Beamtree is a small pathology software company. Beamtree generates revenue from four segments: Diagnostic Technology; Clinical Decision Support; Coding Assistance and Data Quality; Analytics and Knowledge Networks.

We last covered Beamtree about a year ago, concluding that “Beamtree’s lack of profitability does not inspire confidence, and any faltering in organic revenue growth could be painful.”

Since then, the company has demonstrated ongoing ARR growth, and the share price has languished, likely due to the lack of cost discipline that leads the company to continually lose money. The purpose of this article is to examine whether the company might be approaching the end of its cash furnace era, and consider whether the current share price of $0.195 presents an opportunity.

The H1 FY 2024 results showed a loss of $3.4 million before tax (improved from a loss of $4.5 million in the prior corresponding period). Revenue came in at about $13 million, up on $10.5 million in H1 FY 2023, being growth of about 23.8%. This revenue result supports the claimed annualised recurring revenue of $24.2 million at the end of H1 FY 2024. The make-up of this ARR is shown below, although please note the graph is misleading because they have labelled the H1 FY 2024 result as “FY24”.

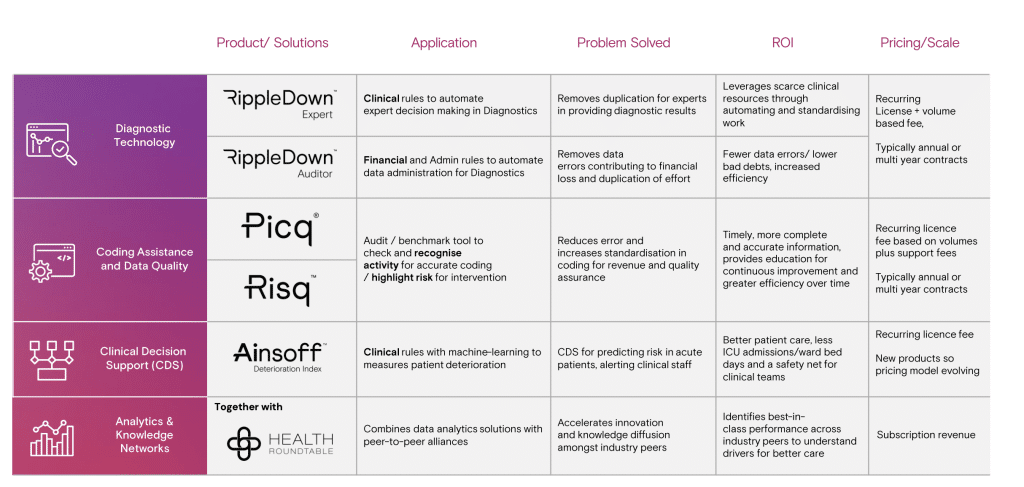

Beamtree is a fairly strange company because it is made up of a series of acquired businesses, and sells a range of different products. The diagram below gives a handy description of the various products, and highlights how the company makes money through a combination of recurring license sales, subscriptions and transaction based fees. This means that we should take the ARR description with a grain of salt, given the products are not strictly subsription revenue; but that the revenue is probably mostly recurring in nature, nonetheless.

Generally speaking, I’d argue that the Diagnostic Technology and Clinical Decision Support are probably the most prospective business lines, because they address the potential for human error to hurt health outcomes, and because they both have the potential to grow organically as the customers grow their own business volumes. Taken together, these two business lines are expected to expand to contribute around 50% of revenues by FY 2026, with the latter growing fastest. Obviously, we should take these sort of aspirational goals with a grain of salt.

The CEO Tim Kelsey said on the recent H1 FY 2024 results call that the company “will be profitable by the end of this financial year.” One of my concerns with the company is when the CEO talks about profit he means operating profit (which was a loss of $550k in H1 FY 2024). Kelsey also noted that Annualised Recurring Revenue was growing at over 20% per annum and “we expect that growth rate to continue into the second half of this financial year.”

