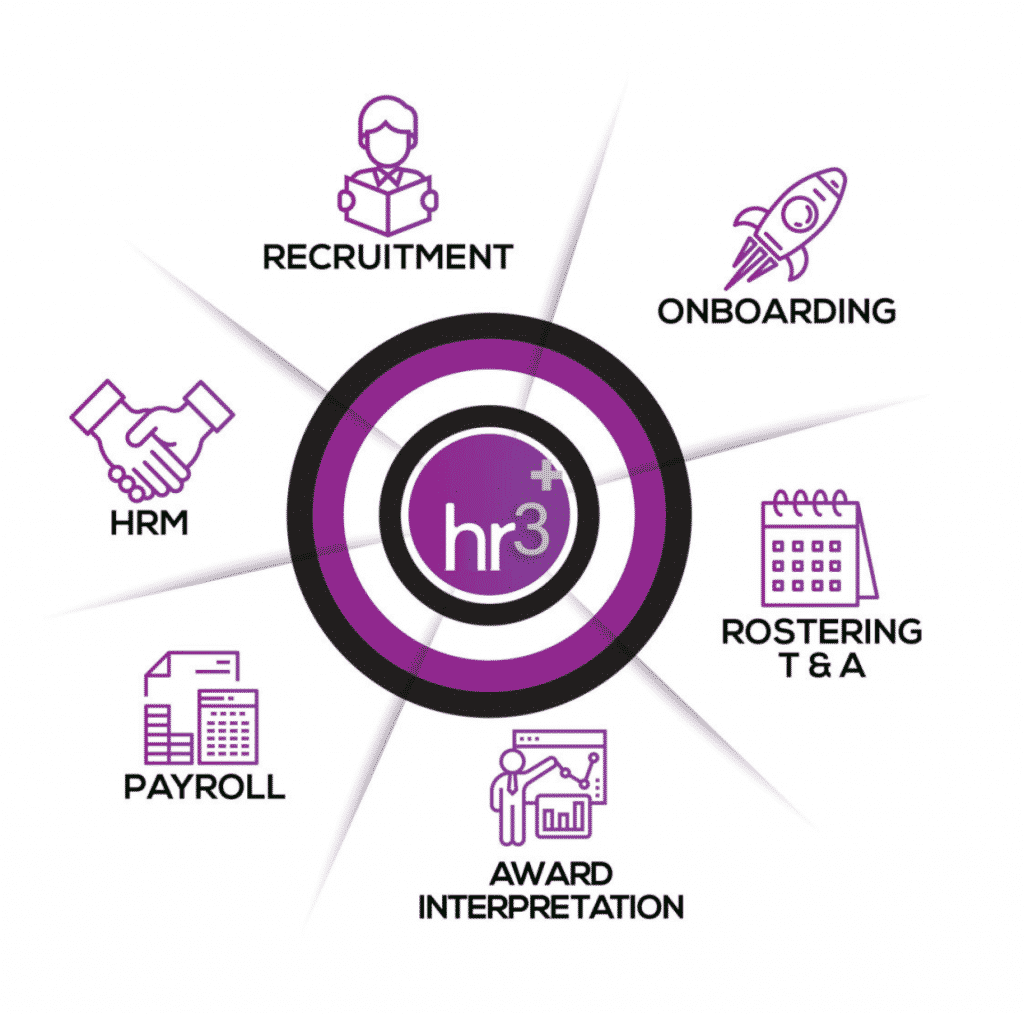

One might reasonably query why I would buy shares in Readytech, given that the business only grew 10% organically in the last year. While it might not be yolo expensive, it’s not really cheap, either, and trades on around 40 times earnings at $1.82. The answer is that it has one feature of its business model that’s just a little bit special. It has the ability to act as a source of truth on company outgoings since it handles a combination of HR and payroll functions. You can see an illustration of its module below.

