One of the stocks that have hampered my portfolio returns lately is Damstra (ASX:DTC), which essentially competes with large access control companies like Honeywell to help industrial and mining clients track employee locations, manage access on sites, manage compliance with regulatory training requirements and generally ensure safety on worksites, for example by breathalysing workers and ensuring they have their scheduled breaks to avoid fatigue.

Most of Damstra’s competitive advantage centres around their terminals which sit at the entry or exit to a worksite (examples below), although they are increasingly involved in tracking workers within a worksite (through the acquisition of Vault) and also do serve customers who don’t have permanent worksites (for example teams working on telecommunication towers).

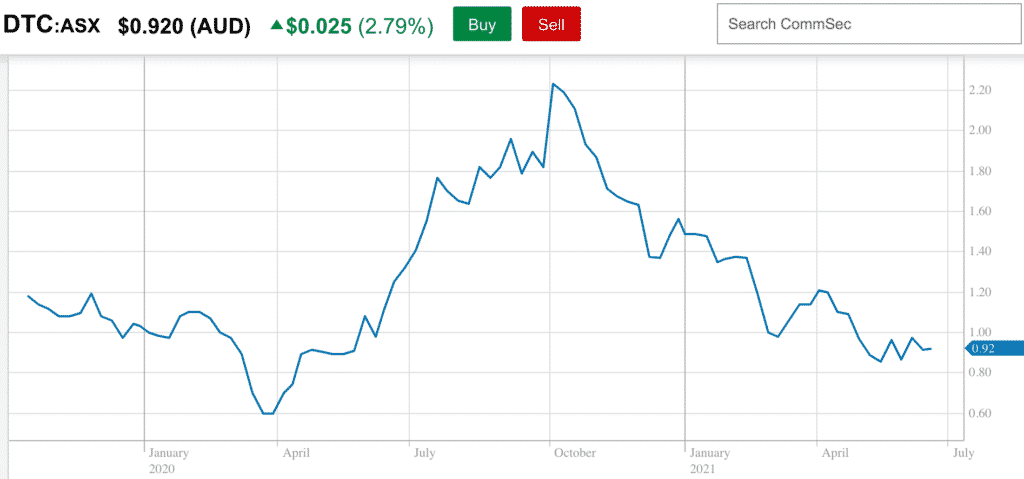

Now, I’ve written fairly consistently about Damstra since April last year when I started accumulating a position around the current price of 90c per share. The reason it’s interesting right now is that the share price is down more than 50% since its peak, which means that it may currently be suffering from shareholders who want to sell for tax reasons.

Investors who have booked profits have an incentive to sell losing positions prior to the end of financial year in order to minimise their tax payable. Many Damstra investors would be currently underwater and this would be creating some selling pressure at the moment. The EOFY is also an opportunity to consider whether I really want this stock in my portfolio or not.

The way I see it, there are two reasons that the Damstra share price has suffered so badly.

The first was somewhat predictable. Basically, around the end of last year Damstra had excellent share price momentum and therefore was attracting momentum investors. On top of that, it was recommended mutliple times by Motley Fool. This helped the share price reach peaks above $2, which was never really justified by the underlying business. Cynically, you could also argue that the company had every incentive to be bullish in their forecasts as they were using their shares to acquire another company (Vault). The higher the value that the Vault vendors placed on Damstra shares, the better for Damstra.

While I did take some profits along the way, I ultimately was a buyer up to around $1.70 (albeit via my holding in Vault shares, which then became Damstra shares). In hindsight that was a mistake, aided by the fact that I was initially arbitraging the Vault/Damstra merger, but then never got around to selling, and just kept the shares.

Fast forward a few months and the additional liquidity in Damstra (from all the old Vault shareholders) saw the register arguably a lot looser and a lot less long term oriented than before. Making matters worse, a delay to a major contract meant that the core Damstra business failed to grow and the half year results saw the company abandon previous guidance of $33m.

