Last night financial services business Diverger released an announcement to the market regarding their FY 2022 results. As expected, the business remains profitable and the company pre-announced Earnings per Share (EPS) of 9.47 cents, up 35% thanks in part to the full contribution of prior acquisitions. Unfortunately, the company did not publish audited results so we did not see the proper audited profit and loss, cashflow or balance sheet.

In my personal opinion as a Diverger shareholder, the announcement was a nothingburger, namely “something that is or turns out to be insignificant or lacking in substance.”

The presentation was subtitled “Preliminary Unaudited Results Presentation Year ended 30 June 2022” but it did not contain a cashflow statement nor any information on the subject of a dividend.

With earnings of over 9 cents, and a share price of around 90 cents, there’s no doubt the company is cheap based on earnings. However, the market is clearly skeptical whether Diverger will pay those earnings out as dividends.

This is sensible, because Diverger’s share register is dominated by HUB24 (ASX: HUB), and it may be that HUB wants the company to minimise dividend payments. There are multiple reasons that may be the case.

In comparison, for a retail shareholder, it would be great if Diverger increased its dividend aggressively. With earnings of 9.47 cents per share and a share price of 91 cents, Diverger could afford to pay a dividend of 10% per year at current prices. Even if Diverger only paid out 80% of its earnings, that would be about 7.5 cents per share, or a yield of 8.2% before franking credits, at the current share price. More likely, the share price would rise and the yield would revert to a lower level. Even if the market only moved the stock to pay a yield of 6%, that would lead to a share price of $1.25.

If the board wanted, they could pay a 7.5 cents dividend.

However, it seems the market does not expect the board to act in this way. Rather, the shares remain subdued because the market lacks confidence that ordinary shareholders can access all that free cash flow.

On the call I asked about the dividend but the company said it would release dividend information in August, with the audited results.

[Edit July 27] Approached for comment, Diverger CEO Nathan Jacobsen said, “The Board reviews capital management opportunities on a regular basis. At this point we have the opportunity to invest in our growth strategy at attractive returns for all shareholders, in excess of a return through additional short-term dividends.”

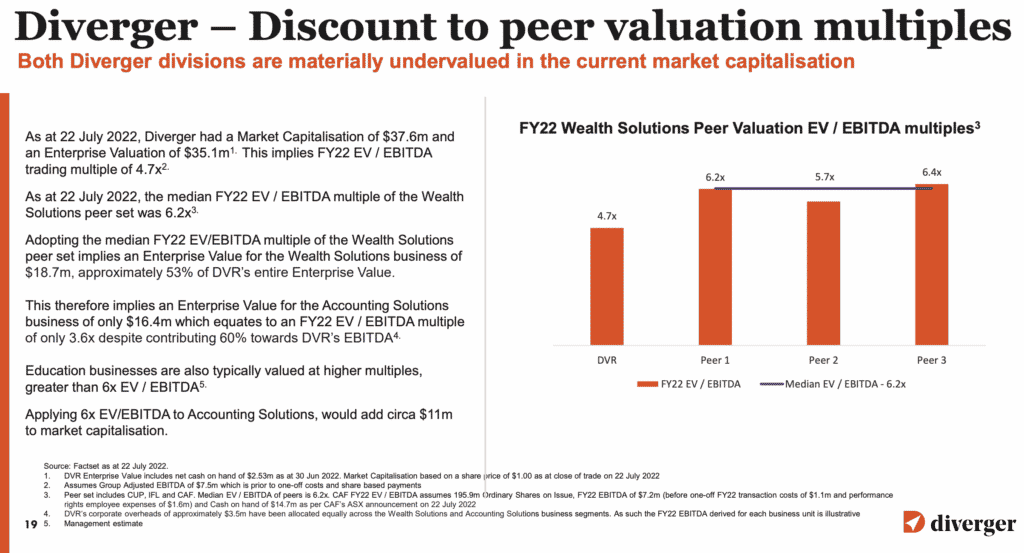

Rather than increase a dividend (or even mention it in the slide deck) Diverger instead inserted a slide in the presentation attempting to argue that, “Both Diverger divisions are materially undervalued in the current market capitalisation”. To me the slide below is an attempt to encourage a higher share price, and it comes across quite ludicrous when the board could easily just increase the dividend, to achieve the same result. It makes me wonder if they actually want to cut dividends, and they are doing this to compensate.

However, this slide is made all the more ludicrous by the fact that Diverger is simultaneously attempting to use its shares as currency, to buy Centrepoint Alliance (ASX: CAF). The announcement did not specify, but I assume that would involve issuing $31.8m worth of shares priced at around the current share price. That’s huge dilution at an undervalued share price, given the company’s market capitalisation is only $37.4m.

Obviously, it would make more sense to address the weak share price prior to issuing a huge amount of shares for an acquisition. The best possible thing for me would be if Diverger ditched its acquisition plans until its share price was higher. The company could drastically increase its dividend, and once the market gained more confidence in the dividend, the share price would probably rise. This would take some time, but it would be worthwhile, because the increased share price could then be used to fund future acquisitions with lower dilution.

Diverger Thesis Broken

For me, the single most important factor of Diverger’s result is its dividend, as the biggest risk is that for whatever reason HUB24 wants to minimize the payment of that super sweet stream of fully franked cash to ordinary minority shareholders.

This presentation has officially spooked me because it did not even mention dividends. As a result, I lack confidence that the board of Diverger will steadily and generously share an increasing cashflow stream with all shareholders, over the years ahead.

I will continue to hold my shares until I find out the full year results, along with dividend information, but suffice it to say this presentation has undermined my confidence in the company. I have always been investing in Diverger in large part for the dividend and it is unfortunate that management doesn’t seem to be speaking my language on this one.

I wish the company all the best going forward and I actually share the company’s view that its subscription businesses such as Tax Banter are undervalued in the market. However, as a shareholder I want dividends in my bank account not presentation slides about the shares being cheap, and definitely not massive dilution.

As I write Diverger stock is trading at less than 10 times historical earnings per share, so it is quite pessimistically priced compared to most companies. However, unless the business commits to steadily increasing its dividend, and disavows any intention to massively dilute shareholders around current share prices, I will probably look to sell my shares after the full year results, if I am offered a decent price. I can’t make any firm decisions on the basis of the announcements last night, but they certainly made me pessimistic about dividend increases, and paranoid about the direction the company is heading. As a result, my original thesis no longer holds, and that deserves to be acknowledged.

Please remember that these are personal reflections about stocks by an author, and this article is not intended as a recommendation. The author owns shares in Diverger and will not trade them for at least 2 days after publishing this article. This article is not intended to form the basis of an investment decision. It is an investment diary intended to be valuable only for the cognitive process it demonstrates. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. Equity Story Pty Ltd and BlueTree Equity Pty Ltd t/a A Rich Life do not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.