Supply Network (ASX: SNL) owns the Multispares brand, founded by Harry Forsyth and listed on the ASX in 1989. His holding company Hergfor Enterprises Pty Ltd, is still the largest shareholder, with over 30% of the shares on issue. It has grown its dividend by 1100% in the last 14 years.

What Does Supply Network (ASX: SNL) Do?

Supply Network owns Multispares, which provides truck and bus fleets with replacement parts, in both Australia and New Zealand. The company’s website is refreshingly forthright; “In simple terms we sell truck and bus parts,” they write. “In practice, we sell a range of services including parts interpreting, procurement, supply management and problem solving.” Basically, Supply Network is a spare parts distribution network operating under the Multispares brand, from 24 locations in Australia and New Zealand.

Although the chairman has often commented that the industry is consolidating, Supply Network has been focussed on organic growth, and this is continuing. At the AGM in November, the chairman commented:

“Over the course of the 2022 financial year, we will move two existing branches to larger premises, double the capacity of another branch by taking over the adjacent unit, develop a second (smaller) Australian distribution centre with an adjoining branch in Melbourne and expand storage capacity at the existing New Zealand distribution centre by around 50%. Although we have experienced some construction and material delays, all new sites should commence operating over the second half except for the new Melbourne DC and branch, which should open in the first quarter of the 2023 financial year. These projects are the major investments in our business plan running to FY 2024.”

Furthermore, he commented that:

“We expect revenue to continue to grow in the second half but costs associated with the current expansion projects and an opening economy will dampen profit growth, and we expect second half Profit After Tax to be similar to the first half.”

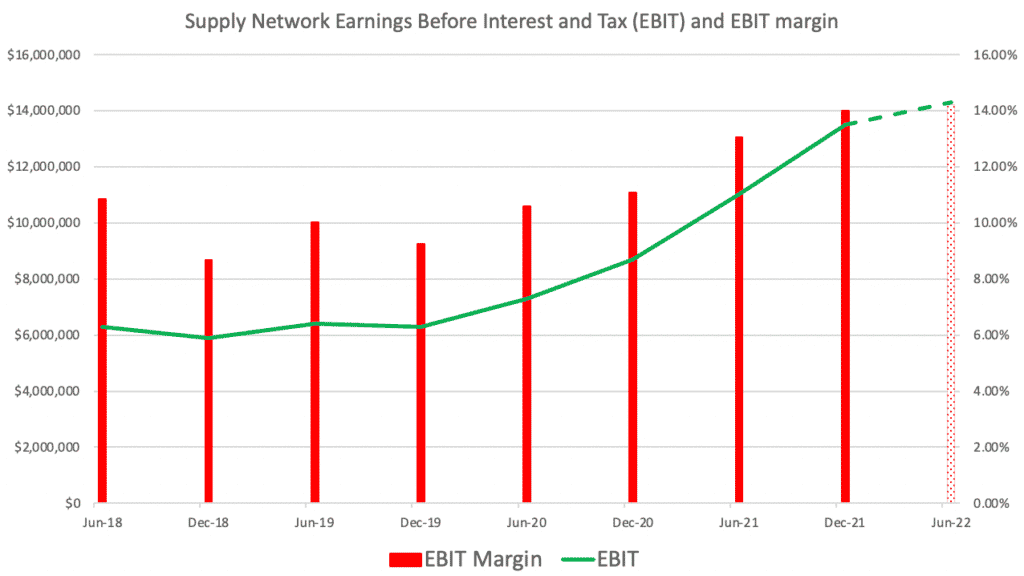

By May, 2022, the company was able to confirm that shareholders should expect revenue of $197m and $19.5m in profit for the full year FY 2022. This implies a slightly stronger second half, with EBIT margins over 14%, assuming the standard tax rate of ~30%.

Does Supply Network (ASX: SNL) Have Pricing Power?

Intuitively, it does not make sense the Supply Network would have pricing power. The company is a distribution company, so having a branch network means that each branch would compete with a different set of local competitors. To a degree, each of those local distributors would ensure that Supply Network cannot simply raise prices whenever it wants, without losing customers.

