Over the last few weeks a number of interesting small-cap companies have updated the market on their progress. I thought I’d share some brief notes on three of them.

Codan (ASX: CDA)

I have previously explained why I bought Codan shares, so I will not rehash the thesis here. Since then, the new Codan CEO Alfonzo Ianniello has bought some shares on market. First, he bought almost $200,000 worth at $6.70, then he spent just over $100,000 buying more shares at $7.56.

In between those two purchases, the company updated the market to say that “the Board is expecting the record FY22 first half profit of $50 million to be matched in the second half of FY22. This will result in a record FY22 full year profit.” This guidance implies a profit of about $100m, putting the company on just over 13 times earnings at the current share price of $7.99.

In a sign of strong leadership, the company also addressed concerns around negative operating cashflow in the last half. They commented that:

“Our decision to invest in inventory rather than let customers down has proven to be the correct

one. Notwithstanding this investment in inventory, $41 million of cash has been generated from

operating activities so far in the second half of FY22, this is a significant improvement over the

first half, which had an operating cash outflow of $13 million.”

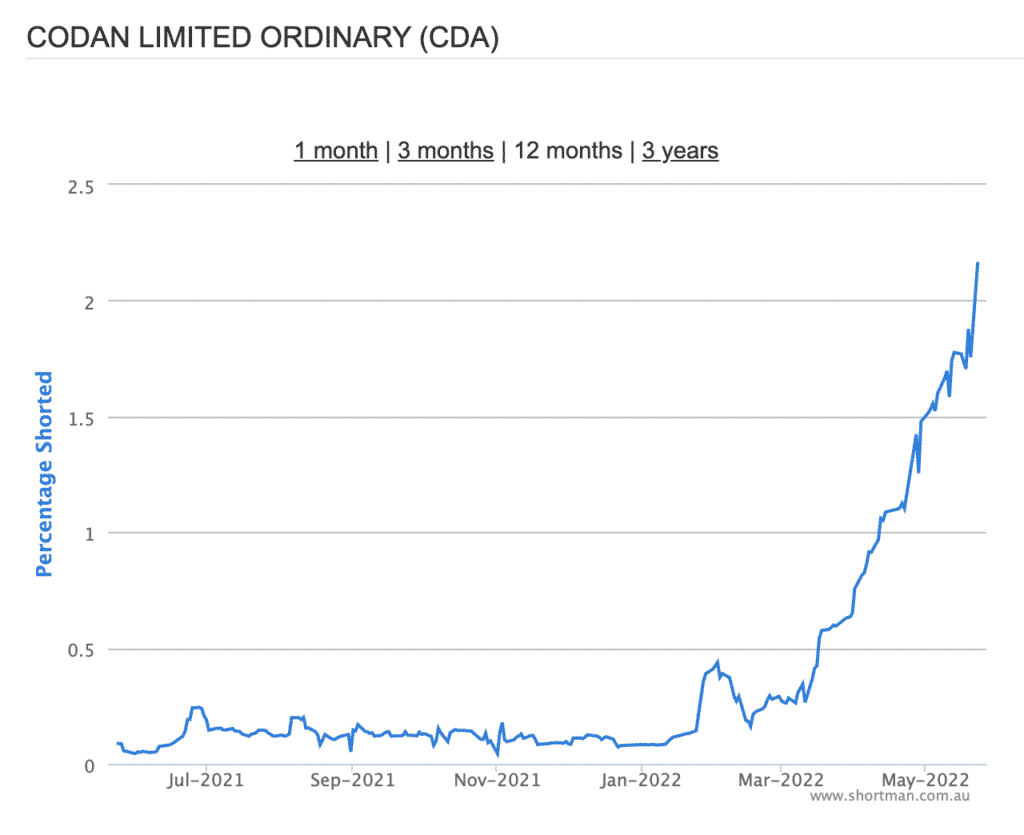

Personally, I have been a bit concerned about the sudden increase in short interest in Codan shares, as you can see below, via Shortman.

I can’t figure out why this would be, other than the ongoing civil conflict in Sudan, which has admittedly put a dampener on the Minelab sales. The company says, it is suffering disruptions in that market but is expecting improvements in FY2023. I don’t see how they could be certain of that but at the end of the day it is outside their control, and probably partially compensated by a fairly low share price.

I don’t think Codan has any particular supply chain disasters, though they are clearly aware that problems could arise. The company does its manufacturing in Australia, UK, Denmark, UK and Canada. I’m still holding the shares I bought, while monitoring developments over time.

Raiz Invest (ASX: RZI)

I own a tiny holding in Raiz because I think it is a useful app to get people saving habitually. For this reason, I think that it is a reasonable business. Basically, it isn’t the best saving and investing option, but it is an easy way to get started, and sometimes that’s a really valuable help.