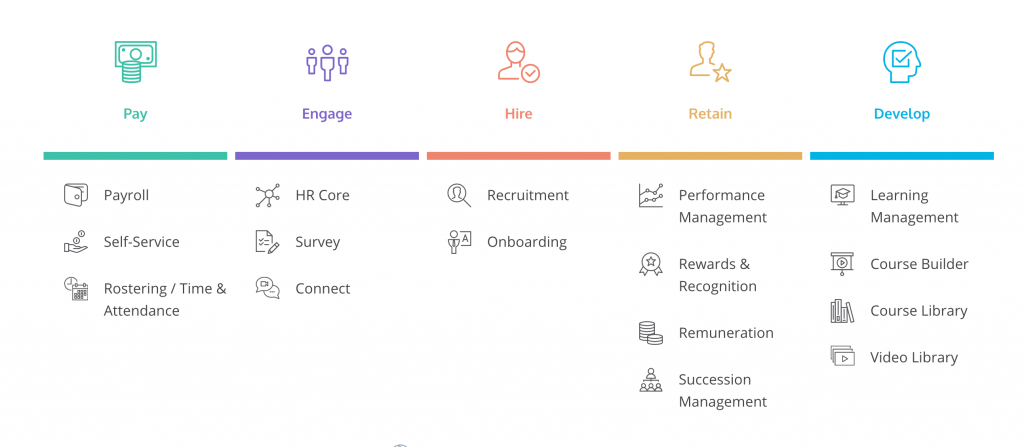

Now, obviously this is a pretty incomplete offering in what is a competitive space. One sleeker looking player in the same space is Elmo (ASX: ELO) a company I have previously owned shares in.

Meanwhile US stonk Workday (NYSE:WDAY) is the big mountain gorilla in the space. It layers enterprise grade analytics across the whole thing, getting deeper into becoming a tool to form the basis of decisions, not just a source of truth. But the point is this increasing ability to assist with and increasingly advise business operations comes from a single seed; acting as a source of truth about who the company is paying, who they need to pay, and why they are paying them.

Workday is, in my view, reasonably attractively priced at about 12.5x revenue. It has the potential to be profitable, it has a strong balance sheet, and it continues to grow its product suite. I don’t see Readytech (ASX:RDY) ever being as good as Workday.

However, the recent listing has cobbled together a bunch of functionality and is now in a position to do more to help businesses, which makes it possible to winner bigger clients. To quote the annual report, “

The complementary acquisitions of Zambion and WageLink are performing well. “Following the successful integration into an all-in-one workforce management platform, HR3+, ReadyTech is gaining market share from legacy platform and enhancing trust from new blue-chip clients, including Glassons, dnata and Bed Bath & Beyond.”

A Niche To Expand To

I am also hopeful that the “breakthrough TAFE contract with

Bendigo Kangan Institute (‘BKI’) in Victoria who selected [ReadyTech’s] Student Management System, JR Plus”, will give the company a chance to develop greater domain expertise in the education sector, and perhaps start winning more education clients. The real upside would be if this could become another channel to market for their HR3 Cloud Payroll/HR offering.

In my view, it will be difficult for Readytech to compete in this category without specialisation, given well-funded competitors, but the company has sufficiently varying customers that it will have to remain a generalist of sorts. Usually, this would be cause for concern, but because Readytech does provide key information about cashflows to its clients, it’s not the kind of system people change readily. So the existence of a customer base, positive cashflow, and accounting profit all create a relatively rare ticket to a fairly attractive dance for Readytech. That optionality is interesting to me.

Healthy Now Anyway

In any event, the business looks reasonably healthy as it stands today. The company says that a “combination of new client wins and cross-selling to existing customers underpinned 19.1% growth in

revenue to $39.3 million”. Within this, subscription comprised 89% of total revenue, so the company has about $35m in recurring revenue. It has around $15m debt, so at the current share price, that’s an enterprise value of about 4.6 times revenue.

Now, I totally accept that you might want Readytech on a lower multiple than Workday, but I’m not entirely sure it should be only a little more than a third. A re-rate to even half Workday’s multiple would see the share price rise around 40%.

Elmo said it had $50m in recurring to the end of June 2020. That means it is on Sales/EV of about 6. Elmo may be in a better position to grow but it has been fast an loose with dilution showing a lack of respect to shareholders in the process. I’d prefer Readytech at the current price.

Finally, Readytech hired sales and technology staff during the year with a view to driving organic growth. There are no guarantees that this will pay off but if it does, then Readytech will look too cheap at the current price, in my view. As a result, I think it’s fair to say I own Readytech shares because I think there are multiple ways to win. Although I’m sanguine about long term potential, I think the risk vs reward is attractive at the current price.

Save time at tax time: A Rich Life depends on Supporters to pay for its free content, so if you’d like to try Sharesight, please click on this link for a FREE trial. It saves me heaps of time doing my tax and gives me plenty of insights about my returns. If you do decide to upgrade to a premium offering, you’ll get 4 months off your subscription price (the best deal available, I’m told) and we’ll get a small contribution to help keep the lights on.

This post is not financial advice, and you should click here to read our detailed disclaimer.

If you’d like to receive a occasional Free email with more content like this, then sign up today!

Disclosure: I hold shares in Readytech and will not sell for at least 2 days after the publication of this article.