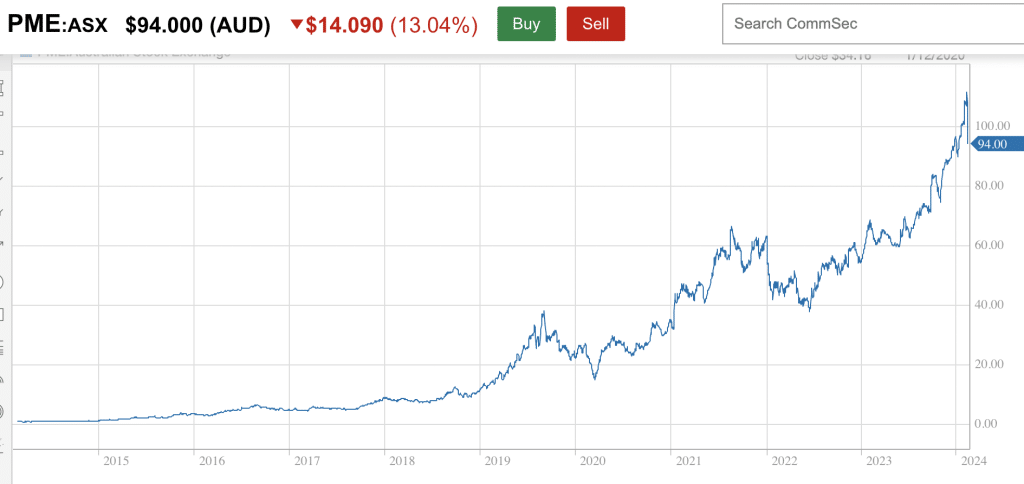

This morning, radiology software company Pro Medicus (ASX: PME) reported its results for the first half of 2024, and in response, the share price has fallen around 11% from $108 to $95.70 at the time of writing. This market interaction with the results in some ways mirrors the positive response to the Pro Medicus FY 2023 results, after which the share price gained about 12%, from $71 to $80. While those moves might be different, what remains consistent is that the business itself produced record revenue and record profit. To wit, in H1 FY 2024 Revenue was up 30.3% to $74.1 million and net profit after tax was up 33% to $36.25m.

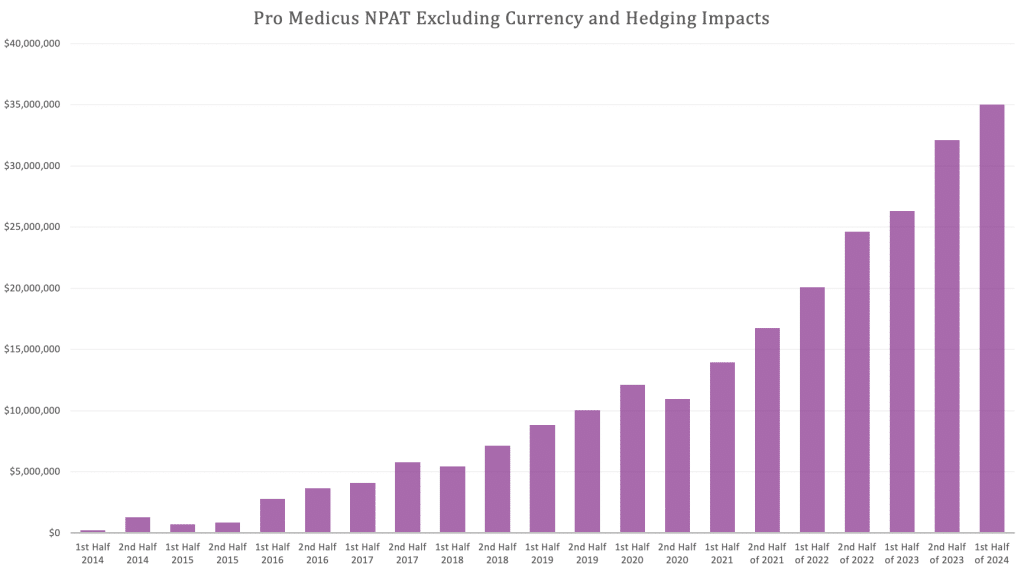

While not necessarily a better guide, I have always tracked net profit less the impact of currency gains and hedges. On this adjusted measure, too, Pro Medicus achieved a record result in H1 FY 2024. However, as you can see from the chart below, the increase on H2 FY 2023 was noticeably less than the increase of H2 FY 2023, on H1 FY 2024.

