Yesterday, truck and trailer parts distributor Maxiparts (ASX: MXI) went into trading halt to raise $17.2 million at a share price of $2.46. This money will be combined with extra debt to fund two acquisitions. The bigger acquisition is Independent Parts (IP) and the smaller is Forch Brisbane. Maxiparts also disclosed a capital raising of $17m to help fund the acquisitions. IP will be the focus of this article given Maxiparts is paying $27m for the business, compared to just $1.9m for Forch Brisbane.

According to Maxiparts, IP has over 450 customers and operates four sites across WA. It recorded revenue of $45.4m and EBITDA of $3.4m in FY 2023. Mining companies contributed 50% of revenue and the top 10 customers made up around 70% of revenue.

Maxiparts noted IP’s inventory and employees are embedded on customer sites, potentially indicating tight-knit relationships with mining customers.

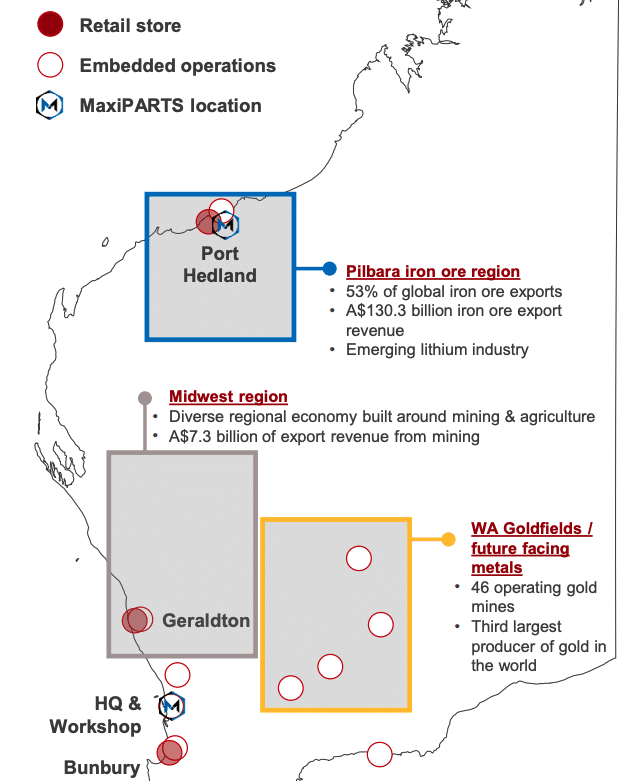

Location plays a key role for distributors to ensure miners get their trucks and vehicles up and running as soon as possible. The embedded operations scattered below highlight the importance of parts distributors being close to mining sites.

Source: Maxiparts Investor Presentation

We know what Maxiparts is buying and the purchase price but is it a good investment?

Positives

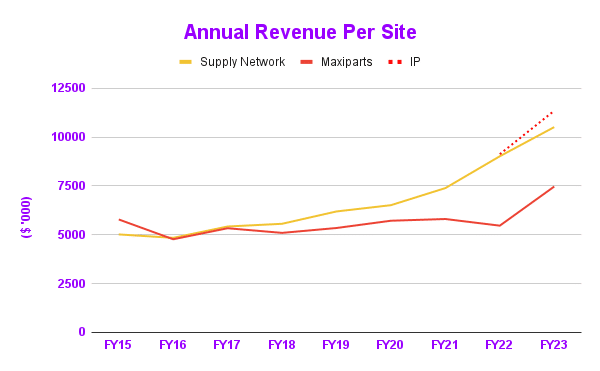

IP sites may have good economics because revenue per site is even higher than parts distribution competitor Supply Network (ASX: SNL). Revenue per site for IP in FY 2022 and FY 2023 outstrips that of both Supply Network and Maxiparts as depicted below.

Source: Author’s calculations based on company figures

It’s important to note past revenue results are not available for IP, and its recent results may have been due to a strong mining cycle rather than sustainable demand growth. IP’s exposure to the mining industry could be a positive if future facing metals like lithium drive growth in mining. Recently, global truck manufacturer Scania announced plans to open a brand new sales and services facility in WA to capitalise on the flourishing mining economic activity. No wonder Maxiparts’ management team sounded so excited.

The final big positive is management’s dogged commitment to its acquisition strategy. Whilst it may not produce the most optimal returns, management continues to target customers within their wheelhouse, being large corporate fleets.

It’s not all positive though.

Negatives

Maxiparts is currently trading at a market capitalisation of around $120m, after a 9% drop in the Maxiparts share price today. It seems investors didn’t like the acquisition and the capital raising at $2.46 probably played a role, since the market price fell to around that price. This may suggest that some of the institutions buying the shares just wanted to flip them for a quick profit.

At $27m, Maxiparts seems to be paying a premium for a business that may be benefitting from a favourable mining cycle. Another way to frame it is Maxiparts is essentially paying for IP’s top 10 customers, which made up 70% of FY 2023 revenue. And I imagine this list would mostly be mining companies.

Assuming steady EBITDA growth of 15%, IP might add around $27.5m in cumulative EBITDA from FY 2024 to FY 2028. On this basis, it would take around five years for Maxiparts to recoup its initial investment.

Source: Author’s calculations based on Maxiparts’ Investor Presentation

At best, I believe the price paid for IP was reasonable. I struggle to find reasons to support a case of it being cheap, especially given growth is never guaranteed.

Price Matters

Maxiparts appears to have acquired the right business at a reasonably expensive price. Its reliance on a capital raising also left a sour taste. Whilst Maxiparts seems to be acquiring its way to scale, the price it pays is vital to producing sustainable returns on capital over the long run.

The acquisition did not scream a bargain like Lovisa’s bargain grab of 114 stores across Europe for 60 Euros. But neither is it obviously expensive like BWX’s 50.1% acquisition of Zoe Blake’s Go-To-Skincare for $89m. It was probably an ordinary acquisition that seemed to disappoint the market.

Whilst there is much to commend on management’s consistency, I’d rather focus on businesses that take an opportunistic approach to acquisitions, with a focus on small bolt-ons.

Disclosure: the author of this article owns shares in Supply Network (ASX: SNL) and Lovisa (ASX: LOV). The editor of this article owns shares in Supply Network (ASX: SNL). They will not trade Supply Network and Lovisa shares for at least 2 days following the publication of this article. This article is not intended to form the basis of an investment decision and is not an official recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. Equity Story Pty Ltd and BlueTree Equity Pty Ltd t/a A Rich Life do not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.