Supply Network Limited (ASX: SNL) H1 FY 2025 Results Stock Analysis

The Supply Network share price has been pretty flat despite market volatility, in the time since it released its H1 FY 2025 results.

Supply Network (ASX: SNL) owns the Multispares brand, founded by Harry Forsyth and listed on the ASX in 1989. In 2022, his holding company Hergfor Enterprises Pty Ltd, was still the largest shareholder, with over 30% of the shares on issue. Greg Forsyth and Geoff Stewart have served as its Chairman and Managing Director for many years.

Multispares is a distributor of bus parts and truck parts with over 20 locations across Australia and New Zealand.

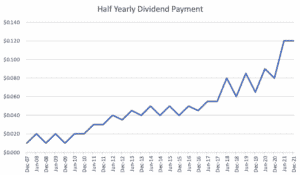

Between the half for December 2007 and the half to December 2021, Supply Network (ASX: SNL) grew its half year dividend by 1,100%.

The Supply Network share price has been pretty flat despite market volatility, in the time since it released its H1 FY 2025 results.

Supply Network management does not talk much but they absolutely walk the walk.

Albeit hardly thesis changing, there is some new information to consider regarding each of these stocks.

Supply Network (ASX: SNL) produced solid results in line with guidance but the share price has run up considerably.

Raymond Jang brings you his in-person impressions from attending the 2023 Supply Network AGM.

Maxiparts (ASX: MXI) is on another acquisition hunt, vacuuming two businesses. One seems to be a great business but is it a sound investment?

Here are some of the small-cap Annual General Meetings coming up this month.

Supply Network shares have not reacted to a strong set of FY 2023 results, probably because Supply Network profit is in line with guidance.

Why has Supply Network performed so much better than Maxiparts?

These 5 ASX small-cap companies all disclosed continuing growth in their AGM presentations, providing a good opportunity to check in on the thesis.

In Raymond Jang’s last piece for A Rich Life, he reflects on key investing lessons, his filtering process, and the road ahead as an investor.

The Supply Network results (ASX: SNL) were great, in FY 2022, but competitor Maxiparts (ASX: MXI) is ready to pounce.

When fear reigns it is hard to force yourself to buy growth stocks, but these three have all stood the test of time and showed their quality in good times and bad.

The founding family still owns over 30% of the shares of this dividend growth stock, which has grown its half year dividend by 1100% in the last 14 years.

These 5 well established businesses have all seen insiders snapping up shares at close to or above current prices.