Cogstate (ASX:CGS) is an Australian software company that earns money by licensing its memory testing software to companies who want to research or treat cognitive diseases such as Alzheimer’s. Unlike many software companies, its revenue is not indefinitely recurring. For example, a clinical trial may be as short as 9 months, as long as 5 years, and could be unexpectedly extended, or cancelled.

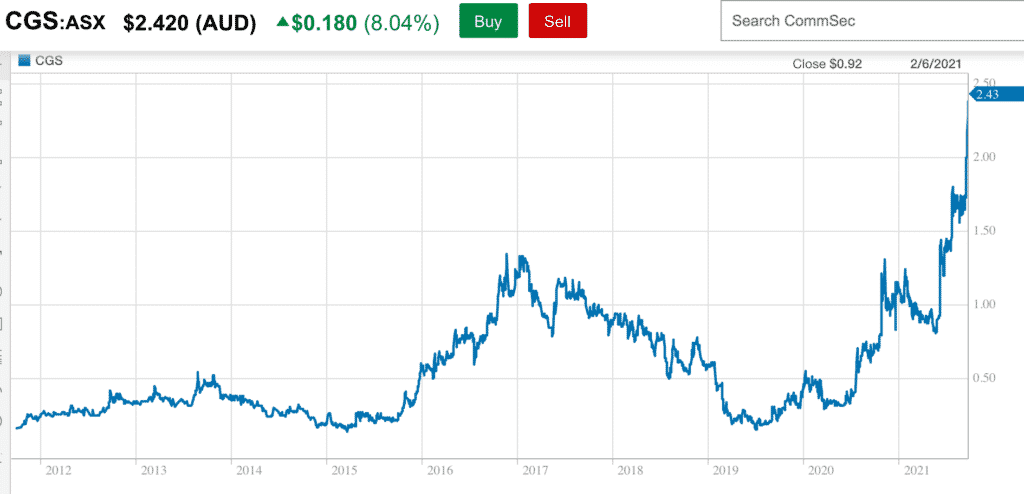

As a result of this, long term Cogstate shareholders have been on a wild ride. In 2015 Cogstate shares sat at 20 cents, but a period of strong sales saw it burst into profitability in 2016, and at one stage the share price was trading at around $1.20. Unfortunately, the profit proved ephemeral and the company made a loss in next year. FY 2019 saw revenue drop some 28%, and a hefty loss. In October 2019, the company raised capital, virtually at its share price low, from major customer Eisai and fund manager Australian Ethical at around 20 cents per share.