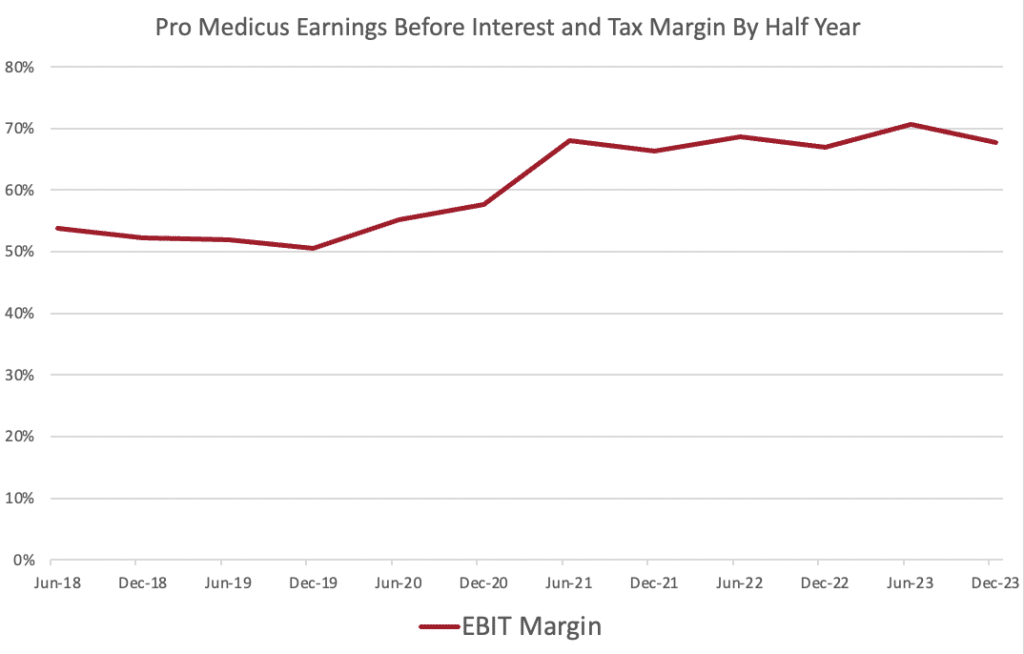

Part of the reason for the slower absolute growth was that the H1 FY 2024 EBIT margin came in at 67.7%, which is down on the unusually strong H2 FY 2023 margin of 70.6% (but still up on the prior corresponding period margin of 67%). All else being equal, the expenses associated with the large RSNA conference occurring in the first half of the financial year will ensure that the first half EBIT is usually lower than the second half EBIT. The company does have pricing power with Pro Medicus CFO Clayton Hatch commenting on the conference call that “We do feel that our pricing is beating inflation on a yearly basis.” As you can see in the chart below EBIT margins have generally improved over the last few years. While pricing power could always lead to improvements, I wouldn’t assume Pro Medicus can sustainably grow margins at the rate it has done previously.

On a sociological level, I believe the share price drop today is more a reflection of a lot of hot money being in the Pro Medicus stock prior to these results, than anything else. There is currently a great deal of hype around AI, and given that Pro Medicus does actually have a credible pathway to profiting from the rise of artificial intelligence, I would assume that most of the increase in the share price over the last few months has been driven by hot money chasing the AI theme, not long term investors with an understanding of the business.

The slight drop in EBIT margins could also disappoint some broker analysts, and as a result, we may well see broker analysts downgrading their price targets for this stock. I bought shares in Pro Medicus long before it was covered by any broker analyst and do not personally pay attention to the price targets they release. However, I do take an interest in the actual net profit they predict and on that score the Pro Medicus NPAT result was less than 1% below consensuns analyst estimates per S&P Capital IQ.

Once you combine the slowing of EBIT margin growth with broken short term share price momentum, I think we are less likely to see bullish coverage from brokers in the next six months, compared to the last six months.