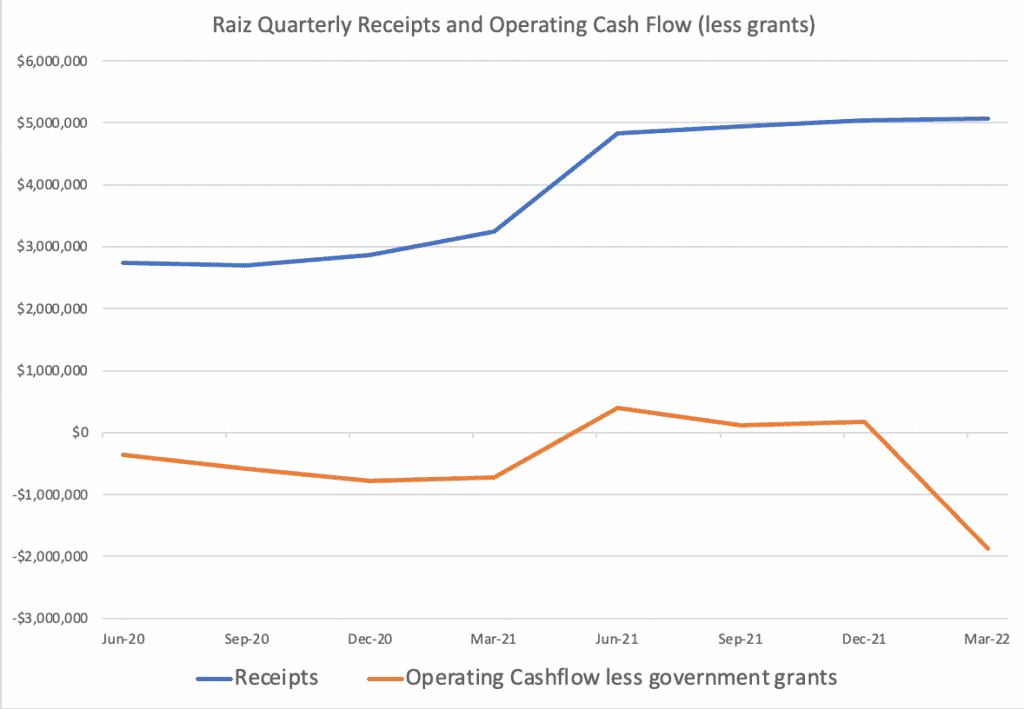

However, I have reduced my holdings recently to a bear minimum, partly because Raiz suffers from being linked to overall market sentiment (it will be harder to grow in a bear market), but also because its most recent quarterly report put it firmly in the “cash burning” category. You can see how it has failed to maintain positive operating cashflow excluding grants (and, as it happens, it is also burning cash even after including grants.

It’s not really possible to argue the company is a breakeven company, any more. It’s a truly bizarre decision by management to give up that status, and pretty unfortunate for shareholders. However, in the longer term, I would argue they will go cashflow positive again.

On the upside, the actual number of active customers globally continues to increase:

Raiz has over $18 million in cash so it can afford to burn cash as long as it is growing active customers. However, that doesn’t mean it’s smart to burn cash when you could be operating at breakeven. Overall, I’m pretty sad that the company can’t even maintain operating cash flow breakeven, as usually better quality businesses can do this, so until its results improve, I will probably just maintain a minimal holding at most.

MSL Solutions (ASX: MSL)

