A couple of months have now passed since I embarked on a strategy to buy a bunch of ASX stocks in the hope of participating in deeply discounted capital raisings.

On April 11, 2020 I posted 10 Stocks I Bought For A Potential Discounted Capital Raise and on April 22 I posted Another 10 Stocks I Bought For Potential Discounted Capital Raisings.

As markets rallied in the time since, and capital raisings became less likely due to central bank liquidity, I sold most of those positions — only a few actually did capital a raising, in the end. Nonetheless, I actually did pretty well out of the strategy because all of the smashed up medium quality companies I bought shares in rebounded quite strongly. Let’s take stock.

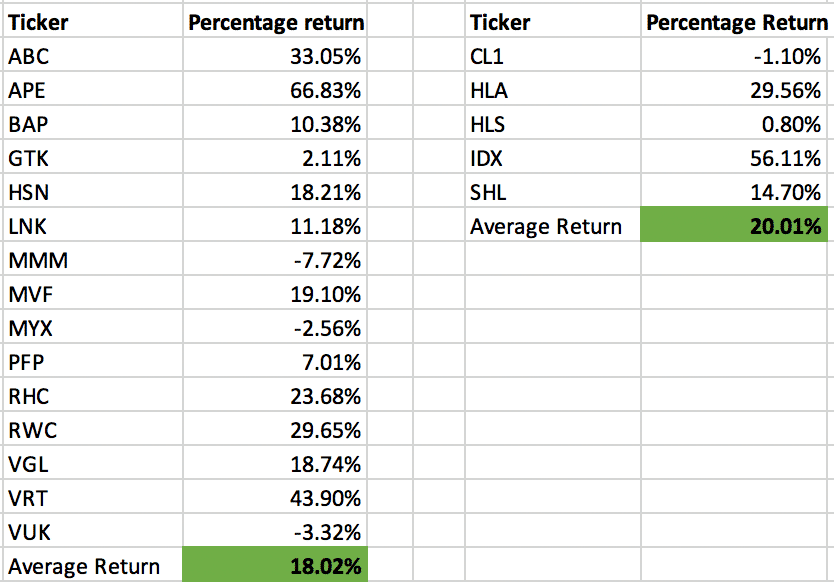

Below are the real returns I generated off the stocks I bought as part of the capital raising strategy. The left hand column is companies I bought, and then sold. In no way did I maximise returns here, and in most cases I sold too early, and could have maximised gains by holding a bit longer. The right hand column are the companies I decided I actually quite like at current prices, and in some cases — such as Class Ltd (ASX: CL1) and Sonic Healthcare (ASX: SHL) I have added to my positions since my first purchase. The returns shown are my average return on the stock (not just the initial purchase — though I think the initial purchase would be a higher percentage return).

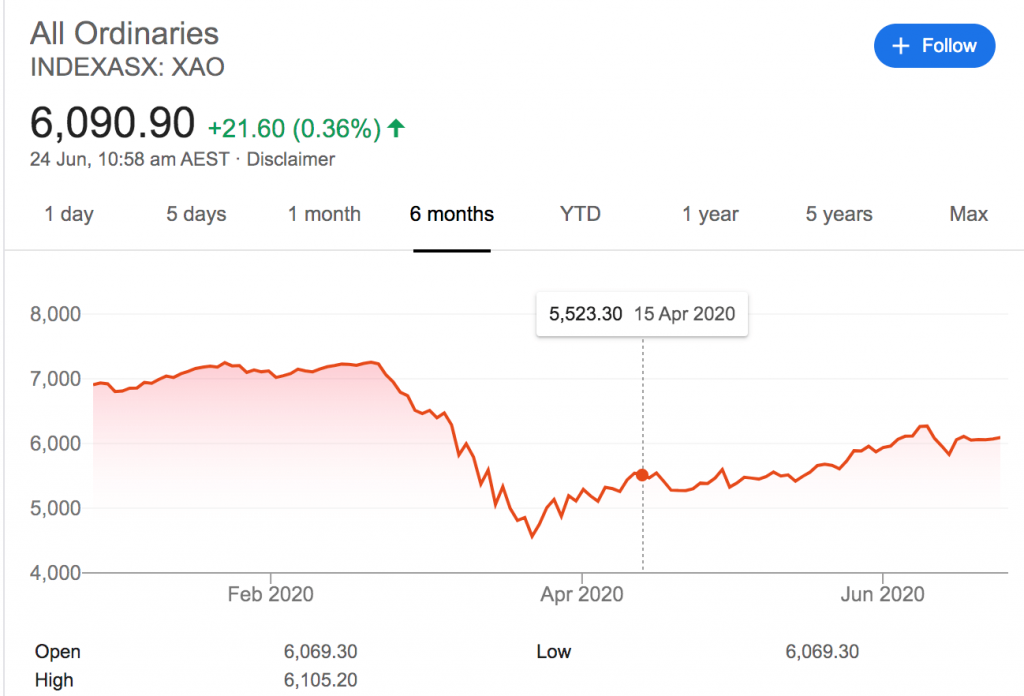

As you can see below, the ASX Small Ordinaries (ASX: XSO) has returned around 15% since the midpoint of my capital raising strategy and the ASX All Ordinaries (ASX: XAO) has returned around 10.2% from the same time.

Was The Strategy Worthwhile?

Buying small positions in a bunch of companies in the hope of a discounted capital raising was a fairly marginal operation during the coronavirus crisis, because the companies that did raise capital disproportionately favoured institutional investors over retail investors.

Companies like Kip McGrath (ASX: KME) and Marley Spoon (ASX: MMM) showed their distain for the little guys by offering a discounted capital raising to institutions, but no retail offering at all.

In the end, Ramsay Healthcare (ASX: RHC), Bapcor (ASX: BAP), Vista Group (ASX: VGL) and Monash IVF (ASX: MVF) all gave opportunities for a small retail shareholder to benefit from a discounted capital raising.

However, the real upside came from the fact that buying distressed-but-decent stocks during lockdown actually generated higher returns than the market. From a financial engineering perspective, this is probably just because these companies have higher leverage as a group and their share prices exhibit higher beta than the market (that is, they are more volatile that the overall market, so should outperform during a rising market).

Overall, despite the limited success of the plan, I would implement such a plan again, because the downside was reasonably well protected by somewhat depressed valuations.

One takeaway for me is that the leveraged healthcare stocks outperformed the rest on the rebound, and only Mayne (ASX: MYX) generated a negative return for me. This was somewhat unlucky as I timed my purchase and sale very poorly (buying on a short term peak) and based on random chance I could have easily turned a profit. I would have confidence buying most healthcare companies in similar circumstances as I believe they almost always have superior access to finance, if that becomes an issue.

This post is not financial advice, and you should click here to read our detailed disclaimer.

Save time at tax time: A Rich Life depends on Supporters to pay for its free content, so if you’d like to try Sharesight, please click on this link for a FREE trial. It saves me heaps of time doing my tax and gives me plenty of insights about my returns. If you do decide to upgrade to a premium offering, you’ll get 2 months free and we’ll get a small contribution to help keep the lights on.

If you’d like to receive a occasional Free email with more content like this, then sign up today!