Whatever other analysts expected, the lower EBIT margin was completely in line with my published expectations when I covered the last set of Pro Medicus results. I said:

“Pro Medicus continued its run of increasing its EBIT margins. In H1 FY 2023, it achieved an impressive 67% EBIT margin, but the H2 FY 2023 result was a new record, with an EBIT margin of 70.6%, despite increasing employee expenses faster than previously. However, once again this figure benefitted from currency and hedging gains, with the full year underlying EBIT margin of 67.2% being a better guide to margins in FY 2024 and beyond.“

In the event, the actual margin for H1 FY 2024 was actually ahead of my “back of the napkin” guide of 67.2%.

Pro Medicus Results Show Slightly Slower Growth In North America

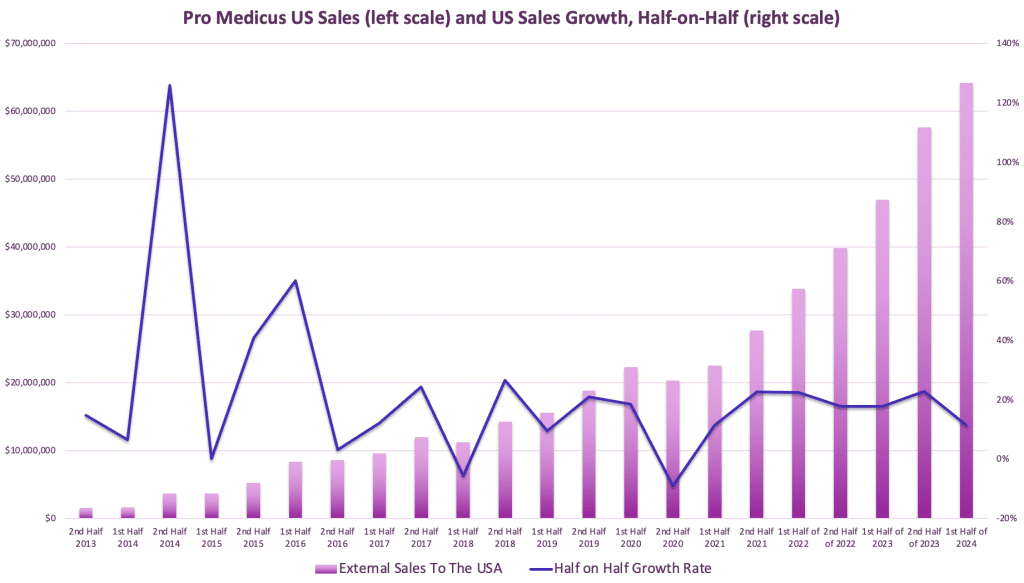

As long term readers will be aware, the core growth engine of the Pro Medicus business is North America. In H1 FY 2024, Australian revenue was basically flat and European revenue down slightly. European revenue has a minimal impact on the result and tends to be more on a licence + maintenance model than a transactional model, so it does not grow consistently. As you can see below, North American revenue hit another record, but the half-on-half growth rate was notably slower than the last couple of years. I would say this is the main negative of this report.

Of course, as you can see from the chart above, half on half revenue has actually fallen 3 times since I have been tracking the stock. This half on half growth rate does tend to bounce around a bit, but since FY 2022 the range has been 11% to 22%, with the H1 FY 2024 result at the bottom of that range. Therefore, an increase in this metric is a key result that I would be keen to see in the next half.

Pro Medicus Free Cash Flow And Balance Sheet

In H1 FY 2024, Pro Medicus produced free cash flow of $25.2m (defined as operating cashflow less capex, capitalised development costs, and lease repayments). This was a 70% conversion rate of NPAT to free cash flow. This result is considerably down on the FY 2023 result of 92%, largely because operating cashflow was not so strong. However, at the time of the FY 2023 results I said:

“This is an incredibly good conversion of net profit to free cash flow, but would have benefitted from some degree of luck. Sometimes, Pro Medicus has had much lower conversion of NPAT to free cash flow, so it’s worth remembering that it does fluctuate a bit due to timing of payments and receipts.“

Therefore, while the cash conversion result in H1 FY 2024 was worse, this was in line with my expectations. The balance sheet remains very healthy with cash and conservative investments worth $131.5m. In addition to this, the company said it had deployed US$5m (around $7.7m) into Elucid, for 3.2% of the company. There is no doubt in my mind that PME did this to encourage Elucid to develop applications that can then be distributed through Visage. I think this is a very good idea, but I am just writing off the $7.7m in my mind now. In my mind it is an expense. In many ways this is very interesting because it will put the expense of developing the AI business on the balance sheet. If you wanted to be harsh you’d run it as an expense like me.