I had already assumed this guidance would not be achieved so I was not surprised to see that, though I did voice my opinion to the CEO that the company would be better off not giving guidance, than giving it and missing. Excluding “other income”, the company reported $12.1m revenue for the first half.

Damstra’s Q3 Report

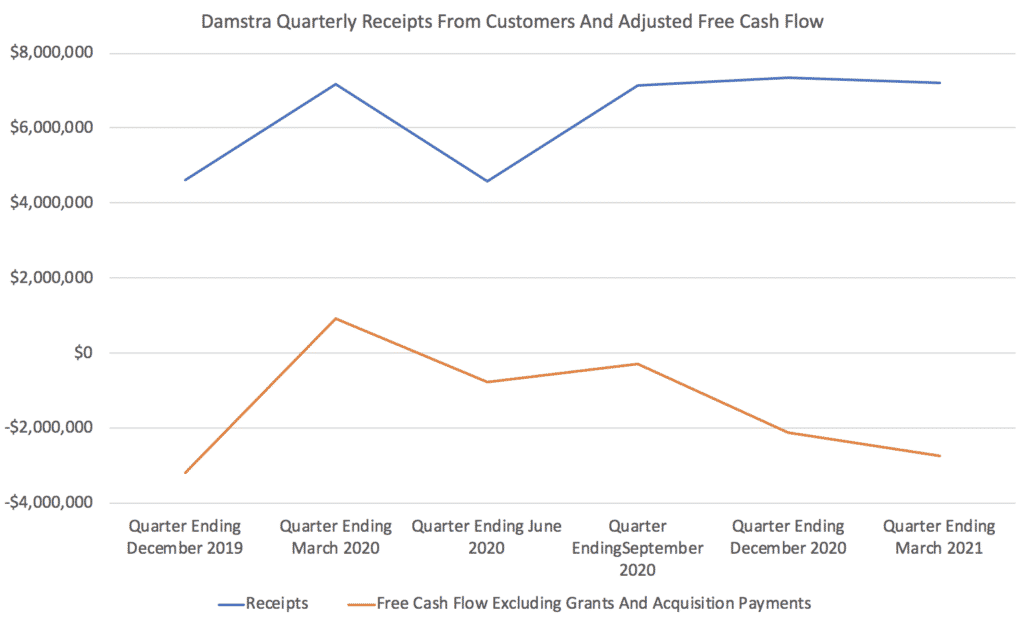

Next, in April, the company reported its results for the third quarter, in which it booked improved revenue of $6.9m, bringing true revenue for the first three quarters of FY 2021 to $19m. While receipts remain above revenue (which is good to see) free cash burn once again deteriorated, as you can see below.

