Life360 (ASX:360) is a mobile app used for location sharing and digital safety. The Life360 business model is for users to join a ‘circle’, whereby other users like family and friends are invited to share their location data. The app offers a free version that includes real-time location data, driving statistics, battery monitoring and limited location alerts and history. Users can purchase subscription plans ranging from $5-$25 per month for extra features like roadside assistance, unlimited alerts, ID protection and individual driving reports.

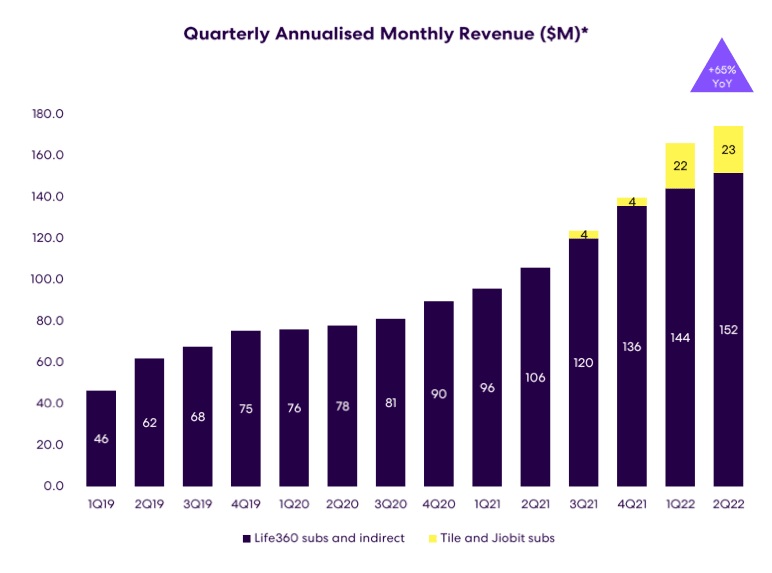

In the nine months of FY 2022, Life360 recorded US$156.9 million in revenue and a net loss of US$79.3 million. Annual monthly recurring revenue has increased by 53% to US$184 million. The company has US$58.9 million in cash (and raised a further AU$50 million in November) and no debt. Life360’s financial year is the calendar year.

The share count has increased from 50.0 million at the end of 2020 to 64.8 million, mainly due to two capital raisings and employee stock compensation. Note that one share equals three Chess Depositary Interests (CDIs), giving Life360 a market cap of approximately $1.02 billion.

Life360’s Growth Strategy

Life360 has an enviable track record of top-line growth, with monthly active users, paying circles and annualised recurring revenue all increasing over 35% in the past year. The company has made two acquisitions: Tile for US$205 million in February 2022 and Jiobit for US$37 million in April 2021.

Despite its Australian listing, Life360’s main operations reside in the United States, which accounts for 62% of its 47 million monthly active users. It’s also looking to expand into new markets such as Canada.

Tile provides a product similar to Apple Airtags, which uses small trackers used for finding devices, wallets, and other ‘things’. Jiobit sells pet trackers. The idea is to combine people, ‘things’ and pets within one app to improve subscription revenue, user retention and upsell opportunities.

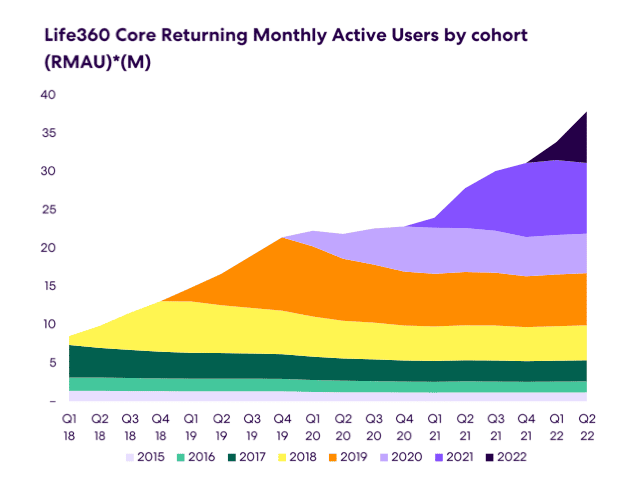

New Life360 users fall away quickly in the first six months after downloading. However, customers that do stay are very loyal, evident by the long tail of customer retention from 2017-2020.

The co-founders remain involved with the business. Chief executive Chris Hulls owns 4.5% of the company, while chief technology officer Alex Haro owns 3.3%.

