One of the most interesting IPOs this year on the ASX (to me) was a company called Doctor Care Anywhere (ASX: DOC) which operates a tele-health service in the United Kingdom.

I take a special interest in this sort of company because it sits at the intersection of healthcare (a defensive industry) and technology (a high growth sector). Arguably, these kind of businesses can be very valuable if they reach maturity, which is what makes them exciting. Unfortunately, the exciting nature of the offering has lead to a very optimistic share price. Today, I’ll explain why it’s worth familiarising ourselves with this business.

Telehealth is the future

As many of you will know, I have owned a US business called Teledoc, for years. While the company isn’t profitable, it has grown remarkably well and now facilitates 10 million doctors appointments per year; and brings in over $1b of yearly revenue. And there is no doubt that tele-health makes sense in many scenarios. This 2020 Trust Pilot review for Doctor Care Anywhere shows why patients like telemedicine in general, and Doctor Care Anywhere in particular.

“Fantastic service. Decided not to call my regular GP as I usually have to wait more than a week for an appointment. I went on the app at 8am, chose a convenient time for a phone appointment of 9.20 that morning. Got a call promptly, discussed my concerns and obtained a prescription all in less than half an hour, without even having to leave work! Have already booked my follow up appointment. So easy and convenient to use. The doctor was super thorough, listened to everything I said and she made thorough notes which I could view later on the app. If this is the future of healthcare I’m more than happy!”

However, up until the pandemic, there hasn’t been much growth in tele-health in countries (like the UK and Australia) where public healthcare is provided. In part, that’s because government bureaucracy can slow things down, but also it’s because the government hasn’t been motivated to unlock the cost and efficiency savings that arise from tele-health.

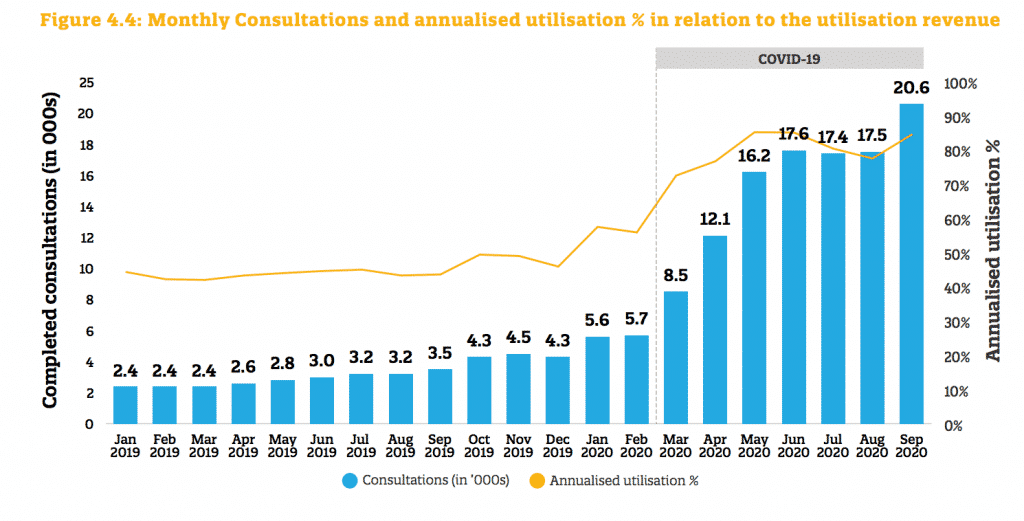

The pandemic changed all that, and now a plethora of doctors are providing some version of telemedicine. According to the New York Times, many doctors in the UK are now using software called accuRX to perform video consultations. In other words, telemedicine arrived in a big way (for all providers) and while Doctor Care Anywhere has plenty of new competition it has been a beneficiary of that, as you can see below.