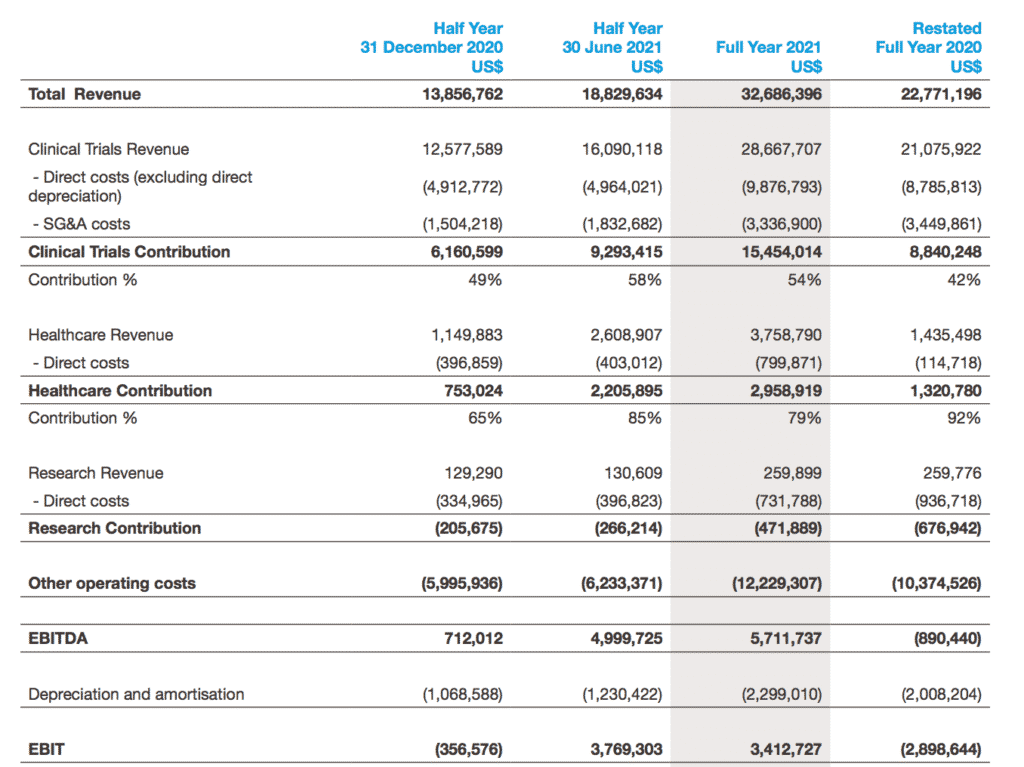

More recently, the second half results suggested that the company has had a change of fortunes. While it made an earnings before tax and interest loss in the first half, increased revenue, both from Eisai and from clinical trial customers, saw the second EBIT rocket to USD$3.77 million. And as you can see below, the share price has risen to new highs.

Recurring Revenue For Cogstate

The biggest bit of news that has the market taking note of Cogstate is that Eisai had its Alzheimer drug, Aduhelm, approved in the USA. Cogstate software is used as a diagnosing tool for Alzheimer’s and the earlier people are diagnosed, the more money Eisai can make selling them their drug. As a result the company signed a 10 year licensing agreement which Cogstate reports under their “Healthcare” Segment. The company will record the revenue on a straight-line basis, though the actual cashflows will be staggered (with a large upfront payment boosting cash in the short term).

The company says:

Under the 10-year global (ex-Japan) agreement between Eisai and Cogstate executed on 26 October 2020:

- In addition to the upfront payments from Eisai of US$15 million, Cogstate is also due to receive an ongoing royalty on revenue

derived by Eisai from the sale of Cogstate technology. Over the course of the 10-year global agreement, the contractual terms

prescribe that the royalty payments shall not be less than an additional $30 million ($10 million over years 1-5 and $20 million

over years 6-10). - The full $45m (upfront payment of $15m plus the minimum royalties of $30m due over the course of the global license agreement)

is being amortised on a straight-line basis over 11 years (10-year term + 12 months to commence). Actual cash royalties paid in

each period will be the higher of (i) royalty amount calculated based on sales of product or (ii) minimum annual royalty.

To get a better idea of this key partnership, check the video below which was shared with me by my friend Huiyi Wang, who showed it to me and drew my attention to Cogstate.

As you can see in the image below, the company already made about $1.15 million in half yearly revenue before the inclusion of the global license deal with Eisai. The global licence should add a minimum of $4.5 million per year to that segment, and given that it is rather sticky revenue, with upside, this part of the business suddenly looks quite attractive. Arguably, I’d happily pay around $50 million for that part of it.

However, the more significant segment, and the one driving the profits, is the clinical trials revenue that can be a bit up and down. Now, Matt Joass of Maven Funds suggested in a recent Strawman Premium presentation that the approval of the Eisai Alzheimer’s drug may drive more clinical revenue growth in the next few years, as other (potentially more effective) treatments try to also get approval.

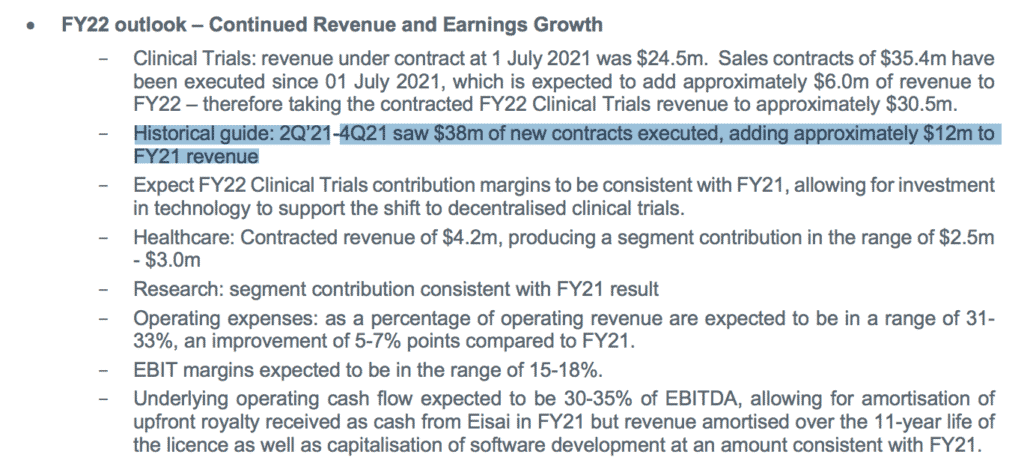

This makes sense, and if true then we could see Cogstate sustain elevated profits for a number of years. And it certainly seems like FY 2022 will be a strong one. The company itself actually says that the Clinical Trials revenue should be at least $30.5 million, with the potential to be significantly higher. You can see how the company invites speculation that revenue could be around 25% higher than the $30.5 million that is almost certain.