Life360’s Latest Financial Results

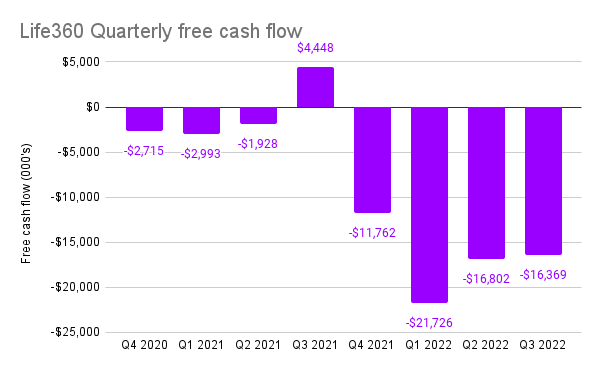

Life360 recently passed through price increases ranging from 25% on higher tier plans to 60% on lower tiers. This is a chunky price increase for any type of business. Management expects churn to increase by only 10%, however, I believe it could be higher given the US is entering a period of economic weakness. Life360 is yet to meaningfully reduce free cash outflows despite management forecasting the company will achieve an operating cash flow positive by CY23. Management also believes there will be a meaningful reduction in cash outflows in Q4. It will be telling if it can sustain that trajectory towards breakeven in Q1 next year.

Why Do Customers Use Life360?

As evident by the 47 million global monthly active users, some of whom populate 1.5 million paying circles, Life360 has tapped into a market niche previously unmet. The product itself is divisive. Some users love the safety of knowing where other users are. Others find it a complete invasion of privacy and resent the app.

My hypothesis is that part of Life360’s attraction is that it alleviates (mostly for parents) the fear of ‘something bad’ happening to another user (usually adolescents or children). It’s similar to the peace of mind provided by insurance. Academic research supports the idea that fearful people overestimate risks (and also the ability to minimise those risks, through apps like Life360, or enhanced screening at airports).

A recent study in the Journal of Clinical Child & Adolescent Psychology concluded engagement with digital health platforms is more effective at improving adolescent behaviour than location tracking such as Life360. The clinical trial showed a significant reduction in alcohol and marijuana use, school delinquency and offences. This highlights the perceived benefit of location tracking may not actually lead to better outcomes between parent and child.

Feature or Product?

Despite the rapid adoption and growth in users, Life360 faces high competition from the likes of Apple, Snapchat and Google. All three companies offer a location-based app that helps track people. Google and Apple also own the marketplace and operating system Life360 is built on.

Given Life360 hasn’t made a sustainable profit, there’s been little incentive for competitors who offer a free location app to match the same features. Should the company begin to achieve profitability, this would likely spark greater interest from other free offerings.

Life360 attempts to differentiate itself by offering premium features such as battery notifications and location history. It also offers towing services and small levels of insurance. It’s hard to see this as a competitive advantage, given a competitor could easily replicate these features. I don’t see any moat, other than mild inconvenience, or the upfront cost of a Tile, that would prevent a customer from switching from Life360 to a competitor.

Privacy concerns

Life360 has previously been criticized for issues over privacy. Effectively, the business was selling location data to data brokers, with limited oversight over where that data ended up. It has tried to alleviate concerns by offering aggregated data, rather than person-specific. Selling data represents a small part of revenue, and it’s not clear why the company would pursue this path given the potential negative publicity. I guess the answer is that the location data of 47 million users is definitely a scarce data set, and Life360 wants to cash in on that.

Was Life360’s Acquisition Of Tile Worth It?

While it’s only eleven months since the acquisition, Tile has failed to live up to my expectations. It has diluted Life360’s gross margin from 81% to 68%. Tile itself has gross margins of just 20%. Customer acquisition costs have also doubled, as management increased marketing to sell the combined offering to customers. The payback period on a Life360 customer was over a year pre-Tile. Now it’s upwards of three years. I also observed that management has removed the marketing payback slide in the investor presentations. It should be said the full integration isn’t expected until Q1 2023.

Most paying circles were acquired on lower CAC, but this highlights the issue with business-to-consumer (B2C) software-as-a-service (SaaS). It’s very hard to turn loyalty into strong cashflows and earnings. Spotify, Netflix, Match (owner of Tinder, Bumble) and Duolingo are other examples of B2C businesses where customer love doesn’t translate into shareholder profits.

Is Life360 A Risky Stock?

The growth is phenomenal, but Life360 is yet to prove it can convert this into a sustainable and profitable business. Over the last three years, the Life360 share price has moved with ‘risk-on’ sentiment. In 2021, it was a market darling, in early 2022 it was a pariah. Now, I’d argue the market is buying the cash flow positive story in 2023.

A focus on cost control and sustainable positive free cash flow would make the stock more attractive. However, new user additions will likely slow after price increases. Personally, I am not confident that Life360 has a good business model. For my mind to change, I would need a material reduction in its cost of customer acquisition and noticeable steps towards free cash flow.

If you enjoyed this article, you might also be interested in 5 ASX Stocks With Positive 2022 AGM Updates.

Sign Up To Our Free Newsletter

Disclosure: the author of this article does not own shares in Life360 and the editor also does not. Neither will trade shares in 360 for at least 2 days following the publication of this article. This article is not intended to form the basis of an investment decision and is not a recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. A Rich Life does not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.