Doctor Care Anywhere Business Model

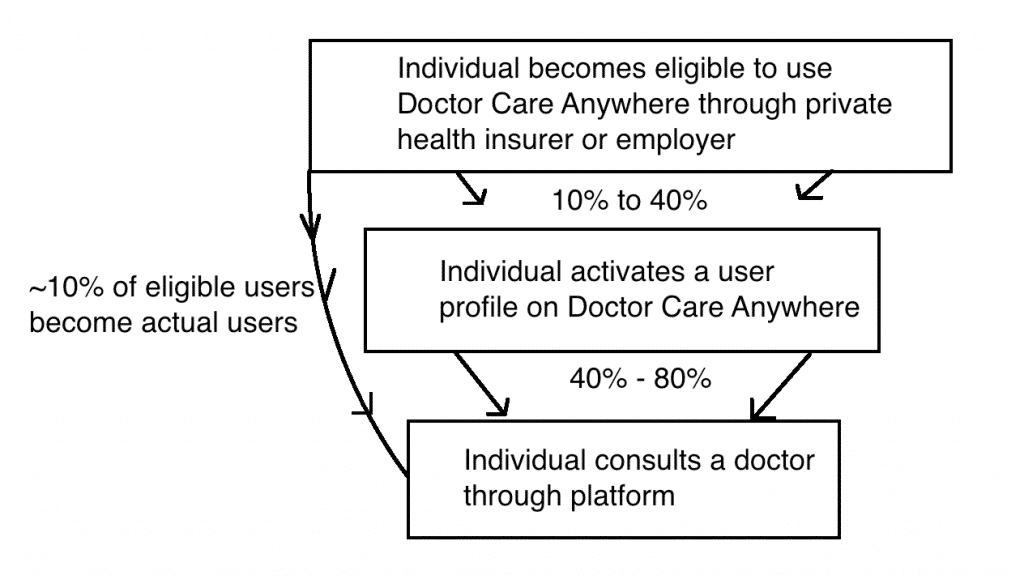

In order to understand the chart above, it’s important to take a closer look at the DOC business model. Rather than approaching individuals to use the service through advertising, DOC has been partnering with AXA Group (a health insurer) and other healthcare providers, like hospital operator Nuffield Health, which provide employers with healthcare packages they can offer to their employees. You can visualise the model like this:

The advantage of this model is that DOC can acquire customers relatively cheaply. Essentially, their services become an inclusion in another company’s offering.

Importantly, Doctor Care Anywhere has two revenue models; one where they are paid per consultation (this is the majority) and another where they are paid per eligible patient (this is more aimed at serving as an employee benefit, where anonymity of usage may be preferred). Offsetting this, they must pay the cost of employing the doctors, meaning that their revenue is not “software revenue”. Indeed, Doctor Care Anywhere is a service provider, not a platform provider.

As you may have guessed by now, the disadvantage of this model is that they are very dependent on their large partners in this case, AXA. Indeed, the private medical insurers have all started partnering with telehealth providers in the UK. On the one hand, this is a massive advantage, because it delivers patients to them, but on the other hand, it means that DOC will never have wonderful margins, because it has a powerful customer with considerable negotiating power.

To quote the prospectus:

“Doctor Care Anywhere [is] with AXA, Babylon with Bupa, Square Health with Aviva and VitalityHealth, and Teladoc Health with Generali UK and AIG Life.“

This post is not financial advice, and you should click here to read our detailed disclaimer.