In terms of the harshness of my mental model you must understand this is a psychological defence I am using to ensure that I keep focussed on the business itself, not the noise around it.

Of course if they manage to pick winners with this strategy and make money out of the equity investments, then my mental model will prove too conservative.

Pro Medicus Growth Outlook

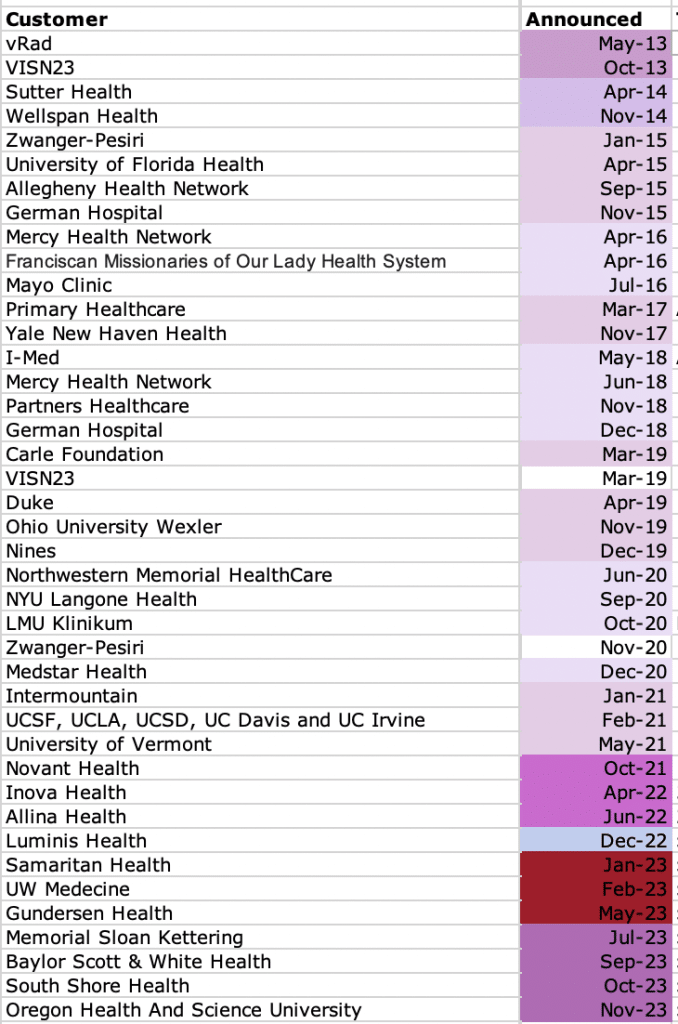

During the half year, Pro Medicus announced four new big contracts. This was a great result for the company since it included the unusually large contract with Baylor Scott & White Health. You can see below that in any given period (each with its own shade of colour), Pro Medicus generally announces between 2 – 4 new customers in any given half.

On the conference call, Pro Medicus CEO Sam Hupert mentioned the four big sales in the half, emphasising the revenue benefits of selling the full stack solution. For a long term shareholder this is incredibly ironic given the original thesis I believed for the stock was that its Visage viewer could make its way in due to deconstructed PACS allowing in a new entrant for just one slice of the technology stack. Now it is on the ascendant, Pro Medicus is becoming the vertically integrated gorilla it once disrupted, as the supplier of archiving, workflow and viewer capabilities, in all its recent contract wins. Let us hope they do not venture into hardware! (I think this unlikely).

The CEO also emphasised that the company is riding high on its extremely swift implementation capability. This is music to my ears because one of the best single factors that I believe gives an indication of the quality of an enterprise software offering is implementation time to total lifetime use of the software. If you have a talent for, or way of estimating this accurately, across multiple listed software companies, please tell me.

Pro Medicus P/E Ratio Update

At the time of the full year results, I wrote:

“With earnings per share of 58 cents, and a share price of $74, Pro Medicus trades on a P/E ratio of about 127.”

