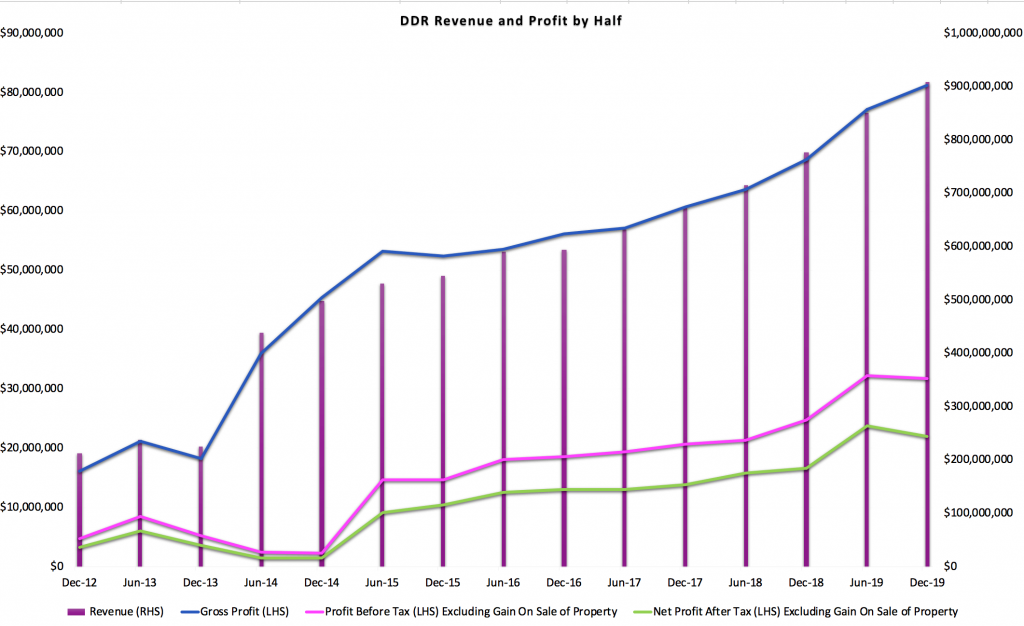

IT equipment and enterprise software distributor Dicker Data (ASX: DDR) last week reported at profit of $54.3 million for the 2019 Financial Year (Dicker Data reports on the calendar year). However, that figure included about $12 million in profit from sale of their current property, so if we adjust for that, the profit would have been closer to $46 million, a whopping 40% increase on the prior year.

Having said that, as the chart below shows, the first half was actually stronger than the second half at a net profit level. This was partly due to an increase in employee pay in the second half, which I speculate was probably a result of team members achieving their targets for the year. Keep in mind that Dicker Data uses a lot of performance pay — and not just for top executives. There was also a little increase half on half in Depreciation and Amortisation and Other expenses, “partly due to the adoption of AASB 16.”

Importantly, the company paid total dividends of 33 cents per share throughout the year, but that includes “an additional special dividend… paid in respect of the after-tax profit on the sale of our property asset.”

To be conservative, I would only forecast a dividend of 27 cents for the the coming 12 months, excluding the impact of the coronavirus on the company. In reality, I expect the virus will have a meaningful impact on Dicker Data since the company is leveraged to overall business activity, and very reliant on supply chains. Offsetting that, many companies will have to spend more on IT equipment and enterprise software to facilitate more remote working during the outbreak.

If we, for a moment, assume that after one year Dicker Data bounces back to its former normalised glory, then I think the normalised yield is probably about 4.6% at current prices, with a high probability of growth over 3 and 5 year time horizons.

Assuming that FY 2020 is disrupted, and that the company is thus unable to maintain its ongoing profit levels, then at the current price of $5.86, the company would probably yield 4.6% in 2021, with further growth quite likely. Even modelling 10% growth until 2025 (below recent rates), and then a steady state, we’d be buying a stock that would be likely to pay out around 6.7% per annum in 5 years, based on today’s price. On top of that, the dividend is fully franked so the grossed up 2025 yield would be over 9.5%. That’s attractive if you have a high degree of faith in the sustainability of the business model and the people running the company, as I do.

I also note that the COO, and CFO both bought shares at around current prices when the share price tanked on Monday (largely, I suspect, as a result of the coronavirus selling). They paid prices from $5.60 – $5.70 and I believe that the risk versus reward is attractive at this price point. Personally, I have bought back a small part of my position today, at slightly above those prices, but below the price I sold some shares at early last week, as previously disclosed here. I can’t stress enough that today’s purchase was a very small purchase relative to my existing holding, which was purchased entirely below $3, and my purchase is less than what I sold last week when I decided to increase my cash holdings.

The main reason I remain positive about Dicker Data is that I know that its board is very heavily invested in the company and will very motivated to take measures to ensure that the company is not unduly harmed by the pandemic. On top of that, I admire the abilities of the operational managers Mary Stojcevski and Vladimir Mitnovetski and take heart that they are recent buyers. Therefore, while I’m extremely thankful I took plenty off the table last week, I think Dicker Data was actually one of the ones I probably should have been slower to sell.

Now, none of this is in any way advice. Rather, I am jotting my thoughts as an investment diary so I can understand my own investing better. At the moment, I am mindful that if the share price falls further in the coming weeks and months, Dicker Data might be one of those companies that have enough decency, track record and utility that one could be comfortable holding throughout a bear market. On the other hand, it might sell-off strongly due to concerns about its debt.

On that subject, we should note that the team managed to actually increase their debt limit with Westpac in February 2020. The annual report said:

“The Westpac receivables facility was renewed on 12 March 2018 for a period of 3 years with a limit of $130m. As of February 2020, this limit was increased to $180m, being an increase of $50m supported by the increase in the receivables balance. This increase provides the required headroom to fund the Company’s current initatives [sic].”

At present, the company has $130m in borrowings and $22 million in cash (as well as receivables of $292 million and payables of $250 million).

That means that Dicker Data has to be in good financial shape come February 2021, unless it extends its facility earlier. Given that 2020 may be a difficult year for everyone, I consider that there is a very real risk of a disrupted, lower dividend in FY 2020.

That said, the team have been rather deft at managing working capital requirements over the years and their financial track record should put them in a strong position to continue to win their bankers’ support. If the market ends up getting very worried about Dicker Data’s debt, I will probably view that as a buying opportunity.

I note that Dicker Data broke even at a free cash flow level in 2019. This is not a bad result for the company, since its growth is reasonably capital intensive since receivables tend to increase a bit (not much) faster than payables, and inventory increases in line with sales, in most years. This year, inventories were up about 20% against a 18.7% increase in sales.

Finally, I would be remiss not to note that the company is showing every sign of adapting to the increasing importance of software in the IT space. It reported that the “software business was the fastest growing sector growing by 38.5% to $429.1m.” This is only about a quarter of total revenues but is clearly going to become more important over time. It is heartening that as software has grown as a percentage of sales, Dicker Data has managed to maintain or even increase margins.

This post is not financial advice, and you should click here to read our detailed disclaimer.

If you’d like to receive a occasional Free email with more content like this, then sign up today!