This morning, radiology imaging software company Pro Medicus (ASX: PME) reported the H1 FY 2023 Pro Medicus results. Statutory revenue was up 28.3% to $56.9 million and statutory profit was up 31.5% to $27.19 million. Pro Medicus half year earnings per share was 26.05 cents, easily covering the fully franked interim dividend of 13 cents.

To its credit, Pro Medicus was quick to point out that this profit result benefited from currency movements. It highlighted that on constant currency basis revenue growth would have been 19.4% on the prior corresponding period. Furthermore, adjusting for currency, hedging and the decreased capitalisation of developer salaries, “underlying profit before tax would have been $35.19m (up 23.0%) for the half year ended 31 December 2022.” These figures give us a good view of an “all else being equal” growth rate.

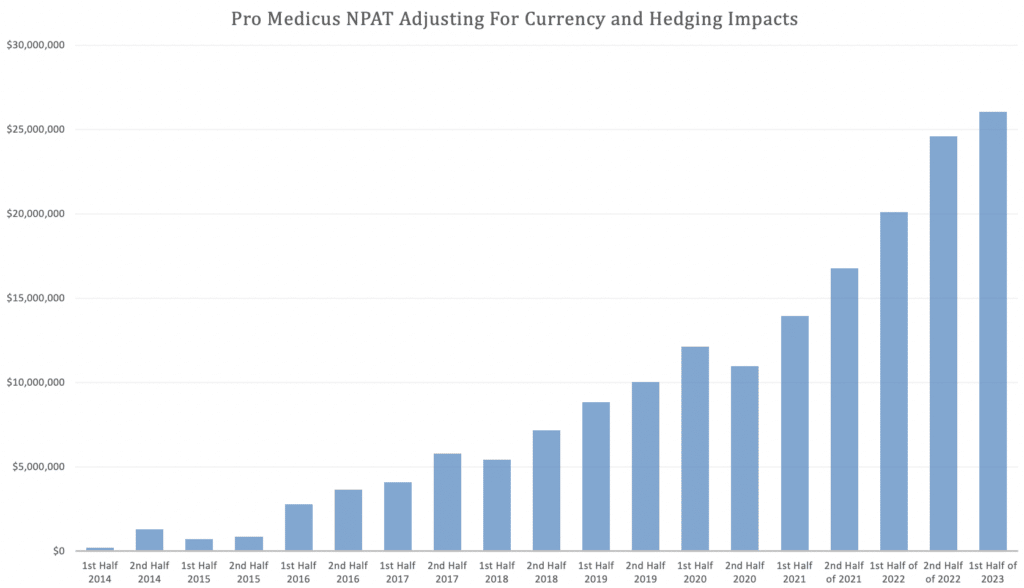

That said, the decrease in capitalised expenses will carry into future periods, so I prefer look at the net profit adjusted for currency movements, especially since I’ve been tracking the same metric since I first bought Pro Medicus stock many years ago. You can see from the chart below that adjusted net profit reached a new half year record, but that half-on-half growth did moderate from record levels, last half. One thing to keep in mind when looking at the chart below is that the first half of each financial year contains the cost of the large RSNA conference (so all else being equal there is usually better growth from H1 to H2 of a financial year than from H2 to H1 in the next financial year).

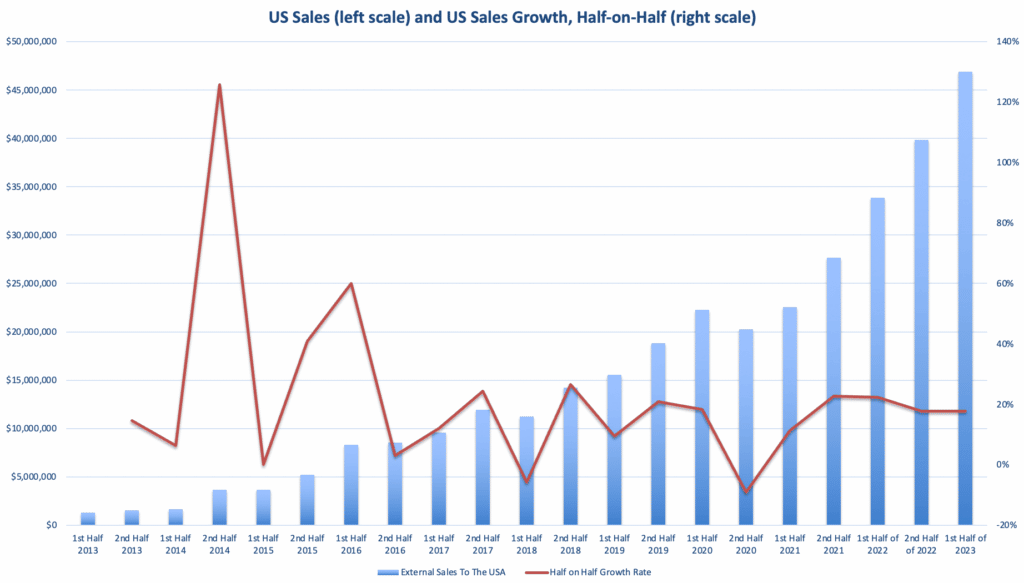

One way to see the underlying competitive strength of the Pro Medicus business is to look at its North American revenue growth. The reason for this is that the company sells its lower growth RIS product in Australia, but is marketing its Visage 7 viewer, Vendor Neutral Archive (VNA) and Visage Worklist products in North America.