After these results, Pro Medicus has trailing twelve months earnings per share of 66.65c. So even after the Pro Medicus share price dropped 13% today, to $94, Pro Medicus trades on a trailing twelve month P/E ratio of 141. The multiple has actually gotten higher! Back when the P/E ratio was 127, I already said:

“I have held Pro Medicus shares continuously since the share price was 86 cents. Selling some Pro Medicus shares too early, based on what I thought was an overly optimistic PE ratio has been the single stupidest financial decision I have ever made. I no longer think it is clever to take profits on this stock, just because the PE ratio is high.”

Obviously, that does not mean I think the stock is a buy at current prices, but I have personally taken way too many profits out of this one already and have zero intention to sell based on the short term interactions between results and market expectations. Let us consider the journey.

The chart above more or less approximates my holding period for this stock. Obviously given it is my largest holding my portfolio was savaged today when the stock dropped 13%.

The highest price I have paid is $28.16 in June 2020. Over the last 3 years the lowest the TTM P/E ratio got was just above 100, back in June 2022. Crazy to say it but the stock on 110 P/E was a strong performer subsequently. The main reason for that is the large contract win plus hype around AI since Pro Medicus is one of the only if not the only ASX stocks that have a credible way of benefiting from the AI revolution.

Of course that is still uncertain.

In response to my question about what could block Pro Medicus from benefiting from future AI applications, the CEO explained that there were three irons in the fire to try to profit from AI. First of all the company is going to try to develop algorithms themselves, like the breast density algorithm. Second they will work with some of their academic partners on projects they haven’t yet discussed publicly. And third they will make investments in companies like Elucid, that could potentially find a route to market via the Visage platform.

Obviously the third prong is the most intriguing… almost too good to be true if it works. It will take luck and skill to turn into the platform for radiology alogorithms, but blimey, I would definitely like to own that business if it were run by aligned honest and competent people. So you can imagine I am not in any hurry to part with PME shares given I have a very high opinion of the honesty, capability and integrity of management. There is alignment with the founders still owning about half the company between them. Yes they have sold down, but pretty modestly compared to the intergenerational fortune of immense proportions that they retain in the company.

I wonder whether it is possible a confluence of factors may mean that Pro Medicus shares come down a bit over the next few months.

A Sociological Observation

While the current share price is above my official desired price based on an attempt at estimating value, I have recently noticed a sociological signal that is telling me to buy Pro Medicus shares. While this conflicts with my rational brain, at a high level the argument would be the evidence of someone else’s schadenfreude is an indication of an irrational negative sentiment in the market. Then, the impulse would be to act against that irrationality. Previously, I let this same person impulse me into buying shares in PME… in March 2020. It was actually pretty well timed.

I guess an anecdote of once doesn’t prove anything.

Nevertheless, this thought disposes me even less to the idea of selling. Rather, I’m more wondering how low sentiment can go. In hindsight, there were multiple times I should have paid up for PME. If Pro Medicus ever drops to my desired Buy price again, I plan to tell my supporters and buy more shares myself. In the meantime, at least the hype around AI should encourage potential customers to sign up with Pro Medicus because it is clearly better positioned to enable that than the competition.

In Conclusion

In conclusion, I think the PME share price has been taken up in the AI hype a bit, but I am genuinely optimistic about their plan to try to benefit from AI in the future. In the near term, I am guessing we may see a period of share price weakness as these results were great but less great than the prior results. There is obviously a lot of optimism in the current share price and so we could definitely further falls from here.

The main things that could cause me to want to sell shares in Pro Medicus would be board and management changes.

The main things I would like to see in the second half are improved cash conversion, improved half on half revenue growth from North America and improved or flat EBIT margins (relative to the PCP).

Overall I’m happy to ride out the sentiment cycle, even though I think it may well go lower from here. I would look more to the business metrics mentioned above for signals to exit the stock rather than the (sometimes extreme) fluctuation in the stock’s P/E ratio, and overall the Pro Medicus FY 2024 results support the notion that this is a very good quality business trading at an optimistic share price. I will remain a happy holder.

Disclosure: the author owns shares in PME and will not trade PME shares for 2 days following this article. This article is not intended to form the basis of an investment decision. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

Sign Up To Our Free Newsletter