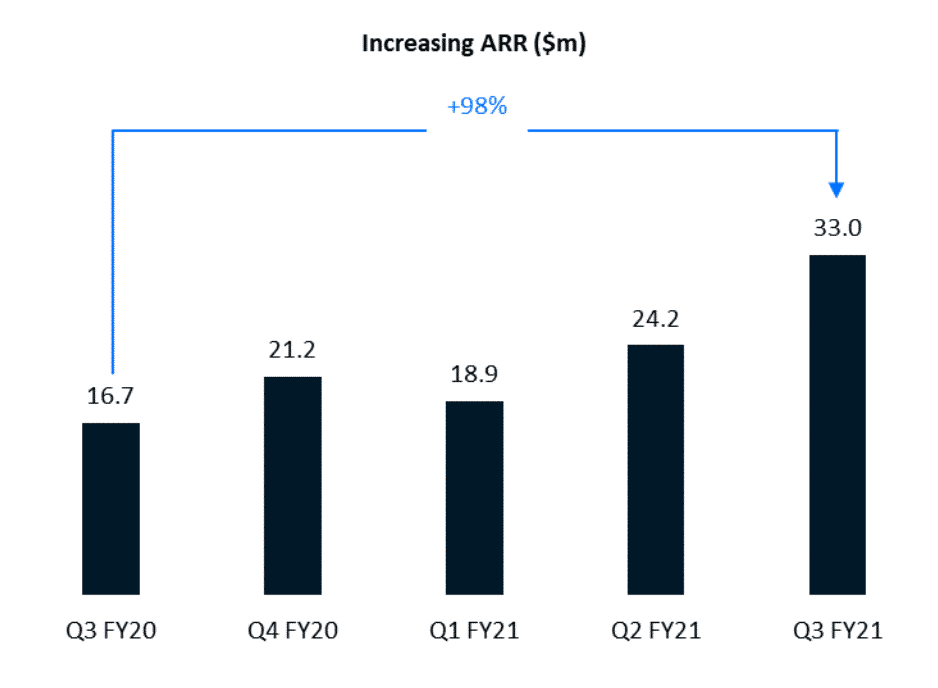

Importantly, Damstra reported Annualised Recurring Revenue of $33m at March 2021, and provided the slightly confusing chart below.

The reason I find the above chart confusing is because the supposedly “recurring revenue” dropped quite significantly from $21.2 m to $18.9m at the beginning of Q1 FY21, suggesting that the revenue is not really recurring. My guess is they lost a significant client, perhaps because a large project finished.

Alongside the quarterly, the company gave a lengthy product update and demonstration which did highlight where some of that cash burn is going (developing new products). The company also gave revenue guidance of $28.5m to $30.5m although it’s not clear to me if this is including “other income” or not. In any event, even my forecast of $28m of real revenue implies a record $9m of real revenue in Q4.

Finally the company announced a debt facility at a 6.5% interest rate which is good news, because it removes the possibility that the company will need to do a desperation capital raise if it needs money to invest in expansion, especially given the CFO said on the call that shareholders “will see cash burn slowing down.”

All of this seems pretty reasonable to me although I prefer use my $28m number than the $33m ARR number they have provided. If I assume that this company is making revenue of $28m, with gross margins above 75%, growing at around 15% – 20% per year, I’d argue that the business is worth at least 8 x $28m, which is $224m. That compares to the current market cap of $167m, at a share price of 90c.

At present, the market clearly doesn’t believe the business can sustain 15% growth, nor does it appear to put much weight on impressively high margins of over 80% in the last quarter.

And yet, if the company does $28.5m in revenue, and grows its ARR by June 30 to just $34m, then it would be in a position to grow revenue to $34m (or more) in FY2022, which would be a gain of 19%. To my mind, it seems clear that the market has lost faith in Damstra’s forward looking guidance and of course nothing good has been achieved by them giving guidance in the quarterly (the share price is down since then).

In some ways, what I’m doing is betting that management who were wrong before are right now. But in another sense, I’m also just tuning out their own estimates and relying on mine. Even if we apply a “management trust deficit” to Damstra I still think that the market is undervaluing the business. While one director did sell Damstra shares over $2.26, neither the CEO nor the Chairman sold shares, and another director bought (a smaller amount of) shares more recently at around $0.93. The CEO and Chairman both have meaningful holdings and are the largest two individual holders, with around 10% of the company each.

Ultimately, I see Damstra as suffering from poor sentiment which can only be fixed if the company hits its financial targets. For now, a huge proportion of the shareholder base could be described as “subdued baggies” and even if we are correct in the long term, the shareprice won’t improve until non-shareholders start getting excited about the stock again.

If we were to distill it down to a single most important binary question it is this: do we believe that there was a “covid slowdown” from which the company is now emerging? If so, then I believe that the current moment may prove an attractive buying opportunity. If not, then Damstra is just a hard-to-grow business with no discernible long term tailwind, and I should not own the stock.

Management says the former is the case, but they have been wrong before. Personally, I am happy to make a bet that they are telling the truth in large part because the most recent quarterly is suggestive that organic growth is improving, and there does not appear to be too much risk of a near term capital raising (based on what management have said regarding the purpose of their debt facility).

The author owns shares in Damstra. This post is not financial advice, and you should click here to read our detailed disclaimer.