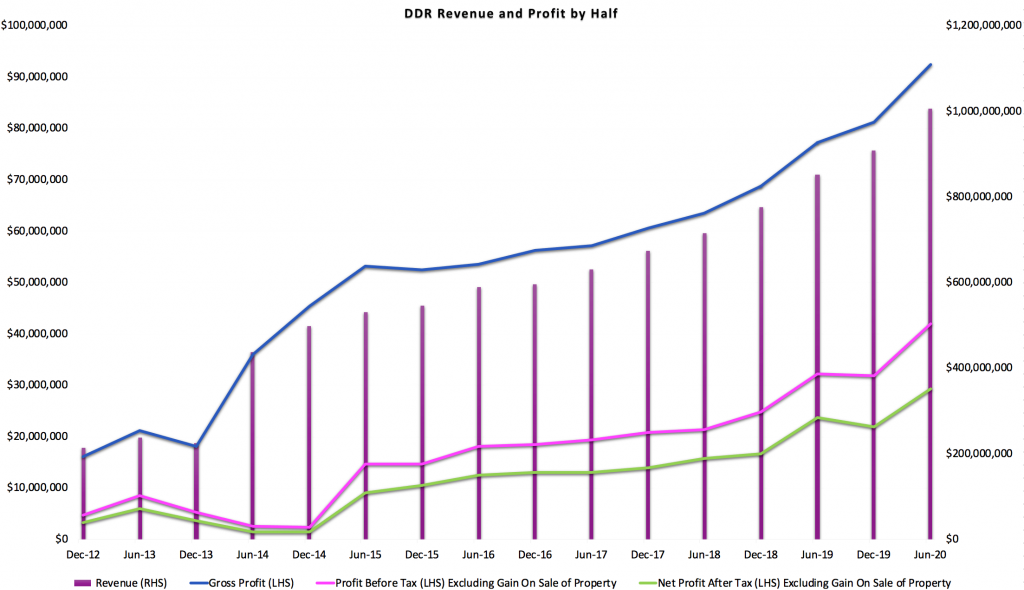

Today should be a good day for the Dicker Data (ASX: DDR) share price as the company has just reported record profit of $29.4m from record half year revenue of just over $1b. The majority of revenue was hardware revenue but about 20% comes from recurring software subscriptions. You can see the results in context, below.

As you can see below, Dicker Data’s profit margins have never been higher than they were in this half.

Clearly, then, Dicker Data has made the most of the fact that “With the recent remote work revolution the Company experienced a surge in demand for remote and virtual working solutions across our hardware and software portfolios highlighting IT distribution’s essential role in enabling business continuity.”

On top of that, the report said that, “As we move into H2 2020 the demand continues to be very strong with customers concentrating heavily on business continuity strategies and prioritising digital transformation during and post COVID-19.”

Should I Buy Or Sell At The Current Dicker Data Share Price?

First of all, this is a question I always ask myself at report time. But I am not suggesting you should do what I am doing and I don’t know your personal situation. For me, I already own Dicker Data shares purchased at lower prices. I have a moderate sized position that isn’t particularly big or small. My question to myself is whether I should adjust my position size given the current Dicker Data share price range of $7.70 – $8.

I definitely think that these were great results. However, its worth examining the optimism in the share price. If we take net profit of $29.4m, and assume that current levels of trading are roughly maintained, then we might expect roughly $65m in profit for the full year (due in large part to strong work from home demand). Using a simple (not weighted) average to calculate earnings per share on the ~172m issued shares, we get about 37.7 cents per share.

This might be too conservative but based on that estimate above, the company trades on a P/E ratio of ~21 at the share price of $8. While this is very elevated compared to history, the company has less debt ($90m) relative to earnings, than it has in the past. At current prices, it’s a safe bet the company yields considerably more than 4%, fully franked, so it continues to appeal as a dividend stock.

My main concern is that the current high net profit margins are not really going to be sustainable as the company faces the disruption of moving into the bigger warehouse that it is currently constructing. I asked management why they have been able to increase PBT margins from ~2% in the past to ~2.5% in the last 18 months. My angle is to see if this is sustainable. While COO Vlad Mitnovetski did not make any forward looking predictions, he did help explain how the past improvements have been achieved. He said:

“As technology becomes more complex and the prevalence of multi-vendor solutions continues to grow, there’s a willingness amongst our customer base to pay a premium to access a team of experts who help them scope, design, configure and deliver technology solutions. Our success is built on our ability to simplify; whether that’s technology, a vendor program or a solution. Our team is the most highly certified in the industry and they know how to help our customers deliver technology solutions that address the challenges of their end-users. This, backed up by our strong systems, operations and logistics capabilities positions us as the most reliable and most sought after distributor in the country.“

Furthermore:

“At the end of the day, when an IT reseller chooses a distributor, they are placing their reputation and brand in the hands of that distributor. The distributor’s service and ability to execute can have a lasting impact on the IT reseller’s relationship with their end-customer and Dicker Data is widely-regarded as the safest pair of hands in the industry. This plays a significant role in why they choose to partner with us, regardless of a price premium.”

I’m also interested in better understanding how long the work from home tailwind can sustain. It’s possible to imagine a scenario where pretty much everyone who is working from home has now set up to do so and then demand falls away as we reach — and pass — peak work from home. Of course, it’s also possible to imagine a scenario where current set ups remain slap dash and suboptimal, and there is a huge backlog of system and equipment reconfiguration (and acquiring) to optimise for a more distributed workforce that is now here to stay.

Finally, I’d like to know more about their self-financed “buy now pay later” option Dicker Data Financial Services. I wonder how much cost or risk is there.

Overall, I would be surprised if the share price does not go up today because this is a well run company that is a beneficiary from the pandemic, with a healthy balance sheet and record profits, revenues and (in due course) dividends. At the moment I’m not quite confident enough on valuation to be buying but for now I’m leaning towards just holding on to all my shares. While Dicker Data may not be my best idea I feel my moderate holding is appropriate and the current price of $7.77 does not seem to be an attractive selling price in light of strong business momentum. Therefore my current plan at the time of writing is to do nothing. My view may change with the share price and/or new information.

Save time at tax time: A Rich Life depends on Supporters to pay for its free content, so if you’d like to try Sharesight, please click on this link for a FREE trial. It saves me heaps of time doing my tax and gives me plenty of insights about my returns. If you do decide to upgrade to a premium offering, you’ll get 4 months off your subscription price (the best deal available, I’m told) and we’ll get a small contribution to help keep the lights on.

If you’d like to receive a occasional Free email with more content like this, then sign up today!

This post is not financial advice, and you should click here to read our detailed disclaimer.