Pro Medicus (ASX: PME) Share Price Down On Fantastic H1 FY 2025 Results

The Pro Medicus (ASX: PME) share price was down slightly in response to the very strong Pro Medicus H1 FY 2025 results.

Pro Medicus (ASX: PME) is a radiology software company founded in Melbourne in 1983 by friends and fellow wine connoisseurs Sam Hupert and Anthony Hall.

Pro Medicus (ASX: PME) was listed in 2000 during the tech bubble at a Pro Medicus IPO price of $1.15. The Pro Medicus share price was languishing until it acquired Visage Imaging from Mercury Computer Systems in 2009, selling just part of the acquired technology for a profit, not long after.

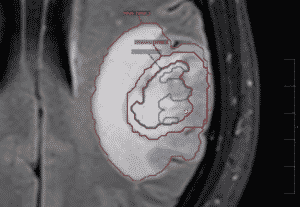

Visage Imaging has benefitted from ownership by Pro Medicus. Long serving General Manager of Visage Imaging, Malte Westerhoff lead the team of developers in Berlin, to develop Visage 7 viewer, which counts won the business of top notch US teaching hospitals like Mayo Clinic.

The Pro Medicus (ASX: PME) share price was down slightly in response to the very strong Pro Medicus H1 FY 2025 results.

The 2024 Pro Medicus AGM showcased its phenomenal employee retention rates and reflected back on the company’s beginnings.

The Pro Medicus share price is up more than 50% in just a few months. I take a look at the PME stock valuation ahead of the AGM tomorrow.

The Pro Medicus (ASX: PME) share price gained more than 8% after it reported another set of strong results, beating analyst estimates.

Albeit hardly thesis changing, there is some new information to consider regarding each of these stocks.

The Pro Medicus (ASX: PME) share price dropped 13% after it reported another set of strong results, albeit with slower half-on-half growth.

The FY 2023 Pro Medicus (ASX: PME) AGM further demonstrated the high quality of the business and the good nature of the leadership group.

Here are some of the small-cap Annual General Meetings coming up this month.

Why did the Pro Medicus share price spike to a record of $78.85 this morning and what is the relevant news for Pro Medicus (ASX: PME)?

The FY 2023 Pro Medicus Results showed record profits and a strengthening competitive advantage, with new products soon to be commercialised.

Claude, Matt and Andrew interview Pro Medicus CEO Sam Hupert.

The H1 FY 2023 Pro Medicus (ASX: PME) Results showed record half year revenue and profit. While the outlook is rosy, cash flow was less ideal.

The 2022 Pro Medicus AGM highlighted the strong competitive advantage of its key product, Visage.

When fear reigns it is hard to force yourself to buy growth stocks, but these are the half dozen I have most faith in (at the right price).

Pro Medicus results show record revenue and profit in FY 2022. Is the Pro Medicus (ASX: PME) competitive advantage improving?

I use watchlists with target desired buy prices to help me take advantage of market volatility in a calm and measured way.

A detailed look at the Pro Medicus major customer list, and why it needs both integrated delivery networks, and academic teaching hospitals.

My analysis of the Pro Medicus half year results suggest that the business is improving in quality as it grows.

Even though growth stocks are down considerably, in my view the top quality growth stocks are still up pretty overvalued.

Pro Medicus (ASX:PME) revealed significant progress with its AI Accelerator at the PME 2021 AGM and a strong contract pipeline.