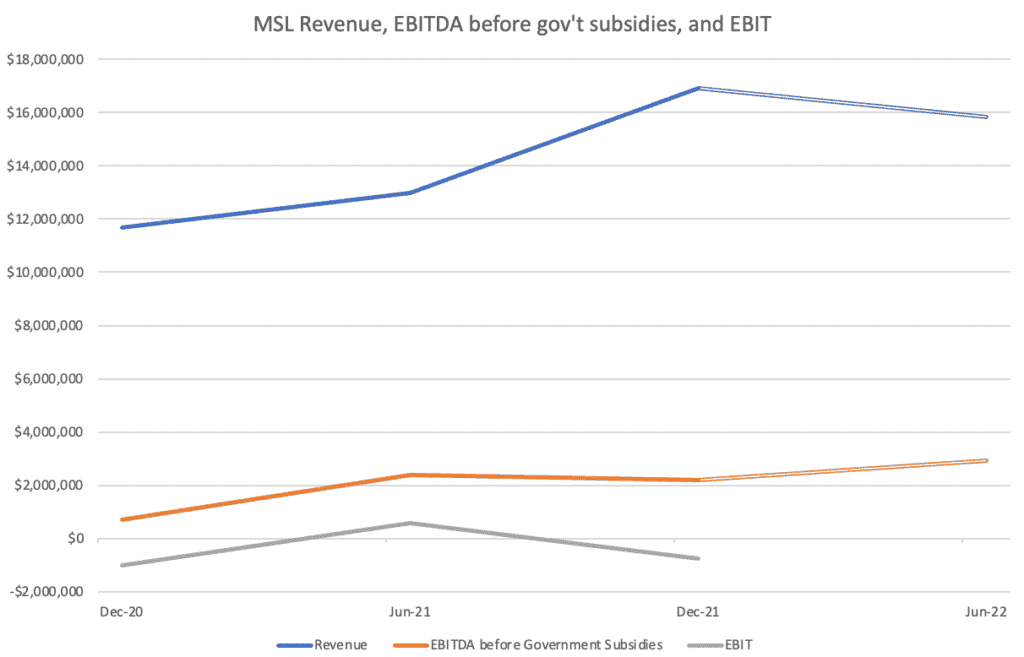

MSL Solutions is a mixed business which operates golfing software, and also provides point of sale software to a range of businesses, including sports stadiums. After the half year results were released in February, I decided to sell my MSL Solutions shares because the company is not really growing recurring revenue much organically.

Today, MSL Solutions updated the market on its progress, noting that it now expects revenue of $32m to $33.5m for the full year, and EBITDA (excluding government subsidies) of between $5m and $5.2m.

In the first half, the company made about $16.9m in revenue so based on the midpoint of guidance, revenue would actually be down, half on half, but EBITDA would be up. While revenue will be higher than the prior corresponding period, that’s at least partly due to the acquisition of OrderMate in October 2021.

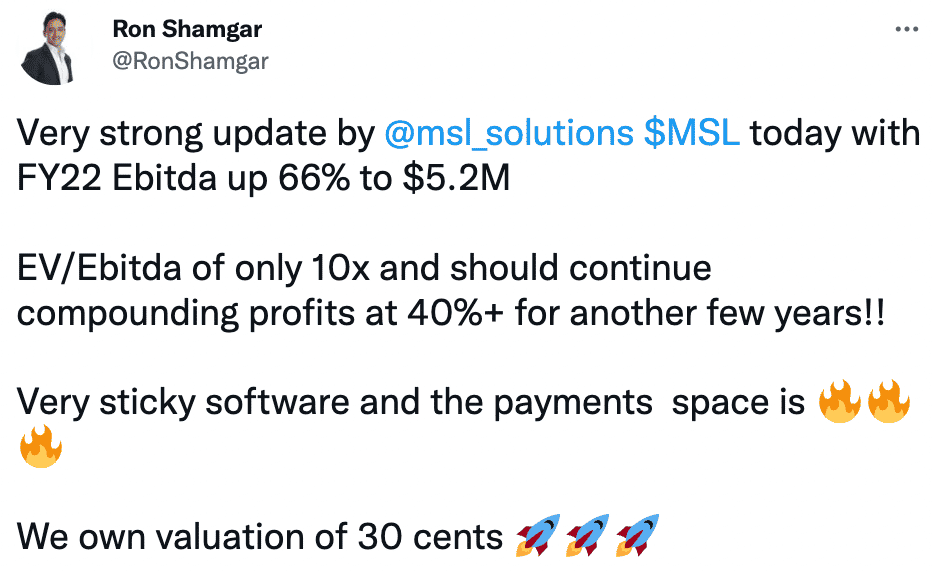

The shares were up 10% today. I wasn’t sure why that would be, but then someone pointed out to me that there was at least one excited fund managed promoting the update on twitter, as you can see in the screen shot below.

The tweet above is slightly misleading given it says FY 22 EBITDA is up 66% to $5.2m, when actually the company said it would be $5.0m to $5.2m. Can you imagine the response if it was a short seller getting this kind of thing wrong? Pretty weird how short sellers are held to much higher standards of accuracy than funds that are long the stock. But I diverge.

The more ridiculous part of the tweet is to claim that MSL Solutions “should continue compounding profits at 40%+ for another few years”. First of all the company has virtually no real profits and had a loss before tax of $857,000 in the first half. Second, even if you used EBITDA as a proxy for profit, it seems highly unlikely MSL Solutions can compound EBITDA at 40%+ for the next few years, since it can’t even grow revenue, and based on guidance the second half EBITDA in FY 2022 will only be about 20% higher than the second half in FY 2021.

The fact that Ron Shamgar, who proudly called Covid-19 “Chinese Pneumonia”, is promoting the stock to retail shareholders, with rocket-ship emojis and bullish (albeit vague) profit growth forecasts, only increases my skepticism of the investment thesis.

The good news for MSL Shareholders is that based on the forecast of $8.5m – $9m cash on the balance sheet, it seems that the business won’t need to raise capital any time soon, so it remains an interesting one to watch. Personally, I won’t get very excited about it until organic growth improves at both the top line, and the bottom line.

I thought this update would disappoint shareholders, but perhaps they haven’t realised that revenue will actually be down, half on half.

The author owns shares in Raiz and Codan. This article should not form the basis of an investment decision. It is an investment diary valuable only for the cognitive process it demonstrates. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer.