During the week, IT equipment and software distribution company Dicker Data (ASX: DDR) reported its results, showing net profit after tax of $57.2 million (up 6%) on revenue of just over $2 billion, for the full year. However, last year benefitted from a profit on sale of a property. Ignoring that, the underlying earnings per share growth was a whopping 19.6%, to 33.95 cents per share.

As you can see in the chart below, revenue was actually down half on half, for the first time since 2013.

However, this slight softening in demand is not overly troublesome, since in the half to Jun 2020, Dicker Data benefitted from a historical rush to buy IT equipment in order to facilitate work from home.

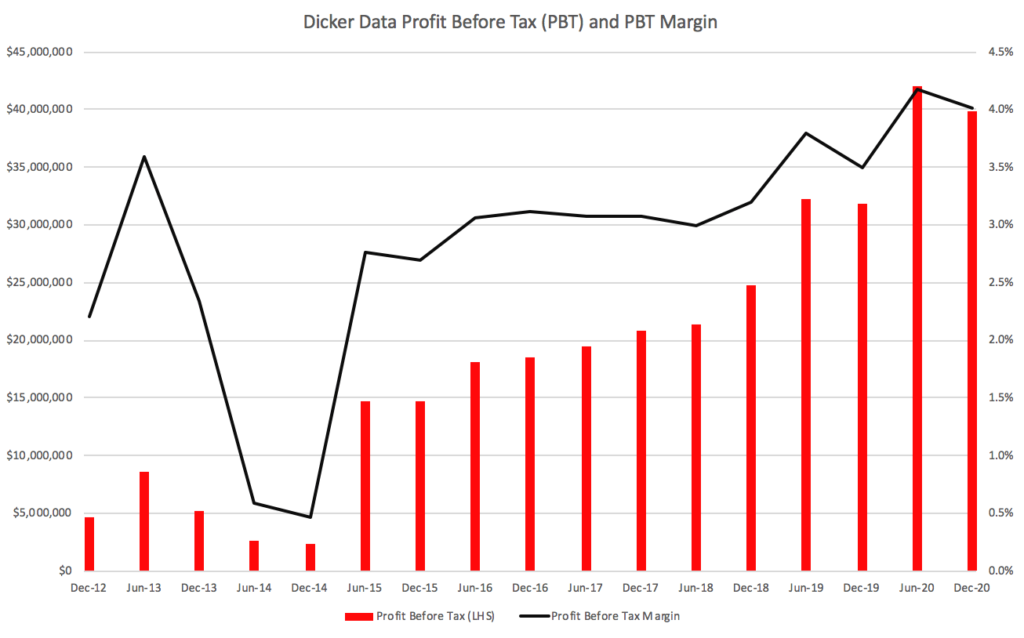

As you can see above, profit has been rising strongly over the last 5 years, and that has been driven by a combination of revenue growth and efficiency gains, resulting in a profit before tax margin of over 4%, up from about 3% prior to the pandemic.

Given that the PBT margin only hit 4% during the pandemic induced demand spike of the first half of 2020, I would not have been surprised to hear that margins would be headed back to 3.5%. However, on the conference call management said, “We are definitely aiming to sustain our margin quality for this year,” so it may indeed be possible to keep margins up around 4%. If so, that’d be a win for shareholders.

Operationally, the biggest news from the chief operating officer Vlad Mitnovetski, was that they had signed VMWare as a vendor. This is important because it is the missing piece of the puzzle for the multi-cloud and public-private cloud systems that are increasingly important in a work from home environment. The COO described it as “Fundamentally, it’s an amazing opportunity… it brings together other vendors.”

After the results, I had the opportunity for a few minutes with the founder and CEO David Dicker. Unlike many companies, the CEO role at Dicker Data is more about oversight than the operations. When asked about the biggest risks to the business, David Dicker basically highlighted the reliance on long-serving employees like the COO and the CFO. The biggest moment of peril the business had ever faced was when Fiona Brown (still a director and major holder) stepped away from the business in 2004.

A second moment of peril happened when former COO Chris Price resigned, and then joined major competitor Ingram Micro. When asked why Ingram was unable to use Chris’s knowledge to better compete with Dicker Data (which has been taking share from Ingram and other disributors), David Dicker speculated that, “We’re an Australian company and we operate in Australia, it’s a different set up than a global org commended from wherever HQ happens to be.”

This makes sense, in the sense that Dicker Data has long stated they try to add value to their partners (ie customers) by helping them out more with support (and now even providing some better finance options through Dicker Data Financial Services). In contrast, Ingram Micro makes more money selling into big retailers like Harvey Norman.

With their new facility, DDR will further enhance the value-add offering, with “a dedicated configuration centre which enables end-to-end system building and deployment services for the company’s partner network. Services offered include asset tagging, device imaging, hardware installation and pre-shipment testing to name some.” I am still expecting some disruption as the company manages the transition to its new facility, but it seems the move will allow both greater scale and greater quality in their offering.

The company has net debt of about $90 million, and produced about $11.3 million in free cash flow during the year. At the current price of $10.49, shares should yield around 3.1%. I suspect this dividend will gradually grow over time, but the company is sufficiently large that it will struggle to grow very fast. Furthermore, it has clearly benefitted from the pandemic. The COO said “we are definitely not going to match the growth rate we had in the PC business this year,” and global chip shortages are also creating supply constraints.

Summing up, this was another good report from Dicker Data with the company kicking goals on a financial and operational basis. I believe the current level of profitably is broadly sustainable and that the company will probably grow in excess of its industry for a while yet. However, the next report will be cycling off “strong comps” so I would expect the next half year report to show little growth at best, and maybe even a lower result.

Probably the worst part of this report was the criticism of travel restrictions which is in keeping with the CEO’s anti-authoritarian streak, having described Australia as “an authoritarian sh#thole”. On the plus side, the new facility “features solar panels, eight electric vehicle charging stations, recycled water systems and over 30,000 new seedlings and trees on the grounds surrounding the new facility.”

At current prices, Dicker Data shares hold little appeal to me. I would probably looking for a forecast yield of close to 5%. If the company grows 10% next year it might pay 37.3 cents in dividends in FY2021, giving a yield of just 3.5%. I could probably see myself buying the stock for around $8, but it doesn’t seem particularly cheap to me right now.

Somewhat stupidly, I sold some Dicker Data shares in February last year only to buy back at around the same price in May and Jun. It is not such a large position that I need to trim it, but it doesn’t seem particularly cheap either. For now, I plan to continue holding though I could definitely see myself trimming my position if I wanted to raise cash.

This article is not financial advice, it is general in nature, and our disclaimer is here. The author owns shares in DDR.

A Rich Life depends on Supporters to pay for its free content, so if you’d like to try Sharesight, please click on this link for a FREE trial. It saves me heaps of time doing my tax and gives me plenty of insights about my returns. If you do decide to upgrade to a premium offering, you’ll get 2 months free and we’ll get a small contribution to help keep the lights on.