On Thursday last week, radio communications and metal detector company Codan (ASX: CDA) announced its annual results. The FY 2022 Codan results showed revenue up 16% to $506.1 million and statutory net profit after tax up about 11% to $100.5 million. The company chose to promote its more modest underlying profit growth of just 3%, which isn’t such a strong result, but is more useful because last year was impacted by one-off acquisition costs (for which the benefit was felt this year). It’s good that the company highlighted this less impressive but more accurate figure.

I have covered Codan quite a lot lately so I won’t rehash the business and my investment thesis right now.

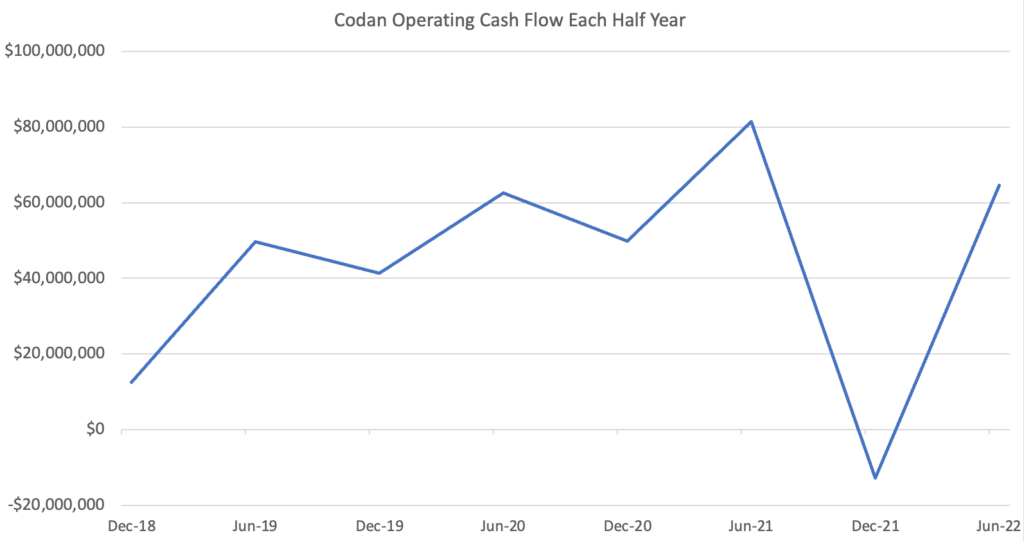

In the FY 2022 Codan results, free cash flow was much lower than profit, at just $32 million. The biggest influence on this was the weak operating cash flow, resulting from a decision to significantly increase inventories. Inventories were up from about $62.7 million to $102.5 million over the year. As you can see below, operating cashflow was smashed in the first half, but rebounded in the second half as the inventory build came to an end.

Is the Enlarged Codan Inventory A Problem?

On the conference call, Codan CEO Al Ianniello said “I would say our inventory has peaked… We’re actually brining inventory back to pre covid levels… We should expect inventory gains from a cash perspective…” That implies that inventory levels should stay flat or even decline from here, and suggests stronger free cash flow in future periods.

The Codan share price is down about 12.5% following these Codan results potentially because there is some skepticism about whether that free cash flow will be forthcoming. After all, one of the disadvantages of a capital intensive business like Codan is that inflationary environments lead to an increase in working capital. Arguably, that’s what we’ve seen in FY 2022.

Personally, I think that even though having to increase inventory is not ideal, it’s reasonable to assume it was intended as a one-off increase, in response to the well publicised increase in shipping times. Codan is not the only company to have increased inventory during the year, and arguably, it is a rational thing to do if you think inflationary pressures will increase your component costs. Put simply the capital may be better stored in the right kind of inventory, than in cash. I also take heart from the improved cash flow in the second half. It may well be that H1 FY 2023 is stronger still.

Codan’s balance sheet could be stronger. At the end of June 2022 it had $22 million in cash and $52 million in borrowings. While this is not a lot of debt compared to historical profit rates, it could pose a threat if profit were to drop severely.

Codan’s Segment Analysis: Metal Detection (Minelab) Down and Communications (Zetron et al.) Flat

Codan’s business is prone to ups and downs due to the lumpy nature of both telecommunications and metal detection equipment sales, and the various factors that can influence demand, discussed in this interview with the CEO.

In terms of the operating profit segment result, $121.3m was attributed to metal detection and about $50m to communications. The H2 communications operating profit result was roughly equal to in the first half, while the H2 metal detection operating profit was down around 5%, half on half.

Codan’s guidance says that that “business conditions Minelab experienced in the second half of FY22 are expected to continue into the first half of FY23” and warns H1 revenue from gold detector sales is expected to be below H1 FY 2022.

Meanwhile demand for secure communications like those sold by Codan is rising, due to Russia’s war against Ukraine and other democracies. Importantly, Codan’s recent acquisitions are going well with order books for both DTC Communications and Zetron running more than 20% higher than the same time last year.

How Much Are Codan Shares Worth?

To be conservative we could allow for revenue from the Minelab metal detection business to decline 20% in FY 2023, even though I don’t think that will happen. Meanwhile, the lower margin communications division is forecasting stronger demand from military. So let’s remain conservative and imagine it stays flat. That would give us FY 2023 revenue of about $450m down about 11% on $506m.

Now, in these Codan results, the underlying profit margin was about 20%, down on 22% last year. In part this was driven by an increasing share of revenue from the lower margin Communications businesses. However, FY 2021 was also a bumper for the metal detection division. In years gone by Codan has had an NPAT margin of around 20%.

However, to be conservative we could model a NPAT margin of 18% on revenue of $450m, which would give us net profit of $81 million. At the current share price of $7.67, Codan has a market cap of just under $1.4 billion, putting it on a price to earnings ratio of about 17.

Arguably, that’s a bit too high for a somewhat capital intensive and cyclical business, even if it does have differentiated IP. That said, it’s not wildly high and it is quite possible that the conservative estimates above prove to be on the low side. Therefore, I think Codan is pretty reasonably priced at the moment, and, while I could easily change my mind, I currently plan to hold the shares I purchased under $7 until at least April next year.

One potential source of upside is if we have only just begun to see the uplift in military spending. The recent inventory build should put Codan in a good position to serve clients if demand does increase. On the flipside, one risk is that a recessionary environment could see metal detector sales to recreational markets take a big hit. The communications division would probably be more resilient because it supports government organisations such as US Fire Departments.

Finally, Codan declared 15 cent dividend bringing the full year dividend a 28 cents per share, being a yield of 3.6% at current prices, so shareholders are paid modestly to wait for capital appreciation.

Did you find this article useful? Sign up to receive access to hidden, Free content like this!

Disclosure: the author of this article both own shares in Codan (ASX: CDA) and will not trade CDA shares for 2 days following this article. This article is not intended to form the basis of an investment decision. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. Equity Story Pty Ltd and BlueTree Equity Pty Ltd t/a A Rich Life do not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.