Because Pro Medicus has somewhat saturated the market with its RIS product in Australia, and the public health system is not such a good fit for the high priced Visage product, looking at the North American business gives us a pulse check on the growth engine of the business.

The good news is that the half-on-half revenue growth in North America was 17%, in line with the normal range over the last few years (excluding the half that was most negatively impacted by covid lockdowns). This part of the business is also significantly transaction based, so Pro Medicus grows with its clients, as they themselves grow. In any event, it looks like the North American revenue is growing in line with historical rates, and that is a positive.

Pro Medicus Cash Flow

One slight negative from this result was that operating cashflow dropped from about $27m in the prior corresponding period to about $20.1 million. This was partly due to an increase in receivables due to an “increased volume of new customer installations finalised towards the end of the period.” On top of that the reduction in capitalised R&D expenditure that “negatively impacted underlying profit before tax by $1.25m”, shifted some expense from investing cashflow, to operating cashflow.

Either way, this was a weaker half in terms of free cash flow, which declined from about $22.3 million in H1 FY 2023 to about $16.4 million in the H1 FY 2023 Pro Medicus Results. The H1 FY 2023 Pro Medicus results boast cash reserves and other financial assets $94.53m, and zero debt.

Pro Medicus Forward Growth Indicators

The recent deals announced with UW Medicine and Samaritan Health Services will help growth in the coming periods. In the short term, the second half of FY 2023 will benefit from a full period’s contribution from the recently implemented contracts, especially Luminis Heath, which only started in December.

The CEO said that, “Our pipeline remains strong, and we have experienced an increase in the number of

inbound RFPs in the last 18 months. Importantly, we have a very healthy spread of

opportunities across tier-one academic institutions, large and medium-sized IDN’s, as well as

some interest from the private sector.”

Key Takeaways From Pro Medicus H1 FY 2023 Results Webinar

One important aspect of the Pro Medicus H1 FY 2023 Results Webinar is that the company still expects to receive its first revenues from either the other departments (such as cardiology) or from AI products, in calendar 2023. That’s good news, but Pro Medicus CEO Sam Hupert noted that these revenues may not be material when they are first booked.

Importantly, the CEO also commented that “Our RSNA 2022 was our most successful to date,” and has already generated more requests for proposal quicker than any previous RSNA conference.

Pro Medicus Competitive Positioning

It was good to hear one analyst challenge the CEO regarding the functionality of competitors products catching up with Pro Medicus. However, that was not the impression of the CEO who said that while previously he thought Pro Medicus was 18 – 24 months ahead of competitors “we thought 18 – 24 months… “we think that gap has actually widened.”

I asked Dr Hupert if the company had lost any tenders out of its pipeline since the last report. The good news is that there were no new losses from the pipeline. I note that past losses have been few and far between; and most of those lost on price, because Pro Medicus is more expensive than its competitors. For me the number of tenders lost from the pipeline is a much better measure of Visage 7’s competitive positioning than the claims of competitors. I covered those lost opportunities in our Pro Medicus 2022 AGM coverage.

Another measure of competitive positioning is the ability to raise prices. The good news is Pro Medicus reported it was able to increase its per transaction fee when renewing its contract with University of Florida, during the period. Further evidence of pricing power is found in the fact that Pro Medicus improved its earnings before interest and tax (EBIT) margins from about 65.9% in the prior corresponding period to 66.3% in the Pro Medicus H1 FY 2023 results.

Just as important, it is well known within the healthcare IT industry that mishaps happen during implementations, so the fact that Pro Medicus can report that “all implementations on or ahead of schedule,” bodes well for their business reputation.

Finally, the Pro Medicus CFO Clayton Hatch said words to the effect that “costs should be relatively flat or even go down slightly from [lack of] marketing spend from RSNA,” suggesting operating leverage should be evident in the H2 FY 2023 profit result.

All of these factors point to very strong positioning for the Visage 7 Viewer, which health IT research and ranking company KLAS now rates as the world’s best Universal Viewer.

Conclusion On The H1 FY 2023 Pro Medicus Results

I have owned Pro Medicus since 2014 and continue to be a happy shareholder, despite having (regrettably) sold much of my original holding. I think that it is reasonable to expect a slightly improved half on half growth rate in H2 FY 2023, after all, the CEO described H1 FY 2023 as “the base for a stronger second half.” The second half will also benefit from three large implementations in this half, and the lack of the RSNA expense.

If we assume that the second half earnings per share increases a whopping 20% on the first half (with accelerated half on half growth), then Pro Medicus would generate earnings per share of just over 57 cents per share. At the current share price of $65.47, that would put the Pro Medicus P/E ratio at about 115, even after a strong second half of FY 2023.

This simple back of the napkin calculation tells us that at a market capitalisation of almost $6.8 billion, Pro Medicus shares already reflect several years of growth. That growth may well occur (and I think it will) but to get upside from here, the company will probably need to also find success in commercialising new products such as a cardiology viewer, new modules on the Visage Worklist, and most importantly AI algorithms to assist radiologists.

You can see all our past Pro Medicus coverage here.

Enter your email address below to receive early access to our articles, as well as occasional free access to paywalled content.

Pro Medicus might be a high quality stock, but the market knows it now. Ahead of their upcoming results, A Rich Life Supporters may wish to re-familiarise themselves with these 5 growth stocks that showed good momentum in their November AGM updates.

Sign Up To Our Free Newsletter

Disclosure: the author owns shares in PME and will not trade PME shares for 2 days following this article. This article is not intended to form the basis of an investment decision. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. Equity Story Pty Ltd and BlueTree Equity Pty Ltd t/a A Rich Life do not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.