However, the increasing EBIT margin over the last few years would suggest that Supply Network can actually increase prices. It seems quite likely to me that the extensive and particular variety of stock that the company holds, for specific makes of buses and trucks, often leave it facing minimal competition to supply any particular part, and a particular time and place. Sure, a competitor could probably provide the same part, but that part might be located further away, so it doesn’t necessarily stop Supply Network rising prices.

On top of that, the company said in May that, “In broad terms, our industry has been passing on product cost increases in higher prices. This has been our practice and we expect to maintain gross margins at around current levels.”

I wouldn’t necessarily have thought that Supply Networks would have pricing power, but it actually seems like the 60,000 active part numbers it carries in stock at its distribution centres and branches. At the end of December, this inventory was worth $61.8m. To a degree, it is not overly surprising that a company providing specialist parts and expertise in a niche, can earn decent margins.

While Supply Network might not have the strongest pricing power ever, it actually does seem like it has some pricing power arising from its store footprint and wide range of stock held.

Is Supply Network (ASX: SNL) Resilient In A Recession?

In December 2021 the company put out a presentation describing the market for replaceable parts and aftermarket parts for commercial vehicles over 4 tonnes. They said that the Australian and NZ market is characterised by: “High and increasing average vehicle age, Constantly evolving technologies, Increasing vehicle (and parts) complexity, Substantial segmentation and related vehicle diversity, Competition between CV4+ operators in all segments, and No significant trend towards fleet consolidation.”

In a recession or uncertain economic time, utilisation of these vehicles may drop, hurting Supply Network. That’s a negative. However, in that scenario, fleet owners are less likely to replace their fleet, which will lead to increased demand for replacement parts. Given Supply Network specialises in being able to service a wider range of vehicles, including older vehicles, ageing fleets should be a positive thing for the company.

Finally, in 2008, Supply Network delivered record EBIT, with the report commenting that, ‘Recently we have witnessed market disruption from a number of global factors including significant fluctuations in the price of oil and currency exchange rates, declining economic activity, dramatic rises in the cost of raw materials and a rising cost of debt. Throughout this period, we have continued to perform well. In 2009, profits were essentially flat, with EBIT up just 4%.

What Price Makes Supply Network (ASX: SNL) Shares Attractive?

Historically, Supply Network has talked about growing its business by 10% – 12% each year, through prudent capital allocation. Essentially, the company pays out about 60% – 70% of its earnings as a dividend. In FY 2021, the company paid out 59% of its earnings commenting that this ratio was “slightly below our target payout ratio in recognition of funding requirements during a period of higher investment and accelerated growth.”

In the first half Supply Network only paid a 12c dividend, against earnings of 23.2c, which is less than 52% payout ratio. If the company earns about 47.5c for the full year (as implied by guidance) then the full year dividend should be about 28.5 cents. Even if the full year dividend is only 28c, that would imply a much increased full year dividend of 16c.

Even if for some reason the dividend payout ratio falls, I still think that 28c per share is a likely minimum dividend that the company is likely to pay in 2023 (and probably more like 32c).

At current prices, this forecast dividend yield implies about 2.9% fully franked. Personally, given the long term track record of Supply Network growing dividends, I’d probably find a forecast dividend yield of about 4% very attractive, but I don’t mind holding on a 3% yield (and I do hold shares).

I think that the company can and should pay a dividend of about 32c by FY 2023 (based on modest growth and a payout ratio returning to the mean) and I’d find a 4% yield quite attractive for this business, then my desired buy price is about $8.00 for really thinking Supply Network shares are quite attractive.

While Supply Network won’t grow earnings every year, due to the potential impact of macroeconomics. And the capital intensive nature of the business means that dividend payout ratios may remain depressed in a period of high inflation, which is continuing. For these reasons, I’m a little cautious about Supply Network.

But the longer term picture is one of very impressive and consistent growth in both dividends, and share price. My guess is that that will continue.

Please remember that these are personal reflections about stocks by an author, and this article is not intended as a recommendation. The author owns shares in Supply Network. This article should not form the basis of an investment decision. It is an investment diary valuable only for the cognitive process it demonstrates. To the extent that this article is advice under the law, it is general advice only. It has not considered your investment objectives. To the extent that this article is financial advice, it is authorised by Claude Walker (AR 1297632), Authorised Representatives of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. Equity Story Pty Ltd and BlueTree Equity Pty Ltd t/a A Rich Life do not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.