Using this guidance, we could expect maybe $40 million of clinical trials revenue, alongside revenue of around $4.2 million for Healthcare. This would give us revenue of about USD$44.2 million. With an EBIT margin of 18%, that would be EBIT of around $8 million. Assuming a normal tax rate of 30%, net profit would be $5.6 million, putting the company on a Price-to-earnings ratio of 54 at the current price of about $2.44 [edit for typo].

In that scenario, the EBIT growth rate would be 47%, which may indeed support that PE ratio, but probably only if the company could report growth in contracted revenue.

A Gold Rush

The information brought to my attention by Huiyi and Matt was inspirational in my view that the approval of Aduhelm may indeed create extra demand for Cogstate testing. Basically, as I understand it, the approval of one drug, especially one that supposedly may not be very effective, would stimulate an increase in new clinical trials.

Now, the company’s sales announcements suggest that they are experiencing an uptick in demand, and that uptick has only just started. You can see what I mean from this excerpt from the company’s announcement on August 24, 2021.

To my mind, the clinical trials division is essentially selling spades in a gold rush. As we saw with Appen (which sold data labelling into an artificial intelligence boom), I would expect a period of increasing sales, followed by a short plateau then a decline. The decline is most likely to arise from competition, and I don’t know how long the rise will last. However, I do think the company’s long history in the marketplace and existing relationships with both Eli Lilly and Eisai will prove to be a competitive advantage of sorts. They should be able to charge some premium based on the proven and widely accepted nature of their offering.

Are Cogstate Shares Attractive?

To my mind, Cogstate is pricing in really high growth. I could imagine a scenario where revenue increases dramatically in the next couple of years. If we see USD$45m in FY2022, we might see $55m or more in FY2023 [edit for typo]. At that point the stock would probably look quite attractive. Allowing for operating leverage (higher EBIT margins), we might see EBIT of around USD$15m and USD$10.5m in NPAT, assuming a normal tax rate. It seems likely that the company could grow into its valuation. That would put the company on a bit over 27x earnings, based on it’s AUD market cap of $379 million.

However, I am personally not entirely comfortable with this kind of logic. To my mind, Cogstate only deserves a multiple of maybe 25 times “boom time” earnings, because I’m naturally concerned that the growth will fade, and fade fast. If operating leverage kicks in hard, then the company could do a lot better than I’ve described, but there is always the risk in a non-recurring business that earnings go backwards. That makes high multiples dangerous.

As a result of this view, I’m more interested in Cogstate from a sociological perspective. Despite a phenomenal share price run, very few funds are talking about it, with Maven being the only one I have noticed. Therefore, that leads me to the view that the stock is not particularly widely owned amongst small cap funds, outside of Maven and Australian Ethical.

One thing I will look for is to see more funds talking about Cogstate, since that may indicate that a greater number of potential investors have got the shareholding they desire. Whispir remains a good example of why it’s better to invest when small cap funds feel they are missing out, than when they have the stock they want. After Whispir raised capital, there were funds talking about their investment, but less actually buying. And so the stock has fallen. This is also why I viscerally dislike it when companies allocate stock directly to funds and not to retail shareholders in capital raisings. But I diverge.

The point is that this will almost certainly show very strong profit growth, and the story is only just spreading. To my mind, that sociological momentum could take the price higher than it deserves to be. Offsetting that, I do note a director sold some shares at $1.77 recently, so maybe we are closer to the peak of the gold rush than I suppose.

I don’t find shares particularly attractive at the current price, long term, but I still think they may go up higher. You see, I could imagine that FY 2022 and FY 2023 are very strong years, and it wouldn’t be surprising to me if we saw a similar share price pattern as we have seen in the past. Oftentimes, with 2 or 3 years of strong growth, the market will simply extrapolate the trajectory. If the business is more cyclical in nature, then that could lead to over-optimism.

Personally, my skepticism about the long term is offset by my optimism about the short term. It is possible that more information will allay my concerns about the long term sustainability of growth and I am keen to follow the company’s development.

If nothing else, Cogstate certainly looks to have crossed a profitability (and business) inflection point, and that makes it an interesting stock to hold. I haven’t decided how long I want to invest in the business, but I am following its development with interest.

Please remember that these are personal reflections about stocks by author. I own shares in Cogstate, purchased below $1.80. Edit: I also sold some shares above $2.20. This article should not form the basis of an investment decision. It is an investment diary valuable only for the cognitive process it demonstrates. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer.