The online luxury goods retailer Cettire (ASX: CTT) released its first quarterly results for FY 2024. Across the top line, Cettire appears to be undergoing swift growth with sales revenue nearly doubling from $66.1m in Q1 FY 2023 to $127.1m in Q1 FY 2024. The number of active customers who made a purchase in the last twelve months lifted by 69% on a quarter-on-quarter basis. The volume of sales was the key driver of revenue growth as the average order value increased slightly.

Cettire reported an adjusted EBITDA of $8.7m, which excludes share-based payments and unrealised foreign exchange items. Management disclosed a delivery margin of greater than 20%. The delivery margin represents sales revenue minus the cost of goods purchased from suppliers and third-party delivery costs. I believe this is the most important metric to track.

Cettire is at the mercy of luxury goods suppliers. Over the last five years, Cettire’s delivery margin has oscillated between 17% to 27%. The brands on Cettire’s digital shelves like Ralph Lauren, Gucci and Fendi are global powerhouses. A lot of these brands already have the wherewithal to sell directly to customers, so why use Cettire? It’s just another digital distribution channel for them to prosper. As a result, the suppliers’ brand power cut into Cettire’s gross margins.

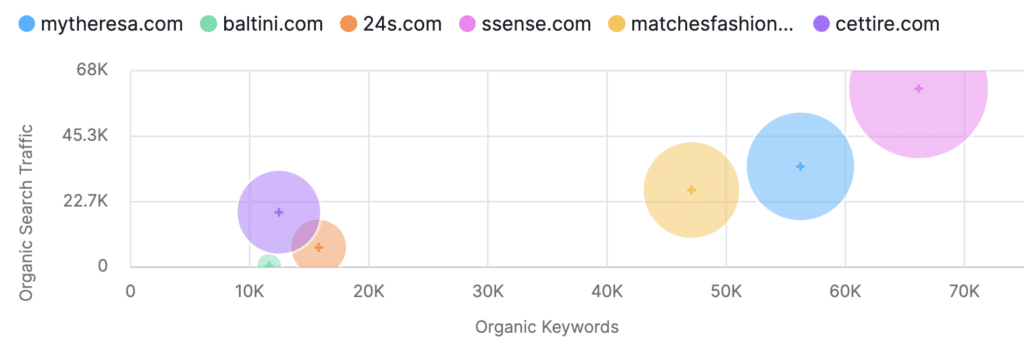

Suppliers want to choose online retailers with the most traffic. Whilst Cettire is steadily growing online traffic, it still lags behind a chain of luxury online retailers.

Source: Semrush

Until Cettire can achieve higher organic traffic, it will be at the behest of suppliers. Cettire is currently trading at a price-to-earnings multiple of around 64x, so investors seem to be quite optimistic about Cettire’s ability to achieve greater organic traffic whilst moderating costs. This is a tall order. The biggest luxury brands seem to be getting stronger and embracing vertical integration. Not only that, the barriers to entry are low and new online retailers can quickly capitalise on a winning Google algorithm to drive organic traffic.

Unless Cettire finds a way to make itself one of the leading luxury online retailers and find reasons for suppliers to stick with it, I’d prefer businesses with existing competitive advantages and greater negotiating power with suppliers. Not only that, Cettire founder Dean Mintz, who remains the biggest shareholder, has been selling his shares.

While we think Cettire is an interesting stock, it’s far from our favourite idea. We reserve coverage of our favourite holdings and top watchlist stocks exclusively for Supporters.

Disclosure: the author of this article does not own shares in or have position in Cettire. The editor of this article does not own shares in or have position in Cettire. This article is not intended to form the basis of an investment decision and is not an official recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. Equity Story Pty Ltd and BlueTree Equity Pty Ltd t/a A Rich Life do not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.