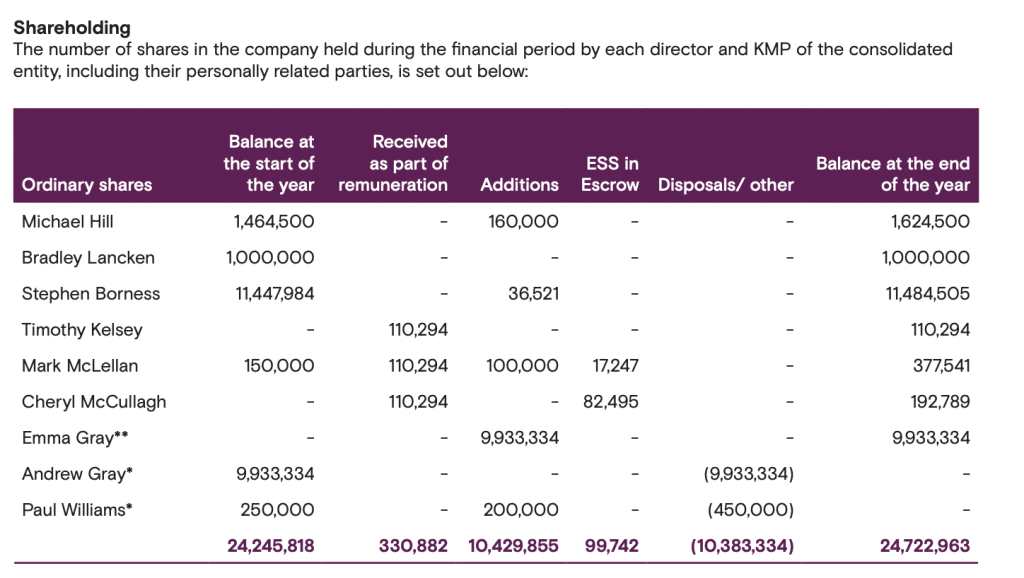

At the end of March director Mike Hill bought about $30k worth of shares at $0.21 in his superannuation fund. That’s considerably less than his annual director’s fee, so I wouldn’t put too much weight by it. The CEO owns about $22k worth of shares, none of them bought on market. As you can see below, the only directors with a significant interest in shares are Emma Gray and Stephen Borness, and the latter has since resigned from the board. Meanwhile, it looks like Emma Gray replaced her husband Andrew Gray on the board. Have you ever resigned from your position and had your spouse selected as the ideal replacement, amongst all the potential candidates? It certainly is a noteworthy coincidence.

Once we take a cold, hard look at Beamtree, it certainly looks like an opportunistic grab-bag of hastily assembled businesses, albeit in an attractive space. I have low confidence in the board and management, due to a lack of alignment with ordinary shareholders, and all the evidence suggests the stock will continue to make (statutory) losses well into FY 2025, at the very least.

Are Beamtree Shares Cheap?

The reason Beamtree is starting to look a bit interesting to me is that its market capitalisation is quite low compared to its revenue. With half year revenue of $13m, and ARR of $24.2m, it would be reasonable to assume that the company can make at least $24m in the next 12 months. At the current price of $0.195, Beamtree has a market capitalisation of just $56 million. This equates to just over 2x forward revenue, which is quite low for a software company. By way of comparison, fellow loss-making health software small-cap Volpara (ASX: VHT) is being taken over at a multiple of 7.5x FY 2024 revenue.

Although they do have some similarities, I’m not for a moment suggesting that Beamtree is of equal quality to Volpara. For one, Volpara has a more coherent product suite and was running at about cashflow breakeven when it received the takeover offer. In comparison, Beamtree is still making losses, even at the nebulous “operating profit” level that the company prefers to tout. On top of that, Beamtree makes plenty of its sales through its reseller partner Abbott, which means that it would make a lower gross margin that Volpara.

That said, Beamtree is currently growing revenue at around 20% organically, which is higher than Volpara was averaging in the quarters preceding the takeover offer it received.

Therefore, if we assume the Volpara takeover was logical (and that is a big assumption), we could make the case that Beamtree might be worth 3.75x forward revenue to an acquirer, being a lower multiple to compensate for its disparate range of different products. That would still provide around 60% upside to the current Beamtree share price.

Furthermore, the company is forecasting it will reach operating profit breakeven, which has a chance of obviating the need for another capital raising (given that much of the difference between operating profit and statutory profit is non-cash amortisation).

The pattern we have seen lately on the small end of the ASX is that once these loss making companies reach sustainable cashflow, there is a much higher likelihood of receiving a takeover offer, since a private buyer can always rip out some costs by ditching the board and saving on expenses associated with being a publicly traded company.

Therefore, even though I don’t rate management or the board, the Beamtree share price does indeed seem like it may present somewhat of an opportunity. That said, it’s not my favourite kind of idea because I don’t trust the board not to make another acquisition and do another capital raising, and I don’t have confidence in the CEO due to his lack of shareholding and minimal focus on statutory profits.

I would have thought Beamtree would be a decent option for investors who would like to own a basket of potential takeover targets. While not all such companies will receive a takeover offer, I thought it was at least worth writing about Beamtree given it displays a lot of the same features as other small cap tech stocks that have received takeover offers over the last 12 months.

Disclosure: the author of this article does not own shares in BMT and will not trade them for at least 2 days following the publication of this article. This article is not intended to form the basis of an investment decision and is not a recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

Please note: only paid-up supporters of A Rich Life received access to this article when it was first published. To thank our Supporters for their generosity, our best content is initially exclusive for Supporters.

If you would like to be among the first to receive articles like these, and even suggest small-cap mailbag articles yourself, then you can click here to join the waitlist to become a Supporter.

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. A Rich Life does not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.