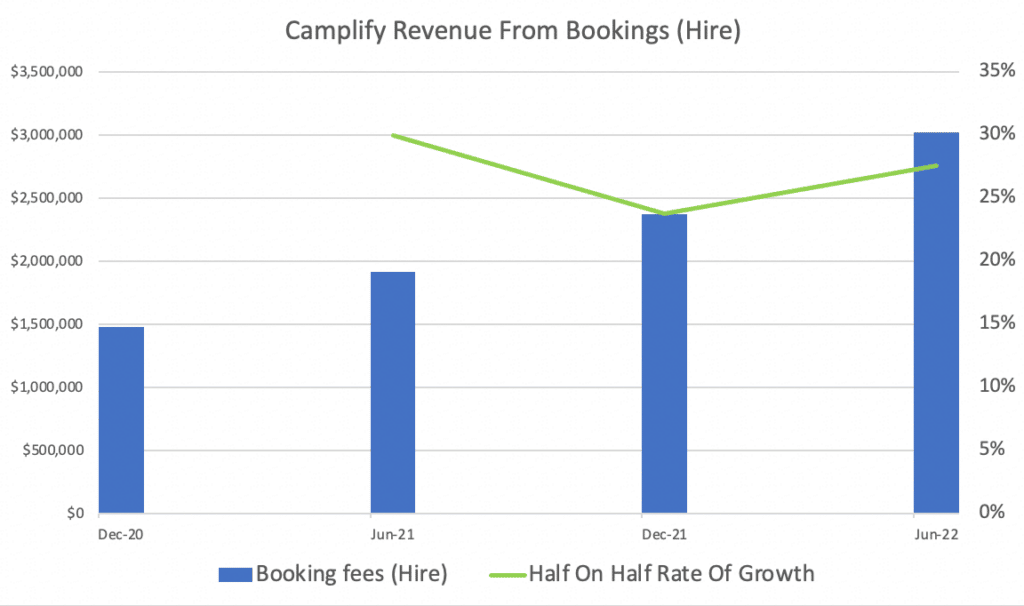

I look at the number of RVs on the platform and the amount spent on bookings on the platform to measure the health of the platform. It is certainly good to see that RVs gained about 61% to 9,926. Booking revenue was up 59% in FY 2022. The second half booking revenue reached a record $3m and the half on half growth rate actually accelerated slightly, though this was no doubt distorted somewhat by various covid measures over the last 2 years.

Were the current growth rate to sustain, Camplify would be run-rating $20m in booking revenue within 3 years. But even if you assume a growth rate of 15%, it is possible to see a run rate of $15m or more within 3 years. Now, I’m definitely not saying this will occur, but I think it’s possible.

Does Camplify Need To Raise More Capital?

Camplify is still a cash furnace, having burned through more than $6m in FY 2022, significantly depleting its cash balance, which now sits at $15 million. On the Camplify results conference call, the Camplify CEO Justin Hales was asked about when the company might reach breakeven. I have (incompletely) paraphrased his answer below:

“We’re looking at growth and scale and we haven’t set a public figure for that [breakeven] at this stage… we’re certainly on a good route towards that and I’d like to see how we can focus our efforts on that over the next 18 month period… We don’t want to turn off the growth engine that we have and we don’t want to focus our efforts on profitability when the ability for us to grow and make sure we are a scale operator in these markets is important.. I think everyone wants to see us being a business at bigger scale… We sort of have our eyes on making sure we’re cost effective… Really focusing on automation so that our breakeven position can be achieved in the not too distant future.”

My guess is that the board is considering whether the company should try to avoid raising capital again. Usually, in my experience, companies that have never made a profit underestimate how difficult it is to be profitable. These Camplify results make me think it will probably want to raise more capital at some point, but that is not certain.

At the current Camplify share price of $2.39, the Camplify market capitalisation is about $95 million. The big unknown is what price it will dilute at, if it does raise capital. Let’s assume it needed to raise $10m more and could do so issuing shares at $2. That would make the hypothetical market capitalisation closer to $108 million. If that were enough to reach breakeven then in 8 years from now you might be looking at a pretty profitable company. I imagine that the booking revenue alone would be pretty profitable, as it is essentially just automatic ticket clipping on a transaction.

Looking deep into the future, I think it’s likely Camplify could be worth a lot more as a profitable company. However, the problem is the uncertainty about when and if it will get to profitability. I find aspects of management style quite promotional, but I suppose that is probably okay in an environment where it seems they are making a grab for what they think will be a profitable niche. I don’t currently own shares, and don’t currently have a strong view on the stock right now, other than that it is well worth watching and following along with.

Truly defensible network effects in small niches can be very valuable, and Camplify may well be in the business of building just that. Well, that and selling Campervans. 🤷♂️

Finally, I thought it was interesting that the macro climate might assist Camplify. The CEO pointed out that as household expenses increase, it becomes more attractive for people to rent out their vans to get tax advantages and income from renting. This might be right since renting out a Campervan allows owners to deduct some expenses associated with it.

Did you find this article useful? Sign up to receive access to hidden, Free content like this!

Please remember that these are personal reflections about stocks by an author, and this article is not intended as a recommendation. The author does not own shares in any of the companies mentioned and will not trade them for at least 2 days after publishing this article. This article is not intended to form the basis of an investment decision. It is an investment diary valuable only for the cognitive process it demonstrates. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives. Any statements considered advice under the law are authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. A Rich Life does not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.