The Numbers

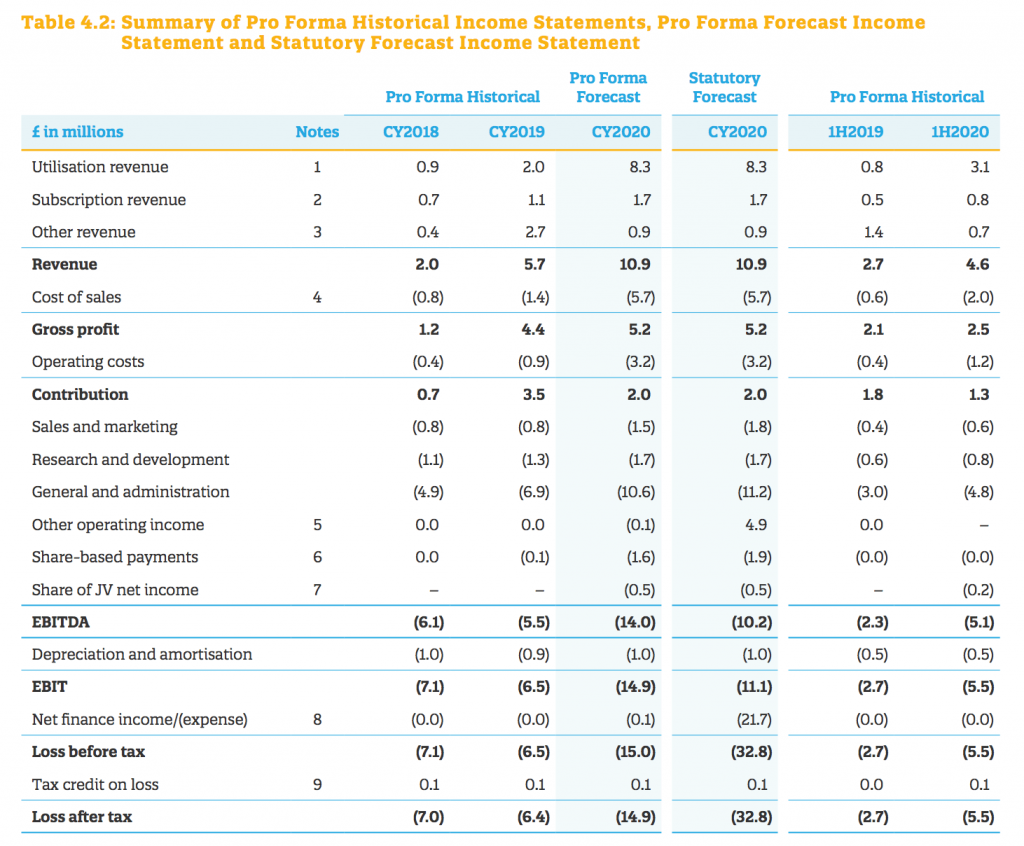

As you can see from the prospectus excerpt below, DOC is forecasting £10.9 million in revenue for 2020.

At the current exchange rate, that translates to about about $19.4 million Australian dollars. The company has 318.5 shares on issue so at a share price of $1.20 it has a market capitalisation of $382 million.

After the IPO, the company has cash of £45.2m which is about $80m Australian, giving an enterprise value of about $300m.

To my mind, the gross profit for DOC is more similar to revenue from a software company, since it represents what DOC gets after the salaries and other related costs of the doctors who deliver the tele-health services to the customers.

Gross profit is forecast to be £5.2m in 2020, which is about $9.2m Australian. That means the company is trading on a whopping 32x gross profit. Realistically, then, investors require phenomenal growth from the business to justify the price.

But that might just be possible. In the prospectus, the company has forecast a reduced gross margin as it has expanded into some specialist services which are currently sub-scale. It also increased the length of consultations from 15 min to 20min, which comprised a hit to the bottom line, but improves the service. This creates a drag on gross profit, which is therefore expected to grow slower than revenue. Ultimately, though, I would expect that gross margins stabilise, or even improve over time.

When it comes to revenue, the forecast growth is high. While that is likely to slow down, the theory to be tested is whether the pandemic has created a permanently higher acceptance of tele-medicine. If it has, that could set the stage for multiple years of strong revenue growth.

Without strong growth in revenue and gross profit, I expect this loss making early stage company to see its shares crater. That is a very real risk, and the main reason I remain so cautious of what is otherwise an interesting company.

How This Might Play Out (and How I’m Playing It)

One of the things I like about this company is that it seems to be in a potential hyper-growth sweet spot. AXA has a profit incentive to drive more and more volume to DOC, since DOC can cut AXA’s costs. That dynamic could easily see gross profit double again in 2021. After all, telemedicine is simply more efficient, and if capitalism has its way, then we should see a huge increase in the practice, over time.

In the worst case scenario, the return to post-covid normal sees tele-health volumes drop considerably, and DOC shares actually crash. In that scenario, we could see the stock fall a very long way (and so I am not comfortable with it as a significant investment).

In the best short term scenario, the company beats growth forecasts and the market focusses on revenue growth, rather than gross profit growth. In that scenario the company can use its cash kitty to drive top line growth and raise more capital in a virtuous cycle to grab market share. My guess is that is what the company is aiming for; and if it can sustain revenue growth of 90%+ year, then I think it has a good chance of success.

In the best long term scenario, DOC manages to consolidate its current position and diversify its revenue streams considerably. I think this is an outside chance, but tantalising nonetheless.

Considering all this, I’ve bought a very small shareholding in Doctor Care Anywhere, in order to motivate myself to follow the story and learn more about the stock. As a general rule I’d have thought that 20x gross profit is a good price for the company assuming it can maintain very high growth rates. So while the current share price is too expensive for me to have confidence buying in volume, I definitely think this is one of the more interesting companies to list this year.

This post is not financial advice, and you should click here to read our detailed disclaimer.

A Rich Life depends on Supporters to pay for its free content, so if you’d like to try Sharesight, please click on this link for a FREE trial. It saves me heaps of time doing my tax and gives me plenty of insights about my returns. If you do decide to upgrade to a premium offering, you’ll get 2 months free and we’ll get a small contribution to help keep the lights on.

If you’d like to receive an occasional Free email with more content like this, then sign up today!

Join the waitlist here to become a supporter and receive content like this as soon as it is published.