Fiducian Group Ltd (ASX:FID) is a founder-led financial planning, funds management and investment platform provider that has provided strong returns to shareholders over the last decade, owing to steadily rising earnings and dividends. While I (Chris Coe, here) think the company has good fundamentals, I am cautious on the outlook and so I sold my holding in November 2022.

But gone does not mean forgotten. With the share price in decline, I recently took another look at the company, since I may look to buy shares again, in the future.

What did the Fiducian Group Ltd (ASX:FID) FY22 results reveal?

Funds Under Management Administration and Advice (FUMAA) dropped 5% in the first half of 2022 as the market experienced increased volatility due to the conflict in Ukraine. In February 2022, Fiducian acquired the financial planning business of People’s Choice Credit Union which increased Fiducian’s funds under management administration and advice by around $1.1 billion. Over the full financial year, however, funds under management administration and advice only increased ~$500 million, due to the negative impact of share market declines.

Source: Fiducian Group Ltd FY22 results

Gross revenue was $69.5 million, up 19% on the prior year and statutory net profit after tax was $13.7 million, up 9% of the prior year. The company has no debt and cash was at almost $17.5 million. Pure free cash flow was about $7.3 million, substantially below net profit after tax. (That figure being operating cashflow less investing cashflow and lease repayments).

Source: Fiducian Group Ltd FY22 results

Fiducian’s FY22 report revealed three major headwinds being fee pressures, increasing compliance costs and falling markets.

From 1 June 2022 administration fees were reduced to keep up with competitors. Fiducian predicts this will reduce fee revenue by up to $1 million in 2023. It was anticipated this would be offset through increased inflows and asset management functions, but declines in funds under management administration and advice make this less likely to happen.

The financial planning industry in Australia is subject to increasing regulations. While regulation is a be positive for society, the regulatory regime has become more time consuming and expensive for financial advisory firms over time. Fiducian has hired additional practice management and compliance team members to provide coaching to advisors. According to the company, it may have one of the highest supervisory management to financial adviser ratios in Australia. Hiring more labour for compliance is an expensive endeavour. The silver lining for Fiducian is that it is increasingly difficult for new competitors to emerge.

Inflation continues to run well above the historical average and some pundits suggest that interest rates will have to rise above the inflation rate before it comes down. This means rates could be higher for longer. Either way the short term market outlook is less than ideal.

There are several factors that could see market volatility continue – among them is the spread of COVID-19 as China opens up, persistently high inflation and increased interest rates, and the Russia-Ukraine conflict. If rates stay high and markets remain volatile, this will probably be negative for fund inflows (sentiment) and funds under management administration and advice (price volatility).

Amongst all the economic facts and figures, what people are thinking often gets overlooked. With the share market outlook cloudy and interest rates rising, people may feel more comfortable leaving their money in the bank.

Fiducian Group Ltd (ASX:FID) Directors Buying Shares

Headwinds, however, such as slowing economic growth, fee pressures and increasing regulatory burdens on the financial planning industry could continue for some time. Despite these negatives, we note recent director purchases.

As the share price has pulled back there have been on-market director buying by founder and Executive Chairman Inderjit (Indy) Singh in October and November totalling $133,114 and Non-Executive Director Samir (Sam) Hallab bought $65,888 worth of shares on-market over November and December.

The company reported at its October AGM that funds under management advice and administration at 30 September 2022 were $11.0 billion (vs $10.94 billion on 30 June 2022), due to financial market weakness. Platform funds under administration were $2.78 billion on 30 Sep 2022, down from $2.85 billion at 30 June 22.

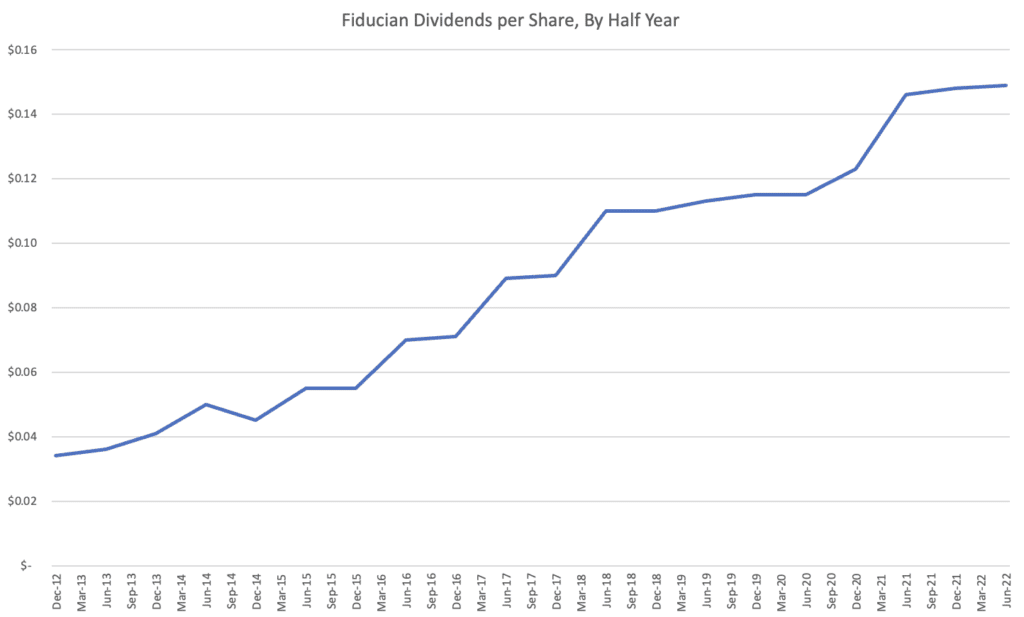

Fiducian has solid fundamentals and has been steadily increasing earnings and dividends over the years, and the company is essentially controlled by Indy Singh the whole time. The history of more than tripling dividend payments in the last decade suggests any future success will be shared with all shareholders.

An Uncertain Time For Financial Advisers

Despite these positives, given the current economic and industry headwinds, I am hesitant to form a view of the stock right now, and plan to ‘wait and see’ what the future brings.

Perhaps a positive indicator for the company’s outlook will be the first rate decrease by the RBA. This may indicate that inflation and bank deposit rates have peaked and are on the way down, potentially followed by a more stable investment environment for financial advisers like Fiducian.

Editor’s note: While I don’t currently own Fiducian shares, I take a slightly more positive view of Fiducian, noting it is a rare small-cap gem with high return on equity, and a long history of honest and competent management. In any event, I concede that Fiducian has had negative share price momentum lately, especially compared to this list of ASX stocks with positive AGM updates might be of interest.

Disclosure: neither the author nor the editor owns shares in Fiducian at the time of writing and neither will not trade for 2 days following this article. However, both reserve the right to buy shares in the future. This article is not intended to form the basis of an investment decision. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

Sign Up To Our Free Newsletter